Move To Puerto Rico And Pay Zero Capital Gains Tax

Note: Under U.S. tax law, long-term capital gains prior to becoming a bona-fide resident of Puerto Rico that are realized within 10 years are subject to 20% tax rate and possibly subject to Net Investment income tax. If the long-term capital gains are realized after 10 years, the U.S. tax rate is 0%.

Do Puerto Ricans Pay Us Taxes

While the Commonwealth government has its own tax laws, Puerto Rico residents are also required to pay US federal taxes, but most residents do not have to pay the federal personal income tax. Then, Who is the most famous Puerto Rican? The list of accomplishments from Puerto Rican celebrities is endless, and it should definitely bring a sense of pride to all Latinos.

Puerto Rico And Federal Income Tax

One of the common excuses for treating Puerto Rico differently from states is that Puerto Ricans do not pay federal income tax in the same way that stateside Americans do.

This is federal law.

At first glance, it appears that the federal law benefits Puerto Ricans. After all, who wants to pay income taxes? The truth is more complicated.

Also Check: How Much To Save For Taxes Doordash

How Long Do You Have To Live In Puerto Rico To Be A Resident

An individual will be considered to meet the presence test if one of five tests is met: 1) The individual is present in Puerto Rico for at least 183 days during the taxable year 2) the individual is present in Puerto Rico for at least 549 days during the three-year period consisting of the current taxable year and two

Disaster Relief Isnt Based On A States Financial Health

There are no official estimates out yet on the cost of the hurricane damage to Puerto Rico, but just fixing the electrical system will cost billions of dollars, a Department of Energy responder told me. Then there’s the cost of rebuilding hospitals, water pumping stations, and other critical infrastructure.

It’s true that the government of Puerto Rico is bankrupt, and, as President Trump likes to point out, partially to blame for its own fiscal mess. And measured on a per capita basis, Puerto Ricans pay fewer taxes per capita than residents of any of the 50 states.

But that is irrelevant. The federal government doesn’t operate business transactions with each state, giving the best services to the states that pay the most taxes. That’s not how the government works.

The Stafford Act, which governs federal response to major disasters, says the government must provide help to Puerto Rico like it would to any other state. It doesnt say that help should be based on the states financial health. If it did, that would mean the government should give less help to Illinois after a disaster because the state is nearly bankrupt.

Don’t Miss: Efstatus.taxact.com 2019

How Puerto Rico Is Different From The United States: Cultural And Geographical Differences

In many ways, Puerto Rico is much like visiting another country if you are a native of the United States. You can expect to eat different foods, speak a different language and experience what its like to live on an island. Life is different from the United States in Puerto Rico. As a result, we recommend visiting the island several times first before making the permanent move.

Additionally, Puerto Rico has special concerns that should be considered. For example, as an island in the middle of the ocean, Puerto Rico experiences hurricanes and tropical storms regularly. For example, in September 2017, Hurricane Maria, a Category 5 storm struck Puerto Rico with deadly force, killing almost 3,000 people and shutting off power for weeks. Hurricane Maria was one of the worst storms to ever strike the islands, costing the island an estimated $91 Billion in damage.

Power outages and utility outages are a common problem in Puerto Rico. The island has an aging infrastructure that frequently has problems and needs upgrading. In addition, political corruption has been a problem for Puerto Rico for decades. As a result, much needed infrastructure repair and other improvements have not occurred.

Limitations Of Puerto Rico Tax Incentives

As you see, Puerto Rico tax incentives come with specific requirements and limitations. They are not a quick tax savings scheme. Still, for people who want to live on the island, Puerto Rico taxes offer an incredible deal.

The next post in our Puerto Rico series we discuss who will benefit most from moving to Puerto Rico and alternative options to tax-optimize your business.

If you are considering Puerto Rico as a tax savings strategy book a call with our structuring expert. He will help you evaluate if this is the best move or if other offshore structuring offers you better tax optimization while maintaining more flexibility.

Don’t Miss: 1099 For Doordash

Puerto Rico Taxes: Does Puerto Rico Pay Taxes

As previously stated, since Puerto Rico is not one of the 50 states of the United States, its citizens are exempt from paying income tax to the U.S. IRS. In addition, corporations based in Puerto Rico are not generally subject to corporate taxes levied in the United States. Finally, if you are a US Citizen who becomes a permanent resident of Puerto Rico, you are exempt from paying US income taxes.

