Do I Qualify For The Mileage Tax Deduction

In years past, many employees could take advantage of the mileage tax deduction to lower their tax liability. However, the passage of the Tax Cuts and Job Acts of 2017 changed this for many people, making it so that only the self-employed and employees in specific industries could take advantage of this deduction.

You can claim the mileage tax deduction on your income tax return if one of the following conditions apply:

- You own a small business

- Youre self-employed and file a Schedule C or Schedule F

- Youre an independent contractor

- You drive for a rideshare service

- Youre traveling for volunteer work

- Youre traveling for medical appointments

- Youre a qualified performing artist

- You work as a fee-based government official

- Youre a reservist in the armed forces

- Youre an active-duty military member that has moving expenses associated with a permanent change of station

Additionally, you will also need to determine what counts as business mileage. The following mileageis deductible:

- Travel from store, office, or another type of business location to other business-related locations

- Travel from your home to another business location if you work from a home office

- For rideshare drivers, trips driven between your first business stop through the last stop

The following mileage is not deductible:

- Travel from your home to your store, office, or other business location

- For rideshare drivers, the trip from your home to your first stop and the trip from your last business stop to home

How Do I Get Tax Relief If I Use My Own Car For Business Travel

If you use your own car or van for business travel, there is the statutory system of tax-free approved mileage allowances available.

The maximum amount per business mile is known as the approved mileage allowance payment .

Your employer can pay or reimburse you up to these amounts on a tax- and NIC-free basis. If your employer pays less than these amounts, you can claim tax relief for the unused balance of the approved amount.

These rates apply where an employee uses his or her own electric or hybrid car for business journeys.

Is Mileage Tax Deductible

The shortest answer to this question is it depends on the type of employee. If its a W-2 employee, mileage is not tax deductible. If employees are not reimbursed for the business miles they put on their personal vehicle, they cannot write them off on their taxes. On the other hand, those who are self-employed can. Why the self-employed and not W-2 workers? What changed? And when did this happen?

In 2017, the Trump administration passed the Tax Cuts and Jobs Act. This legislation minimized itemized deductions, curbing the business expenses tax-payers could deduct. Business mileage was one of those items. The exception to this legislation is allowing the self-employed to deduct mileage from taxes.

Additionally, those driving for medical or charity purposes can also deduct their mileage.

Don’t Miss: Where Can I Do My Taxes For Free Online

What Qualifies As Business Mileage

Starting off simple, it is important to know what exactly qualifies as business mileage, as writing off mileage on taxes can sometimes be tricky when considering all the different activities you might use your vehicle for.

Heres an overview of what counts:

- Trips from your office or place of work to meet with clients

- Travel between different places of work, for example between various branches or outlets

- Errands that relate to your work

- Attending conferences or events in general related to your job

- Business lunches or other meet-ups that relate to work

- Commuting between your house and a permanent place of work is not worthy of a business mileage deduction, though if you are commuting to a temporary workplace such as a regular client or a courthouse if youre a lawyer, these trips do qualify.

- If your tax home is your permanent place of residence, where you head off from daily, these trips also count as business trips.

Vehicles You Use For Work

You may be able to claim tax relief if you use cars, vans, motorcycles or bicycles for work.

This does not include travelling to and from your work, unless its a temporary place of work.

How much you can claim depends on whether youre using:

- a vehicle that youve bought or leased with your own money

- a vehicle owned or leased by your employer

Read Also: Where Do I Mail My Irs Tax Return

Maintain Record Of Receipts

If you choose the actual expense deduction, you don’t need to maintain or record your mileage. Instead, keep copies of relevant receipts and documentation. Each document must include the date, dollar amount of the service or service purchased, and description of the product or service needed. And, of course, the expense must be incurred within the tax year for which you’re making the claim.

