Why The Government Should Just Do Your Taxes For You

The actual work of doing your taxes mostly involves rifling through various IRS forms you get in the mail. There are W-2s listing your wages, 1099s showing miscellaneous income like from one-off gigs, etc. To fill out your 1040, you gather all these together and copy the numbers in them onto the 1040 form. The main advantage of TurboTax is that it can import these forms automatically and spare you this step.

But heres the thing about the forms: The IRS gets them too. When Vox Media sent me a W-2 telling me how much it paid me in 2017, it also sent an identical one to the IRS. When my bank sent me a 1099 telling me how much interest I earned on my savings account in 2017, it also sent one to the IRS. If Im not itemizing deductions , the IRS has all the information it needs to calculate my taxes, send me a filled-out return, and let me either send it in or do my taxes by hand if I prefer.

This isnt a purely hypothetical proposal. Countries like Denmark, Sweden, Estonia, Chile, and Spain already offer pre-populated returns to their citizens. The United Kingdom, Germany, and Japan have exact enough tax withholding procedures that most people dont have to file income tax returns at all, whether pre-populated or not. California has a voluntary return-free filing program called ReadyReturn for its income taxes.

The Obama administration supported return-free filing, and Ronald Reagan touted the idea in a 1985 speech:

You May Like: How To Get A License To Do Taxes

How To File Taxes Online

OVERVIEW

Filing your taxes can seem like a daunting process, but with a little organization and preparation, you can ensure you’ll file on time and with accuracy from the comfort of your own home. Here’s what you should do to be ready for the tax filing deadline.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Whether you’re filing your taxes for the first or the fiftieth time, it’s always a good idea to take a minute to gather your tax information ahead of time so you can file faster.

Starting with a firm grasp of what goes into filing, the documents you’ll need and the terms that are helpful to know, you’ll know how to file taxes online and be done in no time. Tax software like TurboTax can simplify everything and guide you through the process all the way from start to finish.

Mail Form 4506 And Payment

Mail Form 4506 and your payment to the appropriate IRS office. The IRS charges a fee for each tax year you request a return for. As of 2021, the fee for each one is $50 and you can make payment by check or money order, payable to the U.S. Treasury.

Also include your Social Security number and the notation Form 4506 request on your check or money order. After signing the bottom of the form, check the instructions to determine the appropriate IRS address. Note that the IRS office you mail it to depends on your address at the time of filing the tax return, not your current address.

Remember, with TurboTax, well ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

You May Like: Csl Plasma Taxes

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

B Hire And Work With A Tax Preparer

While it’s never been easier to do your own taxes using software, as your financial life gets more complex you might wonder if you’re missing something and should get someone to prepare and help file your taxes. If you have a business or a healthy side gig, or you just want help understanding all of the forms, you might seek out a professional’s guidance.

» Find a local tax preparer for free:See who’s available to help with your taxes in your area

If you don’t want to meet in person with a tax preparer, theres a way to file taxes without leaving the house. A secure portal lets you share documents electronically with a tax preparer. Typically, the preparer will email you a link to the portal, youll set up a password and then you can upload pictures or PDFs of your tax documents.

Read Also: Doordash Taces

What Are The Late Filing Fines And Penalties

The penalty for failing to file a federal tax return by the due date, or extended due date, is usually 5% of the unpaid tax for each month, or part of a month that the return is late, with a maximum penalty of 25% of the unpaid tax.

However, a minimum penalty is imposed if the return is more than 60 days late. If no return is filed after 60 days, a minimum penalty of $435 or 100% of the unpaid tax, whichever is less, can be imposed.

In addition, you may also owe a late payment penalty on the amount of tax due, if any.

The late filing penalty differs from the late payment penalty read more here.

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Earned Income Tax Credit

- Child tax credits

- Student Loan Interest deduction

Recommended Reading: Does Doordash Provide W2

Did Turbotax Rip You Off

Tweet This

I know, its July, the sun is shining, and the last thing you want to think about for the next eight or nine months is taxes. Well, Intuit, the maker of TurboTax, would love for you to forget too. It most certainly hopes you glossed over the revelations by intrepid reporters from ProPublica who discovered its egregious conduct.

Did TurboTax Rip You Off?

Deposit Photos

TurboTaxs recent machinations are like the digital version of Volkswagens emissions scandal. But instead of manipulating software to hide higher levels of pollutants coming out of a car, TurboTax manipulated software and the metadata on its own site so certain results wouldnt show up in Google searches. The tactic likely prevented millions of Americans from filing their taxes for free. Instead, these individuals were nudged to TurboTaxs premium products and charged for a service they should have gotten without paying.