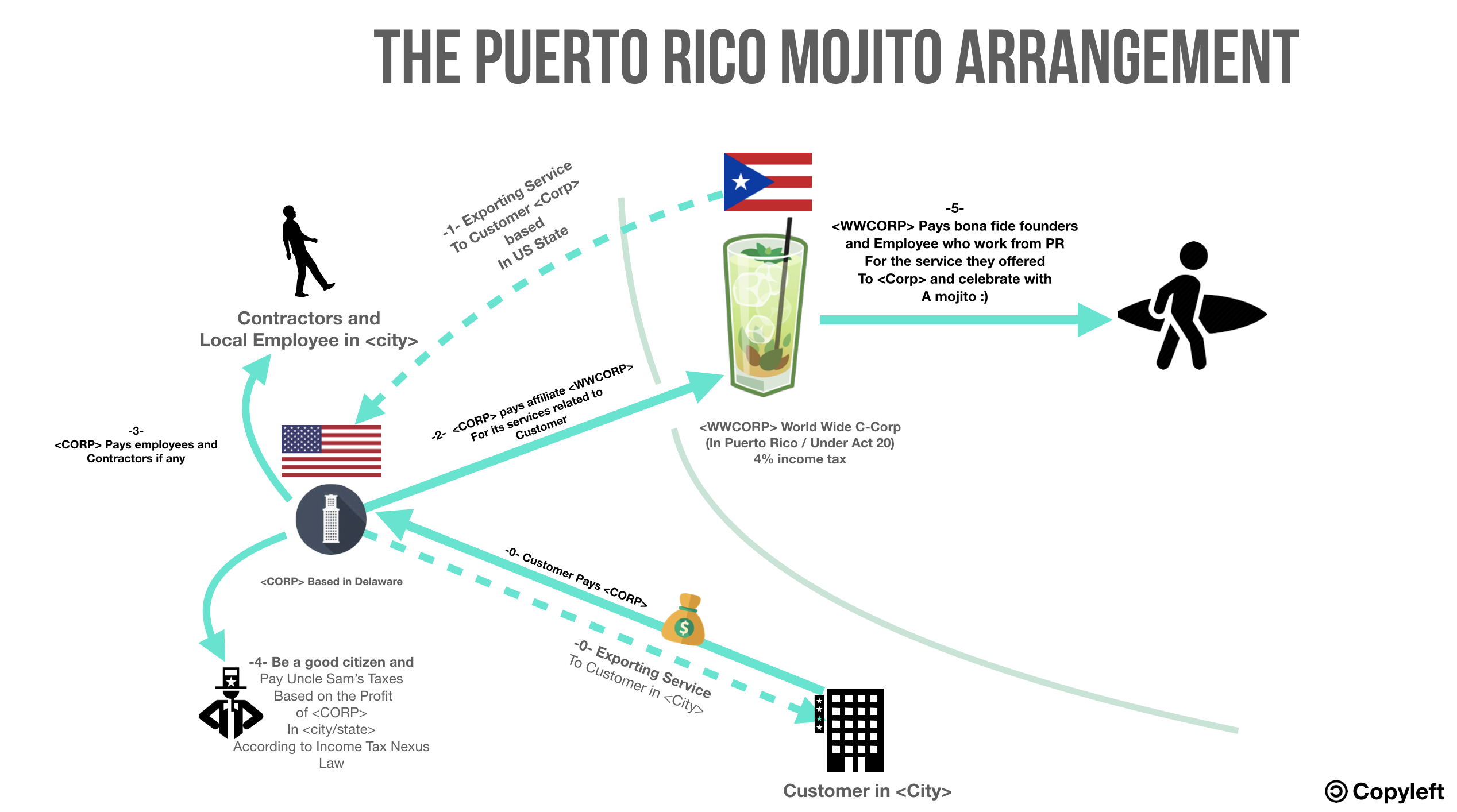

To further answer the question, does Puerto Rico pay taxes?, you should also know that in 2008 Puerto Rico passed legislation to encourage individuals and businesses to conduct business in Puerto Rico. As a result, Act 20: The Export Services Act and Act 22: The Individual Investor Act were passed into legislation. As of 2020, these acts have now been consolidated into Act 60.

Puerto Rico Pays Billions Of Federal Taxes Each Year

Puerto Rico is a US territory and not a state, so its residents dont pay federal income tax unless they work for the US government. Even so, workers there pay the majority of federal taxes that Americans on the mainland pay payroll taxes, social security taxes, business taxes, gift taxes, estate taxes and so on.

The recent economic crisis on the island has put a huge dent in the federal tax revenue collected from Puerto Rico, but it still added up to $3.6 billion in fiscal year 2016. Thats not much less than some states where residents do pay income tax: Vermont and Wyoming paid $4.5 billion in federal taxes that year.

