When Does The Statute Of Limitations Begin

The clock starts ticking on the three-year statute of limitations on the later of the tax return due date or the date you filed your taxes.

If the tax return due date was April 15 and you filed Feb. 15, your timer begins on April 15. If you filed late without an extension on May 3, the timer would begin on May 3.

Why Do You Need To Keep Business Records

Small business owners sometimes forget to keep good records. However, bad record keeping can cause a lot of problems. Here are a few ways of keeping business records can help you:

- Check your business progress

- Keep track of all deductible expenses

- Provide to authorities in case of an audit

Personal and business purchases can get mixed up. This is more likely if you dont keep good records. Receipts are important business records to keep. They can keep your personal and professional purchases separated. They can also help you see the source of your expenses.

Some records are for your information only. That doesnt mean you shouldnt keep them. Business and sales improvement documents can help you succeed. You dont need to keep them by law, but its wise to hang onto them for a while so you can check your growth. Also, you can use the information to make improvements to your business.

It helps to keep the right records when filing tax returns. If you report an expense or income on your taxes, you need to document it. In most cases, these are the same records you use to prepare regular financial statements. Keep them organized and somewhere easy to access.

Keeping good records is very important when you own a small business. Your records will help you project your tax liability. Once you do that, you can make estimated tax payments.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Efstatus Taxact 2016

