Should You Call The Irs

Expect delays if you mailed a paper return or responded to an IRS inquiry about your 2020 return. Some returns require special handling such as those that require correction to the Recovery Rebate Credit amount or validation of 2019 income used to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- “Where’s My Refund” tells you to contact the IRS

Do not file a second tax return. If youre due a refund from your tax year 2020 return, you should wait to get it before filing Form 1040X to amend your original tax return.

How To Use The Irs2go App To Track Your Return

The IRS2Go app is available for both iOS and Android.

The IRS also has a mobile app, IRS2Go, which checks your tax refund status. It’s available for both iOS and Android and in English and Spanish. Using it, you’ll be able to see if your return was been received and approved and if a refund was sent.

To log in, you’ll need your Social Security number, filing status and the expected amount of your refund. The IRS updates the app overnight, so if you don’t see a status change, check back the following day.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Needs a correction to the Recovery Rebate Credit amount

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.

- Includes a Form 8379, Injured Spouse Allocation PDF, which could take up to 14 weeks to process

- Needs further review in general

We will contact you by mail when we need more information to process your return. Recovery Rebate Credit corrections and 2019 income validation does not require us to correspond with you but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund and in some cases this work could take 90 to 120 days.

Read Also: Turbo Tax 8962

What If Im Looking For Return Info From A Previous Tax Year

The Wheres My Refund tool lists the federal refund information the IRS has from the past two years. If youre looking for return details from previous years, youll need to check your IRS online account.

From there, youll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices youve received from the IRS and your address on file.

When Can I Expect My Alabama State Tax Refund

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

You May Like: Does Doordash Provide W2

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measure to prevent fraudulent returns and this has increased processing times.

Recommended Reading: Does Doordash 1099

Call The Irs Directly

For general status updates on your tax refund, it’s probably not a great idea to call the IRS. Its call center is extremely backlogged, which means you might encounter long wait times. And even if you do end up getting through, it may be an AI-powered robot rather than a human being.

The IRS recommends calling only if you havent received your refund after 21 days of the date you e-filed or if one of the other tax-refund status tools tells you to contact the IRS.

Its likely youll only need to call the IRS if something is wrong with your return, and in that case, the IRS will probably contact you first.

How Long Does It Take To Get A Tax Refund

The IRS usually issues federal tax refunds within three weeks. Some taxpayers may have to wait a while longer, especially if there are errors in your return.

When an issue delays your return, its resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to the IRS website.

The date you receive your tax refund also depends on the method you used to file your return.

If your tax refund goes into your bank account via direct deposit, it could take an additional five days for your bank to put the money in your account. This means if it takes the IRS the full 21 days to issue your check and your bank five days to deposit it, you could be waiting a total of 26 days to get your tax refund. Online services like Venmo and Cash App can deliver your tax refund a few days sooner since there’s no waiting period for the direct deposit.

If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

Recommended Reading: Csl Plasma Taxes

About Where’s My Refund

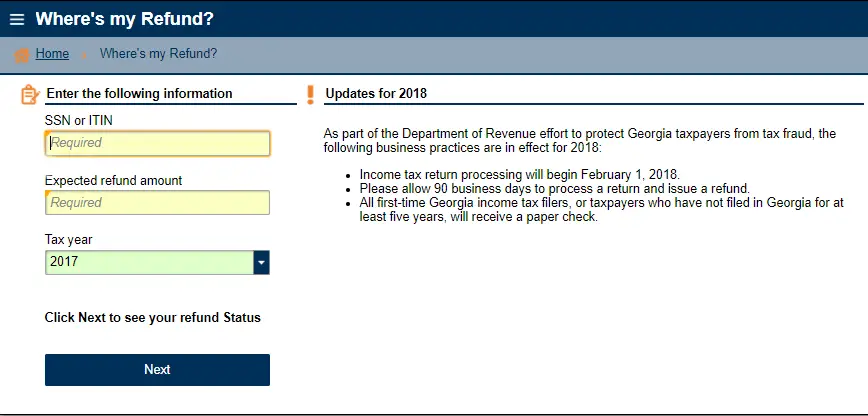

Use Where’s My Refund to check the status of individual income tax returns and amended individual income tax returns you’ve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also recommends filing electronically to improve processing time.

Read Also: Doordash Income Tax

Does Alabama Direct Deposit Tax Refunds

Benefits of Direct Deposit Last year, two thirds of Alabama taxpayers opted to have their income tax refunds direct deposited. The direct deposit system allows you to set up an electronic deposit of your payment into the account of your choice, by providing your banks routing number and your account number.

Wheres My State Tax Refund Nebraska

Its possible to check you tax refund status by visiting the revenue departments Refund Information page. On that page you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

You May Like: Www.michigan.gov/collectionseservice

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

Refunds Things To Know

- Direct Deposit If your bank refuses a direct deposit of a refund, we will mail a paper check to you at the address listed on your return.

- Refund Applied to Debt North Dakota participates in income tax refund offset, which provides that an individual income tax must be applied to reduce a debt you may owe to a state or federal agency. The agency to which the refund was used to reduce debt should be identified in the letter you receive. Contact the specific agency identified for more information.

Read Also: How Much Does H& r Charge

Is There A Delay In Tax Refunds

Because of the pandemic, the IRS ran at restricted capacity in 2020, which put a strain on its ability to process tax returns and created a backlog. The IRS is open again and currently processing mail, tax returns, payments, refunds and correspondence, but limited resources continue to cause delays.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Read Also: Tax Preparer License Requirements

Common Reasons That May Cause Delays

- We found a math error on your return or have to make another adjustment. If our adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. We will return your State tax return for you to complete using the correct form type before we can process your return. View example of form types.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. We will contact you to request this information so we can process your return. Please respond quickly so we can continue processing your return.

