Do I Have To Pay Tax On Gambling Winnings

Gambling winnings that total a sufficient amount are subject to federal income tax. So the short answer to the question is yes, gambling winnings are taxable in all states, at least with regard to federal taxes.

When it comes to state income tax, some states do require residents to pay taxes on gambling winnings, but some do not. Each state has its own rules regarding state taxes on gambling winnings. Among those that do, some tax a flat percentage and some use a formula to calculate state tax owed according to the amount you won.

Read on for information below regarding whether or not your state requires payment of state income tax on gambling winnings.

Gambling Losses Tax Deductions: Softening The Blow

Up to this point, weve explained how all gambling winnings are taxable and how youll have to pay at least 25% on your winnings. However, most of us are well aware that there is no such thing as winning in gambling in the long run , so youre very likely to have more losing years than winning years.

In the USA, you will be able to offset some of your losses through the gambling losses tax deductions but youll need to keep very accurate and clear record of your gambling activities and have required documents such as receipts to go substantiate your records.

According to current gambling winnings tax regulations, youre allowed to deduct an amount of losses that doesnt exceed the amount of your total winnings. So, for example, if you had $10,000 in winnings in a tax year and your total losses amounted to $15,000, youll be able to deduct a total of $10,000. Youll still have to pay taxes on the remaining $5,000.

While this certainly doesnt seem like the fairest way to do things, the reasoning behind this decision is that the IRS wants to prevent people from using these deductions to offset taxes on other types of income. Given the fact gambling activities are sometimes hard to keep track off and it would be very hard to know if someone is actually telling the truth at all times, this explanation does make some sense but still doesnt seem like the best solution.

Do I Pay State Taxes On Gambling Winnings

It depends on the state in which you live.

There are some states that do not require residents to pay state income tax. In those states, you obviously need not worry about state taxes on gambling income. Those states include:

Note that New Hampshire and Tennessee both collect state tax on dividends and interest, but not income tax. All other states do require payment of state income tax in addition to the federal income tax that you pay each year.

Some of these states require no additional state income tax be paid on gambling winnings. In those states, paying federal income tax on your gambling winnings satisfies your obligation.

However other states do require you to pay an additional state income tax on gambling winnings. The amount of tax a state requires can be based on various factors. Some tax a certain amount for lottery wins, and a different amount for other kinds of gambling income. Some base how much they tax on the winners income.

Don’t Miss: How To Reduce Income Tax

Can I Report Gambling Losses

Recreational gamblers who do not identify themselves as professionals when filing tax returns can deduct gambling losses. However, when doing so, they have to itemize their deductions to claim their losses.

To be honest, most recreational gamblers arent going to want to start itemizing their deductions related to gambling. Thats because when they itemize they can no longer take the standard deduction when filing their takes. In most cases, the standard deduction is going to be more than the total of the itemized deductions.

Its worth pointing out that if youre going to call yourself a professional gambler, it really needs to be your full-time job. Those who try to call themselves professional gamblers for the sake of filing taxes who arent really professionals run a risk of being audited.

For everyone recreational and professional gamblers you cannot declare gambling losses that exceed your gambling winnings. Even though in real life people often lose more than they win, when it comes to taxes, yourlosses cannot exceed your winnings.

You Can Deduct Losses If You Itemize

Fortunately, you can deduct losses from your gambling only if you itemize your deductions.

Gambling losses can be deducted up to the amount of gambling winnings. For example, if you had $10,000 in gambling winnings in 2022 and $5,000 in gambling losses, you would be able to deduct the $5,000 of losses if you itemize your tax deductions.

If you had losses greater than your gains, you wouldnt be able to claim the excess. Reversing the example above, if you had $5,000 in gambling winnings and $10,000 in gambling losses, you would only be able to deduct only $5,000 of gambling losses. The remaining $5,000 in losses would be lost forever you cant carry the losses forward.

Whereas your winnings are reported by the payer on a Form W2-G, your losses may not be. You will have to produce other documentation to validate the deduction. This can include wagering receipts or tickets, canceled checks, or other receipts.

It may also be possible to establish your losses by keeping some type of detailed log. This log should include information such as the date and type of gambling activity, people you gambled with, and the amount of your winnings and losses.

Under tax reform, you can only deduct losses directly related to your wagers and not non-wagering expenses like travel-related expenses to gambling sites.

Also Check: How To Submit Taxes Online

Have Fun & Pay Your Taxes

This article tried to answer many important questions, such as are gambling winnings tax deductible and are you required to pay taxes on all of your casino winnings. Hopefully, you now know everything you need to know about this topic and youll be able to stay out of trouble with the taxman. So, have fun, enjoy your online gambling adventures, and dont forget to pay what youre due and youll be fine!

Taxes On State Lottery Wins

It is worth highlighting lotteries among the popular types of titles in the casino. If you have chosen this section for betting, then you need paying taxes on online gambling winnings and loss, which correspond to income tax the hold occurs with winnings from $600.