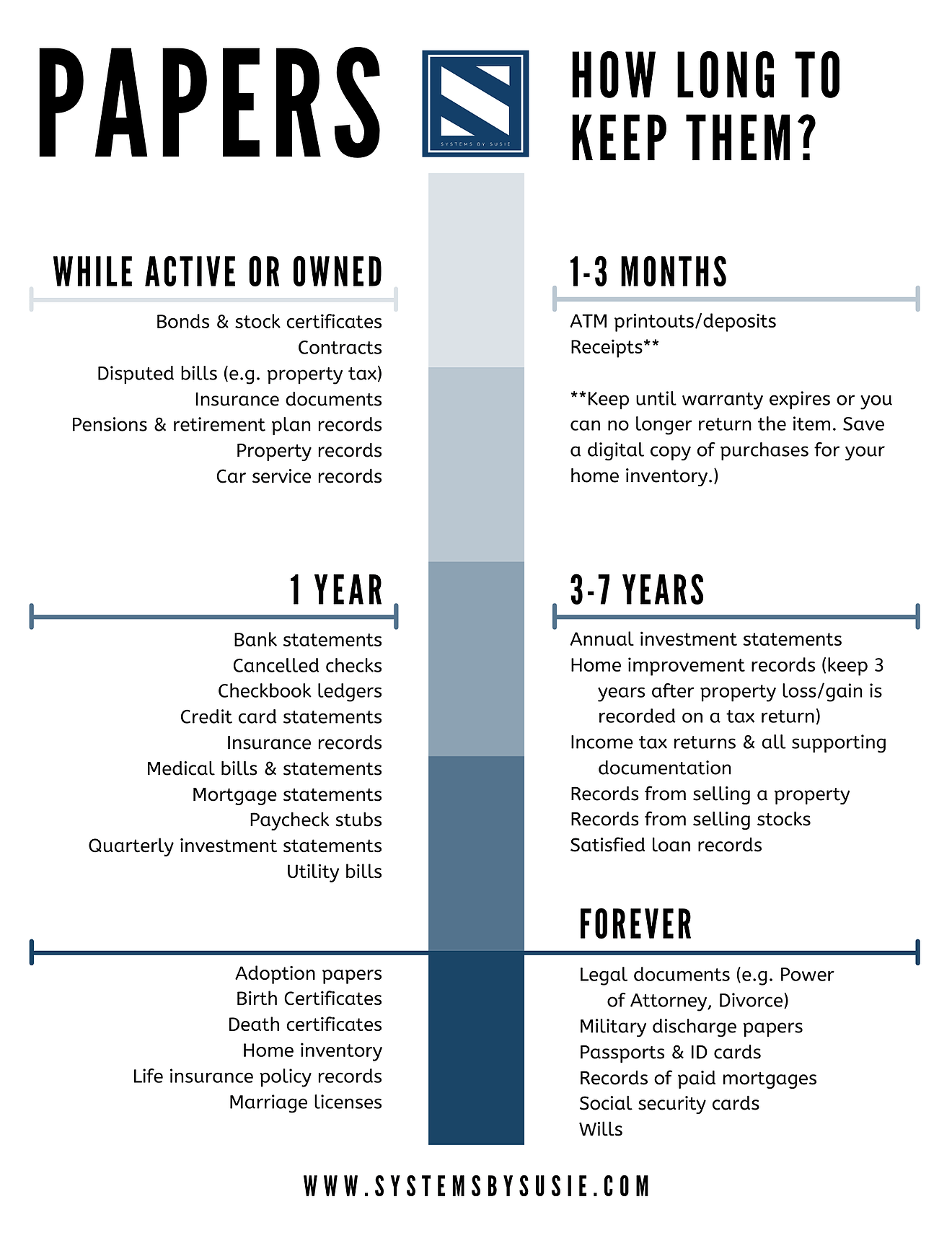

Know What To Keep And What To Toss

You dont need to keep every single receipt the $10 receipt from McDonalds for that hamburger you ate on your business trip six years ago can probably go in the trash.

However, its important to know exactly what you need to keep so you arent hanging on to unnecessary records indefinitely.

Gross Income and Employment Tax Records

Obviously, your tax return starts with the money you made, so keep records of all the money you received in a given year. That means hanging on to things like W-2 forms, 1099s, and K-1s.

Expenses

Particularly if you are working in a self-employed or freelance fashion, you need to hang on to records of expenses. That might mean receipts, canceled checks or proof of payment, annual bank statements, invoices, and sales slips.

Home

Mortgage interest deduction forms are important tax documents to keep, as are closing statements, proof of payment, home insurance records, and purchases and sales invoices.

Investments

If you are earning any extra cash from your investment portfolio, those documents need to be stored, too. Hang on to 1099 forms, 2439 forms, and annual brokerage statements to be safe.

Retirement Accounts

Planning for retirement comes with its own set of tax implications. Keep 8606 and 5498 forms, annual statements, 1099-R distribution records, and 401 or other company-sponsored plan statements.

Health Insurance

How Long To Keep Tax Records: Can You Ever Throw Them Away

Once youve submitted your tax return to the Internal Revenue Service each year, the last thing you probably want to think about is how to store your tax records. But making these arrangements is essential to protect yourself in the event of a future IRS audit.

The general rule is to keep your tax records for three years, but there are several important exceptions for when you might need to keep your tax records for a longer period as a taxpayer. Read on to learn how long to keep your tax records and when you can safely dispose of them.

Recommended Reading: Reverse Tax Id Lookup

How Long To Keep Records For Business Taxes

2 min read

The length of time you need to keep records depends on the action or expense each document records. You may need to hold on to some records permanently, but typically for business taxes, you only need to keep records supporting income or deductions on a return until the period of limitations for that return is up. The period of limitations is the time-span you can amend a tax return to get credit or a refund. Even if you no longer need records for tax purposes, you may still decide to keep them, as other organizations may require them.

But Wait Dont Throw Away That Chipotle Receipt Yet

Even then, youâre not completely off the hook. Any business deduction on your tax return can be questioned during an auditâeven expenses under $75.

In order for the IRS to uphold a deduction under $75 without a receipt, youâll need to present them with the following information:

- The expense amount

- Where and when it was made

- The essential character or purpose of the expense

If youâre deducting meals and entertainment, itâs even more complicated. You might have to submit a list all of the people who were there with you when the expense occurred, and what you talked about .

If you deduct many expenses below $75 a spreadsheet or mobile app like Expensify is usually the best way to keep track of everything without drowning in a sea of small receipts.

If youâre still not sure about which small receipts to keep, you can review the IRS guidelines on proving expenses under $75 here.

Read Also: Reverse Ein Lookup Irs

If You Have Records Connected To Property

The standard three year period of limitations applies to any deductions you make related to your property But sometimes the length of time between when you dispose or sell your property and when you no longer need to keep those documents can be longer than 3 years.

