What Is The Standard Deduction For Seniors Over 65 In 2021

With the standard deduction being increased, seniors may not need to itemize their deductions. For example, the standard deduction is $2,500 for a single person and $10,000 for a married couple filing jointly. This means that if you are eligible for the standard deduction and dont itemize your deductions then you will be able to claim it instead of other items.

In 2021 the standard deduction for a single person under 65 will be $8,400 and the same amount for married couples filing jointly will be $13,800. In 2021, seniors over 65 will have a standard deduction of $4,000.

This is the same as in 2020 for those using the standard deduction. The standard deduction for seniors over 65 in 2021 is $5,000. If a person is sixty-five or older and takes the standard deduction, their taxable income would be reduced by $12,500. The standard deduction for seniors over 65 in 2021 is $2,220.

In addition, the additional standard deduction amount is $3,350. My wife and I are both eligible for a standard deduction in 2021. The standard deduction for seniors over 65 is $2,500. The new tax law in 2021 will change the standard deduction for seniors to $6,000. This is a huge increase from the current figure of $1,550.

Wheres My California State Refund

The State of California Franchise Tax Board is where you can find your CA tax refund status. Check the status of your California tax refund using these resources.

State: CaliforniaRefund Status Phone Support: 1-800-338-0505Hours: Mon. Fri. 7 a.m. to 5 p.m.Online Contact Form: 2020 State Tax Filing Deadline: May 17, 2021

Note: Please wait at least eight weeks before checking the status of your refund.

When Is This Bill Effective

Senate Bill 113 is effective for the tax year beginning on or after Jan 1, 2022. This allows other state tax credits to be used before the pass through entity tax credit. This bill also ends the temporary suspension of net operating losses, and it also takes away the five million dollar business credit limit enacted under Bill 85.

For taxable years after Jan 1, 2019, Senate Bill 113 excludes gross income any amount received from federal restaurant revitalization adopts and grants. Businesses that consider making a pass through tax entity election could see significant tax benefits.

It is very important to note that making the decision to elect pass through entity requires modeling and analysis of your business. In order to do that, you may want to reach out to a reputable tax advisor to help you sort through this new bill to see if it will benefit you and your business.

Recommended Reading: Www Aztaxes Net

General Tax Return Information

Due Date – Individual Returns – April 15, or same as IRS

Extensions – California has an automatic six-month extension to file an individual tax return. No form is required to request an extension.

Form FTB 3519, Payment for Automatic Extension for Individuals. Form FTB 3519 is used to make payment only if a return cannot be filed by the return due date and the taxpayer owes tax. To access Form FTB 3519 in the program from the main menu of the CA return, select Personal Information > Other Categories > File CA Extension . Note: This form cannot be electronically filed. Mail Form FTB 3519 with payment to the appropriate mailing address. .

Drivers License/Government Issued Photo Identification: California does not require Driver’s License or Government Issued Photo ID information to be included in the tax return in order to electronically file. It is recommended by the state that before preparing returns or accepting returns for electronic transmission, you should review two pieces of identification from each new client and retain a copy of this information in your files for four years from the due date of the return or four years from the date the return is filed, whichever is later.

California Releases Guidance On Its Newly Enacted Pass

The California Franchise Tax Board issued guidance about the newly enacted elective pass-through entity tax effective January 1, 2021, to January 1, 2026. The FTB discusses how certain qualifying PTEs may annually elect to pay this entity-level state tax on income. In return, qualifying taxpayers receive credit for their share of the entity-level, ultimately reducing their California personal income tax.

Who Qualifies?

A qualified taxpayer can be individuals, fiduciaries, estates, or trusts subject to California personal income tax and must be a partner, member, or shareholder of a qualified electing entity. Note that a taxpayer must approve of having their pro-rate share of the qualified income of the electing qualified PTE.

PTE Election

A qualified taxpayer can make an annual election on a timely filed tax return. However, once the election is made, it is irrevocable for that year and is binding on all PTE partners, shareholders, and members.

