What Is A Principal Residence

Your principal residence can be any of the following types of housing units:

- an apartment in an apartment building

- an apartment in a duplex

- a trailer, mobile home, or houseboat

A property qualifies as your principal residence for any year if it meets all of the following four conditions:

- It is a housing unit, a leasehold interest in a housing unit, or a share of the capital stock of a co-operative housing corporation you acquire only to get the right to inhabit a housing unit owned by that corporation

- You own the property alone or jointly with another person

- You, your current or former spouse or common-law partner, or any of your children lived in it at some time during the year

- You designate the property as your principal residence

The land on which your home is located can be part of your principal residence. Usually, the amount of land that you can consider as part of your principal residence is limited to half of a hectare . However, if you can show that you need more land to use and enjoy your home, you can consider more than this amount as part of your principal residence. For example, this may happen if the minimum lot size imposed by a municipality at the time you bought the property is larger than half of a hectare.

Designating a principal residence

Can you have more than one principal residence?

For 1982 and later years, you can only designate one home as your family’s principal residence for each year.

For 1982 to 2000, your family included:

Note

Chapter 6 Principal Residence

When you sell your home, you may realize a capital gain. If the property was solely your principal residence for every year you owned it, you do not have to pay tax on the gain. If at any time during the period you owned the property, it was not your principal residence, or solely your principal residence, you might not be able to benefit from the principal residence exemption on all or part of the capital gain that you have to report.

If you sold property in 2021 that was, at any time, your principal residence, you must report the sale on Schedule 3, Capital Gains and Form T2091, Designation of a Property as a Principal Residence by an Individual . See Schedule 3 and Form T2091 for more information on reporting requirements.

The calculation of the principal residence exemption is limited to the number of tax years ending after the acquisition of the property during which the taxpayer was resident in Canada and the property is the taxpayers principal residence. If you sold your principal residence and you were not a resident of Canada throughout the year in which you acquired it, different rules apply to this calculation. If you were not a resident of Canada for the entire time you owned the designated property, call 1-800-959-8281.

This chapter explains the meaning of a principal residence, how you designate a property as such, and what happens when you sell it. It also explains what to do in other special tax situations.

What Is Good About Reducing The Capital Gains Tax Rate

Proponents of a low rate on capital gains argue that it is a great incentive to save money and invest it in stocks and bonds. That increased investment fuels growth in the economy. Businesses have the money to expand and innovate, creating more jobs.

They also point out that investors are using after-tax income to buy those assets. The money they use to buy stocks or bonds has already been taxed as ordinary income, and adding a capital gains tax is double taxation.

Don’t Miss: How To File Income Tax Return For Individual

Small Business Stock And Collectibles: 28 Percent Capital Gains Rate

Two categories of capital gains are subject to the 28 percent rate: small business stock and collectibles.

If you realized a gain from qualified small business stock that you held for more than five years, you generally can exclude one-half of your gain from income. The remaining gain is taxed at a 28 percent rate. You can get the specifics on gains on qualified small business stock in IRS Publication 550.

If your gains came from collectibles rather than a business sale, youll also pay the 28 percent rate. This includes proceeds from the sale of:

- Wine or brandy collections

What Is A Capital Gain Or Capital Loss

In simple terms, a capital gain is an increase in the value of an investment or real estate holding from the original purchase price. If the value of the asset increases, you have a capital gain and you need to pay tax on it. That might sound bad but trust us, making money on your investments is never a bad thing.

Capital gains can be realized or unrealized. A realized capital gain occurs when you sell the investment or real estate for more than you purchased it for. An unrealized capital gain occurs when your investments increase in value, but you havent sold them. The good news is you only pay tax on realized capital gains. In other words, until you lock in the gain by selling the investment, it’s only an increase on paper.

A capital loss occurs when the value of your investment or real estate holding decreases in value. If the current value of the investment or holding is less than the original purchase price, you have a capital loss. Capital losses can be used to offset capital gains and reduce the overall tax you will pay. You can carry capital losses back 3 years or forward into future years.

If you have investments in registered plans such as a Registered Retirement Savings Plan , Registered Retirement Plan or Registered Education Savings Plan , you dont have to worry about capital gains and losses because the investments are tax-sheltered. That means your investments can grow and you dont have to worry about changes in value until you withdraw the funds.

Also Check: What Is Medicare Tax Used For

How To Calculate Tax On A Capital Gain

Before you calculate your capital gains, you’re going to need figure out something called the adjusted cost base. The adjusted cost base is the starting point for determining if you have made or lost money on your investments. It sounds scarier than it is. Most financial institutions will track your capital gains and adjusted cost base for you so there might be no need for you to calculate it yourself. That said, if you have a self-directed account and need to calculate tax on a capital gain start by calculating the adjusted cost base:

Adjusted cost base = Book value , plus costs to acquire it, such as fees.

Once you’ve calculated the adjusted cost base, you can figure out the amount of money that is taxable:

Capital gain subject to tax = Selling price minus the adjusted cost base.

