Which County Has The Highest Tax Which Has The Lowest

Alamance, Caswell, Chatham, Durham, Orange, and Person counties have the highest tax rates of 7.5%.

Avery, Brunswick, Camden, Chowan, Columbus, Currituck, Dare, Davie, Gates, Hyde, Mitchell, Pamlico, Tyrrell, Vance, and Washington counties have the lowest total tax rate of 6.75%.

However, for all vehicle sales, North Carolina charges a flat 3% highway-use tax.

Penalties And Interest For Late Payments

If payment is remitted late, there is a 10% failure to pay penalty that will be due with the next payment. Interest will be charged as well from the date of the last received payment.

If payment is on time but filing is late, there is a failure to file penalty of 5% per month with a maximum fine of 25% for a single return.

For those with a zero return, filing is still required by the listed due date. There is no penalty for failing to file a zero return, but after 18 months, the permit may be revoked for lack of filing.

What Other Fees Are Applied To A Car Purchase

The North Carolina Department of Motor Vehicles collects additional fees from car buyers. Here are the current DMV fees to expect, as reported by Autobytel:

- Certificate of title: $40

- License plates for a passenger vehicle or truck weighing less than 4000 pounds: $28

- Registration for trucks weighing less than 5000 pounds: $43.50

- Registration for trucks weighing 6000 pounds or less: $51.60

- Plate transfers: $15

- Wake, Durham, and Orange County Regional Transportation Authority Registration Tax: $5

Another fee to know about is the documentation fee, also known as a doc fee. Dealerships will charge you this fee when you purchase a vehicle from them to cover the costs of preparing and filing sales documents. State law doesn’t place any limits on these fees, so they vary from place to place. North Carolina car buyers pay an average of $550 in doc fees.

Don’t Miss: When Will My Taxes Be Processed

How To Calculate North Carolina Sales Tax On A Car

To calculate the sales tax on your vehicle, find the total sales tax fee for the city and/or county. In North Carolina, it will always be at 3%. Multiply the vehicle price by the sales tax fee.

For example, imagine you are purchasing a vehicle for $30,000 with a highway-use tax of 3%. You trade-in a vehicle for $8,000 and get an incentive for $2,000. Maryland does not charge tax on trade-ins but does on rebates, so you would pay tax on the $22,000.

In this example, multiply $22,000 by .03 to get $660, which makes the total purchase price, $20,660 .

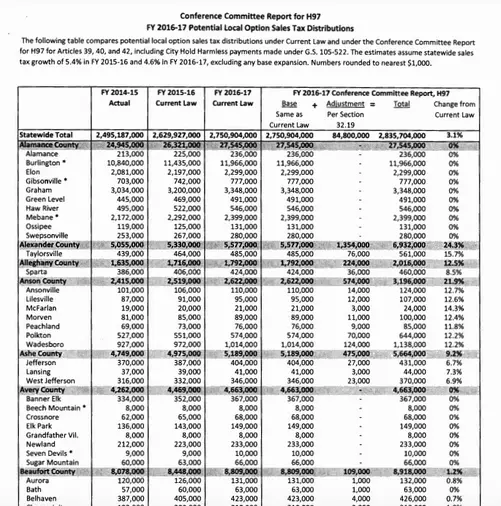

North Carolina Sales Tax Rates By City

The state sales tax rate in North Carolina is 4.750%. With local taxes, the total sales tax rate is between 6.750% and 7.500%.

North Carolina has recent rate changes .

Select the North Carolina city from the list of popular cities below to see its current sales tax rate.

Sales tax data for North Carolina was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Also Check: How To Submit Payroll Taxes

What Is Not Taxed In Nc

Goods that are subject to sales tax in North Carolina include physical property, like furniture, home appliances, and motor vehicles. Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

Current North Carolina Tobacco Excise Tax Rates

The primary excise taxes on tobacco in North Carolina are on cigarettes, though many states also have taxes on other tobacco products like cigars, snuff, or e-cigarettes. The tax on cigarettes is 45 cents per pack of 20 cigarettes, other tobacco products are taxed at 12.8% of the wholesale price and 5 cents per fluid milliliter of vapor products.

