How The Ez Could Cost You

Even if you can file 1040EZ, it might not be the best move.

Take the case of 2016 tax filer Joe P. Taxpayer. Joe finished college last year and got his first full-time job making $40,000. Hes single, renting and has no investment income. A perfect 1040EZ filer, right? Sure, if youre Uncle Sam, because Joe will overpay his taxes by using the short form.

Why? The Form 1040EZ doesnt offer Joe some valuable tax breaks found on the other two returns.

Joe has a student loan. By filing Form 1040A, he can subtract from his income the $2,500 interest he paid on that debt. He cant do that with the shortest form. Joe also started planning for his retirement by putting the maximum $5,500 into a traditional individual retirement account. Because his new employer doesnt offer a company retirement plan, Joes deductible IRA contribution can reduce his taxable income further, but only if he files the longer form.

Joe also would get the chance to reduce his actual bill if he files the longer 1040A. If Joe took a course to improve his job skills and was not reimbursed by his employer for the cost, he could claim the Lifetime Learning tax credit its also available on the long Form 1040. The better tax news for Joe is that a credit allows you a dollar-for-dollar reduction of what you owe the IRS. But the only tax credit shown on the 1040EZ is the earned income tax credit, available only to low-income taxpayers.

As A Sole Proprietor You Have A Different Income Tax Filing Deadline

Self-employed people such as sole proprietors have until to file their income tax. This applies to spouses too, so if your spouse or common-law partner is self-employed, you also have until June 15th to file. However, note that the payment due date for any balances owing on your income tax was April 30th. If you would like to have an expert take all the guessing work off your hands and do your return from start to finish then TurboTax Live Full Service for Self-Employed* is the right service for you.

How do I know if I have whats considered business income?

Are you unsure about whether the Canada Revenue Agency would consider you to have business income or not? See two of our TurboTax blogs that will provide you with more detailed information on understanding your business obligations at tax time.

How To Fill Out A Form 1040

If you’re filing your return using tax software, you’ll be asked to provide information that is translated into entries on your Form 1040. The tax program should then autopopulate Form 1040 with your responses and e-file it with the IRS. You can print or download a copy for your records.

If you prefer to fill out your return yourself, you can download Form 1040 from the IRS website. The form can look complex, but it essentially does the following four things:

Asks who you are. The top of Form 1040 gathers basic information about who you are, what tax-filing status you’re going to use and how many tax dependents you have.

Calculates taxable income. Next, Form 1040 gets busy tallying all of your income for the year and all the deductions you’d like to claim. The objective is to calculate your taxable income, which is the amount of your income that’s subject to income tax. You consult the federal tax brackets to do that math.

Calculates your tax liability. Near the bottom of Form 1040, you’ll write down how much income tax you’re responsible for. At that point, you get to subtract any tax credits that you might qualify for, as well as any taxes you’ve already paid via withholding taxes on your paychecks during the year.

Read Also: Ccao Certified Final 2020 Assessed Value

Who Can File A 1040ez

A taxpayer must meet all of the following to qualify to file Form 1040EZ:

- The taxpayers filing status must be single or married, filing jointly.

- The taxpayer cannot claim any dependents.

- The taxpayer cannot claim any adjustments to income

- The taxpayer can only claim theearned income tax credit . No other credits can be claimed with the Form 1040EZ.

- The taxpayer must be under age 65 and not blind at the end of the tax year.

- The taxpayers taxable income must be less than $100,000.

- The taxpayers income consisted of only wages, salaries, tips, taxable scholarship or fellowship grants, unemployment compensation, or Alaska Permanent Fund dividends.

The taxpayers taxable interest must not be over $1,500.

To claim a single status on the Tax Form 1040EZ, the taxpayer must be:

- Not married.

- According to state law, they were legally separated under a decree of divorce or separate maintenance.

- Widowed before the first day of the tax year and not married during the tax year.

To claim a married filing jointly status on Tax Form 1040EZ, the taxpayers:

- Must be considered legally married as of the last day of the applicable tax year

- Or be considered legally married as of the last day of the tax year, and the taxpayers spouse died before the return was filed.

If you qualify for the Form 1040EZ, it may still be more beneficial to file the Form 1040 to make income adjustments or credits that you may be eligible for.

Get Ready For Next Year

To business owners, every fiscal year provides important lessons on various issues, including taxes. Maybe there are certain changes you can make to reduce your tax liability for the coming year? You can start planning for meaningful adjustments as early as possible. You can have folders for each category of tax information, from income and expenses to retirement contributions. This way, you wont have to start from square one organizing your tax data for next year.

Once you master the process, tax filing becomes less wearisome and takes less of your time. If you are looking for resources to grow your company, contact our team at Economic Development Collaborative today!

