Cellulite: 10 Ways To Reduce Cellulite And Love Your Legs

Did you know that more than 80% of us have cellulite?

The fact is, most of us have cellulite. However, its also a fact that most of us are unhappy with it, and wish we could figure out how to get rid of it without overhauling our lives or spending an absolute fortune

So how do you reduce cellulite once its staring back at you in the mirror? And if youve not seen any orange peel dimples on your thighs so far, how can you go about keeping them at bay?

If youre wondering how to get rid of cellulite, were here to tell you that its not impossible, and thankfully, its not even about expensive lotions and potions.

There are a few simple ways you can get reduce it, and whats more you can kick them off today!

Around 80-90% of us have cellulite, so if you have it, youre not by any means alone. Its caused by a collection of fat that pushes into the skins upper layer, which is what gives that dimpled, orange peel look.

Cellulite doesnt discriminate, and can appear regardless of shape or body type, so you might find it on your thighs, bums, upper arms or tummy, whether youre a size 8 or a size 18. It is also genetic, so if your mum suffers with the stuff then you might find youre more likely to get it too.

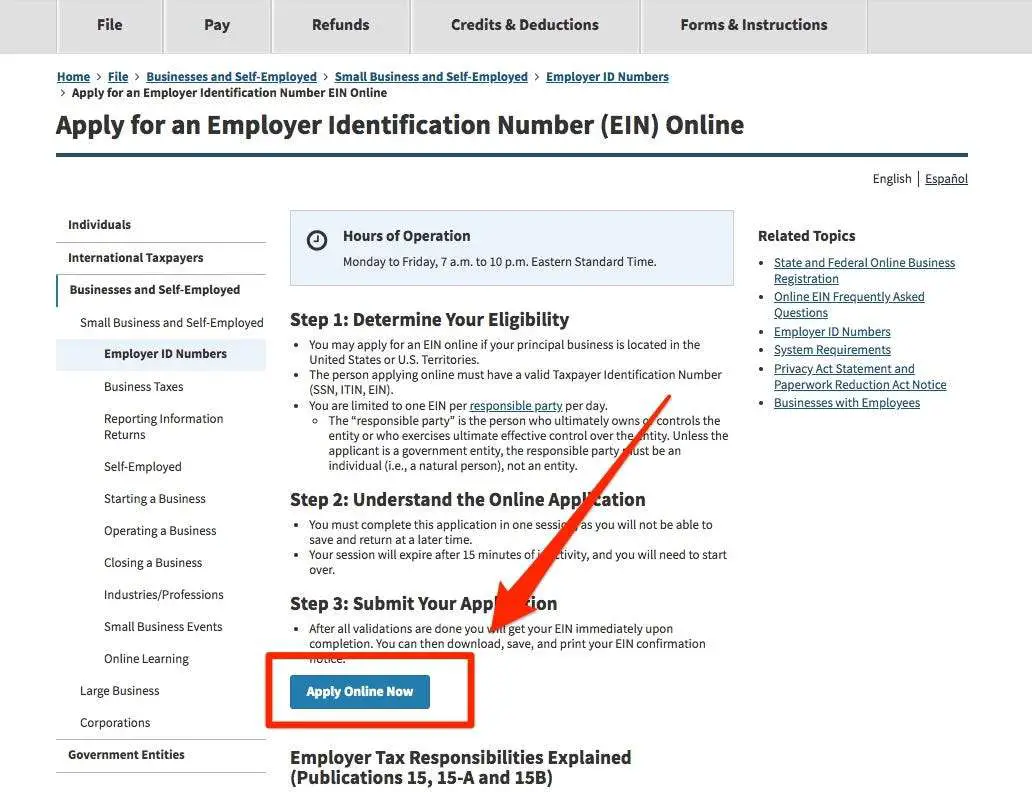

Apply For Your Tax Id Number Via Fax Or Mail

If you have the time, you can theoretically apply for your Tax ID Number through either fax or mail. Both of these processes will take longer than the online process and are generally not advised.

To get a Tax ID Number through fax, you will need to fax in your application and wait for your Tax ID Number to be returned. This is a process that could take days. The fax process can be unpredictable, as fax machines are a fairly old technology and they dont always return errors if messages arent received. If your fax machine disconnects or fails to operate correctly, you may never receive your Tax ID Number even though a Tax ID Number has been assigned. The fax process should take three to four days but if an error occurred on the application, you may need to start again.

