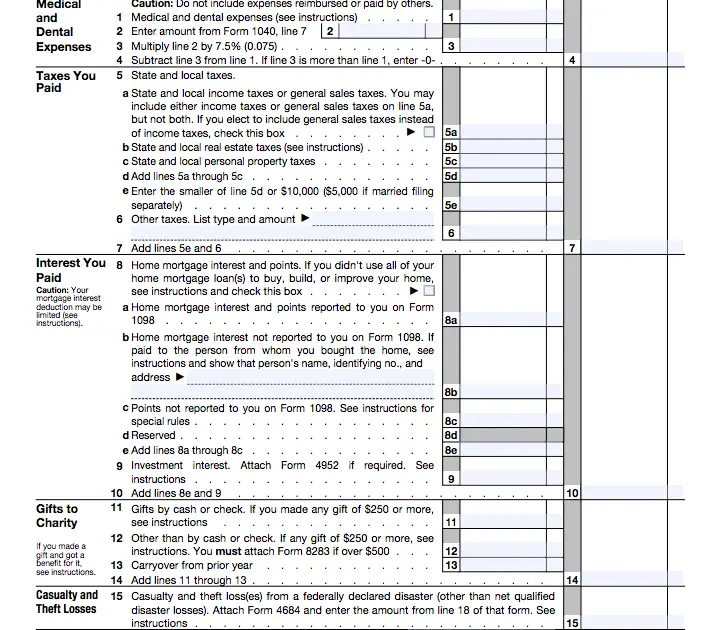

Who Needs To File Form 1040

Broadly speaking, if a United States citizen wants to or needs to file a Federal income tax return, they need to file Form 1040 or a variation of Form 1040 mentioned above. There are three general conditions to consider regarding whether an individual needs to file.

First, the IRS requires individuals with gross income of certain levels to file taxes. This gross income threshold varies based on the individual’s filing status and age. The table below lists the income limits for individuals under 65 years old older tax payers will have higher thresholds, and the threshold changes if neither, one, or both individuals in a marriage are 65 or older.

| 2021 Gross Income Thresholds | |

|---|---|

| Qualifying Widow | $25,100 |

Second, children and dependents may not be required to file if they can be claimed as a dependent. If the dependent’s unearned income greater than $1,100, earned income was greater than $12,550, or gross income meets certain thresholds, the dependent must file their own Form 1040. These rules are slightly different for single dependents as opposed to dependents who are married.

Last, there are some specific situations that require an individual to file Form 1040. Regardless of their income or dependency status, some of those situations include but are not limited to:

There Are Three New Schedules

Very few tax-related items actually disappeared due to the tax law changes. They have just moved around.

Instead of entering as much information on Form 1040, you now use Schedules 1 through 3 to report many tax details. The totals from each schedule are carried over to Form 1040.

The advantage of moving these details to separate schedules is that it cleans up Form 1040 and makes it easier to quickly review. For taxpayers with simple tax situations, IRS Form 1040 may be all they need.

Form : Us Individual Tax Return Definition Types And Use

Consumer Reports

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

You May Like: How To Get Income Tax Return Copy

What Is Schedule 2 Tax Form

Schedule 2: Supporting documentation for tax form 1040 if box 11b is checked. This Schedule is used to report additional taxes owed such as the alternative minimum tax, self-employment tax, or household employment taxes. Schedule 3: Supporting documentation for tax form 1040 if box 12b is checked.

2020 Schedule 2 Form and Instructions

- Form 1040 Schedule 2, Additional Taxes, asks that you report any additional taxes that cant be entered directly onto Form 1040. The 2020 Schedule 2 Instructions are not published as a separate booklet. Instead, you will need to read the Schedule 2 line item instructions found inside the general Form 1040 instructions booklet.

The New Form 1040 Still Asks About Dependents

Youve probably heard that the Tax Cuts and Jobs Act did away with personal exemptions, including those for dependents. That may lead some to believe that its no longer necessary to report dependents on their tax return.

Its important to know that isnt true. You still need to tell the IRS about your dependents, as they can qualify you for the ChildTax or for credits related to dependent care. Dependents can also affect other tax items, such as the Earned Income Tax Credit.

You should expect the new IRS Form 1040 to ask for your dependent information the same as before. Plus, many states require you to enter your dependent information on your state return. If you use tax software, the dependent information you enter on your federal return will automatically transfer to your state return when it comes time to complete that section. The process is rather seamless and ensures your returns meet all requirements.

Also Check: How To Figure Out Tax Id Number

Trumps Tax Returns Released By House Committee Show He Paid Little In Taxes

A House committee on Friday made public six years of former President Donald Trump’s tax returns, which showed he paid relatively little in federal taxes in the years before and during his presidency.

