Q I Am An Indian Resident Taking Up Employmentabroad I Want To Know Whether I Am Eligible To Claim Exemption Of Income Under Nri Category

As per the tax laws in India, you need to first determine your residential status. If you fallunder the Non Resident category then all the provision which are applicable to a Non Residentwill be applicable on you as well. Thus if, your overseas income is transferred to your NRaccount in India, then it will not be taxable, if your residential status is NRI.

Documents Required For E

You do not need to attach any documents with your ITR Form unless required to do so by order of the Income Tax Department. However, the taxpayer must keep some important documents ready with him/her for a smooth e-filing experience. Some key tax documents for easy income tax e-filing are as follows:

- Profit and Loss Statement

- All investment documents

- Home loan interest certificate, etc.

Why Filing A Tax Return In India Is Important

The Income Tax Act 1961, obligates certain eligible persons to file their income tax returns once a year. Filing of Income Tax Return legitimize your earnings and investments whereas non-filing means that you have not disclosed your eligible income which is required to be disclosed as per law, which becomes your Black Money. Also, by filing your Income Tax Return you can get an income tax refund, if you have paid excessive taxes to the government. Further, your Income Tax Return plays a crucial role in the time of applying for loans, credit cards, etc.

Read Also: Look Ein Number

Why Should You File

Many think that filing tax returns is optional and therefore dismiss it as unnecessary and burdensome. Filing tax returns is an annual event and is a moral and social duty of every responsible citizen.

Filing returns is a sign that you are responsible

The government mandates that individuals who earn a specified amount of annual income must file a tax return. Failure to pay income tax and file the income tax return will invite penalties from the Income Tax Department.

Those who earn less than the prescribed level of income can file their income tax return voluntarily.

Your loan or credit card company may want to see your income tax return

If you plan to apply for a home loan in future it is a good idea to maintain a steady record of filing income tax returns as the home loan company will most likely insist on it as a proof of steady income. In fact, you may even consider filing your spouses returns if you want to apply for a loan as a co-borrower. Even a credit card company may insist on proof of income tax return before issuing a credit card.

Financial institutions may insist on seeing your returns over the past few years before transacting with you. In fact, the government may make it mandatory for them to do so, thereby indirectly nudging individuals to file returns regularly even when its voluntary.

If you want to claim adjustment against past losses, a return is necessary

Filing income tax returns may prove useful in case of revised returns

What Is The Latest Amendment Introduced U/s 234f Ie Fees For Filing Of Income Tax Return After The Due Date And Other Consequences Of Non

With a view to improvising tax compliance and effective utilization of information in tax administration, it is important that returns are filed within the due dates. Keeping this in view the law imposes certain fees u/s 234F in case the returns are not filed on time, these are as under:-

If a return is filed on or before the due date i.e. 31st July* – No FeesIf a return is filed after the due date but before 31st Dec.*- Upto Rs. 5,000

NOTE:- In case total income is up to 5 Lacs then the amount of penalty will be Rs. 1,000 in all cases irrespective of the timing of the filing of your return after the due date.

Further, provisions related to fees for delayed filingof income tax returns are applicable from Financial year 2018-19 onwards only.

Recommended Reading: Do I Need To File Taxes For Doordash

Here Are 10 Simple Steps To File Your Income Tax Online:

Taxpayers can log onto Income Tax portal eportal.incometax.gov.in and register through their PAN Card.

After registration, click on the tab e-file and then on File Income Tax Return.

This will allow them to choose the assessment year and whether they want to file it online or offline.

Once the assessment year is selected, the taxpayers can choose to file their returns as an individual, a Hindu Undivided Family or Other.

After selecting the category, they will be required to choose an ITR form. ITR forms 1 and 4 cover salaried individuals, while ITR form 2 is filed by individuals and HUFs who do not have income from a business or profession.

ITR 1 covers income from salary, one house property, and other sources , while ITR 4 covers all of this plus presumptive business income.

Those who have to file income tax returns can calculate their income tax liability as per the provisions of IT laws. Form 26AS is used to summarise TDS payment for all four quarters of the assessment year. The Income Tax Department has defined categories under which taxpayers fall.

After this, they have to fill in the details of bank account and validate it.

This will lead the taxpayers to a page where all the information is filled in, and they must check if the details are correct.

The final step is to e- verify the returns and submit the entry.

Convenient Application For Loans

An income tax return is more than just a financial statement it specifies your annual earnings as well. As a result, banks and NBFCs often require copies of ITRs for granting loans, such as a home loan or vehicle loan. Moreover, filing returns despite having no taxable income increases the chances of loan approval compared to an individual with the same income but no ITRs.

You May Like: Do You Pay Taxes For Doordash

What Will Happen In Circumstances Where I Have Missed The Due Date Or Made A Mistake While Filing My Income Tax Return

Missed the due date

You can file a belated return 3 months prior to the end of relevant assessment year i.e. For FY 2021-22 the filing date of it would be till. but with the payment of late fees u/s 234F).

Made a Mistake

You can Revise your already filed ITR three months prior to the relevant assessment year i.e. For FY 2021-22 filing the date would be 31st Dec 2022.

