Kansas Customer Service Center

Using the Kansas Customer Service Center you can securely manage your tax accounts online. With one login â the email and password, you can securely access Kansas Department of Revenue accounts. You can make electronic payments, view your online activity and file various returns and reports including your sales, use, withholding, liquor drink and liquor enforcement tax returns.

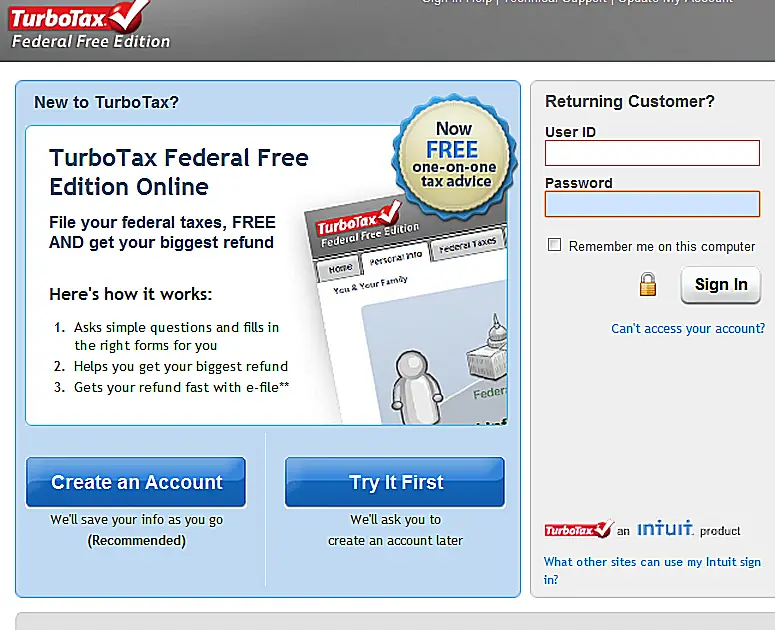

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Earned Income Tax Credit

- Child tax credits

- Student Loan Interest deduction

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

How Do I Get Help Filing My Taxes Online

If at any point you have a question about your taxes or the software, you can browse answers on our online help forum 24/7, or post a question for our online community of users and experts. While youre filing you may realize that youre looking for more guidance or help with your taxes. In that case you can upgrade to a different TurboTax Online product at any time without losing any of the data youre already entered.

Need more help? TurboTax Live Assist & Review gives you unlimited tax advice from one of our tax experts as you do your taxes, plus a final review before you file to make sure you didnt miss anything. Or if you want to hand off your taxes to one of our experts, TurboTax Live Full Service allows you to simply upload your documents and our experts will complete and file your return for you.