For the 2021 tax year, the election must be made when the tax return is filed. Beginning January 1, 2022, and before January 1, 2025, the qualifying taxpayer must make the election when the tax return for the taxable year is filed and remit payment by. Otherwise, the qualifying taxpayer cannot make the PTE election.

Due Dates

PTE Calculation

Read Also: How To Appeal Property Taxes In Cook County

California Enacts Elective Pass

Governor Newson recently signed Assembly Bill 150, which allows for an elective pass-through entity tax and amends and broadens the small business hiring credit . The law enacts the Small Business Relief Act, which permits a qualifying entity doing business in the state to annually elect to pay an elective tax based upon its qualified net income computed at the rate of 9.3%. The qualified entity must be doing business in California and is required to file either an S-Corp, Limited Liability Company, or Partnership tax return for taxable years beginning January 1, 2021, through January 1, 2026. A qualified entity is defined as an entity that is taxed as a partnership or S-corporation. The entitys partners, shareholders, or members in the taxable year of election are exclusively corporations or taxpayers . The entity is not a publicly traded partnership or an entity permitted/required to be part of a combined reporting group. The election is irrevocable and is made on the original, timely filed return for that taxable year.

Filing And Payment Deadline

For 2019 state taxes, the state has extended the filing and payment deadline. California residents now have until July 15, 2020 to file their state returns and pay any state tax they owe. As with the federal deadline extension, California wont charge interest on unpaid balances between April 15 and July 15, 2020.

You dont need to do anything to get this extension. Its automatic for all California taxpayers. But keep in mind that if youre expecting a refund, you might want to go ahead and file as soon as possible. During the coronavirus crisis, the state is continuing to process tax returns and issue refunds.

While this year is a little different, generally, Californias Tax Day is the same as the deadline for filing your federal income tax return April 15. However, if the 15th falls on a Sunday or holiday, the deadline may be extended.

You May Like: How To File Taxes Doordash

California Franchise Tax Board To Hold Sixth Interested Parties Meeting Regarding Market

The California Franchise Tax Board will hold a sixth interested parties meeting to solicit public input regarding additional proposed amendments to Californias market-based rules regulation . The sixth IPM will be held telephonically on Friday, June 4, 2021, at 10:00 a.m. To attend, interested parties need to RSVP to the FTB by May 28, 2021, at the email address set forth in the notice. Instructions on how to participate in the sixth IPM are set forth in the notice as well. The proposed amendments to be discussed include: added definitions of asset management services and of professional services examples to be included in the regulation addition of a special rule for certain professional services and a change to the applicability date .

May 13, 2021

What Are The Filing Deadline And Extension Process

While it usually falls on the California tax filing deadline in 2022 will fall later on . This is in line with the IRS federal filing deadline where a holiday or weekend will move the usual tax day to the next business day. This same date is when you need to have paid your California tax liability or else penalties and interest begin to apply.

If you’ll miss the filing deadline for your California state tax return, the good news is you can get a six-month extension automatically. You’ll just need to submit your tax payment to the California Franchise Tax Board by .

The state lets individuals request a payment plan to have up to five years to pay the taxes. Doing so comes with a $34 fee, but you can get manageable tax payments and avoid further issues such as ending up with a collections account on your credit report.

Read Also: Does Doordash Issue 1099

Assistance With Filing Your Return

-

Volunteer Income Tax Assistance and Tax Counseling for the Elderly – Search by city or county for best results.

-

Tax Aid provides free high-quality tax return preparation for Bay Area families.

-

Earn it! Keep it! Save it! List of Bay Area counties that offer tax help, courtesy of the United Way.

- Free Tax Help: File your taxes for free online and by phone.

-

If you believe a federal tax issue cannot be resolved online or over the phone, call the Taxpayer Assistance Center at 1-844-545-5640.Or find a TAC near you. Assistance at the TAC requires an appointment.

