What Distributions Do Not Qualify For A Subtraction

Certain distributions reported on form 1099-R are not retirement or pension benefits. Under Michigan law, deferred compensation is taxable. These distributions include:

- All distributions from 457 plans

- Distributions from 401 or 403 plans sourced to employee contributions and the earnings from those contributions if they were not matched by the employer.

- Early distributions under the terms of the retirement plan are always taxable regardless of the date of birth of the taxpayer.

NOTE: When considering your pension subtraction, ‘surviving spouse’ means the deceased spouse died prior to the current tax year . Deceased spouse benefits do not include benefits from a spouse who died in 2021. If you or your spouse received pension benefits from a deceased spouse, see Form 4884, Michigan Pension Schedule instructions.

Looking To Retire In Pa

When you are planning your retirement, look for a retirement community such as Cornwall Manor in the state of Pennsylvania. Cornwall Manor offers a variety of housing options with healthcare and other related services. Cornwall Manor was voted Best Retirement Community, Best Personal Care and Best Nursing Home by the Lebanon Daily News. Residents of the Continuing Care Retirement Community include people who have moved from down the road and across the country.

Cornwall Manor is one of many reasons to consider Pennsylvania for your retirement.

Contact Cornwall Manor today to learn more about our community and to request a tour or stay the night as our guest to explore the area and see why PA is such a wonderful place to call home.

Which Is The Cheapest State For A Reasonable Number Of Years To Live

California is a great place to live and have a personal tax rate of four point eight four percent. But the states medical costs are increasing, so it could be more expensive in the future. If you go with Iowa, you would pay 0 percent in taxes on your first Dollars 6,000 of income.

However, there are no personal taxes on income making it less appealing. Some states have lower taxes than others, and some are more expensive. The average cost of living for the median home in a state is Dollars 28,258. In terms of tax bills, the Oregon tax bill is Dollars 14,151 per year.

This state has plenty to offer in terms of cultural and recreational centers. Research on the personal taxes in states across the US has revealed that Texas is the cheapest state to live in for a reasonable number of years. Arizona, Florida, Illinois, New York and Washington are also among the cheapest.

The study found that Alaska was the most expensive state. There are many factors that affect a persons personal tax in the United States. These include where a person lives, their income and family size. One of the most important things to work out though is which state will be considered the best all-round option for a reasonable number of years of living.

Living in states like California, New York or Florida can be costly. If you are looking for a place with low taxes, look out of the country. The state of Arkansas is very affordable and because it is so inexpensive, a person can live there for a long time.

