Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Filing Your Taxes Online

For those wondering “can you file taxes with your last pay stub?”, the answer is yes, but the best way to do so is online. It is possible to use a pay stub to file taxes in the traditional way, but you’ll need to notify the IRS that you’re doing so, and fill out a 4852 form.This can be done in lieu of a W-2. First off, it’s important to remember that you can only file your taxes online under certain circumstances. According to the Internal Revenue Service , the maximum gross income threshold for those wishing to e-file for free with the IRS FreeFile service is currently $57,000.If you earn any more than this in a year, you will have to file your taxes by printing and mailing your tax return. You will also be unable to e-file if you are under 16 years old and have never filled in a tax return previously.If you are currently resident in Guam, the U.S Virgin Islands, the Commonwealth of the Northern Mariana Islands or American Samoa, you will also be unable to e-file. You can still prepare your return online, but you will have to print and mail it if any of the above applies to you.If you fit the bill and have an accurate pay stub, as well as a decent WiFi connection, you’re good to go!

How To File Taxes With Last Pay Stub The Right Way

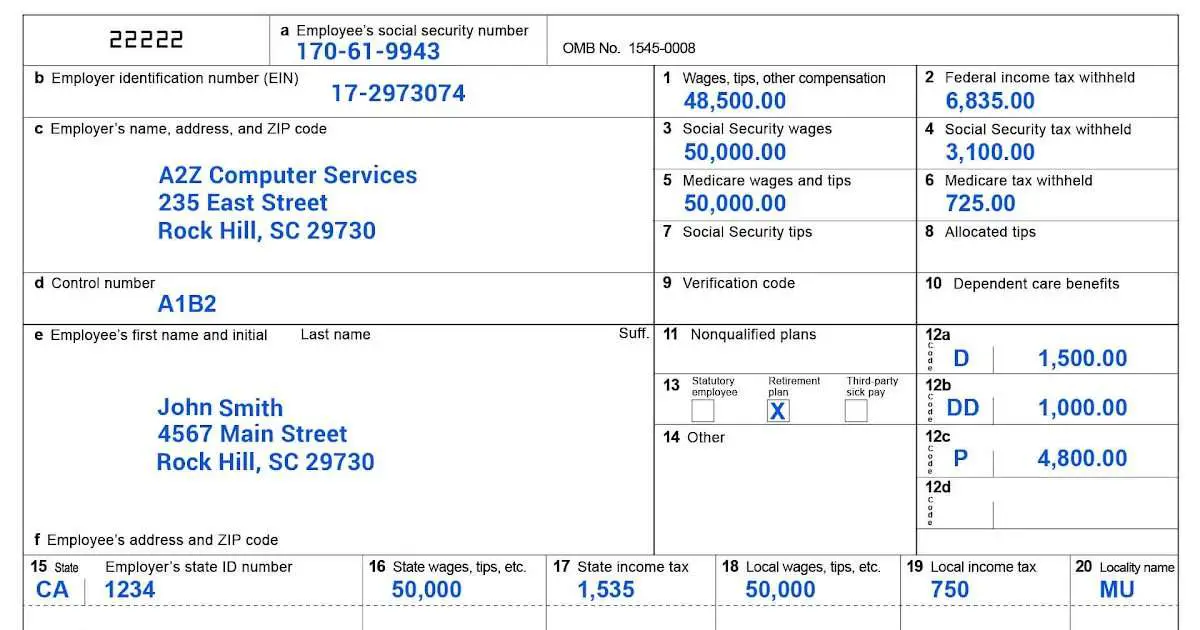

How to use your last pay stub as W-2 form is not as perplexing as it may seem? Essentially, a pay stub will be able to provide most, if not all of the information you need to file your taxes, that you would normally get from a W-2.Your pay stub will, of course, have your monthly or bi-weekly income on it, which is the most important piece of information the IRS needs. It will also list any tax deductions that come out of your paycheck. These are especially important for when you’re doing a tax refund calculator using pay stub.The tax deductions should be listed as abbreviations on your pay stub, next to the total amount deducted. These will normally include Federal Income Tax – this is usually withheld by the Internal Revenue Service.Your home state will also withhold any state income tax due, this is usually listed on your pay stub as “SIT”, although this varies. There will also be entries for any local taxes, social security taxes , and Medicare taxes.Medicare taxes are usually abbreviated as “MEDI”. Once you have all of these deductions in front of you, you can use them to estimate your annual tax payment. If it’s a monthly pay stub, simply add these deductions together and multiply them by 12. If it’s a bi-weekly pay stub, simply multiply by 24, and so on.Once you have your estimate, it’s time to use a tax calculator!

Read Also: Taxes For Doordash

What Do I Need To File My Return Without A W

When you realize that you simply cant wait any longer for your employer to send a duplicate of your IRS Form W-2, “Wage and Tax Statement,” dont let this stop you from filing on time. Although your employer has until January 31 to send out your W-2, if you havent received it by February 27th, you need contact the IRS so a follow-up can be conducted with your employer. Unfortunately, you wont be able to e-file your return if you do not have your W-2. Because you also have to attach IRS Form 4852, “Substitute for Form W-2, Wage and Tax Statement_,”_ which allows you to file your return in the absence of a W-2, you must file a paper return.

