Ways To Assess Property Value

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owner’s property. The assessed value estimates the reasonable for your home. It is based upon prevailing local real estate market conditions.

The assessor will review all relevant information surrounding your property to estimate its overall value. To give you the most accurate assessment, the assessor must look at what comparable properties are selling for under the current market conditions, how much the replacement costs for the property would be, the maintenance costs for the property owner, any improvements that were completed, any income you are making from the property, and how much interest would be charged to purchase or construct a property comparable to yours.

The assessor can estimate the market value of the property by using three different methods, and they have the option of choosing a single one or any combination of the three.

How To Qualify For Capital Gains Tax Exemption

Like I mentioned earlier, if you want to qualify for capital gains tax, you have to meet the following requirements:

- You must have lived in the house for two full years in the past five years to the date of the sale.

- You should own the house.

- If you are a property investor, sell the house through a 1301 exchange.

- You shouldnt hold the money but you are to give it to a third party.

- If you are a member of the uniformed service, you can defer the 5-year rule if you were called to service for an indefinite period or a period of 90 days.

- Also if you are living 50 miles away from the house performing your duty at your duty post, you can be exempted from the 5-year rule.

What Gives The Servicer The Right To Set Up An Escrow Account

Many mortgages have a clause allowing the lender to establish an escrow account basically at any time. The servicer establishes and manages the account on the lender’s behalf.

To find out if and when the lender can set up an escrow account for your loan, read your mortgage contract and any other relevant documentation you’ve signed, like an escrow waiver.

Don’t Miss: Where Can I Find Tax Id Number

No : Pass It On Before You Die

One common solution, says Basraon, is to gift the cottage while youre still alive. This typically only works if you no longer want to use or visit the cottage, says Basraon, and you only have one child that can take ownership of the property. By gifting the cottage now, youre able to pay the current tax burdenthe tax on capital gains that have accrued from when you first purchased the cottage to the fair market value of the property when you gave it to your child. Keep in mind, says Basraon, once gifted, the cottage is no longer your asset and this means your child could sell it, or it could become an exposed asset if, say, your child were to go through a divorce.

Still, if you do decide this is the best option, consider gifting the cottage over a period of five years. By stretching the gift over five years, you could avoid a large one-year tax bill, explains Basraon. But to make sure this is right for you, make sure the added yearly income from the incremental sale of the cottage doesnt push you into a tax bracket that would prompt a clawback of government income support, such as Old Age Security. As a general rule of thumb, you can claim up to $75,910 in income before clawbacks kick in. Thats why its important to seek out professional advice on these matters, says Basraon.