Don’t Miss: Do Beneficiaries Pay Taxes On Life Insurance Policies

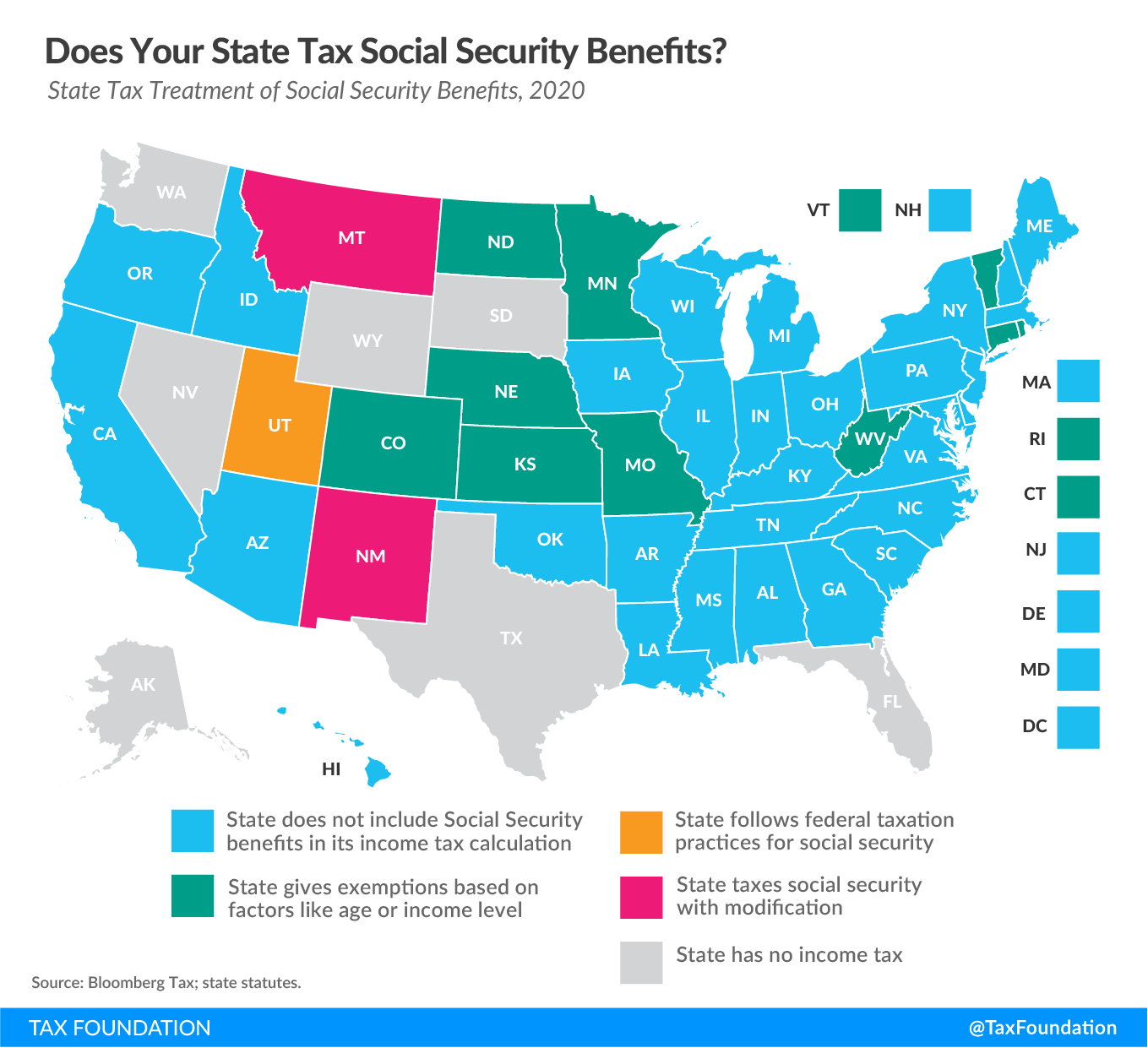

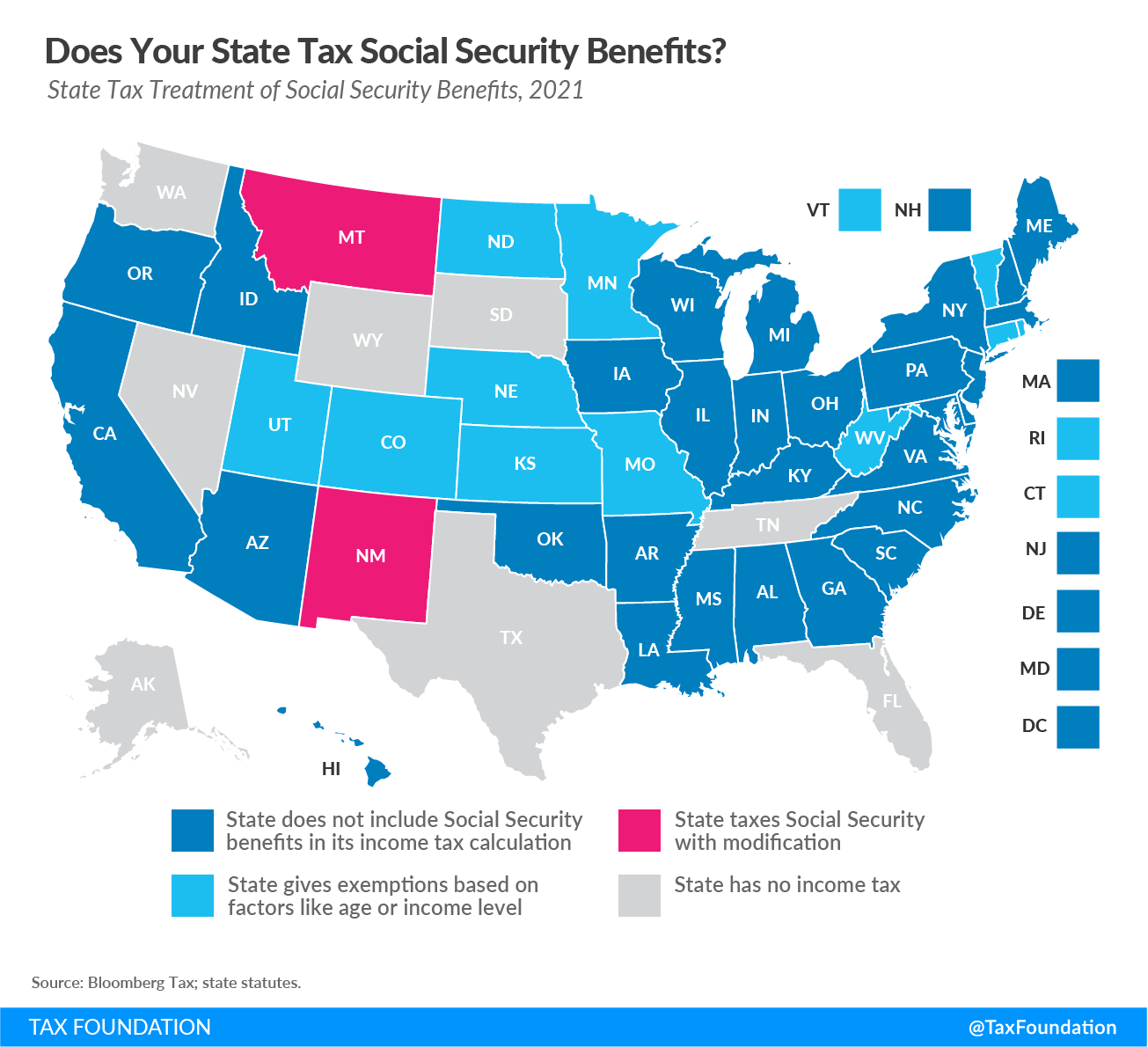

What States Do Not Tax Social Security And Pensions

Alaska, Nevada, Washington, and Wyoming dont have state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions exempting Social Security benefits from state taxation.

What states Dont Tax SS or pensions?

- Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming dont charge any state income tax, so you wont be taxed on distributions from retirement accounts if you live in these locales. The absence of a state income tax also explains why pension and Social Security benefits arent taxed in these states.

What Is The Retirement Age In Pennsylvania

The retirement age is the same in every state. For those born in 1960, the full retirement age according to the Social Security Administration is 67. This means you can receive 100 percent of your social security benefits without any reductions. Beneficiaries receive 50 percent of their spouses retirement benefits when they reach 67 years of age.

If needed, the earliest someone can begin receiving social security retirement benefits is at 62. However, the rate is reduced, and they will only get 70 percent of their own monthly benefits and 32.5 percent of their spouses retirement benefits. As each month passes, the percentage of their retirement benefits grows until it reaches the full amount at age 67.

You May Like: What Happens If I File Taxes Late

Does The State Of Tennessee Tax Your Social Security

Retirement Income: Tennessees income tax is very limited it only covers interest and dividends. As a result, retirees in the Volunteer State dont pay tax on their 401, IRA or pension income. Social Security Benefits: Tennessee retirees also collect Social Security benefits without paying state tax on them.

Take Advantage Of Breaks Where You Can Get Them

In 37 states, you don’t have to worry about state income tax on Social Security. Yet even in some of the others, there are often things you can do. For instance, New Mexico has an exemption for some retirement income that lets you shelter Social Security if you choose to use it in that way. However, many residents use the exemption to protect IRA distributions or pension income instead.