From here check all the due dates to stay one step ahead of Income Tax

Top 5 Websites For Filing Income Tax Returns Online In India

Most of us have been busy collecting the documents required to do our annual tax calculations. The time is here to use these documents to prepare the Income Tax Return and file it with the Income Tax Department . With an intent to collect more information from the taxpayers and enable system-assisted processing of returns, ITRs have been made more comprehensive and detailed.

While it has made the work of ITD relatively easier, taxpayers have been finding it difficult to fill the ITR forms by themselves and thus, feel the need to contact professionals like CAs, etc. However, with the advent of technology, several websites have emerged offering a helping hand for such taxpayers to enable them to file their ITRs cost-effectively.

Here are 5 best websites to file taxes online:

Don’t Miss: How To Do Taxes For Door Dash

How To File Your Income Tax Return Online

First and foremost have all the soft copies, scanned copies of all the required documents like your bank statement and last year’s return. You should also fill out income tax Form 16.

- Step 1: Submit all the required documents to our experts

- Step 2: Through the registered portal our experts will file your income tax returns online

- Step 3: ITR form will be selected based on your category, and experts will fill in all required information and claim any applicable exemptions

- Step 4: Our experts will inform you regarding the tax payable amount if any after all exemptions

- Step 5: Subsequently your income tax returns will be filed without any hassle.

What Is Efiling Of Income Tax Return

E-filing of Income-tax return is filing your Income-tax return online., There are two ways to file an Income-tax return in India:

- One is the traditional method i.e. offline in paper format, where the return is submitted physically to the IT department. and,

- The other one is the electronic mode, where you can submit your return online through the income tax website or by following a few simple steps on Tax2win.

As per the latest announcement by the Income Tax Department, income tax returns can be filed through online method only. However, the super senior citizens are allowed to use the offline paper mode.

Don’t Miss: Do I Have To Pay Taxes On Plasma Donation

Reporting Capital Gains Required

-

There is a requirement of a stock trading statement with purchase details, in case there are capital gains from selling the shares

-

If a house or property is sold, you must sought sale price, purchase price, details of registration and capital gain details

-

Mutual fund statement details, purchase and sale of equity funds, debt funds, SIPs and ELSS

What If I Do Not File

In case you do not file, the Income tax Department will send you a notice asking you to file your return and may ask you to pay a penalty for not filing your income tax return. You will not be given your refund. If you are found to owe the government taxes, the interest on the base tax keeps adding up till you pay.

If you are found to owe the government taxes money, then the interest keeps adding up till you pay. A penalty may also be levied.

A new section 234F has been inserted in Income Tax Act, 1961 with effect from Assessment Year 2018-19 . Under this section, fee is levied if the Income-tax return is not filed within due date. Earlier penalty for delay in filing of return was levied at the discretion of Assessing Officer. But now, the same is payable before filing of Income-tax return.

Also Check: Do You Have To Pay Back Taxes For Doordash

How To File Income Tax Return Online For Salaried Employees

Filing income tax returns promptly is an all-important financial exercise for salaried individuals in India. However, the procedure for filing returns remains fenced by several misconceptions and a general lack of information. So today, we shed light on this subject by answering all queries on how to file income tax returns online for salaried employees.

Lets get started!

What Documents Are Needed To File Itr

Although documents differ with the income source still there are a few documents that are common while filing ITR. Also, note that you do not need to submit/upload any of the documents on the website, these are advised to be kept with you so that required information can be filled correctly, your time is saved and common errors can be avoided)

PAN Card- PAN Number is the mandatory requirement while filing the Income Tax Return. Your name & DOB on ITR should be the same as written in a PAN card.

Aadhaar Card- The government has also made it compulsory for all the taxpayers to use Aadhaar while filing ITR.

Bank Account Statements- Just to find Incomes, Interest on Saving bank account etc. So that you do not miss reporting of any income in ITR.

Bank Account Details- Your details of all the bank accounts i.e Bank account number, IFSC code and Bank Name is needed to be mentioned while filing ITR.

Challan Details- It includes details such as the challan no., BSR code, date, amount of payment of Advance Tax/ Self Assessment Tax etc.

Original Return/Notice- If an individual is filing a revised return or a return is filed in response to notice received, then he is required to fill in the details of the original return and details of notice.

Check the complete list of documents for ITR filing when you have income from salary, house property, capital gains and other sources.

You May Like: Doordash State Id Number For Unemployment California

Income Tax Efiling Guide: Everything You Need To Know

5 Minute |

The total income tax returns filed for 2017-2018 increased by 26%, with 99.49 new tax filers, says an article in The Economic Times. This substantial increase in taxpayers shows that people are becoming more responsible citizens of India. And, with the availability of e-filing of income tax, it has become much more convenient for people to fulfil this responsibility.Electronic filing or e-filing is the term used for submitting your income tax online. E-filing is relatively easier, quicker and more confidential, as compared to the conventional method. Now, you can stop worrying about the tedious paperwork. Here are some easy steps that tell you how to file income tax online.

Faqs On How To File Itr

1. What is the offline method to file ITR?

A taxpayer can file ITR offline with the help of upload XML method.

