Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

Cases When Youll Have To File

Even if you didnt have much income, you may still have to file taxes if any of the following circumstances apply:

- You had Federal taxes withheld from your pension and/or wages for 2019 and wish to get a refund back

- Are you entitled to the Earned Income Tax Credit for 2019

- You received unemployment income

- You were self-employed with earnings of more than $400

- You sold your home

- You owe any special tax on a qualified retirement plan You may owe tax if you:

- Received an early distribution from a qualified plan

- Made excess contributions to your IRA or HSA

- Were born before July 1, 1949, and you did not take the required minimum distribution from your qualified retirement plan

- Received a distribution in the excess of $160,000 from a qualified retirement plan

If any of the above circumstances apply to you then you should file a federal tax return regardless of your earnings.

Most of us with a small business or side hustle will need to file since self-employment income of more than $400 is one of the minimum requirements.

Recommended Reading: How Much Does H& r Charge

How To Calculate Your Total Income For The Year

Calculating your total gross income for the year isnt difficult. Simply add together all sources of income that you received for the current tax year.

Here are a few helpful tips to simplify the process:

- Include All Income: All income for the year is required to be reported to the IRS. This includes wages from your job, self-employment income, commissions, tips, and interest income.

- Gather Documentation: For accurate calculations, gather everything documenting your income. This includes W-2s for wages and 1099-MISCs for contracted work, as well as, bank statements and accounting records.

- Track Income Accurately: If youre married and filing a joint return, ensure that your income and your spouses income are tracked and reported accurately.

- Calculate Your Taxable Income: If your total yearly income is high, dont panic. On your tax return, youll be able to lower your taxable income with deductions and credits, which in turn lowers your tax liability. Well explore this more in further detail a little later.

When It Pays To File

For those few who dont legally have to file, it pays sometimes to send in a return anyway.

This is the case for individuals who dont earn much but might be eligible for the earned income tax credit. This benefit is available to qualified individuals even if they owe no tax, meaning they would get money back from the federal government. Many people think the credit is available only to parents while that is not true, the credit amount is greater for eligible low-wage taxpayers with children.

The IRS also says that most individual taxpayers are due a tax refund. But those taxpayers must send in a Form 1040, Form 1040A or Form 1040EZ to get that cash.

You can check out the filing requirements section of IRS Publication 17 for more details.

Once youve determined that you need to file taxes, your next question is likely to be when do I have to file taxes? This year, the deadline for filing your 2021 tax return is Friday, April 15, 2022. If youre still not sure whether you must file a tax return, ask a tax professional, call the IRS at 829-1040 or make an appointment at your nearest IRS Taxpayer Assistance Center.

Read Also: Efstatus.taxact

How Much Money Do You Have To Make To Not Pay Taxes

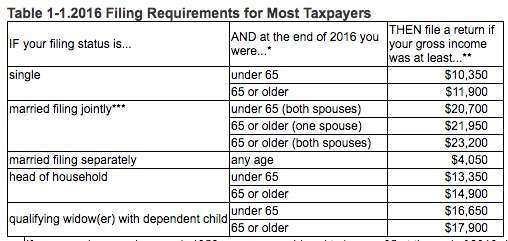

The amount that you have to make to not pay federal income tax depends on your age, filing status, your dependency on other taxpayers and your gross income. For example, in the year 2018, the maximum earning before paying taxes for a single person under the age of 65 was $12,000.

If your income is below the threshold limit specified by IRS, you may not need to file taxes, though its still a good idea to do so.

What this article covers:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

You Must File An Income Tax Return If:

- You owe tax to the CRA.

- Youve participated in the Home Buyers Plan or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have received a Canada Workers Benefit advance payments in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

Read Also: How To Appeal Cook County Property Taxes

How Much Do You Need To Make Before Paying Taxes

Our jobs bring us different incomes and, therefore, different personal income tax requirements. That being said, the majority of Americans do have to pay taxes on the money they make. If you are a single person or are married and filing separately from your spouse, to be required to file a federal tax return, you will need to have gross income of more than $12,000 in 2018. However, different rules may apply if you are married, file as Head of Household, are self-employed or can be claimed as a dependent of another taxpayer.

