When To Expect Your Unemployment Refund

Refunds are expected to begin in May. Depending on whether you fall into the first or second wave, these payments will continue into the summer. If you filed your taxes electronically, you may receive an electronic refund deposited straight to your bank account. If you mailed a paper tax return, you may receive a physical check in the mail.

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

What Do You Need To Do To Get A Jobless Benefits Tax Refund

The law that made up to $10,200 of jobless income exempt from tax took effect in Mar. 2021. Many people had already filed their tax returns by that time. For those early returns, the IRS is making adjustments from its side, and people dont need to do anything to get the refund.

However, some people may need to file an amended tax return before the IRS will release the refund money to them. The agency may contact you if you need to revise your return to unlock the jobless tax refund.

A person who filed later may receive their refund sooner than someone who filed earlier in the season. You may hear countless myths about it, but the truth is theres a variety of reasons for possible delays:

Read Also: How To Get Unemployment In Tn

Don’t Miss: How Can I File An Amended Tax Return Online

Unemployment Taxes At The State Level

If you live in a state that has a state income tax, you may need to pay state income taxes on your unemployment benefits in addition to federal income taxes.

For states that dont have a state income tax or dont consider unemployment benefits taxable income, you wont need to pay state income taxes on your unemployment benefits. These are 17 states that dont tax unemployment benefits:

| States that dont have any income taxes | Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming |

| States that only have income taxes for investment income | New Hampshire and Tennessee |

If you dont live in one of these 17 states, your unemployment benefits may be taxed by your state. Your states individual income tax rate can be found here. To learn more about your state individual income tax, visit your states Department of Revenue website or read Kiplingers State-by-State Guide on Unemployment Benefits.

What Is The Unemployment Tax

The IRS states, Only employers pay FUTA tax. Do not collect or deduct FUTA tax from your employees wages. Employers have to pay both federal and state unemployment taxes to fund the unemployment insurance system. Unemployment compensation is intended to provide benefits to employees who lose their jobs through no fault of their own.

Here is more information about unemployment tax. The tax rate for a start-up entrepreneur is 1.0% for the first year of liability, 1.1% for the second year of liability, and 1.2% for the third. The rate of the following years is quite different and lean on many elements.

Your tax rate FUTA varies between 0.0% and 5.4% due to various factors, including your federal tax responsibility. From 2021, the FUTA tax rate is 6.0%, and it applies to the first $7,000 in annual wages paid per employee. Your employer, on the other hand, may be eligible for a credit of up to 5.4% of FUTA taxable wages if:

- They fully paid and paid their state unemployment taxes on time.

- The Department of Labor has not designated their state as a credit reduction state.

Unemployment benefits Open Daily

You May Like: How To Contact Unemployment Office

You May Like: What’s The Best Way To Claim Taxes

How To Use Tax Refund Trackers And Access Your Tax Transcript

The first way to get clues about your refund is to try the IRS online tracker applications: The Wheres My Refund tool can be accessed here. If you filed an amended return, you can check the Amended Return Status tool.

If those tools dont provide information on the status of your unemployment tax refund, another way to see if the IRS processed your refund is by viewing your tax records online. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

Heres how to check your tax transcript online:

1. Visit IRS.gov and log in to your account. If you havent opened an account with the IRS, this will take some time as youll have to take multiple steps to confirm your identity.

2. Once logged in to your account, youll see the Account Home page. Click View Tax Records.

3. On the next page, click the Get Transcript button.

4. Here youll see a drop-down menu asking the reason you need a transcript. Select Federal Tax and leave the Customer File Number field empty. Click the Go button.

5. The following page will show a Return Transcript, Records of Account Transcript, Account Transcript and Wage & IncomeTranscript for the last four years. Youll want the 2020 Account Transcript.

6. This will open a PDF of your transcript: Focus on the Transactions section. What youre looking for is an entry listed as Refund issued, and it should have a date in late May or June.

You May Like: Unemployment Tn Apply

Irs Issues Another 430000 Refunds For Adjustments Related To Unemployment Compensation

IR-2021-212, November 1, 2021

WASHINGTON The Internal Revenue Service recently sent approximately 430,000 refunds totaling more than $510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020.

The IRS efforts to correct unemployment compensation overpayments will help most of the affected taxpayers avoid filing an amended tax return. So far, the IRS has identified over 16 million taxpayers who may be eligible for the adjustment. Some will receive refunds, while others will have the overpayment applied to taxes due or other debts.