The House Ways and Means Committee had voted to make the thousands of pages of federal returns public in a party-line vote last week, but their release was delayed while staffers redacted sensitive personal information like Social Security numbers from the documents. Friday’s release, the culmination of years of legal wrangling and speculation, included both personal and business records.

Trump on Friday blasted the release in a statement and on his Truth Social platform, saying the Democrats should have never done it, the Supreme Court should have never approved it, and its going to lead to horrible things for so many people.”

He also maintained the returns he fought to keep hidden despite modern precedent that presidents make their returns public “show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises.

The panels top Republican, Rep. Kevin Brady of Texas, called the release of the documents unprecedented, and said Democrats had unleashed a dangerous new political weapon that reaches far beyond the former president, overturning decades of privacy protections for average Americans.

Who Needs To File Form 1040 Schedule 3

Not everyone needs to file Schedule 3 with their federal income tax return. You only need to file Schedule 3 if you’re claiming any of the tax credits or made any of the tax payments mentioned above.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Don’t Miss: Are Refinance Points Tax Deductible

Form 1040a And 1040ez Disappeared

Starting with 2018 tax returns, Form 1040A or 1040EZ no longer exist. Theres no long form 1040, either.

Instead of wondering whether you should file Form 1040A, 1040EZ, or 1040, you simply file the new, compact IRS Form 1040 because thats what all U.S. residents and resident aliens now have to do. It doesnt matter if your tax situation is complex or simple, you must file the new Form 1040. Then, depending on your specific scenario, you file the other schedules and forms as needed. U.S. nonresident aliens, however, must still file Form 1040-NR.

What Is Irs Schedule 2

For the 2018 tax year, the IRS shortened the 1040 tax return, eliminated the 1040EZ and 1040A versions, and added six new schedules to handle the information that moved off the main tax return form.

When introduced, IRS Schedule 2 included just four lines:

- Reserved lines: Listed as one line on the form, several line numbers were reserved for future use and were unnecessary for filing a 2018 tax return.

- Alternative minimum tax: If you owed alternative minimum tax, this line is where you recorded the amount. You also had to complete Form 6251 to calculate your AMT and attach the form along with Schedule 2 to your 1040.

- Excess advance premium tax credit repayment: Filers who received an advance premium tax credit for health insurance purchased through the health insurance marketplace had to file Form 8962, premium tax credit, to reconcile how much they received with how much of the refundable credit they qualified for. If they received too much, they entered the excess amount on Line 29 of that form and then brought the amount over to Line 46 of IRS Schedule 2.

On the final line, you entered the sum of amounts from the other lines. Then that amount went on Line 11 on your Form 1040.

You May Like: Can I File Another Extension On My Taxes

Chances Are Good That If You Filed A Federal Income Tax Return For 2018 It Wasnt A One

As of May 23, 2019, 68% of all individual tax returns filed for 2018 included Schedule A for itemizing deductions or one or more of six schedules the IRS rolled out for the 2018 tax year along with a shorter 1040 tax return, according to IRS data.

Schedule 2 was one of the new schedules added to help simplify the 1040 in the wake of the 2017 tax reform law. In 2018, Schedule 2 had just four lines used to report certain tax information.

But for 2019, the IRS has proposed consolidating those six schedules into three, with the draft of Schedule 2 incorporating its original lines plus lines initially included in Schedule 4.

The IRS says the draft of Schedule 2 could change at least slightly before its finalized.

What Is The Difference Between A 1040 And 1099

Form 1040 and Form 1099 are different components to an individual’s tax return. There are many different types of Form 1099, but Form 1099 is most commonly given to independent contractors to remit tax information relating to payments they received during the tax year. This information is used to complete Form 1040, as the financial records listed on Form 1099 are input into Form 1040.

Also Check: When Is Nys Accepting Tax Returns 2021

Is There A Schedule 2 For 2019 Taxes

The IRS added Schedule 2 when it revised the 1040 tax return for the 2018 tax year. The schedule is getting updated and longer for 2019 as the IRS retires three other schedules and moves some of the information from them onto the proposed Schedule 2.