Filing Your Own Return

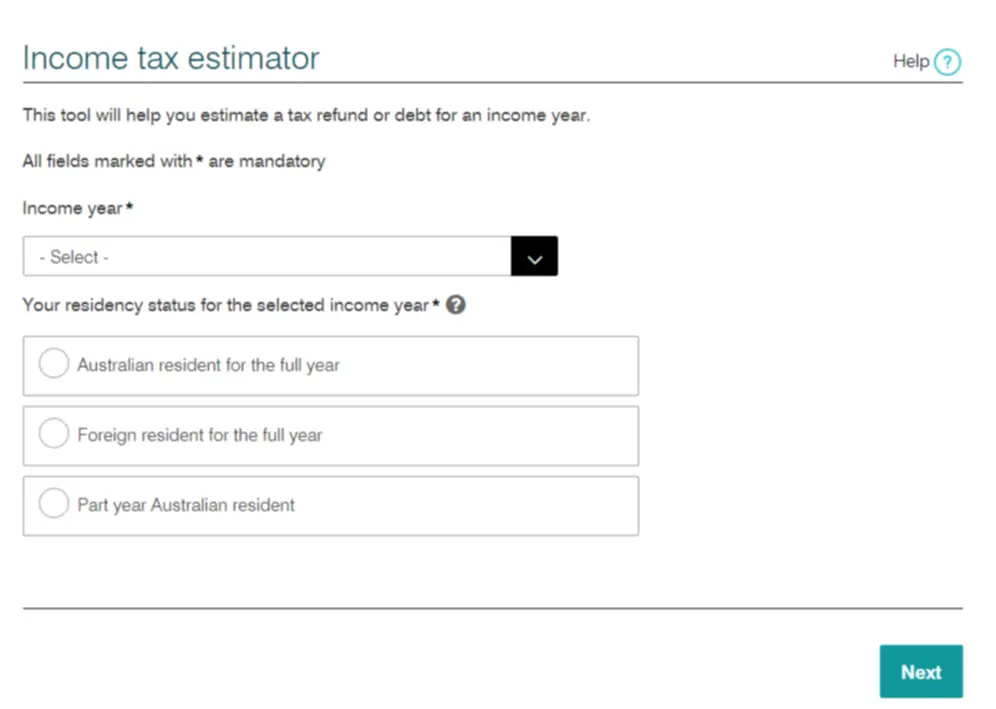

You can use commercial software to complete your income tax return and file it online using the integrated NetFile Québec feature.

When you file your income tax return online, do not send us any paper copies of the return.

When can I file my income tax return using NetFile Québec?

2020 income tax return

- You can file your 2020 income tax return as of February 22, 2021.

Returns from previous years

- You can file your original 2017, 2018 and 2019 income tax returns in the four-year period following the taxation year covered by the return .

- If you did not file an income tax return for 2017, 2018 or 2019 taxation year, and we sent you a notice of assessment for the year covered by the return, you cannot file an original return using authorized software. You have to mail the return to us.

Amended income tax returns

- You can file an amended 2017, 2018 or 2019 income tax return as of February 22, 2021.

End of note

Also Check: How To Buy Tax Lien Properties In California

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Electronic Filing Options For Individual Income And Business Taxes

Being sensitive to the changing economic climate, the Kansas Department of Revenue no longer produces and distributes a large number of paper documents. Instead, instructions, sample tax forms, and schedules can be accessed on the Department’s website by going to the forms and publications page. The Department also offers the following alternative electronic reporting and filing options.

You May Like: Wheres My Refund Ga State

About Free File Fillable Forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to:

- Choose the income tax form you need

- Enter your tax information online

- Electronically sign and file your return

- Print your return for recordkeeping

If you choose Free File Fillable Forms as your Free File option, you should be comfortable doing your own taxes. Limitations with Free File Fillable Forms include:

- It won’t give you guidance about which forms to use or help with your tax situation

- It only performs basic calculations and doesn’t provide extensive error checking

- It will only file your federal return for the current tax year

- No state tax return option is available

- You can’t make changes once your return is accepted

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose 2021 income is greater than $73,000. Taxpayers whose income is $73,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

Free File: Everyone Can File An Extension For Free

The following companies partner with the IRS Free File Program, so that you can e-file your tax filing extension for free. Please be aware that filing an extension gives you time to e-file your federal tax return. If you have a balance due, the deadline to pay is still May 17, 2021. However, if you want to file your taxes now with free, easy to use software use the IRS Free File Program.

You May Like: When Does Doordash Send 1099

Irs Free File Program Delivered By Turbotax

With the IRS Free File Program delivered by TurboTax, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if any of the following applies to you:

- Your federal adjusted gross income for 2020 was $39,000 or less or

- You are active duty military with federal adjusted gross income for 2020 of $72,000 or less or

- You are eligible for the federal earned income credit .

To take advantage of this offer, click here.

How Do I File My Taxes Online

Filing your taxes with TurboTax Free is quick and easy. First youll be asked to set up a profile and follow a simple process to find all the credits and deductions youre entitled to. With the CRAs Auto-fill my return, you can also import your tax info directly from the CRA. This service pulls info from your income slips , government benefit slips, RRSP receipts, and unused tuition credits. All the relevant info will be populated from these forms into your tax return saving you time and effort.

If you decide not to use CRAs Auto-fill my return service, or if you have additional info to enter that isnt captured through the import, you can find all the forms you need quickly and easily through TurboTaxs search feature.

You can also easily look for all the credits and deductions that apply to you using the search bar in TurboTax Free. If youre not sure where to start, heres a list of common credits, deductions, and expenses you may be eligible for:

Once youve entered all your info for the year and youre ready to file, our software will guide you through the steps to NETFILE your return online or print and mail your return. Well also give you step-by-step instructions on how to pay the CRA if you owe taxes.

Also Check: Appeal Cook County Taxes

Free File: About The Free File Alliance

The Free File Alliance is a group of industry-leading private-sector tax preparation companies that provide free online tax preparation and electronic filing only through the IRS.gov website. IRS Free File is a Public-Private Partnership between the IRS and the Free File Alliance. This PPP requires joint responsibility and collaboration between the federal government and private industry to be successful.