The American Rescue Plan Act of 2021, enacted in March, excluded the first $10,200 in unemployment compensation per taxpayer paid in 2020. The $10,200 is the amount excluded when calculating ones adjusted gross income it is not the amount of refund. The exclusion applied to individuals and married couples whose modified adjusted gross income was less than $150,000.

Earlier this year, the IRS began its review of tax returns filed prior to the enactment of ARPA to identify the excludible unemployment compensation. To date, the IRS has issued over 11.7 million refunds totaling $14.4 billion. This latest batch of corrections affected over 519,000 returns, with 430,000 taxpayers receiving refunds averaging about $1,189.

See the 2020 Unemployment Compensation Exclusion FAQs for more information, including details on filing an amended return.

Don’t Miss: How Will My Tax Refund Appear On My Bank Statement

How To Track Your Refund And Check Your Tax Transcript

The first way to get clues about your refund is to try the IRS online tracker applications: The Wheres My Refund tool can be accessed here. If you filed an amended return, you can check the Amended Return Status tool.

If those tools dont provide information on the status of your unemployment tax refund, another way to see if the IRS processed your refund is by viewing your tax records online. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

Heres how to check your tax transcript online:

1. Visit IRS.gov and log in to your account. If you havent opened an account with the IRS, this will take some time as youll have to take multiple steps to confirm your identity.

2. Once logged in to your account, youll see the Account Home page. Click View Tax Records.

3. On the next page, click the Get Transcript button.

4. Here youll see a drop-down menu asking the reason you need a transcript. Select Federal Tax and leave the Customer File Number field empty. Click the Go button.

5. The following page will show a Return Transcript, Records of Account Transcript, Account Transcript and Wage & IncomeTranscript for the last four years. Youll want the 2020 Account Transcript.

6. This will open a PDF of your transcript: Focus on the Transactions section. What youre looking for is an entry listed as Refund issued, and it should have a date in late May or June.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Read Also: How Much Are Payroll Taxes In Massachusetts

More About Tax Brackets

What Is My Tax Bracket?

The federal income tax system is progressive, which means different tax rates apply to different portions of your total income. Tax bracket refers to the highest tax rate charged on your income.

What Are Tax Tables?

Tax tables like the one above, help you understand the amount of tax you owe based on your filing status, income, and deductions and credits.

Tax brackets only apply to your taxable income. Your deductions and taxable income may drop you into a lower tax bracket or potentially a higher one.

Taxable Income vs. Nontaxable Income

Income comes in various forms, including wages, salaries, interest, tips and commissions. Nontaxable income wont be taxed, whether or not it is entered on your tax return.

Also Check: Protesting Harris County Property Tax

Information Needed For Your Federal Income Tax Return

Each January, we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The 1099-G form provides information you need to report your benefits. Use the information from the form, but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. You can file your federal tax return without a 1099-G form, as explained below in Filing Your Return Without Your 1099-G.

A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you, including:

- Unemployment benefits

- Federal income tax withheld from unemployment benefits, if any

- Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments

Recommended Reading: Do I Need To Report Roth Ira On Taxes

Paying Unemployment Taxes At The Federal Level

There are 3 options to pay your federal income taxes on your unemployment benefits. If you dont expect your benefits to add much to any tax you owe, it may be easiest to pay the full amount at tax time. The following options can help you avoid having a large bill at tax time.

1. Request your state employment agency to withhold your federal taxes. Withholding your taxes means that a flat 10 percent of each of your unemployment checks will be used to pay federal taxes, similar to withholding taxes on a regular paycheck.

Usually, you can choose to have your taxes withheld when you first register for unemployment benefits. You can also complete and give Form W-4V, Voluntary Withholding Request to the agency that is disbursing your unemployment benefits to start withholding your taxes. Request Form W-4V, Voluntary Withholding Request from your unemployment office or find it on the IRS website. If your agency has its own withholding form, use that one instead.

Use the Estimated Tax Payments Calculator to make sure that you are withholding enough taxes from your unemployment benefits. If too little tax is withheld, you may also have to make quarterly estimated tax payments to avoid an underpayment penalty.

Depending on the amount of your unemployment benefits and your other sources of income, you may choose to make quarterly estimated payments and withhold your taxes if your total tax withholding does not cover enough of the income taxes you will owe.

| Income from: |

How Much Tax Is Taken Out Of Unemployment Compensation

If you collect unemployment benefits, you can choose whether or not to withhold federal taxes at a rate of 10%. Some states may allow you to withhold 5%. If you do not have taxes taken out of your unemployment checks, you may have to pay quarterly estimated payments or pay taxes when you file your annual tax return. Either way, your unemployment income is considered taxable income just like any other wages or salaries you receive.

