Accounting Periods And Methods

The US tax system allows individuals and entities to choose their tax year. Most individuals choose the calendar year. There are restrictions on choice of tax year for some closely held entities. Taxpayers may change their tax year in certain circumstances, and such change may require IRS approval.

Taxpayers must determine their taxable income based on their method of accounting for the particular activity. Most individuals use the cash method for all activities. Under this method, income is recognized when received and deductions taken when paid. Taxpayers may choose or be required to use the accrual method for some activities. Under this method, income is recognized when the right to receive it arises, and deductions are taken when the liability to pay arises and the amount can be reasonably determined. Taxpayers recognizing cost of goods sold on inventory must use the accrual method with respect to sales and costs of the inventory.

Methods of accounting may differ for financial reporting and tax purposes. Specific methods are specified for certain types of income or expenses. Gain on sale of property other than inventory may be recognized at the time of sale or over the period in which installment sale payments are received. Income from long-term contracts must be recognized ratably over the term of the contract, not just at completion. Other special rules also apply.

% Of Americans Paid No Federal Income Taxes In 2020 Tax Policy Center Says

- More than 100 million U.S. households, or 61% of all taxpayers, paid no federal income taxes last year, according to a report from the Tax Policy Center.

- The pandemic and federal stimulus led to a huge spike in the number of Americans who either owed no federal income tax or received tax credits from the government.

- The main reasons for the spike high unemployment, large stimulus checks and generous tax credit programs will largely expire after 2022.

More than 100 million U.S. households, or 61% of all taxpayers, paid no federal income taxes last year, according to a new report.

The pandemic and federal stimulus led to a huge spike in the number of Americans who either owed no federal income tax or received tax credits from the government. According to the Urban-Brookings Tax Policy Center, 107 million households owed no income taxes in 2020, up from 76 million or 44% of all taxpayers in 2019.

“It’s a really big number,” said Howard Gleckman, senior fellow in the Tax Policy Center. “It’s also really transitory.”

Gleckman said the main reasons for the spike high unemployment, large stimulus checks and generous tax credit programs will largely expire after 2022, so the share of nontaxpayers will fall again starting next year.