While ProPublicas article received attention and even led some regulators to open investigations, it deserves amplification as many consumers who may have been short-changed are not aware of what happened, how they were deceived, or what recourse they should take. Furthermore, Turbo Tax has neither shown remorse nor taken real corrective action .

Deposit Photos

Also Check: How Much Do Taxes Cost At H& r Block

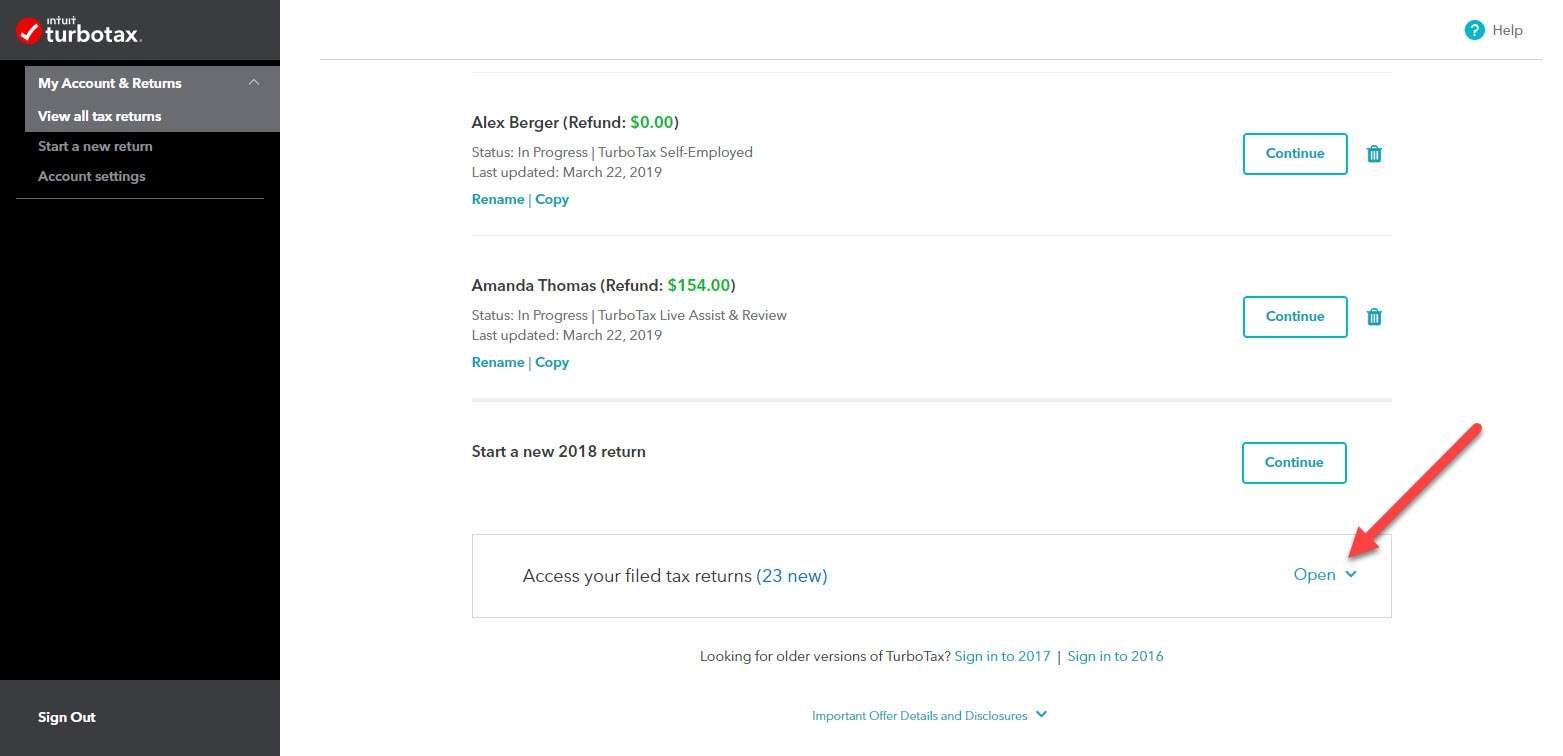

How Do I Prepare A 2020 2019 Or 2018 Tax Return

For tax years 2020, 2019, or 2018

To prepare a new prior-year return, you’ll need to purchase and download that year’s TurboTax software for PC or Mac, as TurboTax Online and the mobile app are only available for the current tax year.

After installing the software, open it and follow the on-screen instructions.

Prior-year returns must be paper-filed, as e-filing is no longer available. We’ll walk you through that process when you get to the File section in the software.