California Rules Taxpayers Were Residents On Date Of Stock Sale

Taxpayers were residents of California before 2008. On July 18, 2008, Taxpayers sold their shares in a corporation and did not pay California tax on the gain from that sale because they considered themselves nonresidents as of February 26, 2008 . The California Office of Tax Appeals affirming the Franchise Tax Boards proposed assessment of additional taxes against the Taxpayersdetermined that even though Taxpayers took some steps to evidence California was not their domicile in renting the Nevada apartment, they did not adopt a new permanent home in doing so . Further, because the taxpayers were California domiciliaries and physically in the State for a majority of the time leading up to and on July 18, 2008, their 28-day presence in Nevada did not outweigh the prior California residency/domicile contacts so as to greater a greater connection to another state. Therefore, the Taxpayers were California residents on the date of the stock sale, and owed personal income tax on the gain on the transaction.

May 5, 2021

Read Also: Can Home Improvement Be Tax Deductible

California Unitary Business Determinations For Holding Company Situations

The California Franchise Tax Board issued a letter ruling setting out the FTBs position on when a pass-through holding company is unitary with other pass-through entities in a number of different scenarios. Unlike the analysis for incorporated entities, the FTBs unitary analysis for pass-through entities requires examining additional, non-traditional factors. Furthermore, when the holding company does not have any operations of its own, the weighting of the non-traditional factors in the analysis is enhanced. The second consideration is if the business structure creates unity. For example, if a holding company functions as a focal point or conduit for operating the business, then the affiliated entities will be considered unitary. In contrast, if the holding company was clearly formed for investment purposes, then there is no unity. Third scenario is if the holding company is associated with one operating business, then the holding company is not unitary with its parent or the operating company. Finally, unlike corporate holding companies, pass through holding companies may not need to own a controlling interest in the operating company in order to be consider unitary with the operating company. Even when a pass through holding company owns less than 50% of the operating entity, the FTB will still examine whether there are indications of a unitary relationship in making its determination.

California State Tax Credits

Available California tax credits include the following:

- Child adoption costs: 50% of qualified costs for a qualified adoption in the year an adoption is begun.

- College access tax credit: 50% of contributions to the College Access Tax Credit Fund, Californias Cal Grants financial aid program.

- Earned income tax credit: Similar to the federal earned income tax credit, Californias credit is intended for lower-income working people. If your income qualifies you, the amount of the credit depends on your income and the number of qualifying children you have.

You May Like: How Do Taxes Work For Doordash

Where Do I Mail/e

You can conveniently e-file your California state income tax return for free using the CalFile service the California Franchise Tax Board website offers. You can simply set up an account on the government website, go through the filing steps and arrange for a quicker refund through direct deposit. If you’d rather not use this service, you can use tax preparation and filing services like TurboTax and TaxAct or have a tax professional handle it for you.

In addition, you can choose to fill out your California tax forms and mail them. The Franchise Tax Board mailing address to use depends on the inclusion of a tax payment as follows:

- Sending with payment: P.O. Box 942867, Sacramento, CA 94267-0001

- Sending without payment: P.O. Box 942840, Sacramento, CA 94240-0001

California Updates Its Golden State Stimulus Webpage

The California Franchise Tax Board has updated its Golden State Stimulus webpage. Among other things, the updated webpage refers to the governors proposal to add and expand stimulus payments for more Californians and notes that these additional payments are not yet available and are pending legislative action and expands the discussion of when recipients will receive their payments. Revisions have also been made to the following taxpayer assistance sections: How to get your payment What to do for a taxpayer who filed a 2020 return but did not claim a California earned income tax credit for which the taxpayer is eligible and Need some help? For more information, please visit the FTB website on this topic.

Don’t Miss: Taxes With Doordash

Free California State Tax Filing

Is it possible to fille a free California state tax filing? You can file a California State Tax Return free if you meet the qualifications. This is quite important to know since that is where most of your money goes. If you do not file a return, you may not have to pay back taxes.

More Tips On Free California State Tax Filing:

Disclosure: This post contains affiliate links and I will be compensated when you make a purchase after clicking on my links, there is no extra cost to you

The good news is that you can file places online to file your state taxes for free or claim a tax refund.

