What Is An Irs Electronic Filing Pin And Why Is E

We work to make electronically filing your taxes as convenient as possible. We will help you to prepare your return and when you are ready transmit it, help to send it safely and securely on to the IRS. Before we do this, you will need to e-sign your return just as you would with a paper filing.

Anytime you opt to electronically file a tax document, you are required to enter either your adjusted gross income from last year’s tax return or your IRS personal identification number . This is also known as e-signing and is used as an electronic signature. It also serves as a way to help protect tax payers against unauthorized filings.

A IRS electronic filing PIN is usually five digits long. It serves to help verify that the person filing is the individual taxpayer or someone filing on the behalf of this taxpayer.

If you do not know what your IRS e-file PIN is, or need to recover one previously used you can find more information here. While this may be a slight inconvenience to some, use of this verification system helps to protect taxpayers from falling victim to fraud.

I Don’t Have A 10 Digit Pin To Efile Fed Payroll Forms

I am required to use a 10 digit PIN to file IRS tax form

Apparently I have one but cannot find/remember it

EFTPS says to call the IRS

The IRS doesn’t answer because the government is closed

I submit for a new one but got rejected because I already have one

Can someone PLEASE help me and make this madness STOP

Hi doodholliday,

You can call the IRS E-file services to reset your 10-digit pin. Within 7-10 banking days, your PIN will be mailed to you.

You might want to file your form manually while waiting for your PIN to make sure you can submit it on time.

If you have further questions, don’t hesitate to reach to the Community space.

How To Get A Pin

If you have been stung by identity theft, the IRS may have already assigned you a PIN for the 2020 tax year. If that’s the case, you’ll be sent a CP01A notice, which has your PIN at the top of the first column on page one. The form also has instructions on how to use the PIN.

If you have reported identity theft to the IRS and didn’t get a PIN, the agency may not have finished investigating your case, or you may have moved before the end of the last year and didn’t notify the agency.

If you haven’t been assigned a PIN, you can request one by using the agency’s “Get an IP PIN tool, as long as you have a Social Security number or a taxpayer identification number. If, however, your annual income is $72,000 or less and you don’t have internet access, you can still get a PIN by filing Form 15227 .

You may also get an in-person meeting at a Taxpayer Assistance Center , which are available in some locations by appointment.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Also Check: How To Do Taxes On Doordash

How Do I Get My E

How can I check my income tax number online Malaysia?

You can check by calling the LHDN please have your IC or passport number ready.

What Is An Irs Ip Pin And What Does It Do

An Identity Protection PIN is a six-digit number given to you by the IRS to prevent anyone else from filing a tax return using your Social Security number. Once you receive an IP PIN, youll need to use it when you file your taxes. Your IP PIN should be shared only with your tax professional or when you file using tax software.

According to the IRS, an IP PIN will help secure your account: Electronic returns without the right IP PIN will be rejected, and paper returns will be subject to additional fraud checks.

Also Check: Do You Have To Pay Back Taxes For Doordash

Process May Be Complicated But Personal Identification Numbers Add Layer Of Security

You have a personal identification number for your computer, your bank card and probably your cellphone. Now you can get a six-digit PIN from the Internal Revenue Service to help guard against identity theft when you file your taxes.

The PIN is an extra layer of security that will protect you if a fraudster who has obtained your Social Security number tries to file a bogus tax return in your name in order to get a refund from the federal government. If this happens, it’s likely that your refund will be delayed while you prove to the IRS that it wasn’t you who filed the false return.

Ideally, scammers won’t be able to get both your PIN and your Social Security number. You’ll get a new PIN every year.

How To Find My Pin Number To File Taxes

There are many reasons why the IRS would assign you an identity protection personal identification number, also known as the IP PIN, to be used when filing your taxes. If you have ever been involved in an identity theft situation, then you will get IRS form CP01A prior to filing your taxes with your PIN on it.

While most people try very hard to keep all of their IRS paperwork, it is not unusual for a taxpayer to lose their PIN number. If you do lose your PIN or you didnt know you had one and you need to find it, then the IRS gives you a few ways you can retrieve that number to file your taxes.

How Do You Get A PIN?

The only way a taxpayer can get a PIN is to either be part of the pilot program for IP PINs that was run by the IRS, or be assigned one by the IRS. The only instance where a PIN can be requested is if you were not able to file your federal return online. As of March 2018, the IP PIN is not something any taxpayer can request for added security.

Use The Get An IP PIN Tool

What If You Cannot Retrieve Your Existing PIN?

It can happen that the Get An IP PIN tool is unable to get you your PIN, but you should not panic. If the IRS website cannot find your PIN, then you can call the IRS to get a new PIN issued. You can call 800-908-4490 Monday through Friday from 7:00 a.m. to 7:00 p.m. in your own time zone to get a new number issued.

You May Like: Do I Need To File Taxes For Doordash

When Do You Have To Register A Tax File In Malaysia

If youre an individual earning more than RM34,000 per annum after EPF deductions, you have to register a tax file.