You May Like: How To Find Employers Ein

What Is A 9465 Form

If you cannot pay your taxes in full when you file, you can use Form 9465 to request a monthly payment plan. If you can pay within 120 days and you owe less than $50,000, you can request a payment plan online, too. Such payment plans will incur a user fee, accrued penalties and interest, but low-income taxpayers may have the user fee reduced, waived or reimbursed. User fees are usually lower when you set up a payment plan online. While a payment plan is in effect, late-payment penalty accruals are cut in half. If you can pay your taxes in full within 120 days, you can apply online for the IRSs payment plan or call the IRS at 800-829-1040 to avoid the fee associated with setting up an installment agreement.

Best for:People who need more than 120 days to pay their taxes in full and owe more than $50,000. If you want to set up a monthly payment plan, the IRS encourages you to request one online.

Do You Owe Taxes On Unemployment Benefits

Yes, unemployment checks are taxable income. If you received unemployment benefits in 2021, you will owe income taxes on that amount. Your benefits may even raise you into a higher income tax bracket, though you shouldn’t worry too much about getting into a higher tax bracket.

People who file for unemployment have the option to have income taxes withheld from their unemployment checks, and many do. If you elected to do this, you have little to worry about.

What if you didn’t choose to have income taxes withheld from your unemployment checks? Don’t panic. If you were employed during much of the year, you may simply see a reduced tax return or a very small tax bill when you file.

Don’t Miss: How Does Doordash Do Taxes

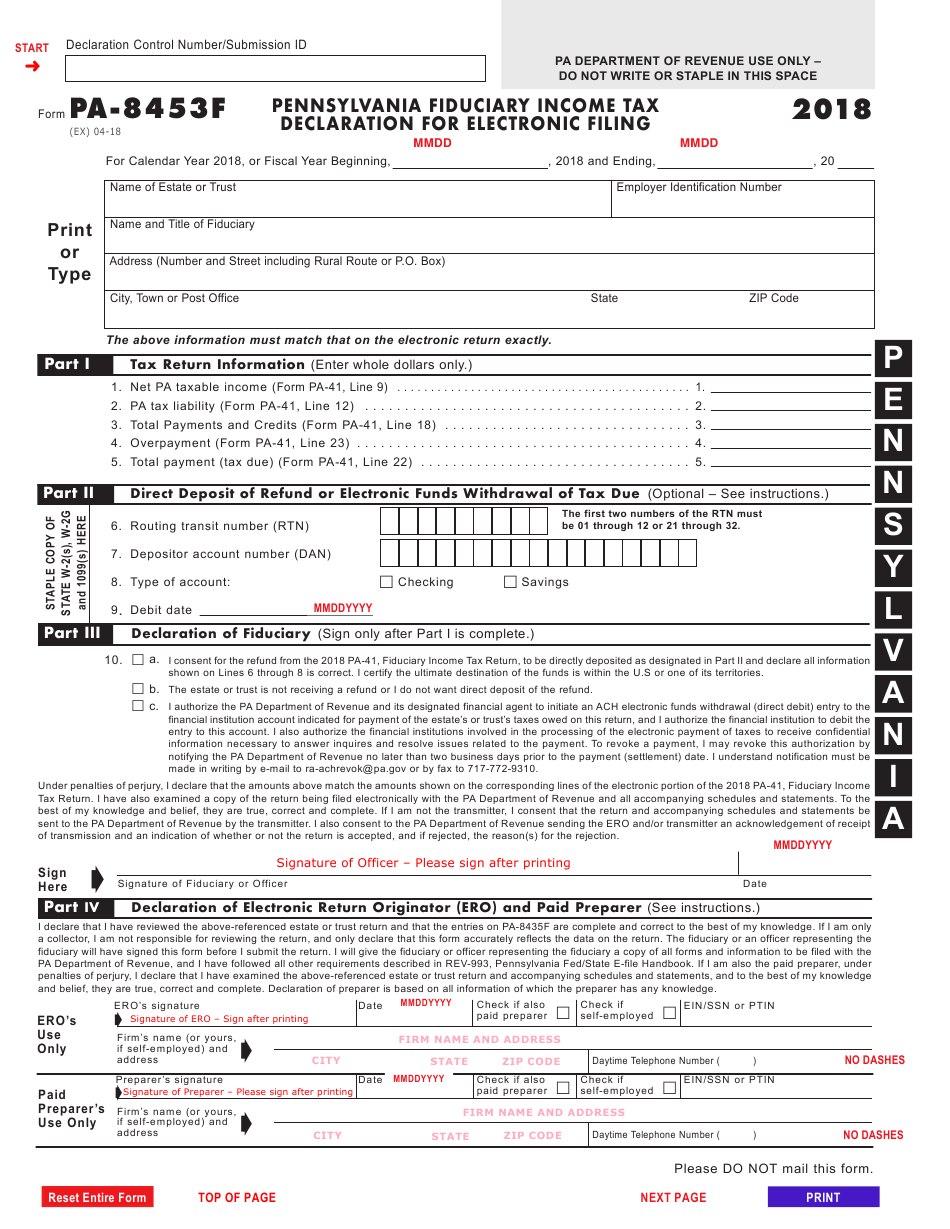

Is Filing Electronically Safe

The appeal of electronic filing is obvious, but is it safe? Your tax filing contains some of the most sensitive data about you: where you live, how much you earn, how many dependents you have, your Social Security number, how high your medical expenses were, and how much you gained or lost from selling investments.