Most states require you to have a valid drivers license in order to file a tax return. In addition, you must be a US citizen to file for Federal taxes. In California, you need to be a resident in order to file a tax return.

Some other things to keep in mind when youre filing for a California State Tax Return. First, there are usually deductions for interest paid on your loan. Also, you might be able to claim things like the amount you spent on entertainment and the amount you spent on taxes and such.

You may also qualify for a California State Tax Credit if youve received benefits from the US Government. These benefits could include things like unemployment and disability payments. Check to see if you qualify for these.

The best part about filing for a California State Tax filing is that you can do it online. This means you can save time and avoid having to come into the office.

What Is The Tax Rate In California

For the 2021 tax year, California has nine income tax rates. They are progressive rates and depend on your filing status and income.

- 1 percent: up to $9,325 or $18,650

- 2 percent: $9,325 to $22,107 or $18,650 to $44,214

- 4 percent: $22,107 to $34,892 or $44,214 to $69,784

- 6 percent: $34,892 to $48,435 or $69,784 to $96,870

- 8 percent: $48,435 to $61,214 or $96,870 to $122,428

- 9.3 percent: $61,214 to $312,686 or $122,428 to $625,372

- 10.3 percent: $312,686 to $375,221 or $625,372 to $750,442

- 11.3 percent: $375,221 to $625,369 or $750,442 to $1,250,738

- 12.3 percent: more than $625,369 or more than $1,250,738

Recommended Reading: Doordash Quarterly Taxes

Workshop: Intro To California Taxes

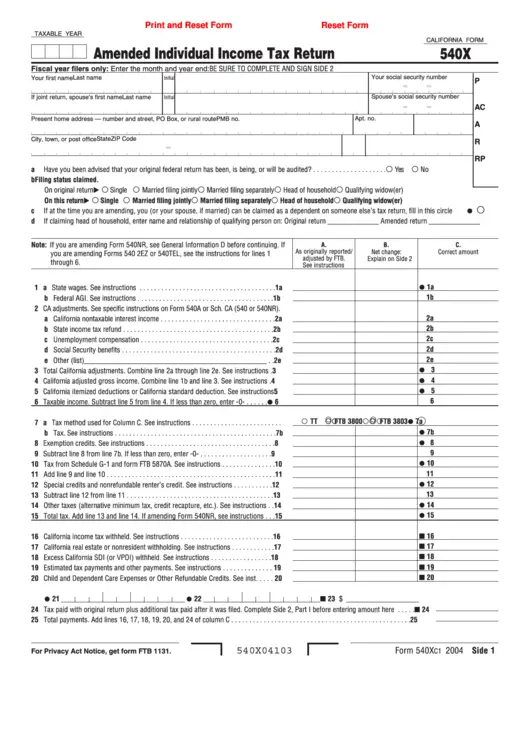

A member of the California Franchise Tax Board will present these workshops to assist you with filing any required state tax forms. We recommend completing your federal tax return before attending one of these workshops. Students or scholars who are considered nonresidents for California state tax filing will complete and file California Tax Form 540NR those who are considered residents for California state tax filing will complete and file California Tax Form 540.

California Update On Extension Of Filing Deadline

The California Franchise Tax Board has announced that California will extend the state tax filing and payment deadline for 2020 returns for individuals to May 17, 2021. This extension does not apply to estimated tax payments due on April 15, 2021. This relief is available to all individual California taxpayers without the need for them to file a request with or contact the FTB. The FTB also has created a FAQs regarding the extension, 2020 tax year extension to file and pay . The California extension is similar to the federal tax filing and payment deadline extension the Internal Revenue Service and the Treasury Department announced on March 17, 2021. In IR:2021-59 , they announced that the federal income tax filing and payment due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021, and that this relief does not apply to estimated tax payments that are due on April 15, 2021, which remain due on April 15, 2021.

Read Also: Ein Reverse Lookup Free