Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

How Much Federal Taxes Are Taken Out Of Paychecks

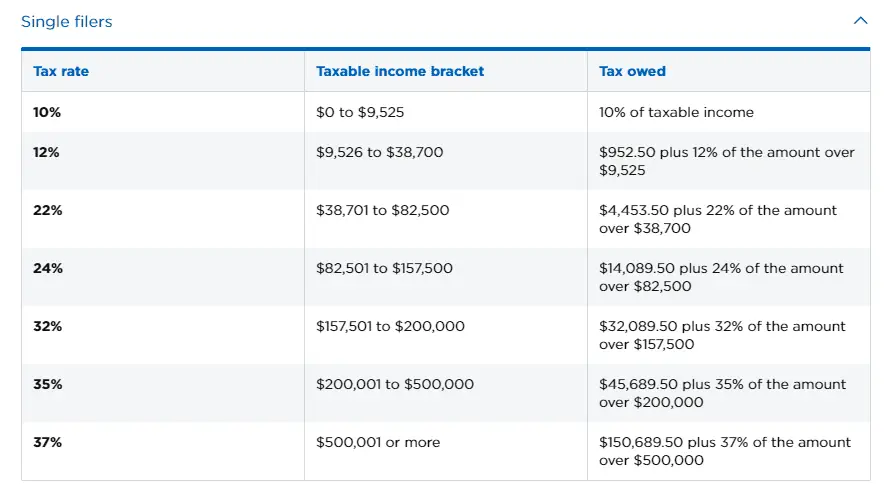

Federal income taxes are an unavoidable bother. Uncle Sam will always get its cut of the action, using the IRS to collect whenever people happen to earn. While people who are self-employed may end up with a different situation, the average person with an employer will have taxes withheld from every paycheck. Federal income tax withholding is based on a rough guess from the IRS about what taxes you will owe at the end of the year. If you happen to pay more in taxes than you end up owing, then the money will be returned to you in the form of a tax refund. With this in mind, how much in federal taxes will be taken out of your paycheck? Heres how to figure it out.

Claiming exemptions to reduce tax withholdingWhen you start a new job, youll likely be required to fill out some financial forms. One of those forms will ask you the number of income tax exemptions you happen to have. Income tax withholding exemptions allow you to reduce the amount of tax an employer will take out of your paycheck. You are legally allowed to do this based upon things like dependents and head of household status. This can be dangerous, of course, because it can mean that you end up owing tax at the end of the year. Most people will not be able to claim enough exemptions to reach this level, however.

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

You May Like: Doordash Driver Tax Information

Understanding Your First Paycheck

You get your first job out of college. You can finally breathe a sigh of relief you have post-grad plans! You can confidently answer that nerve-racking question: What are you doing after graduation?

But as soon as you accept that job offer, the train leaves the station pretty quickly! A whole lot of big financial decisions come at you fast like getting an apartment, paying your bills and setting up a budget to make sure your math checks out.

One of the most shocking things is when you get that first paycheck and how small it really is! You knew some taxes would be taken out but most of us are unprepared for how much really comes out.

“A lot of times when people accept their new job offer, they think, ‘Oh my goodness,’ like $40,000 a year is like winning the lottery when you’ve gone from making like $4,000 a year over the summer, you know?” said Sophia Bera, a financial advisor at Gen Y Planning. “And so I think what people don’t realize is, then how little that actually translates to in their net pay.”

Paycheck Calculators To Estimate Your Pay

Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

ADP Salary Payroll Calculator

Free salary reports covering virtually every occupation, as well as information on salary, benefits, negotiation, and human resources issues for U.S. and Canadian markets. Salary negotiation tips, small business solutions, and cost of living comparisons are also available.

You May Like: Reverse Ein Search

How Much Money Does The Irs Take Out Of Your Paycheck

4.2/5IRS can takeyour paycheckIRS can takeyour checkpay

Moreover, can the IRS take all the money in your bank account?

When placing a levy, the IRS contacts the bank and asks it to hold the funds in your bank account for a period of 21 days. The bank cannot refuse to send the money to the IRS. The IRS can seize up to the total amount of your tax debt from your bank account.