The difference between the selling price of your asset and the adjusted cost base is the sum of money that’s taxable.

If you buy shares at different times in the same fund, you can have different ACBs, depending on the book value at the time of the transactions.

Have Investment Income We Have You Covered

With TurboTax Live Premier, talk online to real experts on demand for tax advice on everything from stocks, cryptocurrency to rental income.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How To Look Up Ein Numbers For Tax Purposes

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Watch Your Holding Periods

Remember that an asset must be sold more than a year to the day after it was purchased in order for the sale to qualify for treatment as a long-term capital gain. If you are selling a security that was bought about a year ago, be sure to check the actual trade date of the purchase before you sell. You might be able to avoid its treatment as a short-term capital gain by waiting for only a few days.

These timing maneuvers matter more with large trades than small ones, of course. The same applies if you are in a higher tax bracket rather than a lower one.

Read Also: What Is The Deadline For Filing Taxes

Do You Have To Pay Taxes On Crypto

The IRS classifies crypto as a type of property, rather than a currency. If you receive Bitcoin as payment, you have to pay taxes on its current value. If you sell a cryptocurrency for a profit, you’re taxed on the difference between your purchase price and the proceeds of the sale.

But exactly how crypto taxes are calculated depends on your specific circumstances. Here’s how it boils down:

-

If you acquired a Bitcoin from mining, that value is taxable immediately no need to sell the currency to create a tax liability.

-

If you disposed of or used cryptocurrency by cashing it on an exchange or buying goods and services, you will owe taxes if the realized value is greater than the price at which you acquired the crypto. You may have a capital gain thats taxable at either short-term or long-term rates.

Brian Harris, tax attorney at Fogarty Mueller Harris, PLLC in Tampa, Florida, says buying and selling crypto creates some of the same tax consequences as more traditional assets, such as real estate or stock.

“The value … goes up and down, and then if you sell or exchange that property then you have capital gain or loss, depending on how that value has moved,” Harris says.

|

when you deposit $1,000 or more. |

Chapter 5 Capital Losses

You have a capital loss when you sell, or are considered to have sold, a capital property for less than its adjusted cost base plus the outlays and expenses involved in selling the property. This chapter explains how to:

- determine your adjustment factor

- report your 2021 net capital losses

- apply your unused 2021 net capital losses against your taxable capital gains of other years

- apply your unused net capital losses of other years against your 2021 taxable capital gains

It also explains the special rules that apply to listed personal property losses, superficial losses, restricted farm losses, and allowable business investment losses.

You will find a summary of the loss application rules.

Generally, if you had an allowable capital loss in a year, you have to apply it against your taxable capital gain for that year. If you still have a loss, it becomes part of the computation of your net capital loss for the year. You can use a net capital loss to reduce your taxable capital gain in any of the three preceding years or in any future year.