2. What is the manually procedure to file ITR offline?

The taxpayer wants to Choose and Download the right Income Tax Form. Fill in all necessary details and convert the file to XML Format. Upload XML file in IT portal and Choose one of the available verification modes Aadhaar OTP, EVC or sending a manually signed copy of ITR V to CPC.

3. What are the different forms that are available as per the Income Tax Law?

The different forms that are available as per the Income Tax Law are ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, ITR7 and ITR-V.

4. Should I attach any documents when I file the Income Tax Returns?

No, you need not submit any documents when you file the Income Tax Returns. However, the relevant documents must be retained and must be provided to tax authorities if requested.

5. Does the Income Tax Department provide the e-filing utility?

Yes, the e-filing utility has been provided by the Income Tax Department. The e-filed returns can be generated, and then be furnished electronically.

6. What is the difference between e-payment and e-filing?

The process of electronically furnishing the returns is e-filing. E-payment is the payment of tax online by using State Bank of Indias debit/credit card or by net banking.

6. Will I face any criminal prosecution in case the tax returns for my taxable income is not filed?

Recommended Reading: How Much Money Should I Save For Taxes Doordash

Last Date For Filing Income Tax Returns

So if you come under the taxable income make sure to file it before the last date.

- Individuals or a firm that are not liable for audit should file income tax returns before July 31 of every year.

- An institution or a company that is liable for an audit should file its IT returns before September 30 of every year.

- Individuals and companies filing belated returns should complete before March 31 of every year

What Is The Tds Rate On Salary For Fy 2021

5% TDS is levied on a taxable income of 2,50,000 5,00,000. Salaried individuals with a taxable income between 5,00,000 10,00,000 are subject to pay TDS at the rate of 20%. The TDS rate increases to 30% for a taxable income of over 10,00,000.

5% TDS is levied on a taxable income of 2,50,000 5,00,000. Salaried individuals with a taxable income between 5,00,000 10,00,000 are subject to pay TDS at the rate of 20%. The TDS rate increases to 30% for a taxable income of over 10,00,000.

Please try one more time!

Also Check: How To Get Tax Information From Doordash

How To File File Nil Income Tax Return/zero Income Tax Return

The process of filling Nil ITR is the same as filing a regular ITR. You can file nil ITR online through e-filing. And you can also e-file your itr using the upload xml method.

Requirements:

Guide On How To File Itr Offline For Super Senior Citizens

Super senior citizens are given the option to file ITR offline during the financial year. Another instance where the ITR can be filed offline is if an individual or HUF has an income of less than Rs.5 lakh and is not entitled to receive a refund.

The step-by-step procedure to file returns offline is mentioned below:

Also Check: Taxes Taken Out Of Paycheck Mn

How To File File Nil / Zero Income Tax Return Offline

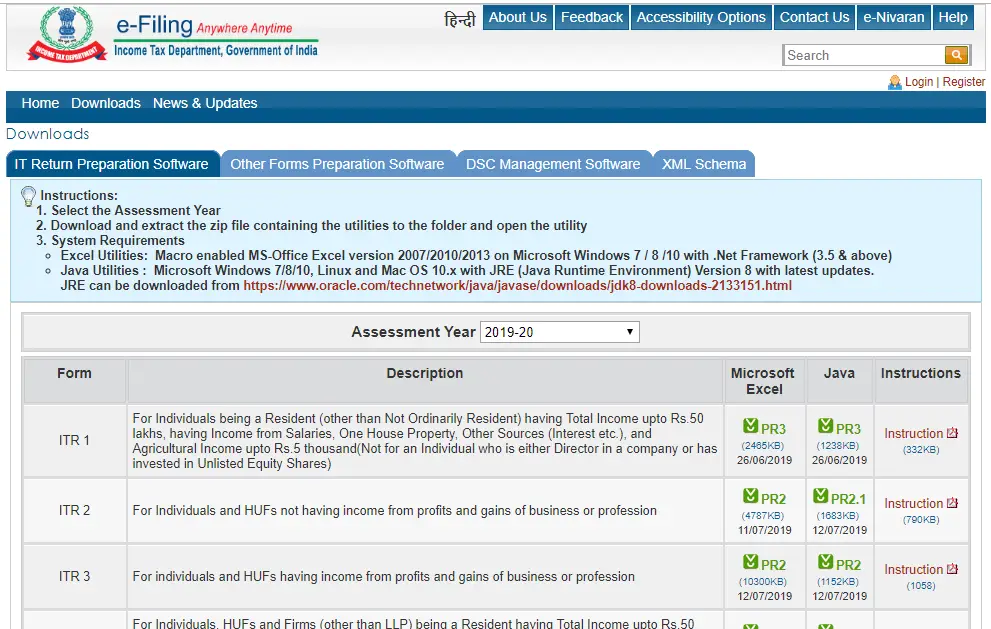

To E-file the Itr Using the Upload Xml Method, the User Must Download either of the Following Itr Utility:

- Excel Utility

- Java Utility

Perform the following steps to download the Java Utility or Excel Utility, then to generate and Upload the XML: