Extends The Expanded Earned Income Tax Credit For Around 17 Million Low

Before this year, the federal tax code taxed low-wage childless workers into poverty or deeper into poverty the only group of workers it treated this way. The Build Back Better framework will extend the American Rescue Plans tripling of the credit for childless workers, benefiting 17 million low-wage workers, many of whom are essential workers, including cashiers, cooks, delivery drivers, food preparation workers, and childcare providers. For example, a childless worker who works 30 hours per week at $9 per hour earns income that, after taxes, leaves them below the federal poverty line. By increasing her EITC to more than $1,100, this EITC expansion helps pull such workers out of poverty.

Stops Large Profitable Corporations From Paying Zero In Tax And Tax Corporations That Buyback Stock Rather Than Invest In The Company

In 2019, the largest corporations in the United States paid just 8 percent in taxes, and many paid nothing at all. President Biden believes this is fundamentally unfair. The Build Back Better framework will impose a 15% minimum tax on the corporate profits that large corporationswith over $1 billion in profitsreport to shareholders. This means that if a large corporation says its profitable, then it cant avoid paying its tax bill. The framework also includes a 1% surcharge on corporate stock buybacks, which corporate executives too often use to enrich themselves rather than investing workers and growing the economy.

How Do I Get The 2021 Child Tax Credit And Get Advance Payments

Advance payments have been sent monthly from July to December 2021. You should have gotten your advance payments if you fall into any of the below categories:

If you are required to file taxes:

- Filed a tax return for tax year 2019 or 2020. Your tax return is used to determine eligibility for advance payments even if you didnt claim the CTC on your tax return.

If you arent normally required to file taxes:

- Successfully submitted your information using the 2020 IRS Non-Filer portal .

- Successfully submitted your information using the 2021 IRS Child Tax Credit Non-Filer portal or GetCTC.

| Filing Status | ||

| Qualifying Widow with Dependent Child | $24,800 | $26,100 |

If you havent received your advance payments, you can get the full amount of your CTC by filing a 2021 tax return . .

If you are a first-time filer, you will need a Taxpayer Identification Number. This can be an SSN or ITIN.

Recommended Reading: Where Can I Drop Off My Taxes

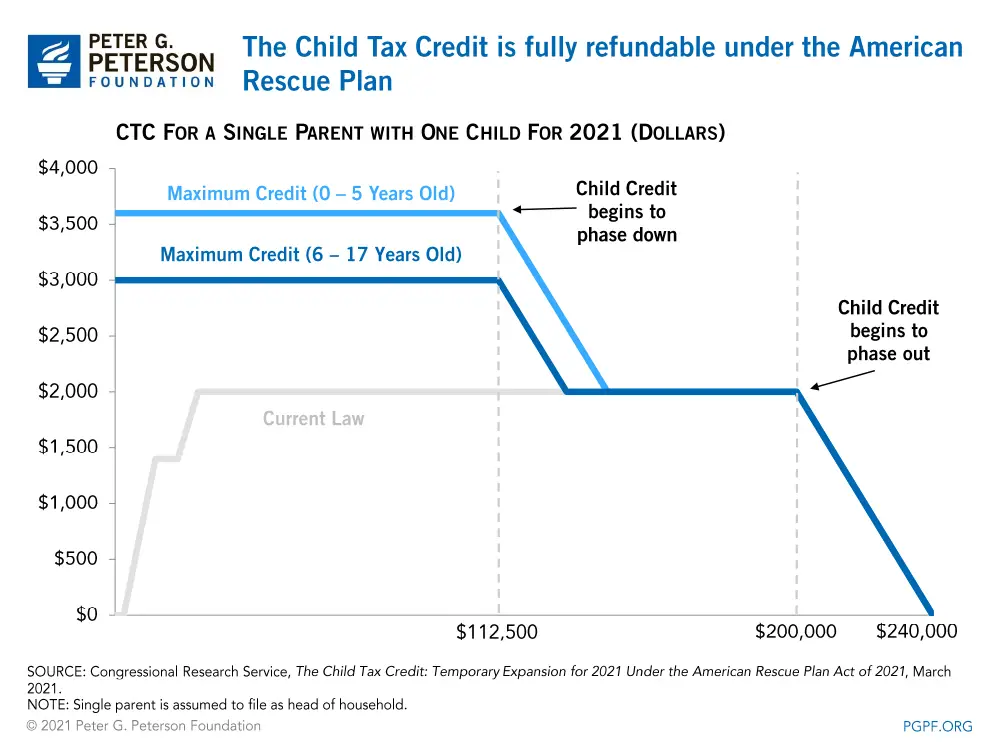

The Maximum Child Tax Credit That Parents Can Receive Based On Their Annual Income

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than:

- $150,000 for a person who is married and filing a joint return

- $112,500 for a family with a single parent and

- $75,000 for a single filer or a person who is married and filing a separate return.

Parents and guardians with higher incomes may still receive a partial payment. Eligible parents and guardians receive a maximum of $3,000 for each qualifying child who was between the ages of 6 and 17 at the end of 2021. Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of $3,600 per child. Children who attend college are qualifying children for the Child Tax Credit if they meet the age and other requirements described in the next section.