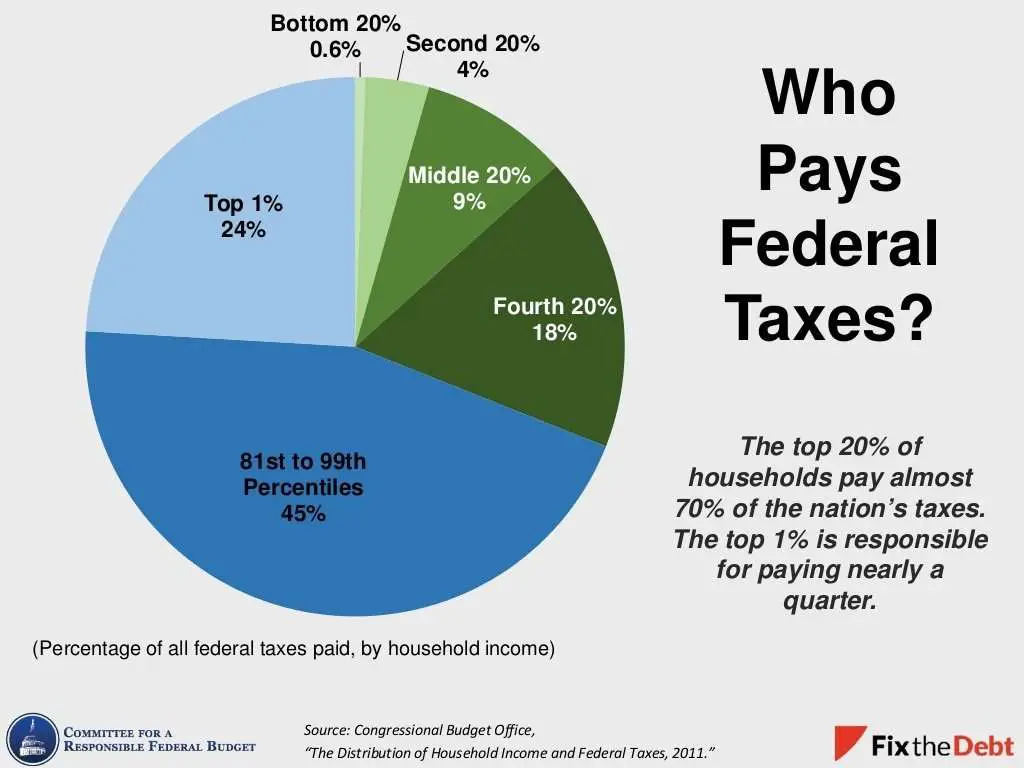

The top 20% of taxpayers paid 78% of federal income taxes in 2020, according to the Tax Policy Center, up from 68% in 2019. The top 1% of taxpayers paid 28% of taxes in 2020, up from 25% in 2019.

