When Should You Take An Itemized Deduction Rather Than Standard Deduction

Taking the itemized deduction may make sense if you had many unreimbursed medical or dental expenses during the taxable year. But keep in mind that those expenses must exceed 7.5% of your AGI, as well as the standard deduction for your filing status, to reap the benefits.

For 2022, the standard deduction for a single taxpayer is $12,950 and $25,900 for joint filers.

Lets look at an example. Imagine that your AGI for the taxable year is $90,000. You were diagnosed with cancer and the combination of treatment, surgeries, medication and hospital stays cost $150,000. In this case, it would make sense to take the itemized deduction because the cost of treatment would well exceed 7.5% of your AGI and is greater than the current standard deduction.

On the other hand, imagine that you had the same AGI for the taxable year but only accrued $5,000 in unreimbursed medical expenses for the year. In this case, taking the standard deduction would be a better way to lower your taxable income because your medical expenses would not exceed 7.5% of your AGI.

Remember that you can only deduct qualifying medical expensesif you accrue thousands of dollars or more in medical expenses but they dont meet the requirements, taking the standard deduction would still be the better option.

Medical Insurance Premiums Pre Tax

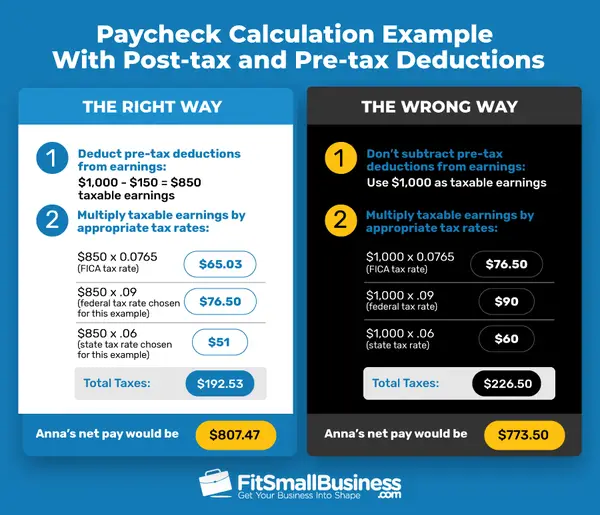

Some employers offer to pay for health insurance premiums through a salary reduction agreement as part of your employee benefits. You agree to get paid a certain amount less in cash and your employer agrees to use that money to pay for your health insurance. For example, you might agree to take $5,000 off your annual salary in exchange for health insurance premiums. You then pay for your health insurance in pre tax dollars, because when your employer fills out your W-2 at the end of the year, your federal taxable income doesn’t include the premiums. For example, if you were going to be paid $85,000, but $5,000 went to premiums, your W-2 only shows $80,000. So, you’re not allowed to claim a deduction for these costs because they’re not counted as income to begin with.

If, on the other hand, you pay your medical premiums out of your own pocket, you’re allowed to deduct those costs as part of the medical expenses deduction. However, the medical expenses deduction is limited to only the expenses that exceed a certain percentage of your adjusted gross income 7.5 percent for the 2017 and 2018 tax years. So, if you’re not itemizing or expenses don’t add up to the threshold percentage of your AGI, you won’t get any deduction.

The Itemized Deduction Over The Standard Deduction

Now you might be asking yourself, When does it make sense to do the itemized deduction instead of taking the standard deduction? The answer is actually simple. For our example family, they are married filing jointly, so their standard deduction is $24,000. If your itemized deductions are greater than $24,000, than you should take the itemized approach. The tricky part is figuring out if you have enough deductions to reach that much.

What Qualifies?

Common expenses that qualify for itemized deductions include:

- Medical expenses

- Property, state, and local income taxes

- Charitable contributions

The important part to look at in this pre-tax, post-tax argument is the difference in qualifying medical expenses. For our example family, the most they can deduct in medical expenses is $3,800 pre-tax, or $6,200 post-tax. The difference between post-tax and pre-tax is the annual cost of your health premiums, $2,400 for our example family, or at most $12,000.

You might be thinking post-tax health insurance premiums may be more beneficial if they help to push your itemized deductions over that $24,000 mark. However, that is not the case. First, lets take a look at this chart showing tax savings if you did file an itemized return.

Hold on a second

FIRE Away!

Recommended Reading: Are Charitable Contributions Made From An Ira Tax Deductible

Tax Deductions For Pre

There are a lot of advantages to having your premium deducted on a pre-tax basis from your paycheck. If your employer sets up a Premium Only Plan , or Cafeteria Plan, your insurance premium contributions can be deducted from your payroll on a pre-tax basis. This plan can save you up to 40% on income taxes and payroll taxes. Also, pre-tax medical premiums are excluded from federal income tax, Social Security tax, Medicare tax and typically state and local income tax.

You can also reduce the amount of taxes that you owe with exclusions, deductions, or credits. These three subsidies are slightly different in nature but all boast big advantages. Essentially, deductions and exemptions both reduce your taxable income, while credits reduce your tax.