Also Check: How Can I Claim Exempt On My Taxes

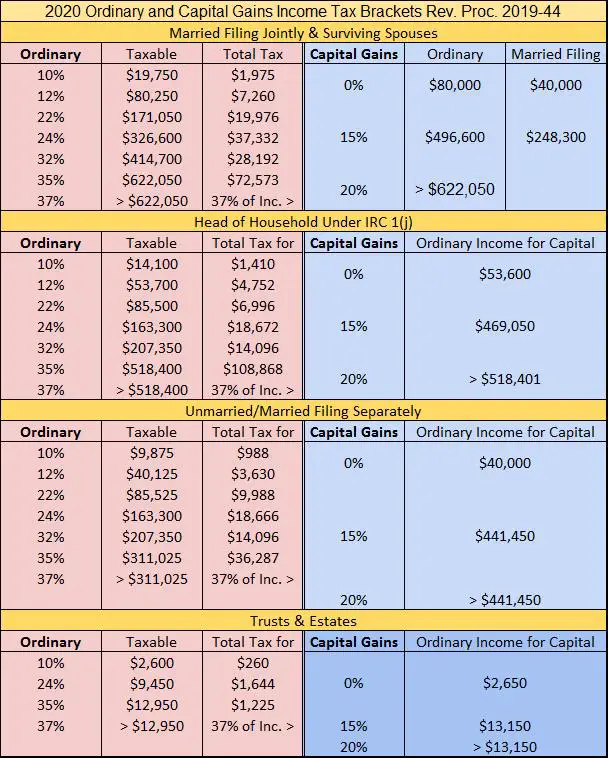

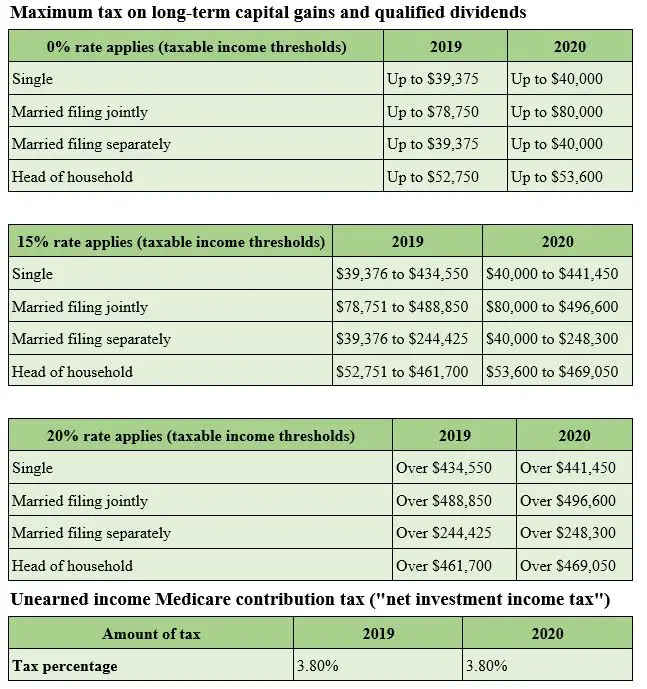

Capital Gains Tax: Short

Capital gains taxes are divided into two big groups, short-term and long-term, depending on how long youve held the asset.

Here are the differences:

- Short-term capital gains tax is a tax applied to profits from selling an asset youve held for less than a year. Short-term capital gains taxes are paid at the same rate as youd pay on your ordinary income, such as wages from a job.

- Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. These rates are typically much lower than the ordinary income tax rate.

Sales of real estate and other types of assets have their own specific form of capital gains and are governed by their own set of rules .

Former Vice President Joe Biden

Biden has proposed taxing capital gains at ordinary income tax rates for taxpayers earning more than $1 million annually and repealing step-up in basis. He also proposed increasing the top marginal income tax rate to 39.6 percent. When this is added to the Net Investment Income Tax on married filers , the top marginal tax rate on capital gains reaches 43.4 percent under the Biden proposal, nearly double the rate under current law. These proposed changes would only affect filers in the top long-term capital gains bracket.

Table 2. Bidens Proposed Capital Gains Tax Rates| Income |

|---|

| -14,000 |

While the proposal slightly reduces the size of economic output, more importantly, it shrinks national income owned by Americans, as measured by GNP. Increasing taxes on capital income discourages Americans from saving and leads to a decrease in national income some of this reduction in saving is made up for by foreign investors, which is why there is a relatively smaller effect on economic output than on national income.

Recommended Reading: When Will Unemployment Taxes Be Refunded

Is This Guide For You

The most common income tax situations are explained in this guide. Use this guide to get information on capital gains or capital losses in 2021. You generally have a capital gain or loss whenever you sell, or are considered to have sold, capital property. The term “Capital property” is defined in the Definitions. Use Schedule 3, Capital Gains , to calculate and report your taxable capital gains or net capital loss.

If your only capital gains or losses are those shown on information slips , and you did not file Form T664 or T664, Election to Report a Capital Gain on Property Owned at the End of February 22, 1994, you do not have to read the entire guide. See Chart 1 Reporting capital gains and other amounts from information slips to find out how to report these amounts.

If you are a farmer and you sold property included in capital cost allowance Class 14.1 that is qualified farm or fishing property or farmland in 2021 that includes your principal residence, see Guide T4002, Self-employed Business, Professional, Commission, Farming, and Fishing Income, RC4060, Farming Income and the AgriStability and AgriInvest Programs Guide, or RC4408, Farming Income and the AgriStability and AgriInvest Programs Harmonized Guide.

If you are a non-resident, emigrant, or new resident of Canada, go to Individuals Leaving or entering Canada and non-residents and refer to the section that applies to your situation.

State Capital Gains Tax Rates

| Rank | |

|---|---|

| 0.00% | 0.00% |

Real estate, retirement savings accounts, livestock, and timber are exempt for capital gain taxation in the state of Washington.

- Values shown do not include depreciation recapture taxes.

- AK, FL, NV, NH, SD, TN, TX, WA, and WY have no state capital gains tax.

- AL, AR, DE, HI, IN, IA, KY, MD, MO, MT, NJ, NM, NY, ND, OR, OH, PA, SC, and WI either allow taxpayer to deduct their federal taxes from state taxable income, have local income taxes, or have special tax treatment of capital gains income.

- This material is for general information and educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions.

- Realized does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Need to figure out your Capital Gains Tax liability on a sale of an asset? The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Recommended Reading: How Do I Calculate Capital Gains Tax

When Do You Owe Capital Gains Taxes

You owe the tax on capital gains for the year in which you realize the gain. For example, if you sell some stock shares anytime during 2022 and make a total profit of $140, you must report that $140 as a capital gain on your tax return for 2022.

Capital gains taxes are owed on the profits from the sale of most investments if they are held for at least one year. The taxes are reported on a Schedule D form.

The capital gains tax rate is 0%, 15%, or 20%, depending on your taxable income for the year. High earners pay more. The income levels are adjusted annually for inflation.

If the investments are held for less than one year, the profits are considered short-term gains and are taxed as ordinary income. For most people, that’s a higher rate.