Effects On Income Inequality

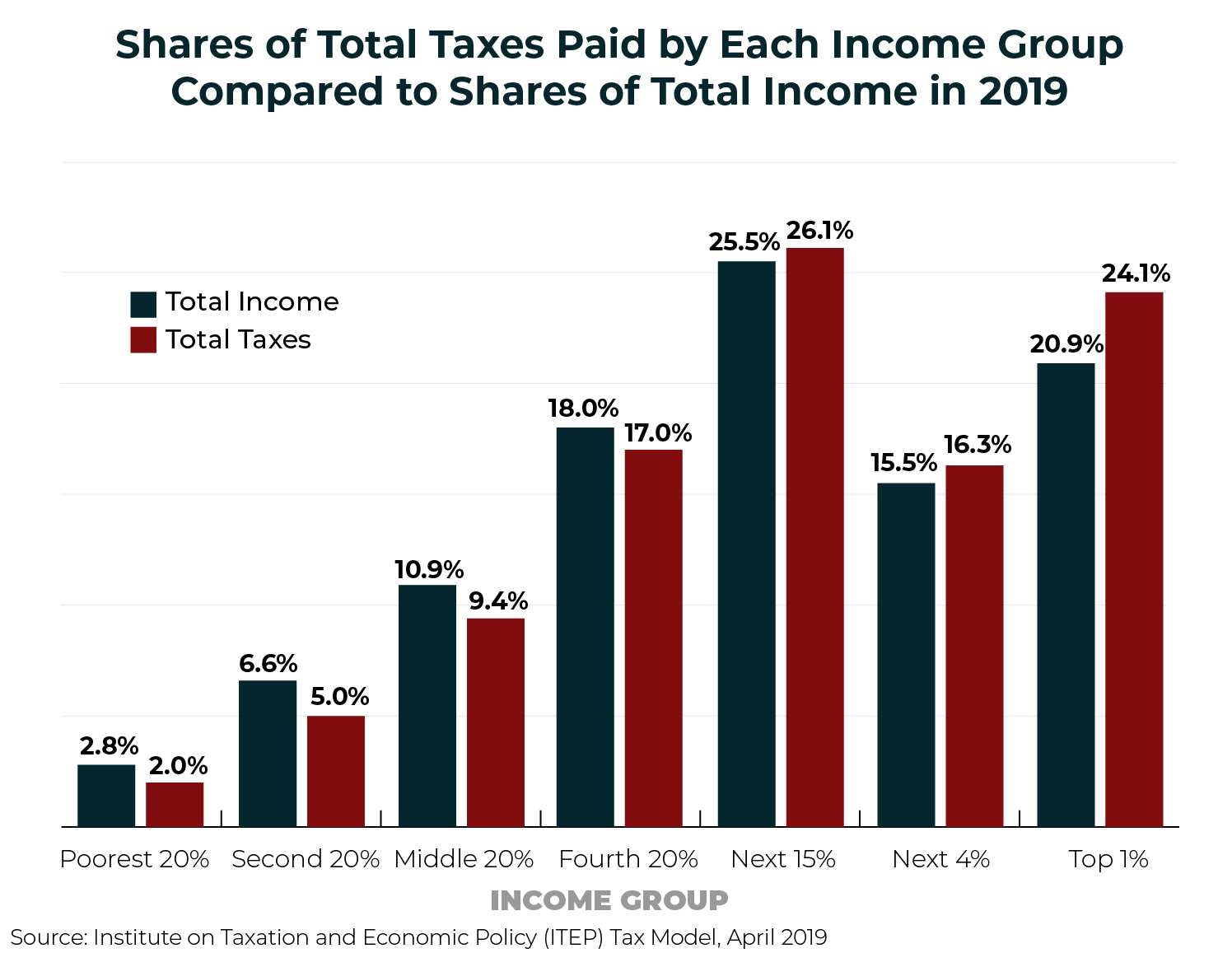

According to the CBO, U.S. federal tax policies substantially reduce income inequality measured after taxes. Taxes became less progressive measured from 1979 to 2011. The tax policies of the mid-1980s were the least progressive period since 1979. Government transfer payments contributed more to reducing inequality than taxes.

Read Also: Doordash 1099-nec Schedule C

What Is A Tax Haven Country

A tax haven country is a country where an employee or, more commonly a business owner, can lower their tax burden or avoid paying taxes altogether. This is extremely difficult to do if you are a salaried employee, but those who own a business and pay themselves through dividends or a salary from that business, and are able to register that business in a tax haven, may be able to legally dodge their tax liability. Common tax havens are the British Virgin Islands, Bermuda, Guam, Taiwan, and Jersey. If you are considering this strategy, work with a cross-border CPA who will ensure everything is done legally.

Which States Pay The Most Federal Taxes

Looking at the amount of federal income taxes paid by people around the country can serve as a reminder that you may be able to do something about your own tax burden.

Tax season reminds everyone how much they pay to support the federal budget.

But are you living in a part of the country where the tax burden falls particularly heavily?

A state-by-state examination of federal income taxes paid by individuals in each state found that, while people everywhere contribute to the federal government, residents of some states clearly pay more than others.

You May Like: How Much Taxes Deducted From Paycheck Mn

Modern Interpretation Of The Power To Tax Incomes

The modern interpretation of the Sixteenth Amendment taxation power can be found in Commissioner v. Glenshaw Glass Co.348U.S.426. In that case, a taxpayer had received an award of punitive damages from a competitor for antitrust violations and sought to avoid paying taxes on that award. The Court observed that Congress, in imposing the income tax, had defined gross income, under the Internal Revenue Code of 1939, to include:

gains, profits, and income derived from salaries, wages or compensation for personal service … of whatever kind and in whatever form paid, or from professions, vocations, trades, businesses, commerce, or sales, or dealings in property, whether real or personal, growing out of the ownership or use of or interest in such property also from interest, rent, dividends, securities, or the transaction of any business carried on for gain or profit, or gains or profits and income derived from any source whatever.:p. 429

The Court held that “this language was used by Congress to exert in this field the full measure of its taxing power”, id., and that “the Court has given a liberal construction to this broad phraseology in recognition of the intention of Congress to tax all gains except those specifically exempted.”:p. 430

Where Do We Go From Here

One thing is for sure the issues surrounding whether the wealthiest in the U.S. are paying less taxes than the middle class, wont rest. From economists to presidential hopefuls to tax policy organizations, everyone has a point or two or three to make. Heres a preview of what you can look forward to in the future regarding these issues.

You May Like: Doordash Dasher Taxes

Restoring A Meaningful Estate Tax

If the tax system were working well at the top end, wealthy people would pay a fair amount of tax each year on their economic income and their wealthy heirs would pay a fair amount of tax on their inherited windfalls of income. Neither side of this equation is working today. As the ProPublica story vividly displayed, many of the wealthiest people pay little tax during their lives. In addition, over the course of a number of decades, policymakers have eviscerated the estate tax so much that Gary Cohn, then-director of President Trumps National Economic Council, reportedly told Senate Democrats in 2017, Only morons pay the estate tax.

Today, fewer than 1 in 1,000 estates owe any estate tax, and the first $23.4 million in value is often tax-free even for these estates. Moreover, the few estates that are large enough to potentially face the tax can use loopholes to reduce or eliminate their tax liability. Wealthy people, for instance, use special funds to shelter massive sums from the estate tax. Casino owner Sheldon Adelson, who recently died, passed $7.9 billion to his heirs tax-free by shuffling his company stock in and out of more than 30 trusts.

Most Individual Taxes California $2345b

In total, California contributes the most individual taxes to the federal budget.