To get a Tax ID Number through mail, you need to mail in your application instead of faxing it. A Tax ID Number will be returned to you in up to six weeks. Understandably, most people cannot wait this long for their Tax ID Number, which is why this is the least efficient method of applying for a Tax ID Number. If your application needs more information on it, the application will be returned to you within six weeks, but the waiting period will begin again once you send the corrected application in.

Neither fax nor mail are the ideal way of processing a Tax ID application. An online Tax ID application will return a Tax ID in under an hour, making it both faster and more convenient.

How Do I Obtain A Missouri Charter Number

Legislators must issue the charter number after one of their state or another has granted an out-of-state corporation authority by filing articles of incorporation or receiving a certificate of authority. On the Annual Registration Report with the corporations name, you will find a printed version of the charter number.

Don’t Miss: Pay Taxes On Plasma Donation

Does Every Business Need A Tax Id Number

If your small business does not need any of the tax accounts listed above , then your small business doesn’t require a Business Number.

For businesses, the CRA’s small supplier definition states that to qualify as a small supplier, your total taxable revenues from all your businesses are $30,000 or less in the last four consecutive calendar quarters and in any single calendar quarter.

How To Find Another Company’s Ein

Usually, small business owners need to locate their own company’s tax ID number, but businesses sometimes need to look up another company’s EIN. For example, you can use an EIN to verify a new supplier or client’s information. Also, in industries like insurance, you might need other companies’ EINs during your daily course of business.

Use one of the following options to find another business’s federal tax ID number:

You May Like: Square Dashboard 1099

Dietary And Lifestyle Factors

People who eat too much fat, carbohydrates, and salt and too little fiber are likely to have greater amounts of cellulite.

It may also be more prevalent in smokers, those who do not exercise, and those who sit or stand in one position for long periods of time.

Wearing underwear with tight elastic across the buttocks can limit blood flow, and this may contribute to the formation of cellulite.

Cellulite is more prevalent in people who have excess fat, but slim and fit people can have it too. It is more likely to happen after the age of 25 years, but it can affect younger people as well, including teenagers.

Identification Number To Be Obtained By A Partnership

NoteexlamcircleCoronavirus

Click Coronavirus Disease to see whether the measures adopted by Revenu Québec apply to the information on this page.

End of note

A partnership must obtain an identification number if it is required to file an information return. This number must be used every time the partnership contacts us or files documents such as:

- the Partnership Information Return and its schedules

- RL-15 slips and

- documents related to the return.

Also Check: Doordash Taxes 2021

Employer Tax Responsibilities Explained

Publication 15 PDF provides information on employer tax responsibilities related to taxable wages, employment tax withholding and which tax returns must be filed. More complex issues are discussed in Publication 15-A PDF and tax treatment of many employee benefits can be found in Publication 15. We recommend employers download these publications from IRS.gov. Copies can be requested online or by calling 1-800-TAX-FORM.