State income tax applies if the amount exceeds the established limit. For example, it is $10,000 in New Jersey.

Other states, for example, California, do not tax lottery winnings. The highest state tax on lottery winnings is in New York, where it reaches 8.82% of the amount.

Don’t Miss: How To Deduct Taxes From Gross Pay

Reporting Gambling Winnings To The Irs

One of the main reasons state governments want to legalize sports betting is because of the potential windfall of cash.

This means that they will be putting a lot of effort into making sure they get as much as possible from players winnings.

Not reporting gambling winnings to the IRS and/or state government is a much bigger risk than the games you are playing.

With the lottery, for example, the state will obviously be made aware of winning tickets. Its also certain that the federal government will be made aware of the winner too.

In terms of gambling, each state in the US has a gaming commission. They are responsible for keeping an eye on all gambling activities.

Casinos have an obligation to report all winners to the gaming commission, so any plans to avoid reporting winnings should be short-lived.

If you do not report gambling winnings, you risk being pursued by the government for tax evasion.

If you are then found guilty of tax evasion for not reporting your gambling winnings, you will face the same consequences as people evading tax on other taxable income.

Can I Claim Gambling Losses

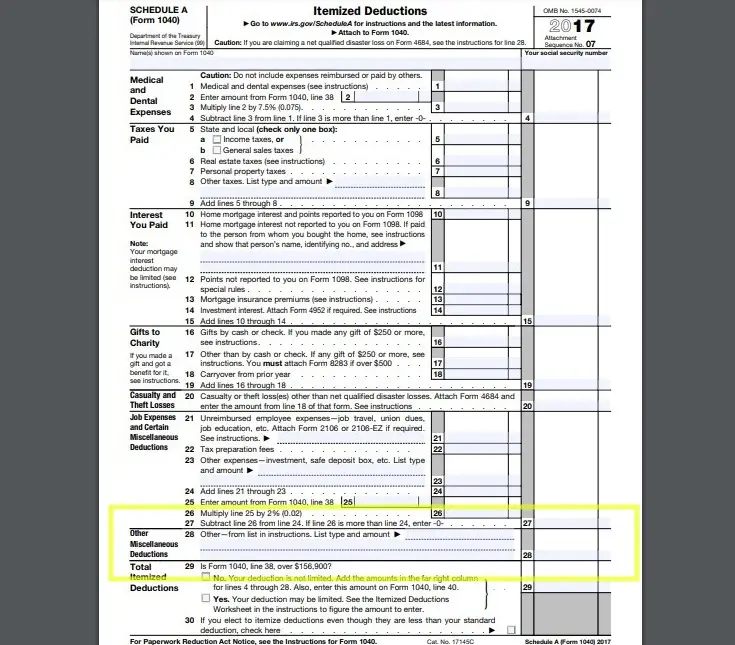

You may deduct gambling losses only if you itemize your deductions on Schedule A and kept a record of your winnings and losses. The amount of losses you deduct cant be more than the amount of gambling income you reported on your return.

Do professional gamblers pay tax?

The professional gambler is not taxable on the profits, nor does he or she receive tax relief for losses.

Do I have to report gambling losses?

Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as taxable income on your return. The deduction is only available if you itemize your deductions.

Do pro gamers pay taxes?

Canada doesnt charge casino players taxes on their profits. It doesnt matter whether you win $100 million playing online slots or $10,000 from live casinos. If you reside in Canada and play gambling games online, you wont be taxed.

How do YouTubers pay tax?

Income earned from Youtube is untaxed, unlike the money you receive from PAYE employment. In a full-time or part-time job, Income Tax and National Insurance are already deducted before you receive your payslip. Whereas with Youtube earnings, youre solely responsible for paying tax on any earnings you make.

How much is 1000 subscribers Worth on Twitch?

What happens if I dont report gambling winnings?

Read Also: How To Apply For Tax Exemption

Can You Deduct Travel Costs And Other Expenses Related To Gambling

Most people cant deduct travel costs or other expenses related to gambling. For example, if you go to Las Vegas and win big, you cant deduct the cost of your trip to offset your gambling winnings.

The exception is professional gamblers who gamble as their job. They can generally deduct things like travel costs as business expenses. They may also be able to deduct their full gambling losses on Schedule C instead of using the itemized deduction rules.

Taxes On Sports Betting Wins

When you win money betting on sports at a retail or onlinesportsbook, the payer is similarly obligated to report wins of $600 or more. As with slot machine wins, the sportsbook might withhold 24% of wins of $5,000 or more per federal tax requirements. Depending on the state, you might have to pay state income tax as well.

While most sports bettors wont be deducting their losses, it is possible to do so. See below for help answering the question Can I report gambling losses?

Also Check: What Is Washington State Tax

Dont Forget To Pay Your Online Gambling Taxes

When you gamble online, it is important to enjoy yourself, but also remember to file your winnings! The IRS takes gambling money very seriously and you want to be sure that you pay your taxes accordingly. If you need any additional information, be sure to visit the official website of the IRS to find all the previously mentioned forms you will need fo file your taxes.