Dependent children age 18 and older can qualify their parents for the $500 Credit for Other Dependents. For more information about the Credit for Other Dependents, see the Instructions for Schedule 8812 .

If you do not qualify to receive the maximum amount, use the Get your Child Tax Credit tool to estimate how much you should receive.

Child Tax Credit: What Will You Receive

If you have children or other dependents under the age of 17, you likely qualify for the Child Tax Credit. Its been increased as part of the American Rescue Plan, which was signed by President Biden in March 2021 as part of a U.S. government effort to help families deal with the financial hardships stemming from the COVID-19 pandemic. Direct cash payments began on July 15. There are also a number of income limits you should know about when planning how much youll receive. Since planning your familys finances goes beyond just taxes, consider working with a local financial advisor to optimize your plans.

Also Check: Can I File Taxes On Unemployment

How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.

As The April 18 Tax Filing Deadline Looms Parents Have Lots Of Questions About How To Report The Child Tax Credit And Last Year’s Monthly Payments On Their Tax Return And We Have Answers

With the right around the corner for most individual federal income tax returns, you may be hard at work getting ready to file your return or reviewing a return done by your tax preparer. As you’re doing this, you’ll want to keep in mind the tax changes that applied for 2021and how they should be reported on your return. You’ll also want to make certain that you’re taking all the tax breaks you are entitled to. One of the most significant changes for 2021 was to the child tax credit, which is claimed by tens of millions of parents every year.

The child tax credit for the 2021 tax year is bigger and better than the 2020 credit. The credit amount was significantly increased, and the IRS made monthly advance payments to millions of qualifying families from July through December 2021.

The 2021 child tax credit changes are complicated and don’t help everyone. For instance, there are two ways in which the credit can be reduced for upper-income families. That means some parents don’t qualify for a larger credit and, as before, some won’t receive any credit at all. More children qualify for the credit on 2021 returns. And, this year, when you file your 2021 tax return, you’ll have to reconcile the advance payments you received with the actual child tax credit you’re entitled to claim.

Question: What were the rules for the 2020 child tax credit?

Question: What changes were made to the child tax credit for 2021?

Recommended Reading: Can I File My Taxes Online

Cbo Expects Economy To Remain Weak Through 2021

CBOs latest economic and budget projections show that the unemployment rate will remain above 10 percent through the end of the year and that it wont return to the levels in CBOs pre-pandemic economic projections until late in the decade. CBO projects that the unemployment rate will be 9.4 percent early next year when people will file for their EITC and Child Tax Credit refunds, will average 8.4 percent for all of 2021 , and wont drop below 6 percent until mid-2024. CBO also projects that real GDP over 2020-2021 will be 6.7 percent below CBOs forecast from January 2020. The even-more-recent projections of the Organisation for Economic Co-operation and Development, issued on July 7, are more pessimistic, forecasting an unemployment rate averaging between 8.5 percent and 11.5 percent in 2021, depending on the scope of the pandemic.

This deep economic weakness means that additional and aggressive fiscal policy measures will be needed, and for an extended period of time, to strengthen demand in the economy.

Child Tax Credit: Impact On Policy And Poverty

The expansion of the Child Tax Credit for 2021 has important policy and economic implications. When the Child Tax Credit was first enacted, it was intended to benefit low- and moderate-income families. Since its enactment in 1997, it has benefited these taxpayers. At higher income levels, the credit is phased out gradually. However, the Child Tax Credit had been criticized regularly for providing little or no benefit to the poorest families, many of whom are not taxpayers and do not file tax returns.

Over the years, frequent amendments increased the Child Tax Credit amount and provided refunds that were limited in amount and scope at one time, refunds were restricted to taxpayers with three or more children. High-income phaseouts continued, and credit disallowance rules addressed fraudulent, reckless, or improper claims. But, for years, the Child Tax Credit did not reach the poorest families.

In 2021, for the first time, the significant increase in the credit amount and the provision of total refundability extended benefits to the neediest families. According to the Center on Poverty & Social Policy at Columbia University, “…the sixth Child Tax Credit payment kept 3.7 million children from poverty in December . On its own, the Child Tax Credit reduced monthly child poverty by close to 30%.”

Also Check: What Is The Limit For Donations On Taxes

Is The Credit Refundable

The Child Tax Credit is nonrefundable and reduces the amount of income tax you owe, up to the total amount. It is also refundable up to $1,400 per child on any remaining credit. If you owe $5,000 in taxes and are eligible for a $2,000 Child Tax Credit, your tax bill would be $3,000. If you owe $2,000 and your Child Tax Credit is $3,000, your tax bill would be zero and you may receive a refund of the remaining $1,000 credit by claiming the Additional Child Tax Credit.

How Were The Advance Payments Be Sent

If the IRS already has your banking information because you had a tax refund directly deposited, your advance payments were sent as a direct deposit. The direct deposits were labeled ChildCTC. The IRS uses the sources listed below to know which bank account to deposit your payments in:

If the IRS does not have any of your banking information, your advance payments will be sent by mail.