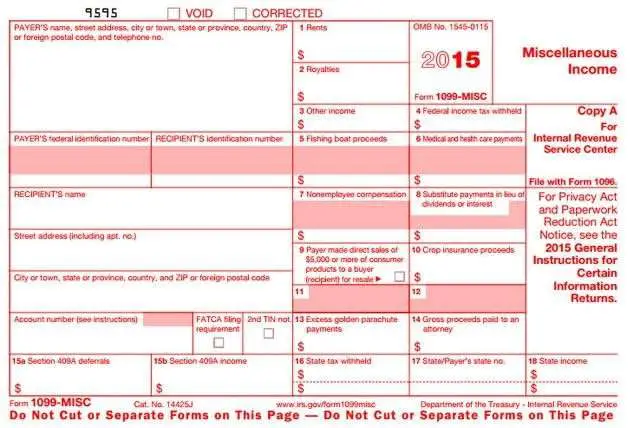

Documents You Need To File Your Taxes Online

Start by gathering all the required financial paperwork youll need to file. This includes any W-2 forms youve received from employers you worked for in the past year, as well as any Form 1099s you received for work with clients as a self-employed worker or for miscellaneous income you earned.

Other paperwork you may have and would need for your tax return includes interest you earned on bank accounts , investment income , student loan interest paid , mortgage statements of interest paid and information on contributions youve made to an IRA or a health savings account . While you can gather all the required paperwork for your tax return as you move through the e-filing process, collecting this information early can save you time later on.

Don’t Miss: How To Get A License To Do Taxes

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Online Taxes At Oltcom

With Online Taxes at OLT.com, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if you meet any of the following requirements:

- Your federal adjusted gross income for 2020 was between $16,000 and $72,000 or

- You are active duty military with federal adjusted gross income of $72,000 or less.

To take advantage of this offer, click here.

Read Also: Do You Pay Taxes On Plasma Donations

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

States That Dont Allow E

All states that charge a state income tax allow you to e-file your state tax return. However, some states dont allow you to e-file a state-only return they require you to e-file state and federal taxes together.

According to TaxSlayer, states that dont allow state-only filing online include:

- Alabama

Also Check: How Much Does Doordash Take In Taxes

Remember These Tax Filing Dates

Apart from the opening date of tax-filing season, the IRS also outlined important closing dates.

You have until approximately Tuesday, April 15, to file your 2021 returns.

If you have tax software or work with a tax professional, it might be worth filing your returns now, or at least getting all the paperwork ready. Of course, these third parties are still subject to the same filing dates as everyone else, but having everything sorted will lead to a stress-free tax season.

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling 800-829-1040 no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

Don’t Miss: Is Plasma Donation Income Taxable

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

- PreSDDSpare, E-file, and Print

- Prepare, E-file, and Print

- Prepare, E-file, and Print

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

Recommended Reading: Doordash 1099 Nec

Why Can Going Back And Filing My 2020 Taxes Even If I Dont Owe Any Money Be A Good Idea

If the IRS owes you a refund for your 2020 tax return, by going back and filing your 2020 taxes, you can receive your refund. Theres a deadline, and youll need to claim your refund within three years of the original deadline to file your return. So, you have until April 15, 2024 to claim your refund on your 2020 taxes. After that date, any unclaimed excess taxes paid by U.S. taxpayers go to the U.S. Treasury.

Before filing your 2020 taxes, you can visit the 2020 Tax Calculator on PriorTax.com to calculate your refund amount. There you will find free prior year tax calculators for 2011 to 2020. These are available to help provide a personalized view of income tax returns for any of the past tex tax years. Our tax calculators are entirely anonymous and dont require an online account or entering any identifying personal information to use.

Additionally, because of the 2020 Recovery Rebate Credit and specific to filing 2020 taxes, if you did not receive the first and/or second Economic Impact Payments or think you qualify for more than you received, it can be a good idea to file your 2020 tax return. If youre eligible for the 2020 Recovery Rebate Credit, youll need to file your return to claim it, even if you wouldnt otherwise have a filing obligation.

Still need to prepare and submit your 2020 tax return? No need to panic!

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

You May Like: Is Donating Plasma Taxable Income