Once you understand where your taxable income stands in relation to these minimums, youll want to know the tax protocol that applies when you earn no income, are paid in cash, or are paid under the table.

File A Tax Return To Claim A Missing Stimulus Payment

The 2020 tax season is different because of the two stimulus checks given out by the federal government. If you think you are owed stimulus money, you may need to file a tax return to claim the Recovery Rebate Credit. Consumers who are eligible for the Recovery Rebate Credit and did not receive the first or second round of stimulus payments must file a 2020 tax return to claim their missing cash.

You might be eligible to claim the Recovery Rebate Credit if you lost income or your income was reduced in 2020 youre a college student that was claimed as a dependent in 2018 or 2019 but are no longer a dependent in 2020, or you gave birth to or adopted a child.

You should also file a return if youre expecting a tax refund or if youll receive one of the many credits available, such as refundable credits, earned income credit, additional child tax credit, American opportunity credit, recovery rebate credit or credits for sick and family leave, says Brent Lipschultz, a partner and CPA at New York-based tax and accounting firm EisnerAmper.

Many peoples situations changed in 2020 and they may be entitled to additional stimulus payment amounts, she says.

If youre a taxpayer who had taxes withheld during 2020, but are not required to file a tax return, the only way you will receive those withholdings back is by filing a return, Curtis says.

Don’t Miss: Is Freetaxusa A Legitimate Site

State And Local Tax Brackets

States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal governments.

California has the highest state income tax at 13.3% with Hawaii , New Jersey , Oregon , and Minnesota rounding out the top five.

Five states and the District of Columbia have top rates above 7%, with Illinois scheduled to join them if Gov. J.B. Pritzker gets his way.

Seven states Florida, Alaska, Wyoming, Washington, Texas, South Dakota and Nevada have no state income tax.

Tennessee and New Hampshire tax interest and dividend income, but not income from wages.

Not surprisingly, New York City lives up to its reputation for taxing income with rates ranging from 3.078% to 3.876% remarkably, the Big Apple is not the worst. Most Pennsylvania cities tax income, with Philadelphia leading the way at 3.89% Scranton checks in at 3.4%. Ohio has more than 550 cities and towns that tax personal income.

Carry Over Tax Credits And Deductions

When you file your tax return, non-refundable tax credits are not paid to you as a refund.

However, refundable tax credits and deductions can be payable to you in the applicable tax year.

Some tax credits or deductions may be applied to a previous year or carried forward to a future year.

An example of this type of tax deduction is the capital gains deduction.

You May Like: Paying Taxes With Doordash

Do I Need To File A Tax Return

You may not have to file a federal income tax return if your income is below a certain amount. But, you must file a tax return to claim a refundable tax credit or a refund for withheld income tax. Find out if you have to file a tax return.

The American Opportunity Tax Credit

This credit covers up to $2,500 for qualified college expenses and is partially refundable. If the credit brings the amount of tax you owe to zero, you can have 40% of any remaining amount of the credit, up to $1,000, refunded to you.To be eligible for the AOTC, students must be within their first four years of higher education and be enrolled at least half time at some point during the tax year.

To claim the AOTC, you must file a federal tax return with a completed Form 8863 attached to your Form 1040 or Form 1040A.

Read Also: How Much Tax Do You Pay On Doordash

What Income Is Low Enough To Not File Taxes

According to your filing status and age, you can earn or lose a certain amount. If youre under 65 and your household income is $12,550, you need to file status if you have a single filing status. An individual with income below this threshold generally does not need to file a tax return from the IRS.

Where And How Can I File My Tax Return

If you have a registered business, earn from agriculture and forestry or are self-employed, you must submit your tax return electronically via the internet portal of the German financial administration Elster. You need to register and verify your identity with your tax ID number and an e-mail address. Keep in mind no to postpone the registration to the last minute as the authentication process takes a few days. You can also submit your tax return electronically with a paid programme or application like smartsteuer. Such paid tools are easier to use than Elster.