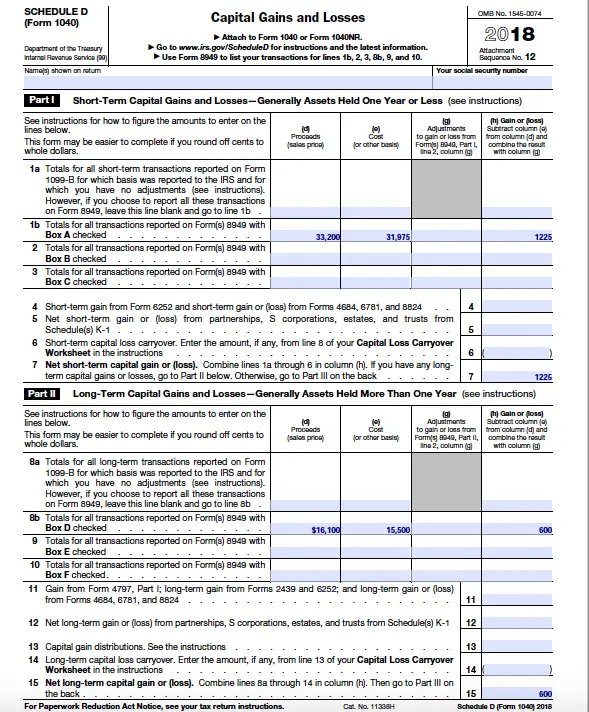

Schedule B Interest And Ordinary Dividends

Schedule B is used for taxpayers who received greater than $1,500 of taxable interest or ordinary dividends. It is also used to report interest from a seller-financed mortgage, accrued interest from a bond, interest or ordinary dividends as a nominee, and other similar types of interest. Input from Schedule B is entered into Line 2b and Line 3b on Form 1040.

Don’t Miss: Is Us Tax Shield Legit

What Are Schedules 1 2 And 3

Schedules 1, 2, and 3 are supplemental documents that are part of a taxpayers income tax filing package, even if they arent filled out.

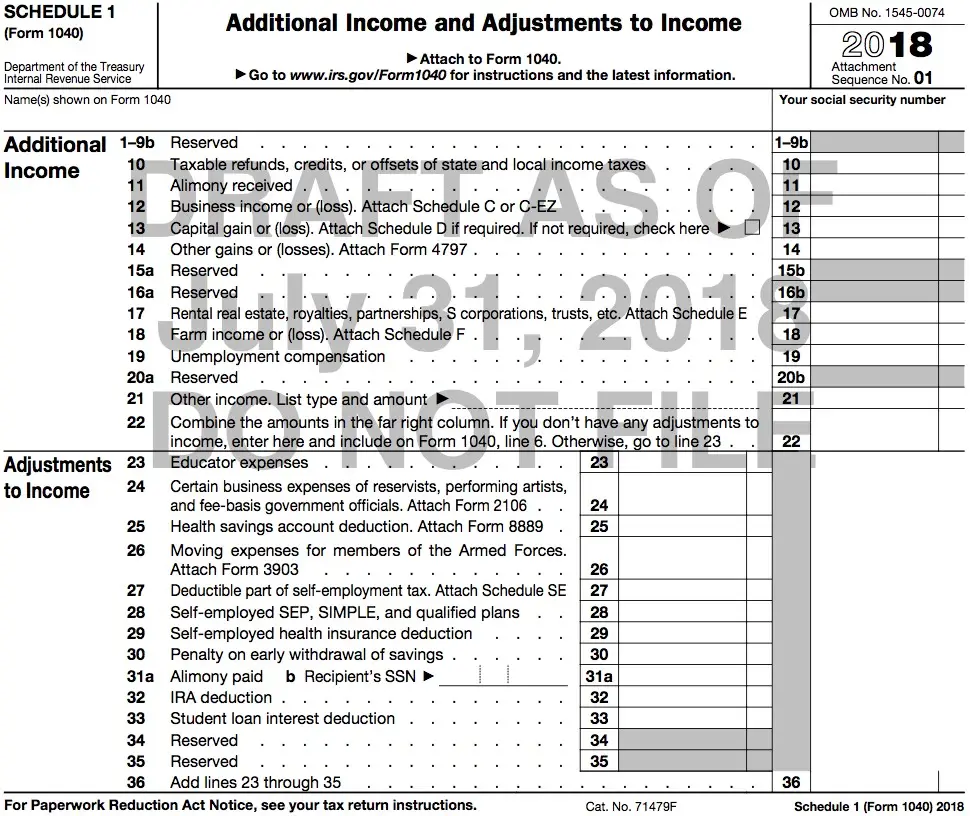

Schedule 1

This form is titled Additional Income and Adjustments to Income and has two parts. Schedule 1 is included with your tax return, even if blank. For taxpayers with simple income such as a W2 and maybe some stock investments, they probably don’t need to fill out a Schedule 1.

For those with more sources of income or complex income sources, a Schedule 1 will probably be used. Other forms/worksheets can be used with Schedule 1. The values from any additional forms will flow through to Schedule 1.

The first part of Schedule 1 is Additional Income. This can include alimony, gambling, business revenue, tax refund, cancellation of debt, and more. All income in Part I is totaled and goes on Form 1040.

Part II is Adjustments to Income. It includes eligible expenses and deductions that offset income from Part I. These adjustments are totaled at the bottom of Part II and go on Form 1040.

Schedule 2

Schedule 2 is for Additional Taxes. Like Schedule 1, this form may be blank but is still included with your 1040. It is a two-page form with two parts.