One may also ask, what money is taken out of my paycheck? Social Security & MedicareThe federal government also deducts money as your contribution to its Social Security and Medicare programs. You’ll be required to give a percentage of your income, currently 6.2% for Social Security and 1.45% for Medicare, to help fund these programs.

In respect to this, how can I get all the money taken out of my paycheck?

5 Ways to Keep More of Your Paycheck

Does IRS check your bank account?

The IRS does not have access to monitor bank accounts, nor do they know where everyone has an account to monitor them. Banks are required to report certain transactions to the IRS, such as interest earned on an account.

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So for 2022, any income you earn above $147,000 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

Read Also: Doordash On Taxes

If The Form Looks Different Than You Remember It Probably Is

Due to the tax changes that were implemented in 2017, the IRS issued an updated Form W-4 that helps you account for the changes in an easier way. For example, your tax withholding is no longer calculated based on the number of allowances, but instead on the factors listed above. If its been a while since youve updated your form and you havent switched jobs, its not a bad idea to take a look and see if you need to submit a new form to your payroll department. It can help ensure youre having the ideal amount withheld, so you can avoid big tax surprises in the future. This article, ‘What You Need to Know About the New W-4 Form‘ has more information on the new form.

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

You May Like: Appeal Property Tax Cook County

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

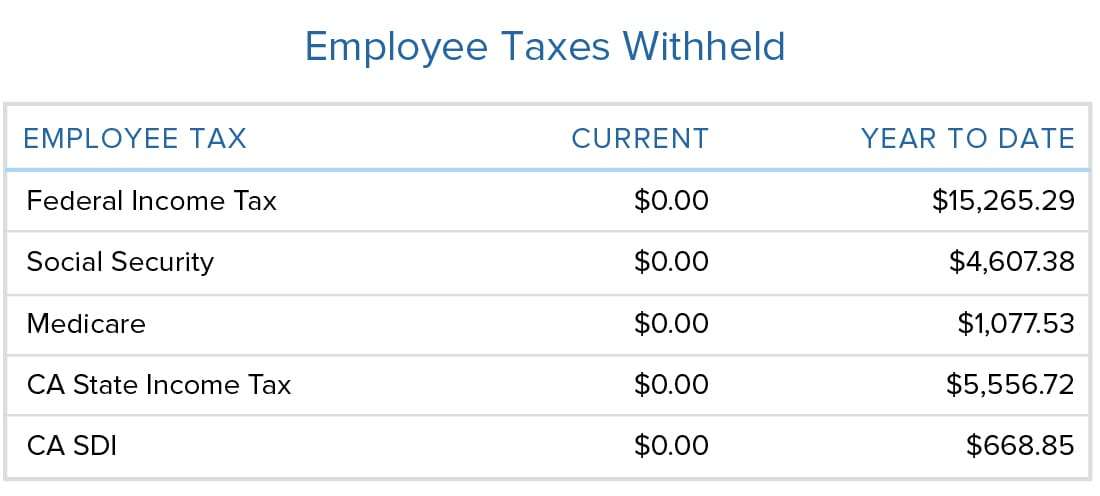

Calculating Your Total Withholding For The Year

Take your new withholding amount per pay period, and multiply it by the number of pay periods remaining in the year. Next, add in how much federal income tax has already been withheld year-to-date. This total represents approximately how much total federal tax will be withheld from your paycheck for the year.

Ask yourself whether you can easily write a check to the government plus a little interest if your calculations show that you’re going to owe the IRS $500 in April. Now is the time to adjust if you can’t.

You can now compare your total withholding to your tax liability projection. If your withholding amount is larger than your tax liability, that’s how much of a federal tax refund you can expect to receive. If your withholding is less than your tax liability, that’s how much federal tax you might have to pay when you file your tax return.

Remember, these amountsyour withholding and your tax liabilityare approximate. You’re close to where you need to be if they’re not too far apart. You’re free to change your withholding at any time during the tax year if a change in your circumstances would result in a tax increase or decrease.

Read Also: Is Freetaxusa A Legitimate Site

Flexible Spending Accounts And Health Savings Accounts

Health savings accounts and flexible spending accounts are programs designed to allow people with health insurance to put money aside for qualified medical expenses. HSAs are designed for those who have a high-deductible health plan . The money you put into an HSA or FSA can be used tax-free to pay for certain out-of-pocket healthcare costs as they arise. If you are enrolled in one of these programs, your contributions to your account will also show up on your paycheck.

Flexible spending accounts can also be set up as dependent care FSAs to allow for tax-free withdrawals for eligible childcare expenses. Your pay stub may reflect these deductions from your pay.

What Are Tax Withholdings

The law says your employer must take money out of your paycheck for taxes. You can choose how much money to withhold from or take out of your paycheck. When you have a big change in your life, you might owe more or less money in taxes than before. To have the right amount of money come out of your paycheck for taxes, you change your withholdings.

Read Also: Efstatus Taxact Com Login

Are You Having Enough Withheld From Your Paycheck

With every paycheck, your employer withholds some of your earnings for taxes. If too much is withheld, its true that you will receive a refund, but when you really think about it, by waiting until tax season to claim that money back, youve essentially provided the IRS with an interest-free loan during the year. On the other hand, if you owe taxes when you file your return, you may have to scramble to pay whats due, and you could also owe interest and penalties to the IRS if you dont have enough withheld throughout the year.

The IRS has a pay as you earn policy, meaning that as you earn money throughout the year, the IRS expects that youll send them what you believe to be your best estimate of what the taxes are on that income. Your employer helps with this calculation and sends it on your behalf, but they use information you provide them to best estimate for you.

The ideal way to handle your tax withholding is to have just enough taxes withheld to prevent you from incurring penalties when your tax return is due, but still owe just a little bit rather than receive a refund. Yes, youll have to make sure you have a little set aside to make that payment in April each year, but in the meantime, you get to enjoy all of the money you earn throughout the year rather than waiting for the IRS to return it to you upon filing your return.

Who Pays Them

Both employers and employees pay payroll taxes. Employers pay the taxes that fund unemployment insurance payments on both the federal and state levels.

These programs are known as FUTA and SUTA for the legislation that authorizes the collection of unemployment taxes. Employees do not contribute to FUTA and SUTA.

Both employees and employers pay Social Security and Medicare taxes, with each paying half the tax due. Employees pay federal, state, and local income taxes employers do not pay personal income tax, but do pay corporate income tax. The FUTA tax rate is 6.2%, but employers can receive a credit of up to 5.4% for SUTA taxes paid.

Don’t Miss: Is Money From Donating Plasma Taxable

What Is A W

A W-2 is a form your employer sends you at the end of every year. A W-2 says how much money you earned during the year. Your W-2 also says how much money was taken out of your paycheck for taxes during the year. You use your W-2 when you file your taxes with the Internal Revenue Service and some states.

Which Turbotax Is Best For You

Figuring out all these specifics can be stressful. But doing your income taxes doesnt need to be, when you use TurboTax Online.

However, if you do feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, theres a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Don’t Miss: Is Doordash Pay Taxed

Factors That Affect Tax Rates

The money your employer takes out of your check is an estimate of how much taxes you owe on your earnings for the pay period. Your earnings determine the size of your payroll tax deductions. Your tax filing status and the number of withholding allowances you claim on your W-4 form also affect your payroll deductions.

Social Security And Medicare Tax Withholding

Besides income tax withholding, there are additional paycheck deductions for Social Security and Medicare taxes. These two deductions are sometimes referred to as payroll taxes or FICA . They are used to support retired workers and pay for their medical benefits, as well as for supporting disabled workers and their dependents. Both FICA taxes are assessed at a flat rate for all workers. For the 2017 and 2018 tax years, the tax rate for Social Security is 6.2 percent. For 2018, the maximum amount of gross income subject to this tax is $128,400. The Medicare tax rate is 1.45 percent, with no maximum income limit.

Recommended Reading: Doordash Tax Rate

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.