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund.

Ways To Get Your Refund Faster

Theres no magic wand that will make your refund arrive instantly. But there are a couple of steps you can take to potentially speed up the process.

Read Also: Opi Plasma Center

Don’t Miss: Doordash 1099 Form

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

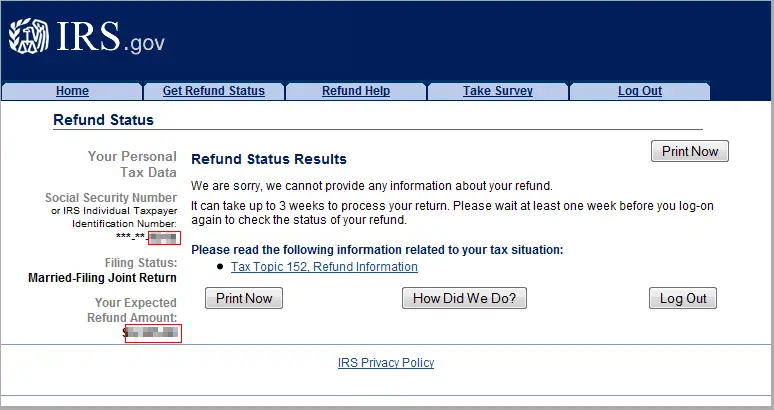

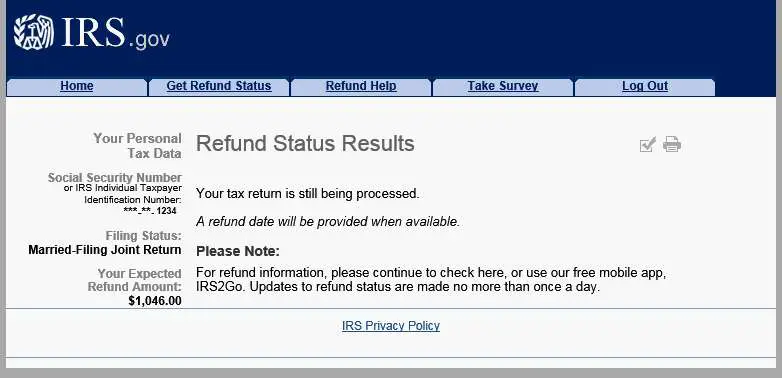

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Ways To Make The Tax Refund Process Easier

Find your tax refund fast by proactively checking your IRS federal tax return status. Before filing and using the IRS Wheres My Refund portal to track your 2020 government return, consider:

- Reviewing your return carefully. Mistakes can delay your returns progress on the tax refund tracker. Be sure to review your information carefully before filing with the IRS.

- Filing early. The earlier you file, the sooner you can check the status of your IRS federal tax return. Early filing also provides more time to deal with issues should something go wrong.

- E-Filing your return. Instead of spending 6-8 weeks wondering wheres my tax refund from the IRS?, do yourself a favor and file electronically. E-Filed government returns are typically processed in under half the time as paper returns.

- Opting for direct deposit. Avoid waiting for your check by having your IRS refund deposited into your account. Once the WMR reads Refund Approved, your money will be ready to spend.

- Tracking your 2020 refund right away. Staying up-to-date on your return ensures youre in the loop every step of the way.

You May Like: Doordash Driver Tax Information

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the Check Your Individual Tax Refund Status page to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states Department of Taxation.

What If I Filed My Tax Return On Time But Havent Gotten My Refund

There are several reasons why your tax return may not have been completely processed yet, resulting in a delayed refund. You may have made errors on your return that required manual processing, or simply included an uncommon form. Regardless of the reason for the delay, if the IRS does not issue your refund within 45 days after receiving your return, the agency is required to start paying interest on your refund amount.

The 45-day time period starts on either the day that the tax return was due, or when your processible tax return was received by the IRS, whichever is later. If you electronically filed on time, the count started on April 18 if you filed a paper return, it began on the day that the IRS marked your return as accepted.

The bad news is that any IRS interest you receive with your refund will be taxable income, much like the interest you would earn from a checking or savings account. The good news is that interest on overpayments to the IRS will rise to 5% starting July 1. The IRS interest rate for overpayment is set at the federal short-term interest rate plus 3 percentage points. With the Federal Reserve raising rates by 0.75% in early June, a full point increase to the IRS interest rate will take effect next month.

You May Like: 1040paytax.com Legitimate

Recommended Reading: Doordash Taxes California

Check Refund Status Online

You can check the status of your refund on Revenue Online. There is no need to login. Simply choose the option “Tax Refund for Individuals” in the box labeled “Where’s my Refund?”. Then, enter your SSN or ITIN and the refund amount you claimed on your current year income tax return. If you do not know the refund amount you claimed, you may either use a Letter ID number from a recent income tax correspondence from the Department.

You will receive the Letter ID within 7-10 business days. After we have received and processed your return, we will provide you with an updated status as the refund moves through our system. It may take a few days for an updated status to appear. Please check back often to verify where your return/refund may be in our process.

The information in Revenue Online is the same information available to our Call Center representatives. You can get the information without waiting on hold.

What If I’m Looking For Return Info From A Previous Tax Year

The Where’s My Refund tool lists the federal refund information the IRS has from the past two years. If you’re looking for return details from previous years, you’ll need to check your IRS online account.

From there, you’ll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices you’ve received from the IRS and your address on file.

Also Check: How To Get Tax Form From Doordash