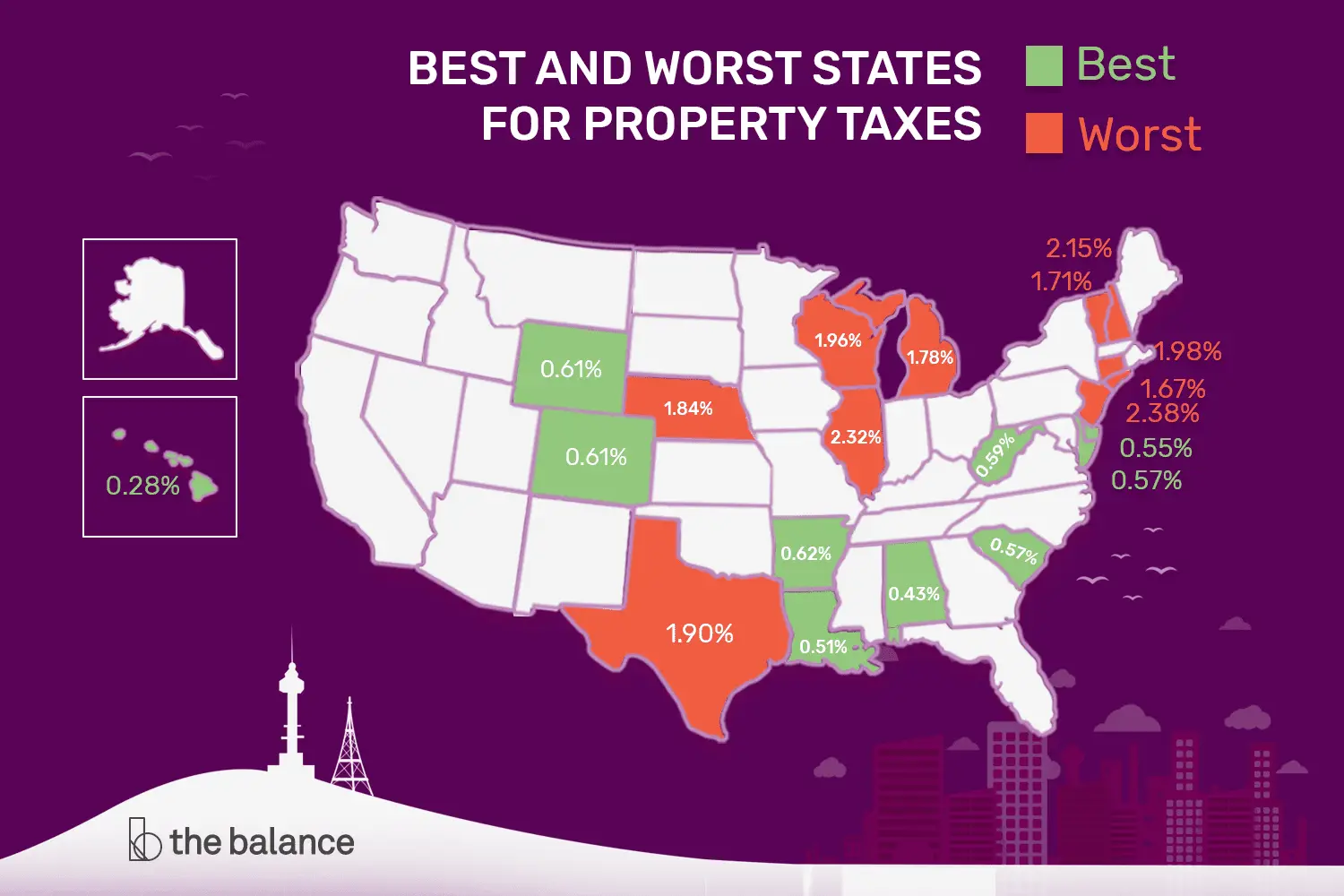

States With The Highest Property Tax Rates

Some of the highest property taxes can generally be found in the northeast, with the highest rate being 2.47% in New Jersey. The average homeowner in New Jersey paid $8,104 per home in property taxes. One reason for the property tax rate being consistently high in New Jersey is that county, and municipal governments cannot impose local income or sales tax in New Jersey as they can in other states. Property taxes pay for most of everything in New Jersey.

The second-highest property tax rate is in Illinois. The property tax rate is 2.30% in Illinois. In 1996, Illinois property tax bills were around the national average and then saw an 80% increase in the following 20 years. Home value appreciation has been lagging despite property taxes increasing quickly.

New Hampshire has the third-highest property tax rate in the U.S. of 2.20%. New Hampshire residents pay a higher percentage of income in property taxes than any other state. The high property tax rate has made it hard for younger people to purchase homes because the property tax bill is often larger than their mortgages. However, New Hampshire does not impose an income tax on earned salaries or wages and does not have a sales tax.

Wisconsin has the fifth-highest property tax rate in the United States of 1.91%, which finally dips just below 2%. Per capita property taxes in Wisconsin are about $1,615.71, above the national average. The median home value in Wisconsin is $178,900, and the median household income is $59,305.

Don’t Miss: Which States Freeze Property Taxes For Seniors

What Documents Are Required From A Non

Its wise to check the exact documents your own bank will need to get your mortgage arranged. Typically, a non-resident will need the following:

- A deposit of at least 35% of the value of the property

- A reference letter from your own bank

- Proof of income including bank statements showing your spending history, and a letter from your employer stating your salary

- A Canadian credit check

When youre opening your Canadian bank account and getting your mortgage set up, youll likely find you need to transfer in money from overseas to get started. Sending an international payment through your normal bank can be very expensive, and take several working days to arrive. Instead, you may be better off using a currency specialist like Wise, for low cost international transfers which use the mid-market exchange rate and charge a simple transparent fee.

Wise payments are made using the mid-market exchange rate – the same one youll find on Google – so there are no hidden charges to worry about. Youll be able to set up your payment online for convenience, and your money is kept safe using bank level security, no matter what currency youre sending.