North Carolina Cigarette Tax -$0.45 / pack

In North Carolina, cigarettes are subject to a state excise tax of $0.45 per pack of 20.Cigarettes are also subject to North Carolina sales tax of approximately $0.31 per pack, which adds up to a total tax per pack of $0.76.

The average cost of a pack of cigarettes in North Carolina is $4.87, which is the 47th highest in the United States.

North Carolina Other Tobacco Products Tax -12.80% / Wholesale Price

In North Carolina, other tobacco products are subject to a state excise tax of 12.80% / wholesale price as well as federal excise taxes .

North Carolina applies a $0.05/milliliter tax to e-cigarette and vaping liquid.

You May Like: How To Do Taxes For Doordash

Don’t Miss: What Does Tax Credit Mean

Which Is An Example Of A Sales Tax

Sales tax is an additional amount of money you pay based on a percentage of the selling price of goods and services that are purchased. For example, if you purchase a new television for $400 and live in an area where the sales tax is 7%, you would pay $28 in sales tax. Your total bill would be $428.

How To Collect Sales Tax In North Carolina

Now itâs time to tackle the intricate stuff! Tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations.

The state-wide sales tax in North Carolina is 4.75%.

There are additional levels of sales tax at local jurisdictions, too.

North Carolina has a destination-based sales tax system, * so you have to pay attention to the varying tax rates across the state. Charge the tax rate of the buyerâs address, as thatâs the destination of your product or service.

* Important to note for remote sellers: While this is generally true for North Carolina, some state have peculiar rules about tax rates for remote sellers. Contact the stateâs Department of Revenue to be sure.

Recommended Reading: Do You Have To File Taxes By April 15th

How Much Is North Carolina’s Sales Tax Rate On Car Purchases

When you buy a car from a dealer or a leasing company in North Carolina, then you’ll pay sales tax on the car’s purchase price. If you buy a car from a private seller, then you’ll pay sales tax on the value of the car. Call your local DMV so they can help you determine your car’s actual value.

North Carolina assesses a 3 percent sales tax on all vehicle purchases, according to CarsDirect. This sales tax is known as the Highway Use Tax, and it funds the improvement and maintenance of state roads. Funds collected from this tax also go into the state’s General Fund and the North Carolina Highway Trust Fund.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Also Check: Can Roof Repairs Be Claimed On Taxes

North Carolina Vacation Rental Tax Guide

Avalara free tax guides

Airbnb and HomeAway/Vrbo have changed the way vacationers travel. More and more guests are choosing to rent private homes rather than book hotels. With a bounty of popular destinations including the Great Smoky Mountains, Asheville, and the Outer Banks, the Tar Heel State offers prospective short-term rental hosts the opportunity to bring in extra income and meet new people.

But new income opportunities bring new tax implications. Like hotel and B& B stays, short-term rentals in North Carolina are subject to tax. Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities.

Failure to comply with state and local tax laws can result in fines and interest penalties. These may not catch up with vacation rental operators in the short term, but the sharing economy is under increased scrutiny so its important to address compliance before tax authorities address it for you.

Avalara MyLodgeTax has put together this guide to help you comply with North Carolina short-term rental tax laws. For more information on the tax rates and jurisdictions that apply to your rentals specific location, use our lodging tax lookup tool.

Recommended Reading: Is Plasma Money Taxable

Wake County North Carolina Sales Tax Rate

Wake County Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Wake County?