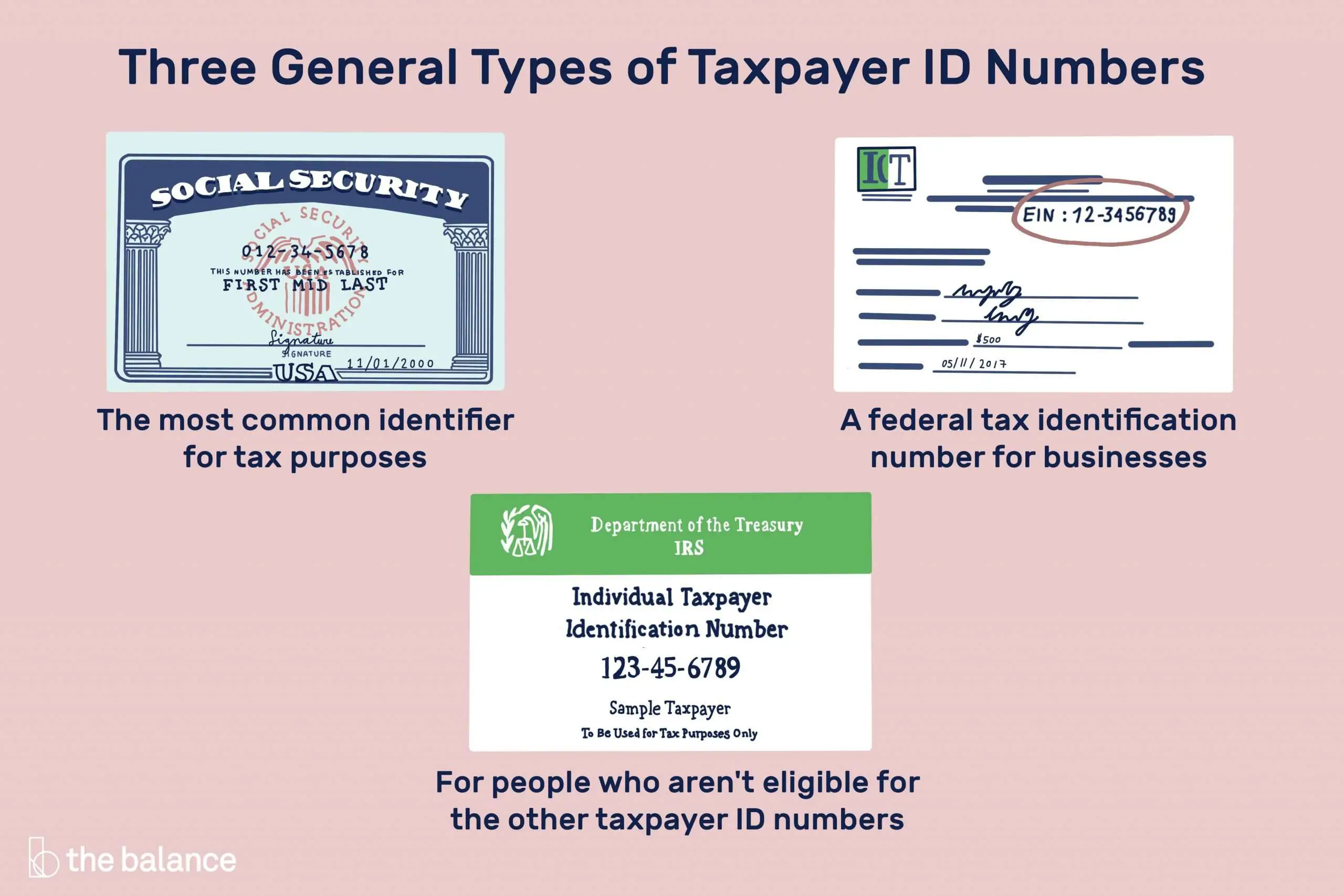

Finding An Individual Tax Id

Though there are pros and cons to doing it, if you have a Social Security number, you can use that as your tax ID, even in business. If you work for someone else as an employee, you get a W-2 no later than Jan. 31 of each year, and the SSN is there at the top. If you need a copy of a form from a previous year, you can get it from the employer who issued it. Employers must keep these for at least four years after you leave the company. Your tax return, like the 1040, the 1040A, or the 1040EZ lists your SSN at the top of the first page.

If you don’t have a Social Security number, but you have filed taxes in the past, you may have used an Individual Tax Identification Number on the forms in the space where the SSN usually goes. That number is valid if used in 2013 or later unless the IRS has notified you that you need to renew. If you do need to renew, use form W-7 to ask for a new ITIN. That process takes about seven weeks. If you have a valid ITIN, but you cannot find it, call 1-800-908-9982 from within the United States for help.

If you lose your Social Security card, you can apply for a new one online if you have a driver’s license or another form of state identification. You can also fill out a paper form and turn it in to the local Social Security Administration office you’ll need to take your birth certificate and a photo ID.

You May Like: Federal Irs Tax Return

What Is Missouri State Id Number

An EIN is a unique identification number. A Missouri tax ID number, also known as an employer identification number or employer identification number, is issued to business entities by the Internal Revenue Service . The number is sometimes called a Federal Tax ID Number or a Tax ID Number . Businesses require EINs for similar purposes as individuals do.

What Is My Tin Finding Out Your Own Tax Number

The IRS have to process huge amounts of data from millions of different US citizens. Organizing this is a real challenge, not only because of the sheer volume of data to be processed, but also because identifying people can be quite tricky without the right system. For example, according to the Whitepages name William Smith has over 1,000 entries in the State of Alabama alone. Across the USA this number increases, and the likelihood is that some of these individuals will have the same date of birth, for example, which is often used to identify people. This means that there needs to be another system for keeping track of individuals for tax purposes in the US other than just their names: A taxpayer identification number serves this purpose.

A Taxpayer Identification Number is often abbreviated to TIN and is used by the Internal Revenue Service to identify individuals efficiently. Where you get your TIN, how it is structured, and whether a TIN is the right form of identification for your purposes sometimes seems like it isnt as straightforward as it should be. However, this guide will look at exactly these issues which should show that finding out this information can be as easy as 1,2,3. In this article, we want to concentrate on the tax number that you as an employee will need for your income tax return or the number that you as an employer require for invoicing, and well explain exactly where you can get these numbers.

