Where Can I Download My Transaction History

You can download your transaction history in the Reports section of Coinbase.com and the statements section of Pro to download Pro transactions.

To calculate your gains/losses for the year and to establish a cost basis for your transactions, we recommend connecting your account to CoinTracker. Learn more about .

What Does This All Mean For You

Traditionally, when it comes to tax time, many crypto users have simply attempted to feign ignorance. They pretend to be unaware of the fact that filing is a requirement, while hoping they arent a big enough fish to get caught in the IRS nets. But the IRS is catching on and the platform is maturing, looking to avoid issues with auditors.

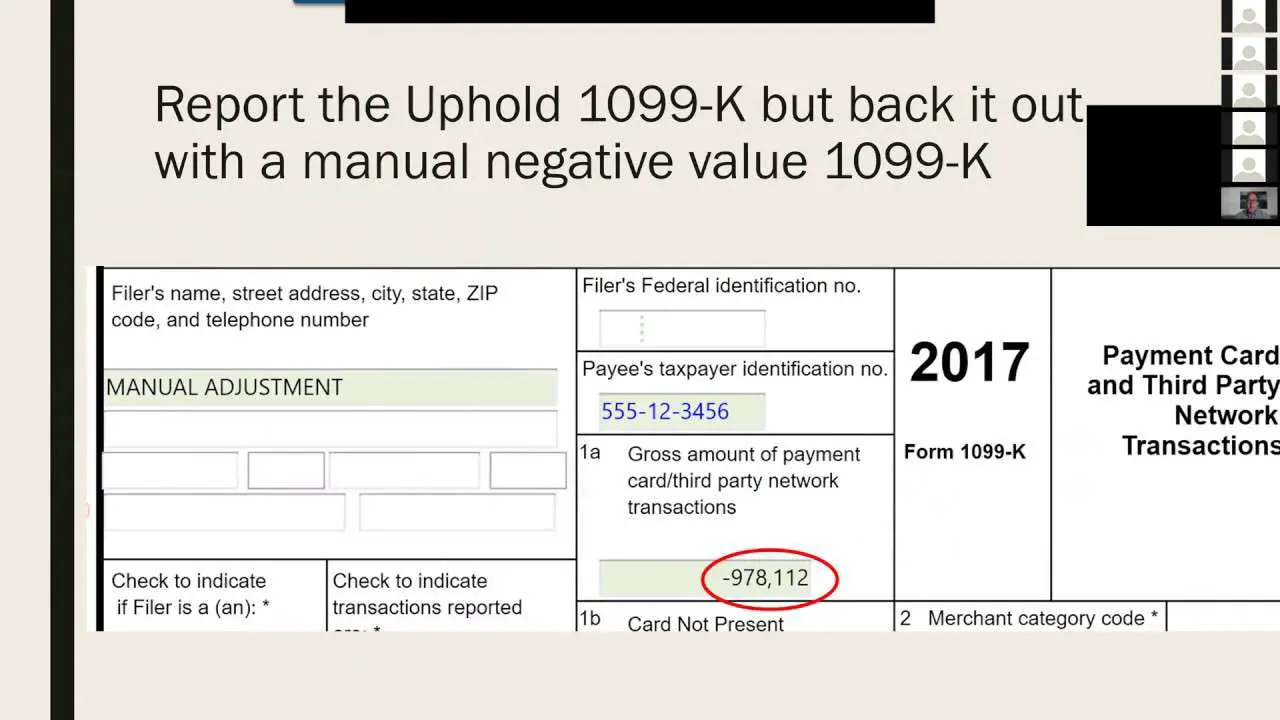

Going forward, Coinbase will issue a 1099-MISC for any crypto user earning more than $600 from Coinbase Earn, USDC Rewards, and/or Staking, income generating products which are similar to bank deposits. Whats not yet clear, however, is whether all users will receive a 1099-MISC or only those earning more than $600 through certain Coinbase products.

However, if the 1099-MISC were to become the standard for all users, many more users would receive the form due to the much lower threshold than for the 1099-K. While sending the form to all users doesnt solve everyones tax reporting issues, at least it lets people know that they arent exempt from reporting earnings to the IRS.