As of the most recent tax year for which figures were available , Californians paid over $234 billion in federal income taxes. Thats about 15% of the national total, and nearly 95 times as much as paid by residents of Vermont.

Recommended Reading: How Much Do You Pay In Taxes For Doordash

The Not So Secret Reason The Wealthiest Pay The Most In Income Taxes

NEW YORK, NY – JUNE 11: Garbage piles up outside of public housing in Brooklyn on June 11, 2018 in… New York City. In an announcement today made public by Manhattan U.S. Attorney Geoffrey Berman, New York City will pay $2 billion to settle claims of corruption and mismanagement at the nation’s largest public housing agency known as NYCHA. Investigators claim that water leaks,holes in walls, lead paint, mold, malfunctioning elevators and rats were a part of daily life for the thousands of residents living in public housing. The deal also calls for the appointment of a monitor to oversee the city-run public housing authority during the 10-year span of the agreement.

Getty

Last October, Bloomberg reported that the top half of taxpayers pay 97% of all federal income tax. And the top 1% pay 37.3% of the total.

That may seem unfair. I’ve seen people, recently in a social media discussion the other day, bring that point up to rebut any criticism of wealth inequality. So, what if the wealthy have more? They do more to support the country. They pay most of the taxes. That should be enough.

In the discussion the other day, the context was wealth and how the rich are getting richer, as MarketWatch reported. The richest tenth of households hold 70% of the wealth in the country as of 2018. In 1989, it was 60%. The share of the top 1% shifted from 23% to 32%.

The figures come from a new Federal Reserve report that examines income and wealth.

Tax Cuts And Tax Fairness

Democratic party leaders have taken rhetorical shots against tax reform bill since it was introduced back in 2017. During the debate, Speaker of the House Nancy Pelosi went so far as to the TCJA the worst bill in the history of the United States Congress. Senate Minority Leader Chuck Schumer also disparaged the bill as a product that no one can be proud of and everyone should be ashamed of.

Progressives continue to assail the TCJA in the years since its passage. A few days before the election, the Center for American Progress, a self-described progressive policy institute, the tax system unfair and said the results of the TCJA were a hugely regressive tax cut.

This ignores that most taxpayers paid less thanks to the TCJA. In fact, the Tax Policy Center estimated that nearly two-thirds of households paid less income taxes in 2018 than they would have under the pre-TCJA code, while 6 percent paid more .

Low-income households having very little tax burden to cut in the first place, in dollar terms, is also why tax cut proposals targeted at lower-income households rely heavily on refundable credits. Like other tax credits, these reduce a filers income tax liability. But unlike nonrefundable credits, any remaining credits are paid to the filer. The refundable portion manifests as direct spending through the tax code.

Recommended Reading: Will A Roth Ira Reduce My Taxes

Us Tax Rate For Married Couples

The United States comes in at 12.6% in this category, giving it the 31st highest tax rate. The countries with the lowest all-in average personal income tax rates on married single-earner couples with two children are the Czech Republic , Chile , and Switzerland . Theres quite a disparity between the highest and lowest income tax burdens among OECD countries.

Germany, Belgium, Lithuania, Denmark, and Slovenia have the highest income tax for singleswhile Lithuania , Norway, Denmark , Finland, and the Netherlands have the highest income tax for married couples with two children.

Here Is Who Really Pays The Most Taxes In America

IRS data has some interesting revelations.

Politicians exploit public ignorance. Few areas of public ignorance provide as many opportunities for political demagoguery as taxation.

Today some politicians argue that the rich must pay their fair share and label the proposed changes in tax law as tax cuts for the rich.

Lets look at who pays what, with an eye toward attempting to answer this question: Are the rich paying their fair share?

According to the latest IRS data, the payment of income taxes is as follows.

The top 1 percent of income earners, those having an adjusted annual gross income of $480,930 or higher, pay about 39 percent of federal income taxes. That means about 892,000 Americans are stuck with paying 39 percent of all federal taxes.

The top 10 percent of income earners, those having an adjusted gross income over $138,031, pay about 70.6 percent of federal income taxes.

About 1.7 million Americans, less than 1 percent of our population, pay 70.6 percent of federal income taxes. Is that fair, or do you think they should pay more?

But the fairness question goes further. The bottom 50 percent of income earners, those having an adjusted gross income of $39,275 or less, pay 2.83 percent of federal income taxes.