You will receive Form 4852 from the IRS along with a copy of the notice that was sent to your employer requesting your replacement W-2. At this point you can continue to wait for your employer to supply the missing W-2, or you can go ahead and use your last pay stub to determine what you need to report on your IRS Form 1040, “U.S. Individual Income Tax Return.”

Change Your Address If You Moved

If your address has changed since you stopped working for your former employer, make sure you filled out a change-of-address form at your local United States Post Office. After submitting this form, you must typically wait seven to 10 days before the USPS processes your request and mail arrives at your new address. If you forgot to fill this form out when moving, mail sent to your previous address will not get forwarded to your new home, and the Postal Service might have returned your W-2 to your former employer.

Read Also: Michigan Gov Collectionseservice

How To Convert A Pay Stub To A W

When tax season rolls around, the one thing you don’t want to do is misplace your W-2, or discover that your employer never sent one to begin with. However, if you don’t have your W-2 on hand when the time comes to file taxes, or you just want to get an early estimate of the amount of taxes you could owe, there is another solution. Fortunately, the IRS has alternatives that allow you to still file your taxes using a pay stub. and Form 4852.

Tips

-

Although having a W-2 is the ideal circumstance when it comes time to file your taxes, you can still complete your return without one. You can use IRS Form 4852, alongside a copy of your last pay stub to provide the necessary information on the standard Form 1040.

What If Im An Independent Contractor

If you are an independent contractor, then you should not be expecting any W-2s. Instead, any company from which you earned more than $600 for the year should send you a form 1099 instead. This form serves a similar purpose to the W-2, except it will not show any withholdings, since as an independent contractor, you are responsible for taxes on your own.

If you fail to receive a 1099 from a company, all of the same instructions above apply. Namely, you can contact the company if you failed to receive it, and file a form 4852 and report the situation to the IRS if that proves fruitless. If you’re a freelancer, on how to file taxes without a W-2.

Don’t Miss: How Do I Protest My Property Taxes In Harris County

How To File Your Income Tax Return Without Your W

Your employer is responsible for providing a vital piece to your tax-return puzzle by issuing you Form W-2, Wage and Tax Statement. Without this form, you wont have the information you need to file your tax return, and your anticipated refund may seem unreachable. Remember that if you dont file your return because your W-2 is missing, you will likely be facing a stiff penalty. This seemingly complex dilemma is easily resolved by filing a substitute form as a replacement W-2.

What To Do If Youre Missing Information

No one is perfect, and losing a piece of paper, such as a T4 slip, can happen. Rest assured, all hope is not lost, and there is a way to recover your information.