Unfortunately, widespread usage of the 1099-MISC would have a few flaws. Coinbase wont, and cant, provide all of the necessary information required to file taxes. Similar to the 1099-K, there is no place to report the cost basis of your cryptocurrency holdings and profits.

On the other hand, not receiving the form doesnt exempt cryptocurrency users from filing with the IRS. As such, most users will still need help from a tax professional or CPA.

What Are Coinbase Taxes

Cryptocurrency may seem like the future of decentralized currency. However, for now, its still subject to the present-day realities of taxation. The IRS needs to know how you trade crypto and you need to know what they need to know.

Firstly, your ups and downs on Coinbase may seem like risk and reward but to the IRS, its all relevant financial activity. The IRS wants you to report income, in every form, and that includes the gains and losses you make on Coinbase.

Since crypto trading is off the grid, you need to be responsible for your own tax forms. Coinbase isnt your employer and doesnt have the forms ready for you. Regardless, they give you the resources to get your tax information accurately. You can request a 1099 form to complete your taxes. If you meet certain requirements , you can get the form directly through Coinbase.

Even if you dont receive this form, the IRS still holds you accountable for reporting your Coinbase activity. Thankfully, all Coinbase accounts feature detailed transaction history that you can use to fill out your taxes.

Read Also: Car Sales Tax In North Carolina

Does Coinbase Supply A Financial Statement

Yes. The Coinbase statement you need is your Coinbase transaction history. This Coinbase account statement will have your complete trading history on the exchange and you can use this to generate a Coinbase tax statement.

See the steps above on how to get a tax statement from Coinbase. Remember, you’ll need to include your complete trading history from Coinbase, for however long you’ve had the account. This is so you can calculate your short-term and long-term gains accurately.

Once you have your Coinbase statement, calculate your crypto taxes manually or upload your Coinbase financial statement to a crypto tax app to fetch a Coinbase tax statement in minutes.

Coinbase Tax Reporting Faqs

1. Do you have to pay taxes on Coinbase?

If you made $600 in crypto by an exchange such as Coinbase, the exchange is required to use Form 1099-MISC to report your transactions to the IRS as miscellaneous income. As a taxpayer, you will also receive a copy of your tax returns.

2. Do you have to pay taxes on crypto every year?

Yes, be it Bitcoin, Ethereum, or any other cryptocurrency, they are all taxable. The IRS deems cryptocurrency as property and thus, crypto is taxed like property the same way as any other asset you own.

3. Does Coinbase give you 1099?

If you made $600 in crypto, Coinbase is required to use Form 1099-MISC to report your transactions to the IRS as miscellaneous income. Even if you make less than $600 via staking or rewards income, you are required to report the earned amount on your tax bill.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.

- 1share

You May Like: Do Doordash Pay Taxes

What To Do With The Coinbase Tax Documents

While most crypto owners usually misinterpret crypto tax reporting as an exclusive act related to capital gains and losses, the case is rather the opposite.

Coinbase tax documents report the taxed crypto as a regular income where the income depends upon the status of your employment. Here are a few instincts to consider:

So Does Coinbase Issue 1099

Yes while Coinbase doesnt issue 1099-Ks, they do issue the 1099-MISC form and report it to the IRS. Youll receive the 1099-MISC form from Coinbase if you are a U.S. resident for tax purposes and earned $600 or more through staking, USDC rewards, and Coinbase Earn rewards, which are all considered miscellaneous income. This kind of income is classified under the ordinary income category as far as taxation. Please go here to learn more.

You May Like: Does Doordash Take Out Taxes

How To Choose Which Tax Software Is Good For You

Choosing the right tax software can be almost as overwhelming as filing your actual taxes. Your choice will depend on how many trades you are making in a year and whether your crypto activity is limited to one exchange like Coinbase, or whether its spread across other activities like and airdrops.

If youre a casual trader who has only made a few transactions then you will be absolutely fine with the free version of a service such as Koinly.

If you have several thousand transactions across several exchanges then you should consider the paid versions of sites like cryptotrader or cointracker.io. These websites can synchronize your trades from multiple platforms and present them in easy to read dashboards and exportable forms.

If youve gone beyond simply just trading crypto and have multiple income streams from things like mining and staking then it would be wise to get professional advice from a certified account who has a deep understanding of crypto assets.