Who Pays The Tax

Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax. Typically, the owner of a property must pay the real estate taxes. However, anyone who has an interest in a property, such as someone living in the property, should make sure the real estate taxes are being paid.

Also Check: Which Pages Of Tax Return To Print

Are There Specific Exemptions For Investment Property

Yes. Investors can look to Tax Code Section 1031 to profit on business or investment properties without paying capital gains tax.

Section 1031 allows you to trade like-kind properties to avoid paying taxes on the initial profit. These like-kind properties must be similar: You can trade a retail space for another retail space, but you cant trade a retail space for a rental property.

If the value of one property is greater than the other, you can add cash to the deal. The person who owns the property of lesser value can pay any difference at the time of sale.

Can I avoid the tax by moving into my investment property?

Yes. If you live in your property for at least two years, it changes the nature of your property from an investment property back to your primary residence. Youre then eligible for the capital gains tax exemption of up to $250,000 .

Say you live in New York City with your spouse. You decide to sell your place in the city, where youve lived for the past two years, and move into your vacation home upstate. Since your city apartment was your primary residence, you take your $500,000 profit tax-free.

Your move upstate doesnt have to be permanent. If you want to ultimately move back to the city, stay in your vacation home at least two years. After two years, that property becomes your primary residence, and you can sell it and pocket another tax-free profit of up $500,000.

The Servicer Might Pay Any Delinquent Taxes If You Don’t

If your loan isn’t escrowed and you don’t pay the property taxes, the loan servicer might pay any delinquent taxes and then bill you for them. Here’s why: Property tax liens almost always havepriority over other liens, includingmortgage liens and deed of trust liens.

Because a property tax lien has priority, a tax sale wipes out any mortgages. So, the loan servicer will usually advance money to pay delinquent property taxes to prevent this kind of sale from happening. The servicer will then demand reimbursement from you, the borrower.

You May Like: Are Mud Taxes Included In Property Taxes

Getting The Ownership Structure Right

This potential strategy is not for every landlord. As things currently stand, it is more useful for higher and additional-rate taxpayers, and those who were previously basic-rate taxpayers, who have become higher-rate due to these changes. Getting the ownership structure right could therefore make a huge difference to the amount of tax paid over your lifetime from your rental income. So let’s take a look at the potential advantages and disadvantages of holding property in a limited company.

However, before we do, as always, we would caution that there is no one size fits all tax solution for landlords. We always recommend that you talk any potential strategy through with a property tax professional such as ourselves.

Exemptions For Home Renovations

Though most renovations can increase your property taxes thanks to their higher valuation, some states offer exemptions for renovations up to a certain dollar amount. Depending on where your property is located, some parts of the country offer to waive property taxes for up to a certain amount of home improvements. In these instances, local governments will set the limit on how much money you can put into a property before you return to paying the full tax amount.

Recommended Reading: Do I Pay Taxes On Unemployment

Is My Primary Residence Exempt From Capital Gains Tax

Yes. The IRS allows you skim up to $250,000 off the profit of a primary residence when calculating capital gains tax. That amount jumps to $500,000, if youre married.

You can typically take advantage of this exemption if you meet three requirements:

- Youve owned your home for at least two years in the five years before youve looked to sell it.

- Your home was your primary residence for at least two years of that same five-year period.

- You havent taken a capital gains exclusion for any other property sold at least two years before this current sale.

Staying in your home longer than two years might help you qualify for an exemption. Even if it takes three years to sell it after you move, you could still avoid capital gains tax if you lived in the home for at least two years.

Whats The Difference Between A Property Tax Exemption Vs Deduction

If you have a property tax exemption, you dont have to pay that particular tax when youre filing your taxes. If you have a deduction, the amount of the deduction simply lowers the income that you have to pay the tax on.

To take a simple example, the standard deduction on federal taxes for the 2021 tax year is $12,950 for single people and those married and filing separately. That amount is removed from their income for the purposes of the tax return.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Read Also: How To Calculate Pay After Taxes

What Do My Property Taxes Pay For

Property taxes fund vital community services like public safety, schools, roads, and parks.

The City of Boise takes our role as stewards of the taxpayer very seriously. For every tax dollar we spent in Fiscal Year 2022, 63.9 cents funded Policy, Fire, Parks and Recreation, and the Library.

You might notice that some city services arent funded by your tax dollars, like the Boise Airport and solid waste management . Thats because fees – like your trash bill – pay for those services.