The minimum combined 2022 sales tax rate for Wake County, North Carolina is . This is the total of state and county sales tax rates. The North Carolina state sales tax rate is currently %. The Wake County sales tax rate is %.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in North Carolina, visit our state-by-state guide.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

NOTE: The outbreak of COVID-19 may have impacted sales tax filing due dates in Wake County. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Also Check: When Are 2021 Federal Taxes Due

How Much Is Sales Tax On A Car In Nc

North Carolina assesses a 3 percent sales tax on all vehicle purchases, according to CarsDirect. This sales tax is known as the Highway Use Tax, and it funds the improvement and maintenance of state roads. Funds collected from this tax also go into the states General Fund and the North Carolina Highway Trust Fund.

North Carolina Car Sales Tax: Everything You Need To Know

If you’re a resident of North Carolina and buying a new or used car, then you have to pay two types of taxes to the state. You’ll also be responsible for additional registration, title, and plate fees.

If you’re a resident of North Carolina and buying a new or used car, then you have to pay two types of taxes to the state. You’ll also be responsible for additional registration, title, and plate fees. Be prepared for your next car purchase by learning more about North Carolina car sales tax and other fees.

Read Also: What Do You Need To Do Your Taxes On Turbotax

North Carolina Ev Rebates & Incentives

There are no EV rebates or incentives for the purchase of EV vehicles in North Carolina. However, there is a federal rebate of up to $7,500 on EV vehicles.

There are some additional perks like HOV lane access and exemption from emissions inspection requirements.

Tax information and rates are subject to change, please be sure to verify with your local DMV.

North Carolina Sales Tax Calculator

You can use our North Carolina Sales Tax Calculator to look up sales tax rates in North Carolina by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

North Carolina has a 4.75% statewide sales tax rate,but also has 458 local tax jurisdictions that collect an average local sales tax of 2.22% on top of the state tax. This means that, depending on your location within North Carolina, the total tax you pay can be significantly higher than the 4.75% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in North Carolina:

Also Check: How To Get Tax Form From Unemployment

How Do I Figure Out Sales Tax

In order to calculate the sales tax of an item, we need to first multiply the pre-tax cost of the item by the sales tax percentage after it has been converted into a decimal. Once the sales tax has been calculated it needs to be added to the pre-tax value in order to find the total cost of the item.