Even during the island’s worst financial crisis, Puerto Rico is still directly funding the US government, including the Federal Emergency Management Agency, which is spending millions of dollars to rebuild damaged infrastructure in Houston after Hurricane Harvey.

In Texas, FEMA has provided $323 million worth of public assistance grants and has authorized both short-term emergency help and long-term rebuilding costs. It only took one week for Trump to ask Congress for extra relief money to help Texas rebuild critical infrastructure and to provide residents and businesses with low-interest recovery loans.

So far, Trump has only authorized the basic response for short-term emergency help in Puerto Rico, even though the island needs extensive work on infrastructure.

Read Also: Ccao Certified Final 2020 Assessed Value

How Else Does This Affect Puerto Rico

The fact that Puerto Ricans do not pay the same federal income taxes as their fellow U.S. citizens in the states is often used to justify unequal treatment of Puerto Rico under federal programs.

The implications of decades of unequal treatment were brought into the open after Hurricane Maria hit Puerto Rico. The weak Puerto Rico health care infrastructure reflected billions of dollars in Medicaid funding never received over the years. The mass migration to the states was inspired in part by more generous benefits that would be granted to recipients in the states. A recent study confirmed that Puerto Rico did not receive the same support after the 2017 hurricane season that states did .

Taxation without representation was a rallying cry against England during the American Revolution, and opposition to this concept remains a key tenet of our democracy.

In the case of Puerto Rico, a lack of representation even with reduced tax obligations creates inequality with the rest of the United States.

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives

There is no doubt that Puerto Rico taxes offer incredible incentives to move to the island. To benefit from the tax incentives you have to meet specific requirements though. Just declaring the US territory your new home is not enough. Lets look at the Puerto Rico tax benefits and how to qualify for them.

This is Part One of our Puerto Rico tax series. Read Part Two here.

Also Check: Efstatus Taxact Com 2016

Topic No 901 Is A Person With Income From Puerto Rico

If you’re a bona fide resident of Puerto Rico during the entire tax year, you generally aren’t required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico. However, if you also have income from sources outside of Puerto Rico, including from U.S. sources, you’re required to file a U.S. federal income tax return if such amount is

Understanding Puerto Ricos Excise Tax

Why Puerto Rico enacted the excise tax? Most often countries around the world will put excise taxes into effect as discouragement for using items such as tobacco and alcohol. This is obviously not the case with the Puerto Rican import excise tax. There is no federal income tax for most Puerto Rican residents.

You May Like: Reverse Ein Search

Act 60 Eligible Businesses

To benefit from the low 4% corporate tax rate the business must meet certain requirements. The key is that the business has to provide a service. That means that manufacturing or other non-service businesses dont qualify.

Eligible services include but are not limited to:

- Research and development

- Trading companies dedicated to international trading

- Commercial and mercantile distribution of products manufactured in Puerto Rico to other jurisdictions

- Assembly, bottling and packaging operations of products to be exported

How To Meet The Presence Test

Being physically present in Puerto Rico, for at least 183 days during the tax year qualifies you as Puerto Rico resident. Presence means you had your feet on the ground at any point during the day

However, there is some leeway. IRS Code Sec 937 provides additional guidance for bona fide residence status. Specifically, you cannot have a tax home outside of Puerto Rico during the tax year and you cannot have a closer connection to the US or any foreign country.

This means that you could spend less than 183 days in Puerto Rico as long as you dont spend more time in the US, or any other country, than you spend in Puerto Rico. Be aware that you then still must meet one of the following requirements:

- Be present in Puerto Rico for at least 549 days during the 3-year period that includes the current tax year and the 2 tax years immediately prior. During each of those 3 years, you must be present in Puerto Rico for at least 60 days.

- Not spend more than 90 days during the tax year in the United States.

- Be present for more days in Puerto Rico than in the United States during the tax year and earned no more than $3,000 income in the United States, i.e. income from salary, wages, professional fees.

- Have no significant connection to the United States during the tax year. Significant connections include when your spouse or child lives in the US, or you have a permanent home there or are registered to vote.

You May Like: How To Do Taxes On Doordash

How The 2017 Us Tax Reform Impacted Pr Companies

Prior to the 2017 Tax Cuts and Jobs Act, you could have a Puerto Rico company, but not be resident there. You would have paid 4% tax in PR and defer US tax on retained earnings. Unfortunately, this does not work anymore.