Does Coinbase Pro Provide Tax Documents

No, Coinbase Pro doesnt provide a tax report. However, Coinbase Pro works with some great crypto tax apps – like Koinly crypto tax software – to help you get your Coinbase Pro tax report in no time at all. The easiest way to do this is with API, but you can use CSV files and do your crypto taxes yourself too.

Recommended Reading: Where Is My Federal Tax Refund Ga

What To Do With Coinbase Tax Documents

Many people perceive that reporting in Crypto tax is just related to profits and losses. The case is entirely different. Regular income is used by Coinbase. Now the question arises! Where will the income get reported? Well, it completely relies on the employment status you have:

Self Employed: A self-employed person is called an independent freelancer consultant or a business owner. If you are self-employed and you use cryptocurrency for the business itself, schedule C is where your Coinbase 1099-MISC will be reported.

Not self-employed: If you are a person who is not self-employed and mainly file 1040 form, then schedule 1 is the place where your data will be filed as other income.

Apart from this, are you using cryptocurrency for any additional thing like purchasing something with Crypto or trading? In this case, Coinbase 1099-MISC will not be able to include all of your transactions in the report.

How Is Cryptocurrency Taxed

Cryptocurrencies like Bitcoin are treated as property by the IRS and many other governments around the world. Other forms of property that you may be familiar with include stocks, bonds, and real-estate.

Just like these other forms of property, cryptocurrencies are subject to both capital gains and income taxes. You will be required to report taxable events on your tax return.

Youâll incur capital gains or losses if you sell your cryptocurrency, trade it for other cryptocurrencies, or use it to buy goods and services.

Meanwhile, earning cryptocurrency through staking, mining, or interest rewards should be reported as personal income and will be taxed accordingly.

For a complete and in-depth overview, please refer to our Ultimate Guide to Cryptocurrency Taxes.

Read Also: 1099 Nec Doordash

Does Coinbase Tell The Irs About My Trades

Potentially. Coinbase is generally going to send you a 1099-MISC and will report to the IRS if you have earned more than $600 in rewards or fees from Coinbase Earn, Staking, or USDC rewards and you’re based in the US. Taking care of paying taxes on your crypto earnings is the best way to ensure the IRS doesn’t end up auditing you which is important as the IRS is ramping up its cryptocurrency investigation division.

On the note of the 1099-MISC that Coinbase Pro sends you – there’s a chance it isn’t accurate. This is due to Coinbase only considering trades and assets on their own platform. If you acquired crypto on another platform and transferred it into Coinbase, then you’re going to need a transaction matching tool/software to help you ensure that your cost-basis and capital gains calculation is correct . This leads us to the next point – tracking Coinbase Pro taxes.

Do You Have To Pay Taxes On Coinbase

In short, it depends.

You may not have to âpayâ taxes if you only had capital losses however, you still have to report your crypto activity on your taxes yearlyâeven if you only had losses on your tax return.

If you had capital gains or crypto income for the year, you will need to pay taxes on your earnings.