Transportation Costs And Medical Mileage Deduction

There are numerous other things you can add to the list of your deductible medical mileage, most of which revolve around personal transport to the medical facility. Keep in mind that the following list does not even remotely apply to your medical mileage if the medical care you were receiving wasnt of vital importance :

- Taxi, plane, bus, and train tickets

- Ambulance transportation services

- Vehicle tickets and expenses for a parent who is obligated to go with a child

- Vehicle tickets and expenses for a nurse and/or any other medical personnel that is legally allowed to give treatments

Recommended Reading: How To Calculate Payroll Taxes

Mileage Reimbursement Problems And Solutions In 2022

One other strike against mileage reimbursements is the decrease in business vehicle travel in some industries. Because of COVID-19, different organizations are following different protocols related to employee travel. Some employees are working remotely and accruing less business mileage. Others are only traveling within a certain smaller radius or making some trips but not others.

This puts lots of people in the low-mileage category, which means that a standard mileage reimbursement will not sufficiently cover the business portion of their vehicle ownership costs. A different approach is even more important now than ever one that addresses both ownership and operation costs, that accurately reimburses different employees at different rates based on their location, and that eliminates inequitable discrepancies between reimbursements.

Hold On To Your Records

After you file your return, you may be required to submit documentation to the IRS to verify your mileage. Because of this, you should hold on to your records for a minimum of three years. Make sure to separate your records, receipts, and other documentation for each tax year to stay organized.

If you find that your records are taking up too much space, you might want to consider scanning your documents, using accounting software with built-in mileage tracking, or using another computer-based form of storage for future tax years.

Also Check: When Is The Tax Filing Deadline For 2021

The Actual Expense Method

The actual expense method requires you to record every expense related to your vehicle and report the total on your tax return. This includes expenses like gasoline, insurance, car lease payments, depreciation, new tires, parking, and tolls.

If 100% of your use of a car is for business purposes, you can deduct 100% of your expenses. If you only partly use your car for business purposes, you can deduct a percentage.

So, if 15% of the miles you drove in 2022 were for work, you can deduct 15% of your total vehicle-related expenses per year on your tax return.

Unlike the standard mileage rate, the actual expense method takes some number-crunching in order to figure out how much you can deduct.

An example using the actual expense method

Say you drove 10,000 miles total in your pickup truck last year, and 2,000 of those miles count as business use of a car. In total, you spent $1,200 on vehicle-related expenses.

x $1,200 = $240

When we divide 2,000 by 10,000, we get 0.2 . Multiplying that by $1,200 gets us 20% of the money you spent on your car last yearâor $240. So you can deduct $240 on your tax return for business mileage.

Types Of Expenses Allowed Under The Actual Expense Method

Why does the actual expense method provide most taxpayers with more savings? It adds up quickly for small business owners when you consider all the expenses that qualify.

These include:

- 𪪠License and registration fees

- ð¿ï¸ Parking

- ð° Most lease paymentsâ

- ðµ Interest on a car loan

Remember, you can only deduct expenses you actually incur. Estimates or approximations of expenses won’t fly with the IRS.

You’ll want to keep all records that support the business expenses you deduct from your tax return. This can be credit card and bank statements, bills, cancelled checks, or even paper receipts that show the dollar amount, date, location, and the reason for the expense.

The IRS asks you to hang on to these records for three years after you file your return.

Read Also: How To Pay Back Taxes To Irs

How Does Mileage Reimbursement Work With Taxes

Mileage reimbursement is made possible with an IRS-approved accountable plan. Essentially, the accountable plan is a set of standards for handling your reimbursements or allowances for employees. In order for mileage reimbursement to be distributed, the accountable plan must satisfy the following requirements:

- Thereâs an established business connection

- Employees provide some form of substantiation for any fees or expenses

- Employees must return excess amounts in reasonable period of time

Granted youâre an employer who permits the use of personal vehicles for business reasons, mileage reimbursement is crucial. This refunded amount will cover yearly fuel, maintenance, and depreciation costs for your employees. Therefore, whether you have a small team or keep growing by the numbers, itâs important to properly track mileage for reimbursement purposes.