A T4 slip indicates how much you were paid before deductions by an employer, in addition to your Canada Pension Plan , Québec Pension Plan , Employment Insurance contributions, and other amounts deducted from your paycheque during the tax year.

Each employer should give you a T4 slip if you worked for them within the last tax year no matter if youre a salaried or hourly-paid employee. Depending on how many companies you worked for, you may have multiple T4s that youll need to submit as part of your tax return.

Employers are required to send out T4s to all employees by a deadline each year . Even if youre not with the same employer, they are still obligated to send you a T4 slip. But sometimes addresses and contact information change, things slip through the cracks, and youre stuck without a T4 as the tax deadline looms.

Luckily, the Canada Revenue Agency featuresMy Account, an online portal for individuals and businesses. This service allows you to access slips that have been processed. You can also check any balances and forward unused credits from the year before, such as tuition credits and your registered retirement savings plan contribution limits.

Also Check: How To File Taxes Without Income To Get Stimulus Check

Can I File My Taxes Without My W2

ikkie_2005_rox

Hello- You might beable to file your return using information from your last pay stub orpaycheck of the year — but that doesn’t mean you should.

We knowthat you count on getting your refund as quickly as possible.However, many tax experts advise against filing without your W-2.

Why? Becausein your hurry, you could cause your refund to be delayed for weeks.

Important: Filing your return using only your last paystub or paycheck could create headaches for you later:

- The IRS or your state might send you notices, if what’s on your pay stub doesn’t match what’s on your W-2. The W-2 contains specific data that isn’t always on your paycheck.

- If the numbers you enter on your return don’t match your W-2, the IRS could hold up your refund for weeks until the differences are resolved.

- You might have to amend your return, If you do file with your pay stub only and some figures differ from your W-2. That can be time-consuming.

As soonas you receive your W-2 ,you can use our TurboTaxImport feature.

Hope this helps and thank you for using TurboTax!

If youremployer participates, import your data automatically tosave time and ensure your return is accurate.

Tips If You Can’t Get Your W

If you have completed the steps above and believe you will not get your W-2 by the April 15 deadline, you still need to file your taxes. You have a few options to avoid IRS fines:

-

Request an extension: Submit Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, to ask the IRS to give you more time to file your taxes. If accepted, you have six more months to file your income tax returns but must still pay your taxes on time. Include with the form your best estimate of how much tax you owe and payment for that amount.

-

File without a W-2: If you do not expect to receive a W-2 from your previous employer â if, for instance, they are no longer in business â you can submit Form 4852, Substitute for Form W-2, Wage and Tax Statement, with your tax return in place of a W-2. Use the information on your last pay stub from that company to estimate your earnings and withholdings and complete the 4852. If you receive your W-2 after submitting a 4852, confirm your estimates, and file Form 1040x to correct any inaccuracies.

You can find and download these forms on the IRS website and must submit them by the April tax filing deadline. Getting an extension or filing a substitute form can slow processing of your return and delay your refund, but prevents the IRS from penalizing you for overdue or unfiled taxes.

You May Like: How To Buy Tax Lien Properties In California

How To File Taxes With Your Last Pay Stub

Tax season is one of the most stressful times of the year, however, it doesn’t have to be. Your W-2 form will provide you with most of the information you need to file your taxes. However, sometimes your employer may have failed to provide you with one, making things a little trickier.Not to worry. As long as you have a pay stub, you’ll be perfectly able to file your own taxes, with minimum hassle. If you want to know how to file taxes with last pay stub, all you need to do is follow a few simple steps.The information on your pay stub, which you can generate yourself online, will help you figure out everything you need to know. You’ll be able to calculate how much you owe, as well as determine whether or not you might be due a refund.As long as you’re filing your taxes online, which is known as e-filing, filing taxes with last pay stub is totally legal and relatively simple. Here’s everything you need to know about filing taxes with your last pay stub.

When To Call In Extra Help

Some people are simply old pros when it comes to filing their taxes. But, if you just dont have the time to figure everything out, theres no harm in calling in reinforcements.