Contents

Recommended Reading: Doordash Paying Taxes

Name A Responsible Party

If youre filing as a sole proprietorship for a Tax ID, you will name yourself as the person trying to get a Tax ID Number. Otherwise, youll need a single individual who is going to be named the responsible party for the Tax ID. An EIN Responsible Party is going to be the person who is contacted in the event that there are any issues with the EIN or if further questions need to be answered. The responsible party has to be a stakeholder in the business. This is usually an owner, general partner, or principal officer.

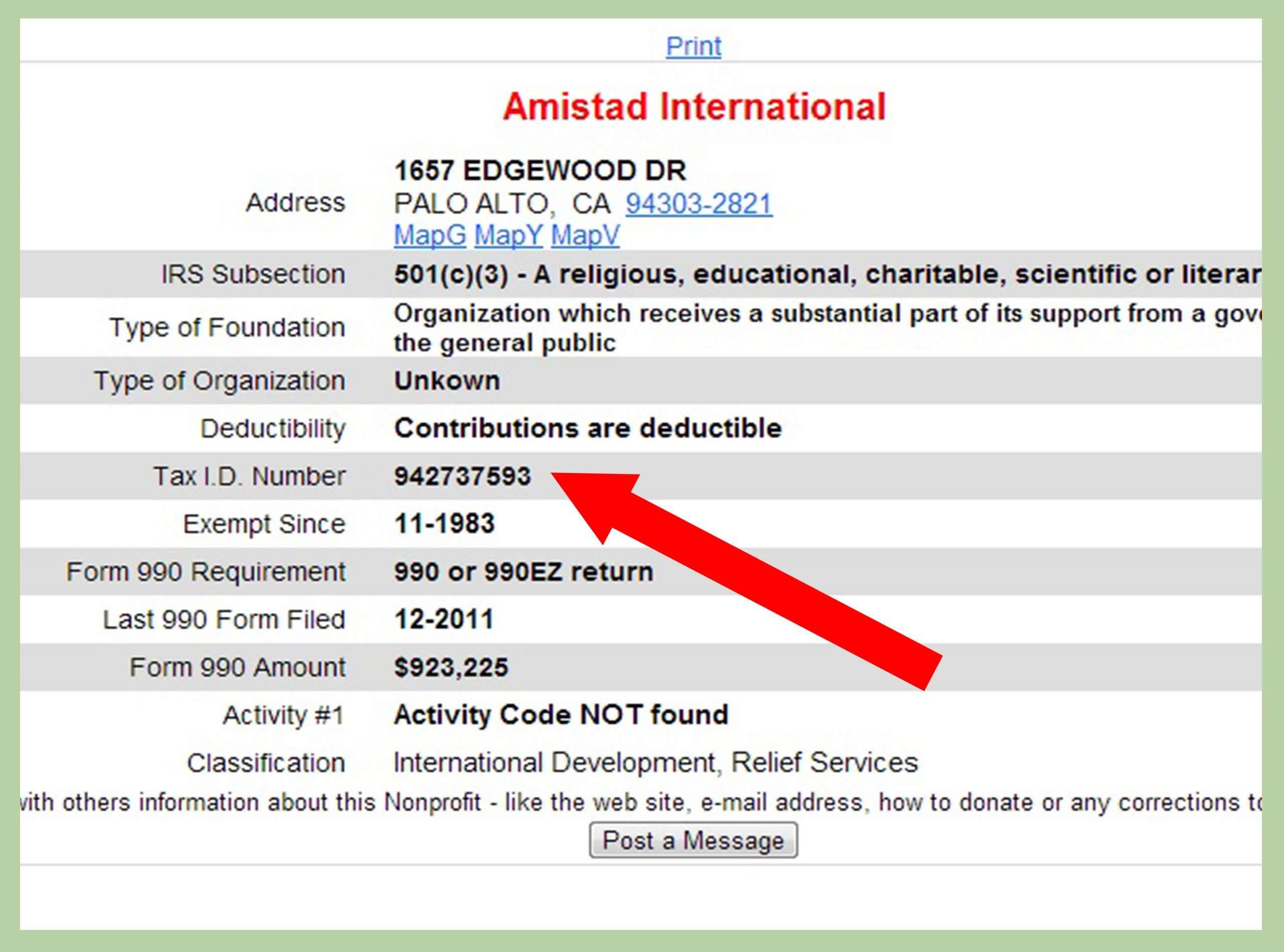

Use Melissa Database For Nonprofits

The Melissa Database provides free federal tax ID lookup for nonprofit organizations.