Say you dispose of a property by selling it during the 2018 tax year, report the financial gain on your 2020 tax return, and file your tax return right on the tax deadline of April 17, 2021. That means youâd need to keep records connected to the property until April 17, 2024 .

These records usually include deeds, titles, and cost basis records .

Next Steps: Create A Document Retention Policy

Organizing your physical and cloud-based storage along with developing a DRP is the best way to ensure your organization complies with record-keeping standards. Review all guidelines carefully and come up with a plan thats easy to implement and stick with.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Recommended Reading: Csl Plasma Taxable

Are Tax Returns Public Record

Tax returns and tax information are not public record. The IRS will only release tax information in very specific cases, like legal proceedings. However, some third-party tax preparers can make your information available if you inadvertently agree to consent. Read the fine print before you use any third-party service. If you are using a tax preparation firm, ask to see their privacy policy.

How Long Do You Need To Keep Tax Records For

The IRS states you need to keep your records “as long as needed to prove your income or deductions on a tax return” this means you need to keep your tax records for three years from the date your return was submitted. For example, if you file your 2018 tax return a few months ahead of the deadline, this means you need to keep all receipts, tax records, and all additional documentation related to the return until April 15, 2022 — three years after the 2018 deadline.

Recommended Reading: How Do You Do Taxes For Doordash

What Are Business Tax Records

Business tax records include anything that directly or indirectly supports amounts claimed on the business’s tax returns. Examples include:

- Invoices

- Tax forms

- Tax returns

Transactions usually generate these documents automatically. Businesses or their accountants then record the accounting effects of transactions and file the supporting records based on the type of transaction and when it occurred.

Digital file management systems offer many advantages, though companies must keep paper originals of some documents. Electronic files take up much less physical space, allow for easier access, and enable quick backup. As a result, many businesses manage their records almost entirely electronically.

These records allow companies to both prepare their tax returns and prove the return’s accuracy during tax audits. The IRS and other tax authorities can deny deductions for unsubstantiated expenses, potentially leading to interest and penalties.

What If I Have Claimed Investment Losses Or Bad Debt Write

Sometimes your financial investments dont go as planned, and you take a significant loss on a stock, business investment, or loan to your deadbeat uncle that never gets paid back.

The silver lining is you get to claim this loss to offset your income on your tax return. However, per the IRS, filing a claim of loss for bad debt or a worthless investment triggers a seven-year period of limitations. In this situation, youll want to make sure to keep your tax records for at least seven years in case of an IRS audit.

Don’t Miss: Do You Have To Pay Taxes On Donating Plasma

No Matter How Eager You Are To Streamline Your Life By Clearing Out Clutter Theres A Good Chance Youll Think Twice About Throwing Out Tax Records

What do you do with all the tax forms whether paper or digital when tax season ends? Holding onto those forms probably seems like a smart idea to a lot of people a 2020 IRS survey says that 62% of taxpayers are so fearful of an audit that they wouldnt even think of cheating on their taxes.

And you should keep tax records at least for a while. In some situations, you may even want to keep some forms forever.

How To Keep Your Records

You may need your records to complete your tax return correctly. If we review your tax return, we may ask for additional documents. You should keep a copy of your return and the records that verify all of the following:

- Income

- Adjustments

Some records need to be kept longer. For example, keep property records as long as they are needed to figure the basis of the property.

Generally, you must have documentary proof to support your expenses, such as:

- Receipts

Additional proof is needed to support deductions for travel, entertainment, gifts, and auto expenses.

Recommended Reading: How To Find Employer Ein Number Without W2

Navs Verdict: Keeping Business Records

As a business owner, its in your best interest to keep your business records organized and easy to find. It may require some work initially, either filing them based on the year or type of document, or scanning them to save space and then shredding the paper. But your effort will pay off in the long run if one day the IRS or a bank asks for these documents.

This article was originally written on September 16, 2020.

How Long Should I Keep Records

The length of time you should keep a document depends on the action, expense, or event which the document records. Generally, you must keep your records that support an item of income, deduction or credit shown on your tax return until the period of limitations for that tax return runs out.

The period of limitations is the period of time in which you can amend your tax return to claim a credit or refund, or the IRS can assess additional tax. The information below reflects the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.