Online NETFILE-certified programs can make filing your return quick and easy. Or, if your taxes are complicated, you can hire an accountant. An accountant may be able to suggest other expenses you can claim on your return, which is why its crucial to save all your receipts.

If an accountant isnt in your budget and you dont want to file online, many communities offer no-charge tax return consulting sessions. Some schools and community centres may even offer simple tax help.

If you make a modest income, you may be eligible for one of the CRAs free tax clinics theyre virtual this year.

Although tax filing was extended last year due to the COVID-19 pandemic, the deadline remains on schedule this tax season. Still, the CRA understands the extraordinary circumstance stemming from 2020, including emergency and recovery benefits, work from home credits, and other financial challenges that will make filing a return difficult this year. Visit the CRA website to learn more about the tax accommodations and assistance available.

Dont forget, the deadline to file your taxes is April 30, 2021!

Don’t Miss: How To Buy Tax Lien Properties In California

Minimum Amount For A 1099

When youre not an employee, you are responsible for paying your own withholding taxes, as well as all of your Social Security and Medicare taxes. The 1099 is a reporting form, and its not the same as trying to file income tax without a W2, which employers use to report wages and taxes withheld to the IRS. For the self-employed, aggregate payments over $600 require a 1099. That doesnt mean that lesser payments arent taxable, but the client doesnt have to furnish a 1099 to the contractor.

What Happens If Your Employer Does Not Pay Payroll Taxes

When employees are paid cash, employers often do not pay the appropriate payroll taxes. This is called payroll tax fraud. Employers may try to justify this fraud by claiming that:

- You will receive more money in cash.

- Every small business, or everyone in this industry, is doing the same.

- You will not be hurt in any way.

However, your employers tax fraud does harm you, by creating the following difficulties:

- You cannot document your income because you do not receive W-2s and paycheck stubs. Without proper documentation of your income, it also may be difficult to file an accurate income tax return, which may prompt an audit by the government.

- You may owe the government unreported taxes that will have to be paid all at once,

- You may be ineligible to receive unemployment, disability, Social Security, or Medicare benefits when you need them.

Also Check: How To Correct State Tax Return

Why Jackson Hewitt

Our Tax Pros will connect with you one-on-one, answer all your questions, and always go the extra mile to support you.

We have flexible hours, locations, and filing options that cater to every hardworking tax filer.

We won’t stop until you get every dollar you deserve, guaranteed. It’s what we’ve been doing for over 35 years.

Can I Access My W

You can access your W2 online sometimes, but usually only if your employer has made it available to you. It’s a good idea to thoroughly check your employer’s website if you haven’t heard from them. If there’s an employee login portal , you might find your W2 somewhere inside. However, not all employers will offer this information online.Even if you can’t access your W2 online, you can still e-file your taxes, which is often easier than filling out the paperwork by hand. If you haven’t found your W2 on your employer’s website,

Also Check: How Do I Protest My Property Taxes In Harris County

How To Do Taxes With Last Pay Stub

Form 4852 is a surprisingly short, one-page document that is relatively easy to fill out, if you have your last paycheck stub of the year. This pay stub has year-to-date totals of all withholding and wages for the year. Simply follow the attached instructions at the bottom of this form. You will need to explain why you do not have your W-2 and supply information from your pay stub, such as your year-to-date gross income and your YTD deductions, including Social Security and Medicare, as well as withheld state, local and federal taxes. Sign the form to validate it, attach it to your 1040 form and submit it to the IRS.

How To Get Your W

A W-2 form is an important document to have when filing your annual taxes. At the beginning of each year, companies send all their employees W-2s that include information about the previous year’s earnings and taxes. If you have changed jobs in the past year, you must still get a W-2 from your former employer to file your taxes properly. In this article, we describe how to get your W-2 from a previous employer and tips if you have not received it yet.

Related:How To Get A Pay Stub

Also Check: Turbo Tax 1099q