Related Blog Posts

Do I Have To Pay Taxes On Gambling Winnings From A Casino

![How Much Money Can You Win Gambling Without Paying Taxes [Answered] How Much Money Can You Win Gambling Without Paying Taxes [Answered]](https://www.taxestalk.net/wp-content/uploads/how-much-money-can-you-win-gambling-without-paying-taxes-answered.png)

Yes, you must pay taxes on gambling winnings from a casino. A more detailed explanation of how gambling winnings are taxed can be found above. You are legally required to report your income from all types of gambling activities.

Different games have different guidelines for when the income becomes taxable, but each must be reported on the tax return. Keep an organized record of all winnings and losses, which can be used to offset against profits.

Don’t Miss: How Can I Pay My Property Taxes Online

What Do You Do If You Get A 1099

If you bet online, you may receive a 1099-K if you receive electronic payments of at least $600. Form 1099-K is an additional tax form the payment processor has to issue. It is separate from a W2-G.

Form 1099-K does not change the tax rules for gambling. You would still follow the above rules. When filing your tax return, you do not necessarily report the amount on your 1099-K. You report your actual winnings and losses.

It is possible that a 1099-K can trigger an IRS audit since the amount reported may be above your taxable winnings. The IRS has no way of knowing this and will only see the higher amount. You may get a CP2000 notice or other IRS notice asking if you underpaid your taxes. When you submit an explanation with your documentation, the IRS will go by your original tax return if you filed correctly.

Are Bank Statements Proof Of Gambling Losses

No. Since bank statements only show a withdrawal of cash or an electronic transfer , they dont sufficiently prove the money was lost. However, bank statements can be used in combination with other receipts, tickets, statements, and documentation such as a diary or similar record of your losses and winnings to provide evidence of your losses.

Recommended Reading: What Happens When You Forget To File Taxes

How To Pay Gambling Taxes In Your State

Everyone must pay federal taxes on gambling winnings. Some states have no state income tax. Most states do, but some of those do not require state income tax be paid on gambling winnings.

In states where you do have to pay gambling taxes , there are a variety of ways to go about doing so.

Most involve entering onto your state tax form the amount of your winnings, often in a box designated Gambling and Lottery Winnings . This amount is then added to other forms of income to calculate your total taxable income.

Each state provides detailed information about how to handle reporting gambling winnings, if required.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.Limited time offer. Must file by 3/31.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund and seewhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: How Does Health Insurance Tax Credit Work

How Much You Win Matters

Its important for you to know the thresholds that require income reporting by the payer. Winnings in the following amounts must be reported to the IRS by the payer:

- $600 or more at a horse track

- $1,200 or more at a slot machine or bingo game

- $1,500 or more in keno winnings

- $5,000 or more in poker tournament winnings

All of these require giving the payer your Social Security number, as well as filling out IRS Form W2-G to report the full amount won. In most cases, the casino will take 25 percent off your winnings for IRS gambling taxes before paying you.

Not all gambling winnings in the amounts above are subject to IRS Form W2-G. W2-G forms are not required for winnings from table games such as blackjack, craps, baccarat, and roulette, regardless of the amount.

Note that this does not mean you are exempt from paying taxes or reporting the winnings on your taxes. Any and all gambling winnings must be reported to the IRS. It only means that you do not have to fill out Form W2-G for these particular table-based games.

Am I Taxed On Group Gambling Bets

Yes, you are taxed on group or team gambling bets. In fact, its the same the tax system used to gambling winnings for individuals.

If you are betting with a team, it becomes even more important to track your bets and keep a record. You dont want to be taxed on the entire payout when you only took home a percentage of it.

Also Check: How Much Tax Do You Pay On Lottery Winnings

Can I Get My Gambling Losses Back

You are allowed to list your annual gambling losses as an itemized deduction on Schedule A of your tax return. If you lost as much as, or more than, you won during the year, you wont have to pay any tax on your winnings. Even if you lost more than you won, you may only deduct as much as you won during the year.

How do taxes work with eSports?

How to include eSports income on your tax return. Firstly, it depends on how you received the money. If you entered a competition and won the money by yourself, you will technically have won a prize or award, which still needs to be taxed. In general, nonresidents who receive this are taxed at a rate of 30%.

Does tournament money get taxed?

Yes, its true. Generally, the U.S. federal government taxes prizes, awards, sweepstakes, raffle and lottery winnings, and other similar types of income as ordinary income, no matter the amount. This is true even if you did not make any effort to enter in to the running for the prize.

Your Gambling Winnings Are Considered Income

All income is taxable and gambling winnings are considered income. They apply even if you arent a professional gambler. If you win money from lotteries, raffles, horse races, or casinos that money is subject to income tax.

When you win, the entity paying you will issue you a Form W2-G, Certain Gambling Winnings, if the win is large enough.

Read Also: What Does Tax Abatement Mean