The new tax law eliminated tax deferral on foreign retained earnings. This means that if you are not a PR resident, you would pay US tax on the business income. So for non-PR residents, there is no tax incentive for having a Puerto Rico company.

Taxes In Puerto Rico Now

First, people in Puerto Rico now pay 11% in sales taxes. This is more expensive than any State in the U.S., and it decreases the buying power of all the money used in Puerto Rico. It is the same for the rich and the poor. States sales taxes range from zero in 5 states to 9.45% in Tennessee. Puerto Rico pays more in sales taxes than any state.

Recommended Reading: Efilemytaxes

Puerto Ricos Financial Crisis

For years, Puerto Rico has struggled with mounting debt problems. In 2012, the territory suffered a credit downgrade, which makes it more difficult to borrow money to finance infrastructure improvements or even function as a government. Second, Puerto Rico has an aging population that requires government services such as medical care and retirement pensions. Finally, in 2016 the United States approved Puerto Ricos request to move toward bankruptcy with the new Promesa law. The bankruptcy proceedings are an ongoing issue for Puerto Rico.

Topic No 903 Us Employment Tax In Puerto Rico

Employers in Puerto Rico are subject to the taxes imposed by the Federal Insurance Contributions Act and the Federal Unemployment Tax Act . An employer is a person or organization for whom a worker performs services as an employee. As an employer, you’re required to withhold, report, and pay employment taxes to the United States

You May Like: Do I Need To File Taxes For Doordash

A Note About Tax Savings In Puerto Rico

Given the changing and volatile political climate in the United States, it is unclear for how long the tax savings of Act 20 and 22 will last. There is clearly a growing populist movement in the United States that wants to increase taxes on investors and business owners. This is not a big surprise to any student of history. Populism movements have played out many times in the past. Venezuelan politics under the Hugo Chavez was one example of this.

Even if you are not prepared to move to Puerto Rico, you may seriously consider beginning the application process for Act 20 and/or Act 22. Getting your foot in the door with an application may be a smart move if US legislators move to block US Citizens from these juicy tax incentives.

Who Will Benefit From The Assignments Of The Reconstruction Of Puerto Rico

I wonder, how much is being paid out to US Corporations in the Slow “Recovery” of Puerto Rico?

I guess that seeing how many US corporations are benefiting from the Aftermath of Hurricanes Irma and the numbers might go either way.

If you are in San Juan, it is normal to stumble upon a Con Edison vehicle who is working to reestablish the electricity on the Island. As I walk around my neighborhood it’s clear that the Hurricanes brought people from the outside who are being employed by US corporations.

I think we should keep a close eye into what is claimed to be given to Puerto Rico and how much is going out as it came in while there are still people without water and electricity 6+ months after Hurricane Maria and Irma impacted the Island.

Also Check: Does Doordash Do Taxes

Us Federal Taxes In Puerto Rico

do not apply in Puerto Rico, including, for example, the federal gasoline tax, the tax on local telephone calls, and the tax on tobacco consumed in Puerto Rico. However, there are exceptions notably the environmental taxes imposed under chapter 38 of the tax code on petroleum and certain chemicals. A different type of exception is provided by section 7652 of the tax code,

Puerto Rico Tax Return For Us Citizens

If you match either of the following criteria, you should not submit a tax return for the United States:

1) During the whole tax year, you are a bona fide resident of Puerto Rico, and

2) your exclusive source of income is from Puerto Rico.

Employees of the United States government, including members of the armed forces, are subject to separate rules. For more information, please see the section below.

If you have income from sources outside of Puerto Rico, including from the United States, you must file a federal income tax return in the United States if the amount exceeds the U.S. filing threshold for your filing status.

If youre a U.S. citizen who relocates from Puerto Rico to the United States and was a bona fide resident of Puerto Rico for at least two years prior to relocating, you can deduct any Puerto Rican source income from your U.S. income tax return for the time you were still residing in Puerto Rico during the year.

If you are a bona fide resident of Puerto Rico and are qualified to exclude income from Puerto Rico from your U.S. tax return, you must figure out the filing threshold provided in the U.S. tax return instructions. IRS Publication 1321 will assist you in determining how much income you have that requires you to submit a tax return in the United States.

Read Also: Do I Have To File Taxes For Doordash

Guide To Income Tax In Puerto Rico

What the Individual Resident Investor Tax Incentive saves you is the income tax on dividends and capital gainsunder the tax incentive, these are taxed at 0%, as long as you are a bona fide resident of Puerto Rico. Similarly, with the Export Services Tax Incentive , you are required to pay yourself a reasonable salary and must pay