Also, just because your benefits are taxable for federal purposes doesn’t mean that they will be even in states that tax Social Security. Many states have much higher thresholds for taxation than the IRS.

Retirees like to hold onto as much of their Social Security as they can, and dealing with taxes is never ideal. Knowing which states tax Social Security at the local level means you can take that into consideration in planning where you want to spend your retirement.

This article was written by Dan Caplinger from The Motley Fool and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

You May Like: How To Obtain Prior Year Tax Returns

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance you’ll have to boost the overall tax efficiency of your retirement income plan. Here’s how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while you’re collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

Why You Can Trust The Annuity Expert

The Annuity Expert is a licensed annuity broker and insurance agency since 2008. We offer the largest selection of annuities in the United States. Information provided is written by a financial professionalnot a content writer with no financial experience.

We have been recognized as an authority of annuities and insurance by:

- Yahoo Finance!

Don’t Miss: What Can Be Itemized On Taxes

States That Dont Tax Social Security

Thirty-seven states plus the District of Columbia do not tax Social Security benefits. These states include the nine that dont have any income tax at all, which are:

- Rhode Island

Specifics vary, but all the states in this category have some type of Social Security offset based on how old you are or how much you make. Colorado, for example, allows taxpayers 55 and older to subtract some of their Social Security income, while Kansas provides a total exemption for taxpayers earning less than $75,000, regardless of filing status. In Montana, some Social Security benefits may be taxable so it advises its taxpayers to complete a worksheet to determine the taxation of their Social Security benefits.

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Recommended Reading: How Much Do You Have To Make To Pay Taxes

Minimizing Taxes In Retirement

If you’re considering moving to a more tax-friendly state in retirement to save some money, that’s not necessarily a bad idea. But taxes are just one part of the big picture in retirement. Consider how moving to a different state would affect your overall cost of living.

For instance, what are the property taxes in your prospective new state? How much will it cost to rent or buy a home? If you move, will you be spending more on travel to visit friends and family? Weigh all the pros and cons of moving to see if the tax advantages outweigh the costs.

When you’re depending on Social Security to make ends meet, paying taxes on benefits can throw off your retirement plan if you don’t factor them into your budget. The more you understand about taxes, the better off you’ll be.

State Taxes And Retirement Distributions

AARP

Taxing retirement plan distributions isn’t an all-or-nothing proposition. For example, 34 states don’t tax military retirement income. Nine of those, are the states listed above that dont have income taxes. The others: Arizona, Alabama, Arkansas, Connecticut, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New York, North Carolina, North Dakota, Ohio, Pennsylvania, Utah, West Virginia and Wisconsin. California, Vermont, Virginia and Washington, D.C. fully tax military retirement pay. All other states have partial allowances for military pay. And Virginia only allows Congressional Medal of Honor recipients to exclude their military retirement income.

Note: You may not have paid tax on your retirement income, but that doesnt mean that your state doesnt tax retirement income under certain conditions: 27 states tax some, but not all, retirement or pension income. Typically, these states limit the amount of tax by income levels.

| 27 states limit the amount of tax by income levels |

|---|

| Alabama |

Don’t Miss: Where Do I Mail My Federal Tax Return

Who Should Retire To Pennsylvania

- If you need access to high-quality medical care after retirement, you will find everything you need in PA. Central PA is home to first-class medical facilities such as Penn State Hershey Medical Center Penn Medicine/Lancaster General Health the VA Medical Center UPMC Pinnacle and WellSpan health systems.

Understanding Taxes On Your Social Security Benefits

You should already know that your income can be subject to both Federal income tax and state income tax. At the Federal level, single filers will owe no taxes on their Social Security benefits if their AGI is less than $25,000. If you earn between $25,000 and $34,000, then 50% of your Social Security benefits will be taxable. For those who earn more than $34,000, 85% of Social Security benefits will be taxable. Regardless of your income, 15% of your Social Security benefits are never taxable at the Federal level.

In addition to Federal taxes, you might owe state income taxes on your benefits if you reside in one of the 12 states listed in the previous section. Each state has its own tax rates and methods for calculating how much of your benefit will be taxed. These taxes can reduce your overall disposable income.