Residency Questions For Non

Who can buy real estate in Canada?Canada welcomes home buyers from all countries, and there are no restrictions on the amount or kind of real estate you can buy. Some banks will restrict the number of properties they will finance to 5 properties per person. Additionally, as of April 21, 2017, there is a 15% Non-Resident Speculation Tax that must be paid by non Citizens and non-permanent residents read the details here.

Will buying a property in Canada improve my chances at immigration?Immigrating to Canada is a complex process and, unfortunately, owning property here is NOT one of the factors taken into consideration. Of course, it wont hurt your chances and will be considered part of your overall net worth, but simply owning a home in Canada does not affect the selection process. If youre wondering if youd be eligible to immigrate to Canada, visit the Government of Canada Citizenship and Immigration website.

Im a Canadian citizen living in a different country. Would I be considered a non-resident for the purposes of buying real estate if Im an expat?Citizens of Canada who dont reside in Canada for more than half the year are considered non-residents by banks but not by the government for the purposes of the non-resident speculation tax. Canadian citizens are not subject to the 15% non-resident speculation tax.

Recommended Reading: Do You Have To Claim Stocks On Taxes

Property That Is Not Liable For Lpt

Your property is liable for LPT if it is a residential property on 1November.

If your property is not liable for LPT, you do not need to submit an LPTreturn.

- Commercial property that is fully subject to commercial rates and is not a residential property

- Unoccupied property that is not suitable for living in

- Diplomatic property

- Mobile homes, vehicles and vessels

Useful Property Tax Information

Most property tax assessments are done either annually or every five years, depending on the community where the property is located. After the owner has received their assessment with its property valuation, a property tax bill is mailed separately.

The information the assessor has is considered part of the public record. Owners can see how much they must pay by going to the assessors website and entering their address. Sometimes they may be charged a small fee for accessing this material. Another option is to go to the assessors office in the county courthouse. Once you are at the county courthouse, you can look up the information and print out a copy for a nominal fee.

Read Also: How To Pay Taxes On Contract Work

Senior Property Tax Exemption

States often provide tax exemptions for senior citizens who have reached certain ages. Some areas may base eligibility on Social Security status. The details of the senior exemption vary based on the state, and there are often residency and income restrictions. Some of the statutes just defer the taxes until the property is sold.

For details, contact your local department of revenue. Youll have to read the fine print, but its still worth looking into the tax laws in your area.

How Do Property Taxes Work

Real property tax is handled a bit differently than personal property or income taxes. Property taxes are based on the assessed value of your home. In all cases, this is based on your property value. Whether its your full property value depends on the jurisdiction youre in.

For example, the taxable portion of your homes value given by an assessor may be limited to some portion of its actual value pursuant to state law. If the valuation is $250,000, the taxable value of the property may only be $125,000, for example.

Property taxes are assessed using a unit called a mill. Mill might strike you as meaning million, but for the sake of tax math, you want to think about the metric system. Mills are assessed based on every $1,000 of property value.

Don’t Miss: How Much Mortgage Interest Can I Deduct On My Taxes

Tips On How To Avoid Paying Taxes

Tip #1: Become a Business Savant

Its no secret that businesses have the most leverage when it comes to tax credits, tax deductions or tax write-offs.

Some of the richest people in the world do this. If they like to golf, then buy the golf club. And if they like to take a vacation, then they buy a resort.

Now, of course, thats a joke and some extreme examples, but what we want you to do is think about your own needs and wants, and how they could tie into a business.

Now we know some people arent into business, but we would still encourage you to take a look into your passions, your skills, and what you do currently to make income

and see if you can mesh that into starting your own business.

So if you want to take advantage of massive business deductions, you have to join the party.

As the rapper Drake once said, Everything a brother purchase is a write-off.

Tip #2: Become an Investor

The golden rule when it comes to avoiding taxes is to delay as much income as possible. And most wealthy people dont take cash unless they absolutely need it.

So if you start a business and its growing, youre generating a lot of revenue.

Sure, you can pay yourself a lot of money, but guess what, youre also going to pay a lot of taxes.

But heres a big tip: Reinvested profits are not taxed!

For example, lets say you make $100,000 profit and at the end of the year, you decide to reinvest $80,000 by buying equipment, or getting a property, or just doing a really big ad campaign.