When are the next ringgitplus Tax Guide for Malaysia?

The RinggitPlus Team 1st March 2022 Malaysia Personal Income Tax Guide 2021 Jacie Tan 25th March 2021 Everything You Should Claim For Income Tax Relief Malaysia 2021 Jacie Tan 12th March 2021 Malaysia Personal Income Tax Guide 2020 Jacie Tan

How To Obtain An Identity Protection Pin In 2021

In the past, the IRS has assigned verification numbers to victims of identity theft to file their tax returns, if requested by the victimized individual. The number is referred to as an identity protection PIN . The IP PIN is a six-digit code known only to the taxpayer and the IRS. It helps prevent identity thieves from filing fraudulent tax returns using a taxpayers personally identifiable information.

The IP PIN serves as the key to an individuals tax account. Electronically filed returns that do not contain the correct IP PIN will be rejected, and paper returns will go through additional scrutiny for fraud. Effective now, anyone can request an IP PIN, it is no longer limited to victims of identity theft. Given the uptick in unemployment tax fraud, where thousands of social security numbers were compromised, now is the time to consider obtaining the IP PIN.

Key Facts About the Identity Protection PIN

How to Obtain an Identity Protection PIN

If you want an IP PIN for 2021, visit IRS.gov/IPPIN and use the Get an IP PIN tool. This online process will require that you verify your identity using the Secure Access authentication process if you do not already have an IRS account. Visit IRS.gov/SecureAccess for a list of the information you need to be successful. After you have authenticated your identity, a 2021 IP PIN will immediately be revealed.

All taxpayers are encouraged to first use the online IP PIN tool to obtain their IP PIN.

Read Also: How Much Do You Pay In Taxes Doordash

How Do I Find My Irs Electronic Filing Pin

If this is the first year you are using an e-file program to transmit your return you will need to create a 5-digit IRS electronic filing PIN. You can also generate a new PIN if your existing one is forgotten or misplaced. Below are the instructions for doing this. Note – for your own protection, you will be asked to verify your identify with some basic information before being issued a filing PIN.

You will need the following information before you begin:

- Social Security Number

How To Get Your Ip Pin Reissued

If you’re unable to retrieve your IP PIN online, you may call us at for specialized assistance, Monday – Friday, 7 a.m. – 7 p.m. your local time , to have your IP PIN reissued. An assistor will verify your identity and mail your IP PIN to your address of record within 21 days.

Exception:

- Its after October 14 and you havent filed your current or prior year Forms 1040 or 1040 PR/SS.

If you fall under the exception and if you cannot access the Get an IP PIN online tool, your best alternative at this time is to file your tax return by paper without your IP PIN.

Youll need to complete and mail a paper tax return without your IP PIN. Well review your return to confirm its yours, but this may delay any refund youre due.

Existing IP PIN users seeking to retrieve their numbers should not apply for a new IP PIN with Form 15227. The Form 15227 application process is only for taxpayers who are newly opting into the program and do not already have an IP PIN requirement.

Also Check: How To Take Taxes Out Of Doordash

Can I File My Tax Return By Phone

Ottawa, Ontario

Canada Revenue Agency

Yes! Auto-file your tax return with the Canada Revenue Agencys File my Return service! If you received an invitation from the Canada Revenue Agency to use our automated phone service, File my Return, you may be eligible to auto-file your return through a dedicated phone line service for free.

How To Request A Virginia Tax Pin

If you are a victim of identity theft and need to file a Virginia income tax return, and want the added protection of a Virginia Tax PIN, send us the following:

- A letter explaining how your personal information was compromised.

- Your full legal name

- Your Social Security number or tax ID number issued by the IRS

- Your current address

- A clear copy of a government-issued ID card, such as a Virginia drivers license, Virginia identification card issued by DMV, or a voter registration card with your current name and address

- Documents showing you are a victim of identity theft. This could be a letter from an employer, an insurance company, a hospital, a broker, or a police report if one was filed.

- Daytime phone number where you can be reached

Where to mail your PIN request:

Department of Taxation

Also Check: Ein Free Lookup

Security Of Personal Information

We accept responsibility for the security of information once we receive it. We take precautions to ensure that there is no unauthorized access to your data, and ensure the confidentiality of data you send using NETFILE. We use sophisticated security and encryption to protect this website and your personal information.

We are also responsible for making sure personal and financial information is sent in an encrypted format between your computer and our servers. This ensures that computer hackers and other Internet users cant view or alter the data you send to us.

Tax software companies whose products are certified for NETFILE are not representatives of the CRA. You are not obliged to send personal information directly to the tax software company when you ask for software assistance. Email is not a secure method of communication. Sending personal information by email is a big concern and increases the risk of identity theft.

Efile Irs 10 Digit Pin

I am set up to efile but my 10 digit – said it had expired. what do i do about that? is it an IRS thing ro QB thing.. i can epay for not efile. i called IRS – they said it was something to reset in QB — QB says i need to get it set via IRS. maybe i don’t know the correct wording but it’s becoming very frustrating. I tried to re-enroll but it was rejected because i’m already enrolled. i just need a new pin – i know where to put it when i get a new one — should be easier if it expires every so often.