Don’t Miss: What Is Federal Tax Due

When Will I Start Receiving My Monthly Payments

People who receive payments by direct deposit got their first payment on July 15, 2021. After that, payments continue to go out on the 15th of every month. If you havent provided the IRS with your bank account information on a recent tax return, a check will be sent out to you around the same time to the address the IRS has for you.

Strengthens The Affordable Care Act And Reduces Premiums For 9 Million Americans

The framework will reduce premiums for more than 9 million Americans who buy insurance through the Affordable Care Act Marketplace by an average of $600 per person per year. For example, a family of four earning $80,000 per year would save nearly $3,000 per year on health insurance premiums. Experts predict that more than 3 million people who would otherwise be uninsured will gain health insurance.

Don’t Miss: Can You Pay Your Tax Monthly

If Your Marital Status Has Changed

If your marital status changes, let us know by the end of the month following the month in which your status changed. However, do not tell us of your separation until you have been separated for more than 90 consecutive days.

You can tell us by using one of the following methods:

When we get notification of your change in marital status, we will recalculate your CCB taking into consideration your new marital status and your new adjusted family net income.

Your CCB will be adjusted starting with the month following the month that your marital status changed.

Example 1

Terry was a single parent and received the CCB for her two children based on her income. In September 2022, Terry married Peter who had a net income of $100,000 in 2021. Terry informed the CRA of their new marital status by using My Account. The CCB payments will be based on Terrys new adjusted family net income and their CCB payments will change starting with the October 2022 payment.

Salim and Iman had a child on August 15, 2020. On September 1, 2020, the couple applied for the CCB by completing Form RC66, Canada Child Benefits Application. As Salim is a stay at home parent, they applied and attached a signed letter from Iman stating that they are the parent who is primarily responsible for all the children in their home and should receive the CCB for the family. Without the letter, Iman would receive the CCB for the family.

Example 2

What If I Filed A 2020 Tax Return But The Irs Still Hasnt Processed My 2020 Tax Return

The IRS will use your 2019 tax return to determine if youre eligible for advance payments and if you are, the amount you will get. Once your 2020 tax return is processed, your payment amount may change.

Because of the IRS delay on processing tax returns, your advance payments may not be adjusted in time. You will have to file a 2021 tax return to receive any missing money that you are owed.

Read Also: How Can I Pay My Property Taxes Online

If You Have A Spouse Or Common

For CCB purposes, when a child resides with a female parent in the home, the female parent is usually considered to be primarily responsible for the child and should apply. However, if the child’s other parent is primarily responsible, they can apply. They must attach to Form RC66, Canada Child Benefits Application, a signed letter from the female parent that states that the other parent with whom she resides is primarily responsible for all the children in the household. If the child lives with same sex parents, only one parent should apply for all the children in the home.

Note

The female presumption is a legislative requirement and only one payment per household can be issued under the income Tax Act. No matter which parent receives the CCB, the amount will be the same. For more information, see How we calculate your benefit.

If your spouse or common-law partner is a non-resident of Canada during any part of the year, you will have to fill out Form CTB9, Income of Non-Resident Spouse or Common-Law Partner.

When your spouse immigrates to Canada, they have to send us in writing all of the following information about themselves:

- social insurance number

- statement of income

If you have a new spouse or common-law partner

For more information on how to update your marital status, see If your marital status has changed.

Example 1

Example 2

Example 3

How Do The Monthly Advance Payments Of The Child Tax Credit Affect The Credit On The Tax Return For 2021

The IRS estimated the advance payments based on the number of dependent children reported on a taxpayers prior year return. If taxpayers claim more or fewer eligible children for 2021, the total payment amount may be more or less than their actual credit. If, as will be the case for most taxpayers, the advance payments constitute less than a taxpayers entire annual child tax credit, the taxpayer can claim the remaining undistributed credit balance on their 2021 tax return.

If a taxpayer received advance payments that exceeded their total credit for the year, they may be required to repay the excess when filing their return. However, repayments for low-income taxpayers and repayments of small amounts generally will be waived.

Don’t Miss: Can You Track Your Tax Return

What Is The Maximum Age Of The Children To Request The 2021 Child Tax Credit Payments

The changes to the Child Tax Credit are currently just for the 2021 fiscal year, however President Biden wants to extend the credit until 2025. And if Democrats in Congress have their way, the credit would be made permanent in theAmerican Families Plan.

Eligible families can receive up to $3,000 per child between the ages of 6 and 17 at the end of 2021. Each child under age 6 at the end of 2021 could qualify for up to $3,600. The credit is fully refundable so even if a family owes less than the amount of the credit, they will receive the excess as a tax refund. In the case of the revamped Child Tax Credit, parents will receive part of the credit in advance if they choose.

Under the American Rescue Plan taxpayers can claim up to $500 each toward the child tax credit for 18-year-old dependents and dependents between the age of 19 and 24 who are attending college full-time.

Are you a taxpayer? Do you have kids under 18? Then you are probably about to get a tax cut — deposited directly into your bank account, each month, starting July 15 — thanks to the American Rescue Plan. How much? This tool will let you know.

Ronald Klain May 18, 2021