Recommended Reading: How Do You File Taxes For Doordash

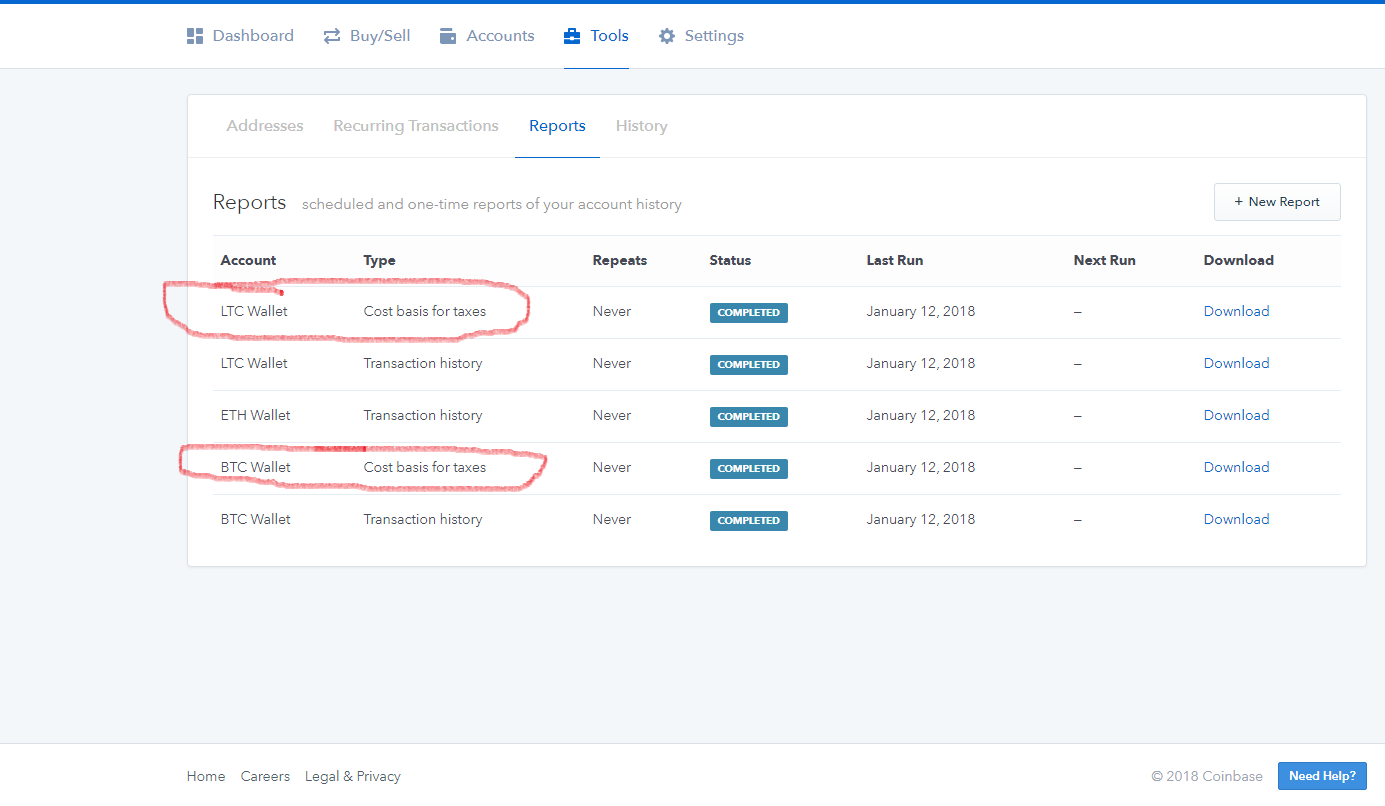

How To Calculate Coinbase Cost Basis

To you need to know the cost basis of each of your transactions. In laymans terms, this simply means what was the amount of dollars you originally spent to buy your bitcoin, and what was the dollar value when you sold it.

This cost basis is used to calculate your gains and your losses. The reports you can generate on Coinbase calculate the cost basis for you, inclusive of any Coinbase fees you paid for each transaction.

Coinbase uses a FIFO method for your Cost Basis tax report. They will give you a summary of all your crypto purchases and sales along with the cost basis and capital gains.

Sending and receiving crypto into your Coinbase wallet is treated as buying or selling that asset at market price so its important that you keep your own accurate records as well. If you sent bitcoin to your , or other hardware wallet, and then sent it back to Coinbase at a later date you would not want to file this as a sale of bitcoin.

How To Invest Your Tax Refund In Cryptocurrency

If you choose to take advantage of this offer, you’ll need to complete a few basic steps, including starting to file your tax forms from the Coinbase section of the TurboTax site. You can also get up to $20 off TurboTax if you are a Coinbase user.

Once you’ve completed your tax forms and your refund amount has been calculated, you’ll set up Coinbase as your direct deposit account that you want your refund to go into. After choosing Coinbase as your direct deposit option, you’ll need to activate the account and choose which crypto you want to invest your refund in.

While this process can make it convenient and simple to buy cryptocurrency with your tax refund, you do want to make sure it’s the right financial move for you. You should ensure you have a fully funded emergency fund before buying cryptocurrency, and you must take into account that virtual currencies can be a volatile investment and they can carry a higher risk.