Can you trust the tax software companies and the government to have employed best-in-class security to protect your data both as its being transmitted and while its being stored? If you use online tax software, your information is also being stored in the cloud, creating another point of vulnerability.

For this reason, some people prefer to purchase downloadable software so their data is stored only on their own computer. That way, they are vulnerable to one less data breach possibility.

In this era of data breaches and identity theft, security and privacy questions are important to ask. The table below shows what security features online tax services provide as of January 2021 for the 2020 tax return season. Note that the absence of a feature in the table doesnt necessarily mean the software provider doesnt have it, just that the information wasnt available on the companys data security page. Also, while each service describes its encryption practices differently, all appear to be using appropriate methods.

| Security and Fraud Prevention Features in Popular Tax Preparation Software, January 2021 | |

|---|---|

| Software Brand | |

| not advertised | not advertised |

Online Tax Preparation Services

Several websites can help you prepare your federal and state taxes. They tend to target certain types of taxpayers based on how complex your taxes are.

High-end services charge a bit more for their services, but give comprehensive solutions for people who own their own companies, have complex investments, or just need to do some serious number crunching at tax time. Less expensive or free services offer more simplified interfaces for those of us who dont have as many unique details to report to the IRS.

Some web-based services will give you forms one at a time to fill out. Others offer an interview-style interface that asks you questions one at a time about your income, deductions and such. Some services offer tiered levels of complexity with variable pricing.

The IRS website offers a program that waives the tax preparation fees of several popular preparation services. The program is called Free File and is offered only to certain individuals based on your income level, age and other factors. Keep in mind that some companies participating in Free File also offer free or inexpensive return preparation with fewer restrictions if you visit the company website directly instead of through the IRS.