If you have a legitimate need to find the EIN for another business, then you can use one of these options to look up the number. Just be sure to keep your own EIN secure. Only share the number with a limited subset of peoplelenders, prospective suppliers, bankers, etc. You should guard your business’s EIN just like you would guard your social security number.

Recommended Reading: Do You Pay Taxes Working For Doordash

Answer Five Short Questions

The first question requires you to select the type of EIN you are applying for such as a sole proprietorship, corporation, LLC, partnership or estate. You then need to choose the option that best describes why you are applying for an EIN. This can be to start a new business, for banking purposes or for a range of other reasons. The online questionnaire then requests your name and Social Security number before you can finish your application.

Too Early To Tell If These Work

Laser-assisted liposuction

Liposuction is an invasive medical procedure that works well for removing small amounts of fat.

Bottom line: While liposuction can remove unwanted fat very effectively, its not recommended for getting rid of cellulite. It can make the dimpling more obvious.

Adding a laser treatment to liposuction, however, may help get rid of cellulite. Its too soon to tell whether laser-assisted liposuction is effective.

Ultrasound

A technique called ultrasonic liposculpting is a non-invasive procedure that targets and destroys fat.

Bottom line: There is no evidence that ultrasound alone can reduce cellulite. When combined with another cellulite treatment, however, ultrasound may reduce the appearance of cellulite. Its too early to tell whether it will be effective. More studies are needed.

Recommended Reading: How To Pay Quarterly Taxes Doordash

Finding The Employer Id

If you’re looking for the EIN of a business, there are several places to search.

Hire the top business lawyers and save up to 60% on legal fees

What Is A Tax Id Number

A tax identification number, or TIN, is a unique nine-digit number that identifies you to the IRS. It’s required on your tax return and requested in other IRS interactions. Social Security numbers are the most popular tax ID numbers, but four other kinds are popular too: the ITIN, EIN, ATIN and PTIN.

Recommended Reading: How To Do Taxes On Doordash

What If I Need My Business To Be Federally Incorporated

If you intend to incorporate your business federally, the Business Number is supplied by Innovation, Science and Economic Development Canada when your incorporation is approved. To apply for federal incorporation you can visit Corporations Canada and be sure to learn the difference between federal and provincial incorporation beforehand. After receiving the Business Number from ISED, you can apply for any of the above-mentioned tax ID program accounts through the CRA.

Why You Need To Know Your Business Tax Id Number

The IRS requires most types of businesses to apply for an EIN. The exceptions are some sole proprietors and owners of single-member LLCs, who can use their social security number instead of an EIN. But even small business owners who don’t have to get an EIN often opt to get one, so that they’re able to separate their business and personal finances.

If the IRS requires you to get an EIN or if you choose to get one, these are some of the situations where you’ll need to provide your business tax ID number:

-

When filing business tax returns or making business tax payments

-

When applying for a business loan

-

When opening a business bank account

-

When applying for a business credit card

-

When issuing Form 1099s to independent contractors

Although each of these transactions doesn’t happen regularly, when you consider all of them together, you’ll need to provide your EIN at least a few times per year. So, this is a number worth committing to memory and storing safely. Ideally, you should retrieve your business tax ID before you complete any of the transactions above.

Read Also: Www Michigan Gov Collectionseservice

How To Obtain An Identification Number

To obtain the partnership’s identification number, you can:

- call our client services or

- complete form LM-1-V,Application for Registration.

Note

The name of the partnership entered on the information return must be exactly the same as the one you gave when you registered the partnership with Revenu Québec.

End of note

Finding Your Individual Tax Id

You May Like: Doordash Calculator

Ein Lookup: How To Find Your Business Tax Id Number

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

This article has been reviewed by tax expert Erica Gellerman, CPA.

A business tax ID number, also called an employer identification number or federal tax ID, is a unique nine-digit number that identifies your business with the IRS. Owners of most types of business entities need a business tax ID number to file taxes, open a business bank account, obtain a business license, or apply for a business loan.

How Much Do You Need?

Most people know their social security number by heart, but not all business owners know their business tax ID number. Your EIN isn’t something that you use on a day-to-day basis, so keeping this number top of mind isn’t as easy as remembering your company’s phone number or address.

However, your EIN is essential for some very important business transactions, like filing business taxes and obtaining small business loans. Accuracy and speed matter in those situations. Not having your business tax ID can prevent you from getting crucial funding for your business or meeting a business tax deadline.

How to find your business tax ID number:

Check your EIN confirmation letter

Check other places your EIN could be recorded