Are Health Insurance Premiums Tax Deductible

For the 2020 and 2021 tax years, youre allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself, your spouse, or your dependentsbut only if they exceed 7.5% of your adjusted gross income . Additionally, self-employed people may deduct premiums even if they don’t exceed 7.5% of their AGI.

Also Check: How Many Years Can I Go Back And File Taxes

What Are Examples Of Incorrect Payroll Deductions

Incorrect payroll deductions are often the result of employers charging their employees for benefits and services that they should be paying themselves. This includes:

- Federal unemployment tax

- Personal protective equipment required by OSHA

- Tools necessary to perform work

There may be additional restrictions at the state level on withholding income to cover uniforms, cash register shortages and job-related expenses.

How Much Do You Save With Pre

Our rule of thumb: Aim to save at least 15% of your pre-tax income1 each year, which includes any employer match. Thats assuming you save for retirement from age 25 to age 67. Together with other steps, that should help ensure you have enough income to maintain your current lifestyle in retirement.

Recommended Reading: What Tax Bracket Are You In

Post Tax Medicare Premiums

Post-tax Medicare premiums that are paid out of your pocket may be deducted to compute applicable credits. This applies to the following types of coverage:

What If I Qualify For Federal Premium Subsidies

You may qualify for an income-based premium subsidy, also called an advance premium tax credit , for coverage you bought through the Health Insurance Marketplace. Any premium you pay that’s reimbursed by an APTC can’t be deducted from your taxes. But any remaining premium can be deducted.

For example, say your APTC is $300 and your tax return shows you can deduct $500 in premiums. In that case, you could claim the additional $200 on your return. If your eligible tax deduction is lower than your APTC amount, the difference is subtracted from your refund or added to your balance due.

You May Like: Do I Have To File Income Tax

Is Health Insurance Tax

Health insurance premiums are deductible on federal taxes, in some cases, as these monthly payments are classified as medical expenses. Generally, if you pay for medical insurance on your own, you can deduct the amount from your taxes. Your income and how you get your insurance help determine whether the costs are eligible for tax deductions.

Below are some typical sources for health insurance and tax guidance for each item.

Which Is Better Hmo Or Hdhp

Plus, an HDHP will give you the ability to contribute to an HSA, which can be a great tool for paying for planned medical expenses. An HMO could be a good option if you know that the doctors and specialists you see are part of an HMO network, or if you are comfortable seeking a lot of care from an HMO network.

Recommended Reading: Can You Pay Taxes In Installments

State And Local Exceptions

Some states set laws for employers that offer health insurance as employee benefits. For example, in Connecticut, an employer that offers health insurance to be paid partially via payroll deduction must do so under a cafeteria plan.

If you are subjected to state and local income tax withholding, whether pretax contributions are excluded from those taxes depends on your state and local governments. Consult your state revenue agency for its guidelines tax withholding for Section 125 health insurance deductions.

Are Dental And Vision Included In Any Healthcare Plans

Health insurance plans can include dental and vision, but usually dont. Employers must add them on separately most of the time. But note that enrollment for this kind of insurance is ongoing, not just at the end of the year.

Consider finding a healthcare plan that includes dental or vision or gives you the option to add them on later. Your employees dental and visual health is crucial, especially as most modern businesses involve staring at screens. Routine appointments mean detecting problems early and making sure employees can keep doing their jobs effectively.

You May Like: Where Can I Mail My Tax Return

Medical Expense Deductions For The Self

There is an exception made to the 7.5% rule for individuals who run their businesses. Among the many other tax deductions and benefits that self-employed individuals can claim, you’re allowed to deduct all your premium payments from your adjusted gross income, regardless of whether you itemize your deductions. However, you may be precluded from this deduction if you are:

- Eligible to participate in another employer’s plan and elect not to

- Self-employed, but you have another job that offers a health plan

- Eligible to receive coverage through a spouse’s employer-sponsored plan.

There are also limitations imposed on self-employed individuals based on the amount of their business income. In any given year, a self-employed person cannot deduct more than the income they generate through their business operations. Individuals who operate more than one business can designate only one of them as the health insurance plan sponsor you cannot add up the income generated by multiple companies to claim the maximum deduction. In the case of self-employed persons, it may be in their best interest to choose their most profitable business as the plan sponsor to increase their potential amount of tax relief.

Is An Hsa A Good Idea

HSAs Are Great If You Never Get Sick So even if you’re the model of perfect health right now, you can invest that money for 30-40 years and use it when you’re retired. Money in your HSA can even be applied to deductibles, coinsurance, and copays if you decide to switch back to a traditional plan in the future.

Read Also: What All Do I Need To Do My Taxes

Are There Advantages To Either Option

Its important to understand the difference between pre- and post-tax benefits because choosing one or the other could be disadvantageous to the policyholder, depending on the type of benefit. Pre-tax contributions reduce overall taxable income and provide an immediate tax-break for employees. Its advantageous to pre-tax benefits when savings on current taxes is needed. However, with pre-tax contributions, taxes could be owed down the road when the benefits are used.

Post-tax contributions for benefits do not reduce overall tax burden but can provide future relief when its time to utilize the benefits. They may not provide tax breaks on the front end, but a post-tax deduction can result in savings in the future

This blog is up to date as of July 2020 and has not been updated for changes in the law, administration or current events.