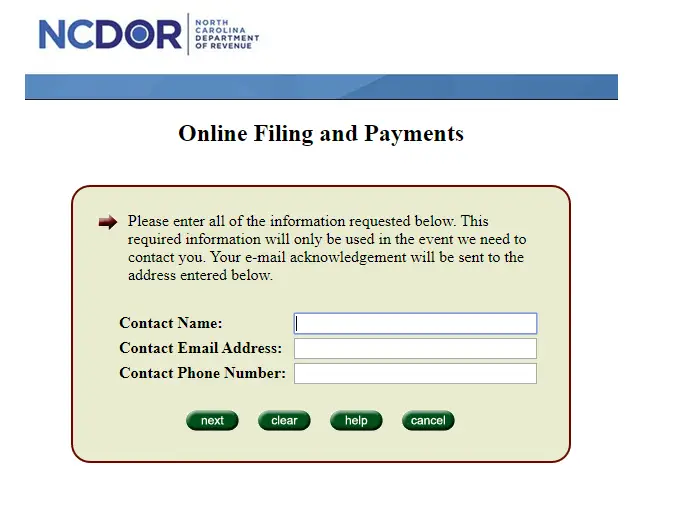

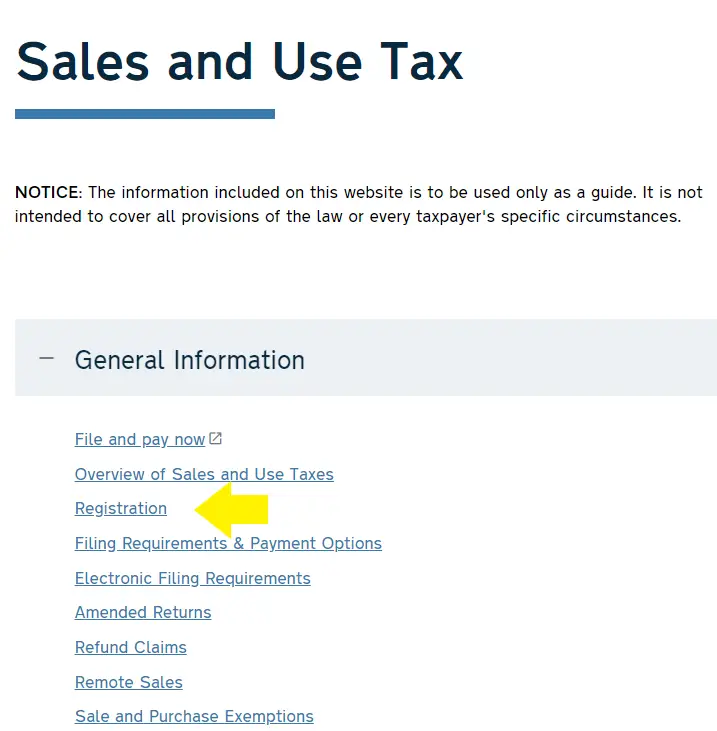

File Your Sales Tax Return

Now that youve registered for your North Carolina seller’s permit and know how to charge the right amount of sales tax to all of your customers, you are all set to file your sales tax return. Just be sure to keep up with all filing deadlines to avoid penalties and fines.

Recommended: Accounting software can help simplify your business tax returns as well as help with payroll and bookkeeping. Try our recommended accounting sotware today to save thousands of dollars on your taxes.

Read Also: Who Can Claim Child Tax Credit

Employer Payroll Tax Withholding

All employers are required to withhold federal taxes from their employees wages. Youll withhold 7.65 percent of their taxable wages, and your employees will also be responsible for 7.65 percent, adding up to the current federal tax rate of 15.3 percent.Speak to your accountant for more information.

North Carolina Dealership Fees

The average dealership fee in North Carolina is $550, and there is no statewide limit on how much this fee can be. This is known as the document or “doc fees”.

These are the fees paid to handle the state paperwork when dealing with a vehicle sale. Usually, you will not be able to negotiate this fee. However, other dealers fees such as advertising and transport fees can be negotiated.

Don’t Miss: How To Get Tax Credit For Solar

Do You Have Nexus In North Carolina

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in North Carolina.

You probably have nexus in North Carolina if any of the following points describe your business:

- A physical presence in North Carolina: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- Any affiliate businesses or individuals in the North Carolina, which generate sales.

- Online ads or links on a North Carolina-based website, which channels potential customers and new business.

- A significant amount of sales in North Carolina within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in North Carolina is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

How Much Is North Carolina’s Vehicle Property Tax

North Carolina policy states that all vehicles will be taxed at 100 percent of their appraised value. How much this tax will cost you depends on where you live since vehicle property tax rates vary by county. The DMV requires you to pay the property tax rate for where you currently reside. They won’t prorate the amount due to in-state relocation, which means you won’t get a tax break even if you haven’t lived in your current home for the entire year.

After the county determines your car’s value and appropriate tax bracket, they’ll mail you a bill about 60 days before your registration is going to expire. You then pay the property tax within 60 days prior to registration renewal. If necessary, you can apply for a deferment of another 60 days for payment as long as you’ve owned the car for the entire current tax year. If you haven’t owned the car for the whole year, then they’ll adjust your bill so you’ll only pay tax for the time you’ve owned the vehicle.

Read Also: How To Pay Taxes On Stocks

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Overview Of North Carolina Taxes

North Carolina now has a flat state income tax rate of 5.25%. The average effective property tax rate for the state is below the national average. There is a statewide sales tax and each county levies an additional tax.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 2022 filing season.

Recommended Reading: Doordash Mileage Calculator

Also Check: How Do You Do Your Own Taxes Online