Here are some other resources that might help:

Recommended Reading: Do Tax Preparers Have To Be Licensed

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the Out of Country circle on Page 1 of Form D-400. Out of the Country means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up owing even more taxes because you can no longer claim the lucrative tax credits you might have otherwise qualified for.

Also Check: Doordash Driver Tax Calculator

How To File Your Taxes Simply And Easily

We recommend TurboTax as the number one tax preparation platform for the average American. If you want to file your taxes for free and you have relatively simple tax affairs, theres no better alternative.

With a guarantee of accuracy and perfection, you can have peace of mind when you file your taxes this year.

When Is The Tax Filing Deadline

The final tax deadline for the US is Monday, April 15th. However, you should aim to file your taxes earlier, so you can take the weight off your mind. You can file your taxes with TurboTax the moment you get the relevant forms from your employer for this tax year.

Even if the IRS is not yet accepting filings, TurboTax will keep your tax return on file and submit it at the earliest possible opportunity.

Also Check: Is Plasma Donation Income Taxable

Collect All Necessary Documentation

You need W2s, 1099s, and all other relevant forms for the year in question. If you are itemizing deductions, you also need receipts and records to back up your claims. If you dont have these forms, contact your employer, former employer, or a financial institution. With wages, you can often get the numbers you need from your last pay stub of the year.

If you cant get a hold of these documents, contact the IRS directly at 1-800-829-1040 or request the IRS mail you a wage and income transcript . Usually, wage and income tax transcripts go back up to 10 years. Therefore, you can obtain 1099 and W2 information, even if you cannot locate these documents.

If you are self-employed and were 1099d, IRS wage and income transcripts will help you determine your income for a taxable year. Also, you can obtain bank statements that will also help you identify income and expenses.

Can I File A Tax Return From 5 Years Ago

What is the deadline for e returns for years you have not yet filed. The IRS prefers that you file all returned tax returns for years you have not yet filed. However, if you apply for a credit, the IRS usually only requires that you file tax returns the last six years in good standing, as opposed to the last four. In certain instances, however, the IRS may have access to over six years of tax returns.

Read Also: How Does Doordash Affect Taxes

How To Plan Ahead To Pay Back Taxes

The best way to avoid paying back taxes is filing your annual tax return during tax season. Take time to review your overall tax situation to come up with strategies for reducing your tax bill and achieving your financial goals.

If you think you owe back taxes, consider working with a tax professional who can help you gather past tax returns and file any that you may have missed.

If you think you might owe the IRS when you file your tax return this year or next, consider making estimated tax payments in advance. These payments are generally required for sole proprietors who arent subject to withholding from their paychecks by an employer. Making quarterly estimated tax payments can help you to avoid penalties on your upcoming tax return.

+ How Do I Speak To A Live Person At Turbotax 2021 Images

We have various wallpapers about How do i speak to a live person at turbotax 2021 available in this site. You can get any images about How do i speak to a live person at turbotax 2021 here. We hope you enjoy explore our website.

Currently you are searching a post about how do i speak to a live person at turbotax 2021 images. We give some images and information connected to how do i speak to a live person at turbotax 2021. We always try our best to present a post with quality images and informative articles. If you did not find any articles or photos you are looking for, you can use our search feature to browse our other post.

How Do I Speak To A Live Person At Turbotax 2021. You can speak to a person, you just have to go through the procedure to do that. Read faqs, ask a question in our answerxchange community, or give us a call. Or you can phone turbotax support during business hours and they can question you. How do i speak to a real person at turbo tax , need a number you can check your refund method that you selected upon filing by following these steps.

You May Like: Look Up Employer Ein Number

How To Transfer Previous Tax Years Into Turbotax

How to Transfer Previous Tax Years Into TurboTax. The process of preparing and filing a current-year tax return often requires taxpayers to access previous-year tax returns and worksheets, verifying transaction, depreciation and capital-gain information. TurboTax allows you to transfer data from a previous tax year by using a relatively flexible “Transfer” feature that searches your computer for past-year tax files.

Why File For An Extension

Filing an extension automatically pushes back the tax filing deadline and protects you from possible penalties. Late-filing penalties can mount up at a rate of 5% of the amount due with your return for each month that youre late.

- For example, if you owe $2,500 and are three months late, the late-filing penalty would be $375. x 3 = $375

- If youre more than 60 days late, the minimum penalty is $100 or 100% of the tax due with the return, whichever is less.

- Filing for the extension wipes out the penalty.

TurboTax Easy Extension is a fast and easy way to file your extension, right from your computer.

You May Like: How To Pay Doordash Taxes

Also Check: Tax Form For Doordash

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax returns from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $50 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return is stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Recommended Reading: Csl Plasma Taxable