4 minute read

Both plans are designed to help protect you financially, however, depending on your situation, one may be more beneficial than the other. Learn more.

3 minute read

Knowing that your loved ones are protected through life insurance can help provide you with peace of mind, even during inflation and uncertain times.

May 10, 2022

2 minute read

Are you trying to decide between disability insurance and critical illness insurance? Learn why it may be important to have both.

Reporting On The Form W

Employers that are subject to this requirement should report the value of the health care coverage in Box 12 of the Form W-2PDF, with Code DD to identify the amount. There is no reporting on the Form W-3 of the total of these amounts for all the employers employees.

In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee. See the chart, below, and the questions and answers for more information.

An employer is not required to issue a Form W-2 solely to report the value of the health care coverage for retirees or other employees or former employees to whom the employer would not otherwise provide a Form W-2.

The chart below illustrates the types of coverage that employers must report on the Form W-2. Certain items are listed as “optional” based on transition relief provided by Notice 2012-9PDF . Future guidance may revise reporting requirements but will not be applicable until the tax year beginning at least six months after the date of issuance of such guidance.

The chart reviews the reporting requirements for Box 12, Code DD, and has no impact on requirements to report these items elsewhere. For example, while contributions to Health Savings Arrangements are not to be reported in Box 12, Code DD, certain HSA contributions are reported in Box 12, Code W .

Recommended Reading: How To Find Out Who Claimed You On Their Taxes

Understanding Health Insurance Premiums

Health insurance premiums, the amount paid up front to keep an insurance policy active, have been steadily increasing as healthcare costs have increased in the United States. Premiums can be considered the “maintenance fee” for a healthcare policy, not including other payments that consumers have to pay, such as deductibles, co-pays, and additional out-of-pocket costs.

When the Affordable Care Act was passed by President Barack Obama in 2010, it allowed certain families to access premium tax credits on their health insurance plans, relieving some of the burdens of skyrocketing health insurance premiums.

According to research by the Kaiser Family Foundation, a non-profit organization that focuses on healthcare issues in the U.S., roughly half of Americans receive health insurance through an employer-based plan.

If your medical premiums are deducted through a payroll deduction plan, it’s more than likely that you’re covering your share of your insurance premium with pre-tax dollars. So, if you deducted your premiums at the end of the year, you’d effectively be deducting that expense twice.

How Does An Hsa Ppo Plan Work

It’s paired with a federal tax-free* health savings account to help you save money. Preventive care services such as a flu shot are fully covered. You pay 100% for all other services until you meet your plan-year deductible.After your deductible is met, you pay a copayment or coinsurance for covered services.

Don’t Miss: How Much Money Will I Get Back In Taxes

Are Health Insurance Premiums Tax

Maybeif your healthcare costs are high enough

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

A Tea Reader: Living Life One Cup at a Time

Health insurance is one of their most significant monthly expenses for some Americans, leading them to wonder what medical expenses are tax-deductible to reduce their bill. As healthcare prices rise, some consumers seek to reduce their costs through tax breaks on their monthly health insurance premiums.

If you are enrolled in an employer-sponsored health insurance plan, your premiums may already be tax-free. If your premiums are made through a payroll deduction plan, they are likely made with pre-tax dollars, so you would not be allowed to claim a year-end tax deduction.

However, you may still be able to claim a deduction if your total healthcare costs for the year are high enough. Self-employed individuals may be qualified to write off their health insurance premiums, but only if they meet specific criteria. This article will explore tax-deductible medical expenses, including the requirements for eligibility.

Is Supplemental Health Insurance Tax Deductible

Supplemental health insurance premiums, like hospital indemnity insurance and critical illness insurance, are generally tax deductible, but only as a qualified medical expense.

You can deduct the cost if the total cost of your medical expenses and supplemental health insurance premiums exceeds 7.5% of your AGI and you take the itemized deduction.

Don’t Miss: Where To Pay Irs Taxes

Q: Do I Have To Take Part

A: No, it’s up to you. You can choose not to participate in the Plan by filing a Waiver Form with the Benefit Administration department. You will be given a Waiver Form for the Plan at the same time you become eligible for the Plan. If you do not waive participation in the Plan prior to the date required for such waiver, you will be deemed to have elected to participate, and your insurance premiums will be deducted on a pre-tax basis for the next Plan year.

How Do Small Business Health Insurance Tax Deductions Work

Like larger companies, small businesses are typically able to deduct some of their health insurance-related expenses from their federal business taxes. Expenses that might qualify for these deductions may include:

- Monthly premiums

- Contributions to an HSA

- Tax-advantaged dollars

Even if you cant afford to enroll in a group health insurance plan, you may still be able to set aside tax-advantaged dollars to help employees buy coverage on their own. Each of these tax options features benefits for both your business and your team, so it is important to understand the details of each to ensure you are getting the most for your health insurance investment.

Let us take a closer look at the expenses that may qualify for tax deductions below.

Recommended Reading: How Much Taxes On 1099 Form