If you’re financially prepared for crypto investing and have researched which coins you want to buy with your refund, then taking advantage of Coinbase and TurboTax’s offer could be a great option to simplify the investing process.

You May Like: Plasma Donation Taxable Income

How To Handle Cryptocurrency Transactions On Your Tax Return

You can usually download a transaction report from your cryptocurrency exchange platform, including all of your buys, sells, and exchanges of cryptocurrency in your account. If all of your cryptocurrency transactions occur on one exchange, gathering the information you need to report transactions on your tax return should be relatively easy. If you have cryptocurrency transactions on several exchanges, you’ll need to download several reports.

Can You Import Coinbase To Turbotax

The short answer is yes. You can import your Coinbase transactions into TurboTax with the help of Cryptotrader.

You need to download your transaction history from the Coinbase website and use them to upload into .

There are some limitations though. You can only upload a maximum of 1000 transactions into Turbo Tax and the gains loss calculator will not include any transactions that were on Coinbase Pro.

Also Check: How Much Taxes Do You Pay For Doordash

Will You Receive A 1099 From Coinbase

As of the 2020 tax season, Coinbase has changed eligibility for Form 1099. Coinbase, Coinbase Pro, and Coinbase Prime users need to check their new eligibility requirements to receive the form from Coinbase for tax purposes. Its worth noting that Coinbase users outside of the United States will not receive the form under any circumstances and have to rely on their account history to accurately record their transactions for tax purposes according to the rules of their region.

In order to receive Form 1099, you have to be an account-holder on Coinbase in the US or US tax-compliant areas. You also have to complete transactions in cryptocurrency trading on the platform in the previous year, equal to or exceeding $600 worth.

This includes currency awarded through Coinbase Earn, Staking, or USDC Rewards. So long as the amount you earned through trading totals at least $600, you could be eligible for Form 1099.

Please note that there are several versions of Form 1099. Coinbase no longer issues 1099-K or 1099-B for its traders as of the 2020 season. The only form they still issue is 1099-MISC, probably to streamline their tax services.

Even if you didnt receive a form, your crypto trades must still be reported to the IRS.

Why Can’t Coinbase Generate My Tax Forms

Many cryptocurrency investors use additional exchanges, wallets, and platforms outside of Coinbase. Perhaps you also trade on Coinbase or earn interest from BlockFi. The trouble with Coinbase’s reporting is that it only extends as far as the Coinbase platform. If you use additional cryptocurrency wallets, exchanges, DeFi protocols, or other platforms outside of Coinbase, Coinbase can’t provide complete gains, losses, and income tax information.

Also Check: Taxes Taken Out Of Paycheck Mn

Whats The Purpose Of Coinbase 1099 Tax Forms

1099 information reporting has been around for a long time. There are multiple types of 1099âs in existence today .

Each of them serve the same general purpose: to provide information to the Internal Revenue Service about certain types of income from non-employment-related sources. Put another way, 1099âs are sent out to report on the income that you received that wasnât from an employer.

1099âs give both you and the IRS records of your non-employment income. If the IRS receives a 1099 detailing income that you did not report on your tax return, you will be retroactively charged penalties and interest on your tax payment.

Learn more about how Coinbase reports to the IRS.

Does Coinbase Report To The Irs

Coinbase reports some of your transaction activity to the IRS if you meet certain criteria. Coinbase will send you and the IRS a 1099-MISC if:

– You are a Coinbase customer AND

– You are a US person for tax purposes AND

– You have earned $600 or more in rewards or fees from Coinbase Earn, USDC Rewards, and/or Staking in 2020.

Read Also: Employer Tax Identification Number Lookup

How To Download & Export Coinbase Pro Transaction History

Theres a couple of ways to get your Coinbase Pro transaction history -download it from your account as a file, or automate this with the Coinbase Pro API:

Log in to your Coinbase Pro account and select your profile in the top right, then statements. On the statements page, you can generate both an accounts statement and a fills statement as either a CSV or a PDF file. This file will get emailed to the email address associated with your Coinbase Pro account and may take a couple of days to arrive.

Please note if you’re using Coinbase, you’ll need to import a separate CSV file with your Coinbase transaction history too. See our guide on Coinbase tax reporting.