How To Claim Tax Deductions Using Irs Mileage Rates

If you’re deducting mileage for moving, medical or charity purposes, you’ll need to itemize on your tax return in order to claim the tax deduction for mileage. Itemizing means youll need to set aside extra time when preparing your returns to fill out the big enchilada of tax forms: Form 1040 and Schedule A, as well as supporting schedules that feed into those forms.

If you’re self-employed, youll claim your mileage deduction as a business expense on Schedule C.

If you file your taxes online, the software will ask about your mileage during the interview process and calculate the deduction.

Read Also: Which Pages Of Tax Return To Print

Choosing The Standard Mileage Rate Or Actual Expense Method

Whether you opt to deduct the standard mileage rate or use the actual expense method depends one which approach saves you more money. Your best bet is to spend one month tracking your vehicle expenses, as well as business mileage on your vehicle. Then do the calculations to find out what you can deduct using each method.

Determine If You Qualify For The Mileage Tax Deduction

Before you claim the mileage tax deduction on your tax return, you must first determine if you qualify for this deduction. Mileage tax deductions can be claimed by small business owners, self-employed individuals, independent contractors , reservists, qualified performing artists, certain government employees, and individuals that travel for volunteer work or medical appointments.

If youre unsure if you qualify, talk to an accountant or tax professional about your specific situation.

Also Check: How Much Taxes Do I Have To Pay For Unemployment

Medical Mileage Deduction 101

Medical mileage deductions are most often related to your trips to the doctor, medical or dental. Since this category is very broad, the IRS made sure to make a list of deductible medical mileage .

Beginning on Jul. 1, 2022, the standard mileage rates for cars are as follows:

- 62.5 cents per mile driven for business use.

- 22 cents per mile driven for medical or moving purposes, up 4 cents from early 2022.

- 14 cents per mile driven in service of charitable organizations.

Deductible medical expenses revolve around health insurance that is usually not covered by the employer, including both uncovered premiums and unreimbursed premiums. These costs include diagnosis, treatments, prevention, cure, or mitigation according to IRS standards.

Taking all this into account, the amount you would be able to save from medical mileage deduction is still pretty vast. That is the reason why the IRS subjected this category to adjusted gross income limitation .

Deduction Under The Actual Expenses Method

To find the amount of your deduction under the actual expenses method, you first have to figure out how much of all the driving you did that year was for work.

12,000 business miles / 18,000 total miles = 66.7%

Next, you multiply that percentage by your total car expenses.

$16,805 expenses x 66.7% = $11,203

Read Also: Can I File My Past Taxes Online

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

The Standard Mileage Rate Method

The standard mileage rate method is a much simpler way of calculating the business use of your car. It does not require you to track individual purchases and save receipts. Instead, you simply keep track of your mileage for the tax year.

As with other tax deductions, you must determine the percentage of your mileage that applies to your business.

- If half the miles you drive are for business and half are for personal use, you will multiply your total mileage by 50% to arrive at the business portion .

Once you have determined your business mileage for the year, simply multiply that figure by the standard mileage rate.

For the first half of 2022 the rate is 58.5 cents per mile and increases to 62.5 cents per mile for the second half of 2022. Carrying through the example above assuming equal amounts of driving during the year:

2,500 business miles x $0.585 plus 2,500 business miles x $0.625 = $3,025 standard mileage deduction.

Uber makes it easy to track your online miles. The mileage reported on your Tax Summary includes all the miles you drove waiting for a trip, en-route to a rider, and on a trip. This is a good starting point for calculating your total business miles.

- You can add to this figure the business miles you drove without passengers, picking them up or to a central location after dropping them off.

- Remember to log only the miles driven for your business.

- No matter how loudly that slice of pizza called your name, you cannot deduct the miles you drove to pick it up.