Don’t Miss: Do You Pay Taxes On Plasma Donations

Using Identity Protection Pin

To ensure no one uses your Social Security Number or Individual Taxpayer Identification Number to file taxes for the current year, you can create an Identity Protection PIN , which is a six-digit number generated for use each calendar year.

You could do that by using the online “Get an IP PIN” tool after getting an IRS account. Alternatively, if you have an AGI of $72,000 or less, you could apply through Form 15227, Application for an Identity Protection Personal Identification Number , and fax or mail it to the IRS. After that, you will receive your IP PIN via the U.S. Postal Service.

The third option is to book an appointment and attend an in-person meeting at your local Taxpayer Assistance Center to get your identity verified.

Once you have your IP PIN, you could use it to verify who you are when the tax preparation software or any other IRS-associated site prompts you for your identity. And you can use that instead of an AGI PIN for taxes. In addition, you could use it to identify yourself when filing a paper tax return.

It is worth noting that if you have experienced identity theft in the past and the IRS has sorted the issue, it will generate a new IP PIN each year via the CP01A Notice. And that is what you would use instead of applying for a new number.

Do remember that the IP PIN can only be used when filing Forms 1040, 1040-PR or 1040-SS. And to enjoy doing so, you must meet the identity verification measures, which include providing an ITIN or SSN.

Important Information About Ip Pins

- An IP PIN is valid for one calendar year.

- A new IP PIN is generated each year for your account.

- Logging back into the Get an IP PIN tool, will display your current IP PIN.

- An IP PIN must be used when filing any federal tax returns during the year including prior year returns.

- FAQs about the Identity Protection Personal Identification Number

Read Also: Doordash Tax Tips

Retrieving Your Ip Pin

If you misplace or lose your IP PIN information, you can retrieve it using various methods. Below are some of these ways.

- You can use the IRS Get an IP PIN Online tool to validate your identity again and obtain the current IP PIN.

- You can contact the IRS support representatives at 800-908-4490 from Monday to Friday, 7 a.m. to 7 p.m. your local time . Once your identity is verified, your IP PIN will be resent to your current address within 21 days.

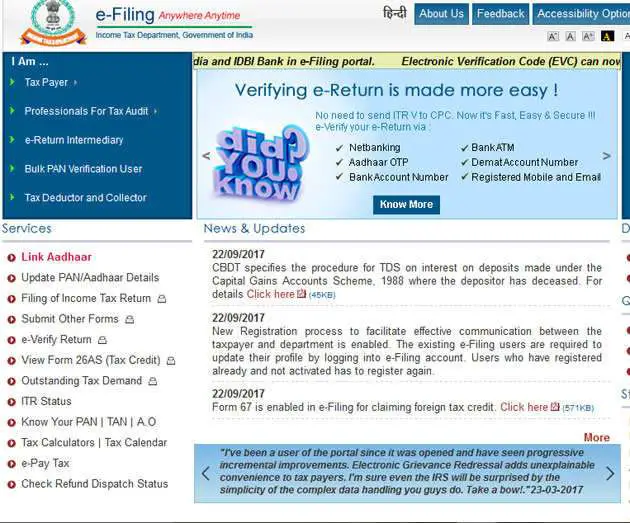

How Do I Check My Income Tax Malaysia

What is E-Filing PIN?

The Self-Select PIN Method is one option for taxpayers to use when signing their electronic Form 1040 and Form 4868. The PIN is any five numbers the taxpayer chooses to enter as their electronic signature.

Don’t Miss: Michigan.gov/collectionseservice

Can I Verify My Identity For Irs Online

To verify their identity with ID.me, taxpayers need to provide a photo of an identity document such as a drivers license, state ID or passport. Theyll also need to take a selfie with a smartphone or a computer with a webcam. Once their identity has been verified, they can securely access IRS online services.

What Is An Ip Pin And Do You Need One

Identity theft has become a serious problem and fraudsters have used stolen identities to file false tax returns and claim refunds before the rightful filers can do so. Even childrens Social Security numbers are being targeted.

The Internal Revenue Service created an Identity Protection Personal Identification Number Opt-In Program to protect taxpayers whose identities had been stolen. Although the program was initially for victims of identity theft, it is being expanded in phases to all taxpayers. The IP PIN is a six-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number on fraudulent federal income tax returns. An IP PIN is used only on Forms 1040, 1040PR and 1040SS.

There are a number of reasons for signing up for an IP PIN, but also some drawbacks. Data breaches have become prevalent and most of us have our personal information stored somewhere online, which means we risk having that information leaked or stolen. The IP PIN offers a greater level of security when it comes to protecting people from tax-related crimes. The IP PIN is an important tool as it will thwart tax-related identity theft, preventing many of the problems that come with identity theft. If your identity is stolen, the IRS flags your account for the next three years, resulting in slower processing of your tax return and a delayed refund if one is due.

Read Also: Wheres My Refund Ga State