Recommended Reading: Are Federal Tax Returns Delayed

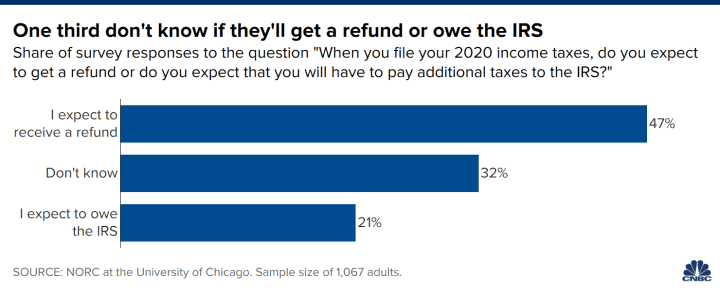

Will I Get A Tax Refund From Unemployment

Will I get a tax refund from unemployment? What Are the Unemployment Refunds? In a nutshell, if you received unemployment benefits in 2020 and paid taxes on that money, youll be getting some or all of those taxes back via direct deposit or the mail.

Hereof, How long is unemployment on Covid?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation program.

Similarly How much taxes do you pay on unemployment? If you had taxes withheld on jobless benefits, the federal taxes are withheld at a 10% rate. On $10,200 in jobless benefits, were talking about $1,020 in federal taxes that would have been withheld. Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund.

When Will I Get My Jobless Tax Refund

The IRS normally releases tax refunds about 21 days after you file the returns. However, many people have experienced refund delays due to a number of reasons. First, the IRS is working through a huge backlog.

For the unemployment refund processing, the agency took it upon itself to adjusted peoples returns. Thats taking time and leading to delays in releasing refunds. The IRS decided to process jobless tax refunds for simple returns first. Therefore, people with complicated returns might experience delays in getting their refunds.

For some people, the IRS is sending out refunds as paper checks, while for others get a direct deposit to the bank account provided. How you elect to receive your refund can also determine how long you have to wait for it. The IRS offers a tool that people can use to check the status of their refund.

Read Also: How To Pay State Income Tax

Will You Get A Refund For The Jobless Benefit

Although many filers may have expected that they would receive another break this year, this is not the case, as unemployment benefits will count as taxable income.

“There’s no exclusion this year,” said Mark Luscombe, principal analyst for Georgia-based Wolters Kluwer Tax & Accounting.

“But last year at this point there was no exclusion either.

“At this point all unemployment compensation in 2021 is fully taxable and I’m not expecting an exclusion to be adopted.”

Most Dont Have To File An Amended Return

Most taxpayers dont need to file an amended return to claim the exemption. If the IRS determines you are owed a refund on the unemployment tax break, it will automatically correct your return and send a refund without any additional action from your end.

The only reason to file an amended return is if the calculations now make you eligible for additional federal credits and deductions not already included on your original tax return, like the Additional Child Tax Credit or the Earned Income Tax Credit. The IRS said it will be sending notices in November and December to people who didnt claim the Earned Income Tax Credit or the Additional Child Tax Credit but may now be eligible for them.

If you think youre now eligible for deductions or credits based on an adjustment, the most recent IRS release has a list of people who should file an amended return.

The average IRS refund for those who paid too much tax on jobless benefits is $1,686.

Also Check: How To File Taxes With No Income For Stimulus Check

Some Taxpayers Can Expect Refunds After Covid

The Internal Revenue Service says it will work on refunding money to people who filed their tax return before claiming the new break on unemployment benefits.

The American Rescue Plan allows taxpayers who earned less than $150,000 to waive up to $10,200 in unemployment compensation, which means you dont have to pay tax on unemployment compensation of up to $10,200.

Because the change occurred on March 11, after some people filed their taxes, the IRS came up with a solution for those who have already filed.

The agency says it will automatically issue refunds to eligible taxpayers. The IRS will issue refunds in two phases, starting with those who filed individually for the $10,200. Those who filed jointly will be in the second phase.

The refunds are expected to begin in May. For more information, click here.

According to the Bureau of Labor Statistics, over 23 million U.S. workers nationwide filed for unemployment last year.

Weather Alert

Currently in Reno