Thirty-seven million tax filers have no tax obligation at all. The Tax Policy Center estimates that 45.5 percent of households will not pay federal income tax this year.

Along with tax cuts, tax simplification should be on the agenda.

Image: Reuters

Recommended Reading: Doordash Tax Write Offs

Countries With The Highest Single And Family Income Tax Rates

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

If you could live anywhere in the world, wouldnt you want to know the potential income taxes before moving and how that compared to the U.S. tax rates? Perhaps, but thats not the only question to ask. Your filing status of single or married is also a factor in determining which locations might have the highest income taxes. What’s more, the countries with the highest taxes on high incomesSlovenia, Belgium, Sweden, Finland, and Portugalare mostly different from the countries with the highest taxes on average income earners.

Being married with children also can make a difference. Denmark has some of the highest taxes in the world on both single and married taxpayers, but the other top four countries in each of the two categories are completely different, though theyre all in Europe.

Americas Tax System Can Be Better

Americas tax system is moderately progressive and there are opportunities to make it still more progressive. State and local governments have many options to make their tax codes fairer. Congress has options to make the federal tax code more progressive, to offset the regressive impacts of state and local taxes. Some of those options involve repealing provisions of TCJA, but others would address problems in the federal tax code that predated TCJA.

The federal personal income tax has a progressive rate structure and also provides low-wage working people with tax credits that are refundable, meaning they can result in negative income tax liability for certain low-income households. Corporate income taxes are paid directly by corporations. But like all taxes, corporate income taxes are ultimately borne by people. In this case the tax is borne mostly by the owners of corporate stocks and other business assets, which are mostly owned by well-off households. The estate tax applies only to the value of any estate exceeding $11,580,000 in 2020 and consequently only affects the very wealthiest families.

Steve Wamhoff, Emmanuel Saez and Gabriel Zucmans New Book Reminds Us that Tax Injustice Is a Choice, Institute on Taxation and Economic Policy, October 15, 2019.

Recommended Reading: Is Freetaxusa Legit

Realized Capital Gains And Dividends

Realized capital gains and dividends are both heavily concentrated among the affluent. The top 1 percent of households received 75 percent of taxable long-term capital gains in 2019, according to the Tax Policy Center. More than half went to the highest-income 0.1 percent of households those with annual incomes of more than $3.8 million. Before the supply-side tax cuts of the 1980s, the tax rate on capital gains was 35 percent . Today, the top tax rate on capital gains is a much lower 23.8 percent. Moreover, as noted above, effective tax rates on capital gains are even lower than these statutory rates because taxpayers can avoid taxes altogether by holding, rather than selling, their assets until death .

President Bidens campaign proposal to phase out the deduction for households with more than $400,000 in income would raise $143 billion, almost exclusively from the top 1 percent, before the deduction expires at the end of 2025 , the Tax Policy Center estimated.

Policymakers could combine the Biden proposal to eliminate lower tax rates on realized capital gains and dividends for high-income households with his campaign proposal to phase out the pass-through deduction and, as a result, eliminate the special tax advantages that the wealthiest people enjoy on their taxable income.

The Tax History Of The Top 1% Isnt Much Different Than How Things Are Now

When people begin arguing about how much the wealthiest Americans have paid in taxes in the past versus how much theyre paying now, its helpful to have some context. According to the Tax Foundation, The top 1% of Americans today do not face an unusually low tax burden, by historical standards.

Find Out: Tax Loopholes Only the Rich Know

Also Check: Taxes Grieved

Which States Pay The Most In Taxes Compared To Their Lifetime Earnings

Taxpayers in New Jersey are estimated to pay 61.84% of their lifetime earnings in tax, based on current earnings, assets, and tax rates figures. While those living and working in Tennessee will pay just 23.24% of their lifetime earnings on federal and state taxes.

In the chart below you can see a state by state breakdown of the average lifetime earnings against lifetime taxes, and the percentage of earnings that will go towards tax payments.

| State | |

|---|---|

| $1,224,682 | 23.24% |

These figures were calculated by adding both federal and state lifetime taxes across earnings, sales, property, and automotive, then compared against a lifetime earnings figure based on the results of the latest American Community Survey and multiplied by average years worked in the U.S. .