Recommended Reading: Is Doordash Worth It After Taxes

Does Mileage Reimbursement Get Taxed

As mileage professionals, we constantly get asked what items fall under taxable income. And our answer to that question is often the same â it depends! When an employee drives a personal vehicle for work, a company will typically reimburse them for auto-related expenses. This is commonly known as mileage reimbursement. But what stumps a number of employees is whether mileage reimbursement counts as taxable income. That is why weâve clarified any misunderstandings of the IRS mileage reimbursement rules below.

Can You Use Either Deduction Tracking Method

If you use standard mileage in your first year of driving for Uber or Lyft, then you can choose whether you want to use actual car expenses or standard mileage in the future. If you use actual expenses the first year, then you must continue to use actual car expenses for as long as you drive with that vehicle. The exception is leased carswhatever method you pick the first year you must stick with for the duration of the lease period.

Recommended Reading: Are Donations To Public Schools Tax Deductible

What Does This Mean For Delivery Drivers

This depends on the company. If the delivery driver is a W-2 employee with the company, they will not be able to deduct mileage on their taxes. However, if the delivery driver is employed as a contractor and keeps mileage logs, they can deduct business miles. They can also deduct the business use of other things, including parking, tolls and mobile phone usage.

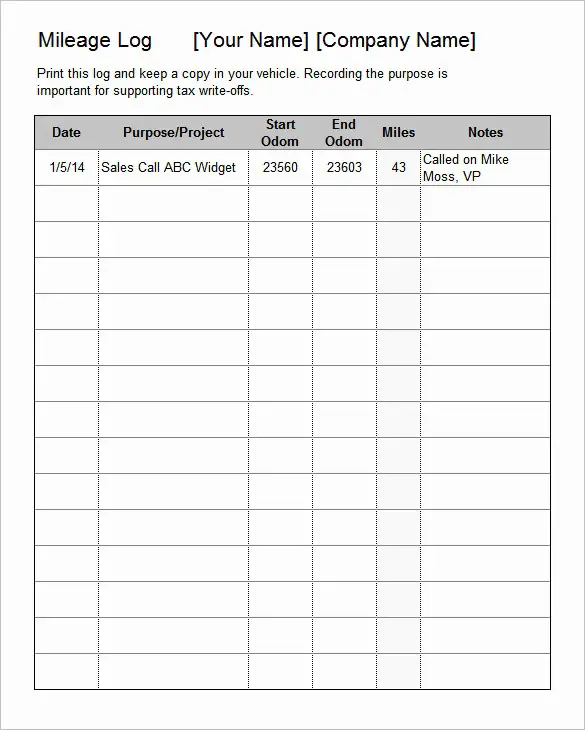

Track Your Business Mileage

To claim mileage deductions on your next tax return, you must first keep accurate records of your mileage. For decades, people have been tracking their business mileage with pen and paper.

But luckily for you and tax professionals everywhere, technology has advanced, and now there are mileage tracking apps to make recording business mileage easier than ever. Mileage Tracking is available within the FreshBooks iOS app or FreshBooks Android app. You can also use a stand-alone mileage tracking app like Everlance, which automatically and reliably tracks business mileage, then compiles all your mileage tax deduction data into IRS-compliant reports.

If youre a business owner, its also a good idea to put specific requirements in place for your employees mileage logs. You can to distribute to your staff so theyre aware of whats expected from their reports if they track mileage manually.

IRS STANDARD MILEAGE RATE

The IRS Standard Mileage rate is the standard mileage reimbursement rate set by the IRS each year so that employees, contractors, and employers can use it for tax purposes. This rate fluctuates yearly and applies to vehicles, including cars, trucks, and vans.

For the 2021 tax year, the rates are:

- 56 cents per mile for business miles driven

- 16 cents per mile driven for medical or moving purposes

- 14 cents per mile driven in service to a charitable organization

Read Also: Can You Pay Property Taxes Online