As an Employee, you can submit your tax returns electronically if you choose so unless you have other incomes/income progressions- for instance, when you receive a parental allowance or unemployment benefits, exceeding ⬠410 per year in addition to your wages. Then you, too, are obliged to file your tax return . You can also submit your tax return by hand and deliver it per post or in person. You will find the appropriate forms in your Tax Office or online at formulare-bfinv.de. Visit Behördenwegweiser to find the Tax Office responsible for you.

Please note: In principle, you do not need to send the receipts associated to your tax return to the Tax Office. But you must preserve all the evidence and documents as the Tax Office may demand proof if any questions arise until up to ten years after your tax return.

Read Also: Federal Tax Id Reverse Lookup

Why You Might Want To File Even If You Dont Have To

You should bear in mind that even if its not necessary for you to file a tax return, you might still want to do so. Look into it, because its possible to be able to deduct a limited amount of higher education expenses, or at least claim some education-specific tax credits such as the American Opportunity Credit. This depends on each situation, but its important to look into it first and see if you qualify.

When Does A Retirees Income Trigger Taxes

Retirees who are still working likely have at least two streams of income: Social Security benefits and a paycheck from a job. The Social Security benefits you receive can be taxable if 50% of your benefits, plus all of your other income, is greater than the specific limits for your filing status. These amounts are as follows:

- Single filers, qualifying widowers and heads of households bringing in more than $25,000, based on the math above, may have to pay taxes on their Social Security benefits.

- A married couple filing jointly bringing in more than $32,000, based on the math above, may have to pay taxes on their Social Security benefits.

With that, the benefits you receive may or may not be taxable based on your other income. For example, lets say that you are a single filer that received $20,000 in Social Security benefits. Additionally, you earned $20,000 at a part-time job. When you run the numbers, 50% of your benefits plus your other income would be $30,000. With that, Uncle Sam would require you to pay federal taxes on a portion of your Social Security benefits.

As another example, lets say a receives Social Security benefits of $20,000. You also bring in $20,000 through other sources. With that, 50% of your benefits plus your other income would be $30,000. Thats less than the base amount for married couples filing jointly. So, you wouldnt have to pay federal income tax on any of your Social Security benefits.

Also Check: Do You Have To Pay Taxes With Doordash

Affordable Care Act Premium Credit Claim

If you have health care coverage as required by the Affordable Care Act, also known as ACA or Obamacare, you might need to file a return.Specifically, this will be the case if you qualified for federal help in buying your health care coverage through the health insurance marketplace or exchange. If advance payments of the ACA premium tax credit were made for you, your spouse or a dependent who obtained such marketplace medical coverage, that amount must be reported by filing a Form 1040 tax return and Form 8962, Premium Tax Credit.

This will ensure that you got the appropriate tax credit in advance. If you received too much premium help, youll have to repay it when you file your return. If you did not get enough, you can collect the extra when you file.

If I Dont Meet The Minimum Income Requirements Should I Still File A Tax Return

Even if you dont meet the minimum income requirements, you may still choose to file a tax return. This is particularly true if you will be receiving a tax refund. There are also other instances where you may not meet the income requirements but meet other IRS requirements that would require you to file your federal tax return.

Recommended Reading: H& r Block Early Access W2

Compassionate Allowance : Supplementary Income Up To 410 Euros Tax

Employees, civil servants, and retirees with supplementary income that is not subject to wage tax are not required to pay tax on it as long as it doesnt exceed the exemption limit of 410 euros per calendar year. Supplementary income between 410 and 820 euros will be taxed at a reduced rate. This is known as compassionate allowance and is automatically calculated by the Tax Office. For example, if you have rental income of 600 euros, the Inland Revenue Office deducts the 600 euros from 820 euros 220 euros then remain tax-free, while the remaining 380 euros are taxable.

Please Note: In the case of joint taxation of married couples, the supplementary incomes will be added without doubling the exemption limit of 410 euros!