You May Like: Who Claims Child On Taxes With 50 50 Custody

What State Is Best To Avoid Taxes

State of Washington has a well-known tax exemption that doesnt complicate the tax return process. Another way to find the state with the best personal tax experience is to search for those that have a low top marginal income tax rate. If a state has a high top marginal income tax rate, this indicates that the state imposes more taxes on wealthy individuals.

New Jersey has the lowest taxes on personal income, property and some sales tax. Rhode Island is best for avoiding sales tax. For many people, purchasing a home is the biggest expense of their career.

If you do not want to pay higher state taxes on your mortgage, you should consider buying a home in a state that does not levy personal income taxes. There are 38 states in the USA that are tax-free on personal income. New York is the state with the most taxes in the USA, while Nevada has a 0% tax. New Hampshire and Wyoming also have no state income tax.

In order to avoid the high taxes in California, people may want to consider moving to Florida. One of the main differences between the two states is that Florida is a no-income-tax state while California has a progressive tax system. Taxes are a topic that comes up in every state.

Nys Pension Taxation Requirements By State

Will Your NYS Pension be Taxed If You Move to Another State?

If you are considering moving to another state, you should be mindful of the fact that states often enact, amend, and repeal their tax laws please contact their Revenue Agency yourself to verify that the information is accurate. The following taxability information was obtained from each states web site.

We also strongly recommend that you do some further preparation, such as discussing the matter with your tax advisor, before making important decisions that may affect the taxability of your pension and other retirement income.

Information updated 2/24/2022.

Recommended Reading: Do I Have To Pay Taxes On Social Security Income

Social Security Benefit Taxation By State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. Of this number, nine statesAlaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyomingdo not collect state income tax, including on Social Security income.

Out of the nine states that do not levy an income tax, New Hampshire still taxes dividend and interest income.

Below is a list of the 12 states that do levy a tax on Social Security benefits on top of the federal tax, with details on each states tax policy.

What Is The Retirement Age In Pa For State Employees

Pennsylvanias statewide State Employees Retirement System, or SERS, is one of the oldest and largest retirement plans for state employees in the country. When the state first hires an employee or when they get close to retirement age, they have lots of decisions to make about their retirement benefits, including at what age they wish to retire.

The SERS normal retirement age is 65, 60, 55 or 50 years of age, depending on what class of service you were in. A SERS employees class of service is determined by when they became a member and the type of work that they did. The annual pension for SERS members is calculated with a formula that includes a few variables about your service as a state employee, including:

- Class of service

- Final average salary

Read Also: How Are You Taxed On Stocks

What Is The Most Tax Friendly State

Everybody wants a lower tax bill. One way to accomplish that might be to live in a state with no income tax. As of 2021, our research has found that seven states Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyominglevy no state income tax. 1 New Hampshire doesnt tax earned wages.

How This Impacts Where You Retire

You could end up ahead anyway, even if you retire in one of the states that impose a tax on Social Security benefits if all other taxes in the state are favorable, such as sales tax, gasoline tax, or property tax. And you might still be subject to federal taxation on your benefits, even if you live in a state with no state-imposed tax. So just be sure to consider all financial aspects of moving to another state, especially if you are collecting Social Security benefits.

Recommended Reading: When Is The Deadline To File 2021 Taxes

Understanding Taxes On Social Security Benefits

Since 1983, Social Security payments have been subject to taxation by the federal government. How much of a persons benefits are taxed will vary, depending on their combined income , nontaxable interest, and half of their Social Security benefits) and filing status. Regardless of the result of the Internal Revenue Service calculation, the amount subject to taxes wont exceed 85% of the total benefit.

| Combined Income |

| $44,000+ |

Income from other retirement programs also may be subject to federal income taxes. Pension payments, for example, are either fully taxable or partially taxable, depending on how much in after-tax dollars the individual invested into the contract.

Spousal Social Security benefits and Social Security disability benefits follow the same basic rules as the primary Social Security program in that the amount subject to federal income taxes is dependent on the retirees total income. Supplemental security income, however, is not taxed.