Part I is titled Tax and is for the alternative minimum tax and excess advance premium tax credit repayment, which is related to ACA health insurance credits. These two values are added and transferred to form 1040. Thats it for Part I.

Schedule 3

What Is Irs Form 1040 Schedule 3

OVERVIEW

Form 1040 isn’t as long as it used to be, thanks to a few new schedules. This article provides guidance for filling out Schedule 3 and explains which taxpayers may need to use it.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Recommended Reading: Will Rav4 Prime Qualify For Tax Credit

Irs Schedule 1 2 And 3

If the Financial Aid Office becomes aware of conflicting information, we may request a Schedule 1, Schedule 2, or Schedule 3. Beginning with the FAFSA year 2020-2021, no other schedules are typically required for verification.

Schedule 1: To be verified if there is conflicting information

Schedule 1 is used to report types of income that aren’t listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

Schedule 2: Supporting documentation for tax form 1040 if box 11b is checked.

This Schedule is used to report additional taxes owed such as the alternative minimum tax, self-employment tax, or household employment taxes.

Schedule 3: Supporting documentation for tax form 1040 if box 12b is checked.

This Schedule is used to declare your capital gains or losses for items such as real estate, shares and mutual funds in addition to any other capital properties you have disposed of.

What Is Schedule 2 Tax

Schedule 2: Supporting documentation for tax form 1040 if box 11b is checked. This Schedule is used to report additional taxes owed such as the alternative minimum tax, self-employment tax, or household employment taxes.

kb.drakesoftware.com

- What is the purpose of the Schedule 2 tax form? As part of the benefits of filing a married tax return, you would use this form to claim the transfer of an unused amount from your spouse or common-law partner. Those amounts are the age amount, the amount for children 18 years or older, the disability amount, and the tuition, education and textbook amounts.

Recommended Reading: How Do I Pay My Arizona State Taxes

What Is A Schedule 2 Tax Form

Schedule 2: Supporting documentation for tax form 1040 if box 11b is checked. This Schedule is used to report additional taxes owed such as the alternative minimum tax, self-employment tax, or household employment taxes.

kb.drakesoftware.com

- Schedule 2: Supporting documentation for tax form 1040 if box 11b is checked. This Schedule is used to report additional taxes owed such as the alternative minimum tax, self-employment tax, or household employment taxes.

How To Fill Out A Form 1040

If you’re filing your return using tax software, you’ll be asked to provide information that is translated into entries on your Form 1040. The tax program should then auto-populate Form 1040 with your responses and e-file it with the IRS. You can print or download a copy for your records.

If you prefer to fill out your return yourself, you can download Form 1040 from the IRS website. The form can look complex, but it essentially does the following four things:

Asks who you are. The top of Form 1040 gathers basic information about who you are, what tax-filing status you’re going to use and how many tax dependents you have.

Calculates taxable income. Next, Form 1040 gets busy tallying all of your income for the year and all the deductions you’d like to claim. The objective is to calculate your taxable income, which is the amount of your income that’s subject to income tax. You consult the federal tax brackets to do that math.

Calculates your tax liability. Near the bottom of Form 1040, you’ll write down how much income tax you’re responsible for. At that point, you get to subtract any tax credits that you might qualify for, as well as any taxes you’ve already paid via withholding taxes on your paychecks during the year.

Don’t Miss: What Is The Website To Pay Federal Taxes

Where Can I Find Form 1040

Form 1040 is not a tax statement or form that gets distributed to taxpayers. Unlike a W-2 or 1099 statement that is mailed by an employer or party you’ve contracted with, Form 1040 is available for download on the IRS website. In addition, free IRS filing platforms such as Free File Fillable Forms will provide digital copies. Last, some public courthouses or Federal buildings in your community may offer paper copies available for pick-up.

What Is Form : Us Individual Tax Return

Form 1040 is the standard Internal Revenue Service form that individual taxpayers use to file their annual income tax returns. The form contains sections that require taxpayers to disclose their taxable income for the year to determine whether additional taxes are owed or whether the filer will receive a tax refund.

You May Like: Are Home Repairs Tax Deductible 2020

Ii: Other Payments And Refundable Credits

Part II of Schedule 3 is for reporting other taxes you might have paid in addition to withholding and estimated tax payments. These include:

- Amounts paid with your extension request

- Excess Social Security tax withheld

Part II is also where you report other refundable credits that don’t have their own lines on Form 1040. Refundable credits are very similar to tax payments you made since they can get you a refund even if you don’t owe any tax. The refundable credits on Schedule 3 include:

- The net premium tax credit and the health coverage tax credit, which help offset the cost of health insurance for people with low or moderate income

There’s also a catchall line for other credits and tax payments that don’t fit anywhere else.