Note: Keep copies of your filed tax returns. They help in preparing future tax returns and making computations if you file an amended return.

Read Also: How To Calculate Doordash Miles

How Do I Properly Dispose Of Business Tax Records

- Double check that anyone your business is associated with is okay with you discarding the documents. They may need them for an outstanding claim or other matter, so its best to check in with them first.

- Dispose of your records properly by shredding theminstead of trashing or recycling. Theres a lot of personal and financial data on your old tax returns and other financial records, so do what you can to make sure your information is protected by disposing of your records responsibly.

How Many Years Of Tax Returns Should You Keep

June 10, 2021 By: Cox Search

For many people, tax time can be a stressful period, one with many more questions than answers. From worrying about whether you will get a refund or have to make a payment, to concerns about being audited by the Internal Revenue Service , tax time can be a headache.

According to a survey, more than 60 percent of US adults found tax season stressful. One of the reasons around this high level of anxiety is a sense of . For those who love to shred, keeping old papers around be a nuisance. For those who keep anything and everything, having a mountain of paperwork may not be the best strategy.

Remember, if you feel intimidated by tax preparation, you arent alone. And if you feel you cant handle it by yourself, turn to an experienced, friendly tax professional who can help you get the most from your money. So, ? Find out more about tax returns and timeless with this handy guide.

Also Check: Do You Have To File Taxes With Doordash

Mistakes On Tax Returns And Audits

If you discover that a mistake has been made on your tax forms, you have up to three years to submit an amended return. Use Form 1040-X to enter the corrected information and submit a hard copy via the mail. To amend state taxes, fill out the federal Form 1040-X and attach it to your states amendment form .

If the IRS catches a mistake, such as a missing or incorrect Social Security number, you could face a fine. Take care to review your original tax return thoroughly before submission. Get an early start during tax season so you dont feel rushed and accidentally enter incorrect information, and keep all pertinent tax documents well organized so your calculations are easy to confirm.

You May Like: Where To File Va State Taxes

A Good Grasp Of Tax Law Can Help Your Business Succeed

When determining how long to keep your business records, it is safe to assume that most must be kept for at least 6 years. However, there are certain exceptions that you may be required to keep for longer.

If you are well aware of your tax obligations, you will be prepared in the event that the CRA or Revenu Québec ask to see your records.

If you have any questions about tax laws and regulations in Quebec and Canada, feel free to contact the tax accountants at T2inc.

You May Like: Doordash 1099-nec Schedule C

How Long Should A Company Keep Records

Basically, the IRS states that you must keep records for at least three years, whether you e records as long as needed to prove the income or deductions on a tax return. According to general law, you must keep the tax records for three years on the first day the return was filed, or on the 15th day prior to the due date.

How Long Should You Keep Business Tax Records And Receipts

Reliable record keeping allows businesses to prepare financial statements that help business owners keep tabs on their expenses. However, many companies aren’t sure how long tax records and receipts need to be saved in the era of paperless transactions and cloud-based systems. Record keeping is a dull subject matter, but it’s an essential task as if you make the wrong choices, you face litigation and problems with the IRS. Understanding how long you should keep these records will help you avoid these problems.

Recommended Reading: How Taxes Work With Doordash

Tax Records To Keep For Seven Years

The three-year rule is a good rule of thumb for most people. However, there are some situations in which you may need to keep documents longer.

For example, if you omit more than 25% of your gross income from your tax return, the IRS legally has six years to assess additional tax. If you file a fraudulent return, whether purposefully or by accident, that statute never expires.

What Other Types Of Business Records Should Be Kept

Business records are any document, invoice, or receipt related to the operations of a business. This includes:

- Accounting: bank statements, receivable ledgers, inventory, etc.

- Human Resources: personnel and payroll records, employee reviews, etc.

- Other Miscellaneous Corporate records: insurance policies, warranties on equipment, etc.

Insurance companies, lenders, and other establishments have their own period of limitations for the business records listed above. Whether youre a high-income individual who freelances on the side or you run your own business day and night, TPI Group offers tax preparation services and more to protect your future.

Read Also: Pastyeartax.com Review