Recommended Reading: How Much Do You Pay In Taxes Doordash

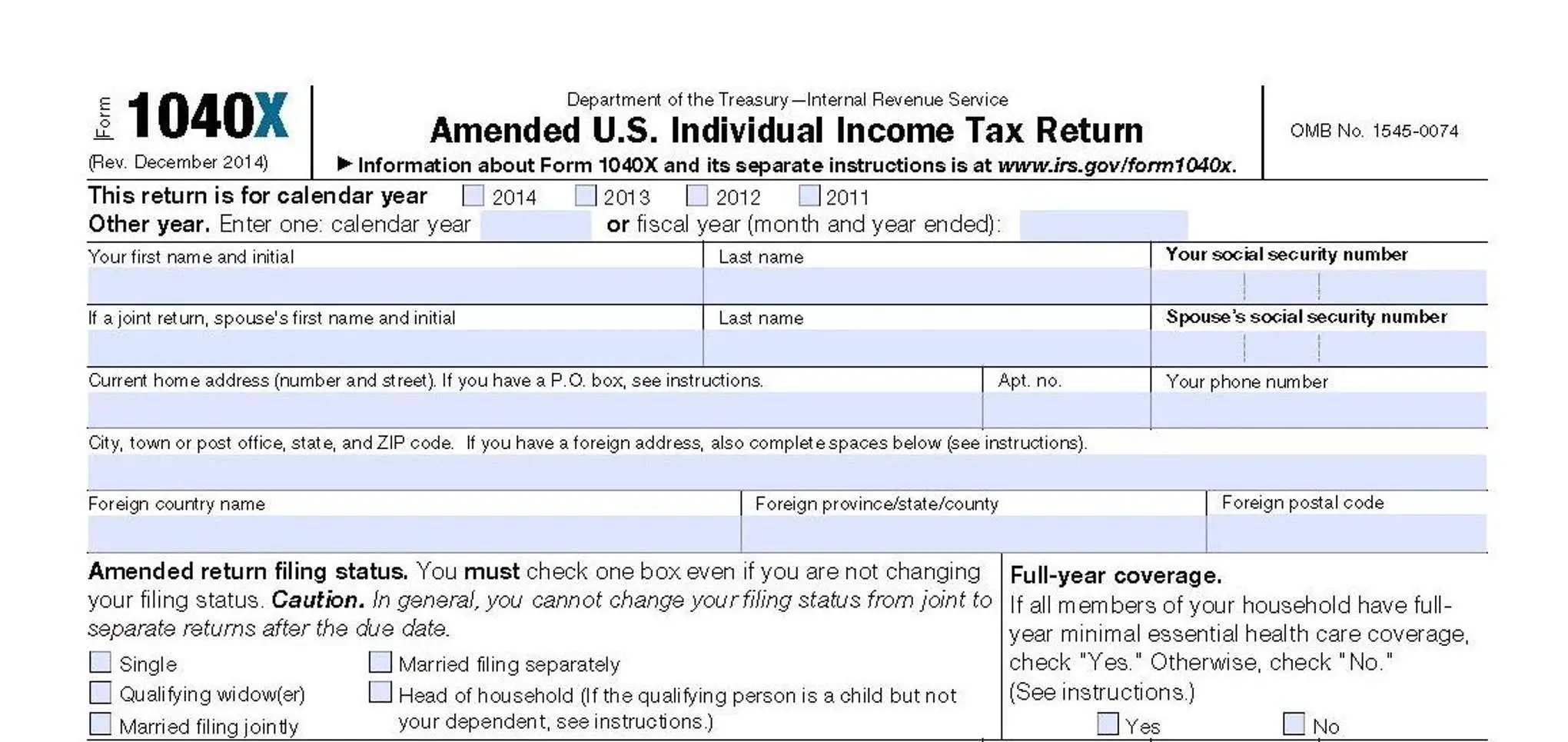

What Irs Tax Form Should I Use And What Are The Requirements For Using Form 1040a Form

Your return can be a little more complex with Form 1040A.

For example, you can have capital gain distributions or distributions from an IRA and still use Form 1040A.

You can claim certain tax credits using Form 1040A, including the credit for child and dependent care expenses, credit for the elderly or the disabled, education credits, retirement savings contribution credit, child tax credit, earned income credit, and additional child tax credit.

You cannot itemize your deductions using Form 1040A.

In addition, some less common tax items prevent you from filing Form 1040A.

Verifying Your Name And Social Security Number

The identifying information section of the W-2 is essentially a tracking feature. If the income you report on your taxes does not match the information on all of your W-2s, the IRS will want to know why. Similarly, the IRS will match the reported payment amounts with your employer’s corporate tax reporting for accuracy.

But most importantly, since the IRS receives a copy of your W-2s, it already knows that you likely have reportable income and may contact you if you fail to file a tax return. If the name or Social Security number on your W-2 is inaccurate, you should immediately report this to your employer to correct.

Also Check: Doordash 1099 Nec

Deadlines For Making Tax Forms Available To You

The IRS has established deadlines by which employers and financial institutions must mail you these forms or make them available electronically. Here are the deadlines for when youre supposed to receive some of the most common forms people need to file their 2020 tax returns.

- 1099-S, Proceeds from Real Estate Transactions Feb. 1

- Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. March 15

What Is A 941 Form

Use Form 941, also titled Employers Quarterly Federal Tax Return, if youre an employer, to report income taxes, Social Security tax or Medicare tax withheld from employees paychecks and to pay the employers portion of Social Security or Medicare tax. Youll need to fill this out four times a year by these deadlines: April 30, July 31, Oct. 31 and Jan. 31.

Best for:Employers.

You May Like: Tax Preparer Licensing

What Parents Need To Know

When it comes to helping your child file their income taxes, you should know the following:

- Legally, your child bears primary responsibility for filing and signing their own income tax returns. This responsibility can begin at any age, perhaps well before your child becomes eligible to vote.

- According to IRS Publication 929, “If a child can’t file his or her own return for any reason, such as age, the child’s parent, guardian, or another legally responsible person must file it for the child.”

- Your child can receive tax deficiency notices and even be audited. If this happens, you should immediately notify the IRS that the action concerns a child.

- According to IRS Publication 929, “The IRS will try to resolve the matter with the parent or guardian of the child consistent with their authority.”

Paper Returns Have Vulnerabilities Too

Its also important to consider how safe it is to submit your tax return by mail. Paper returns can be lost or stolen. Theyre also more susceptible to error. Unfortunately, your private information is vulnerable no matter how you submit your return.

Certain forms cant be e-filed no matter how you complete them. However, most people wont need to file these forms. The most common circumstance when you might have to submit a paper return is if you need to file an amended return.

Besides the possible security riskswhich may be outweighed by features such as convenience and receiving your refund fasterare there any other cons of filing your tax forms electronically?

Read Also: How Much Tax For Doordash

Filing For Educational Purposes

Filing income taxes can teach children how the U.S. tax system works while helping them create sound filing habits for later in life. In some cases, it also can help children start saving money or earning benefits for the future as noted above.

Even if your child doesn’t qualify for a refund, wants to earn Social Security credits, or opens a retirement account, learning how the tax system works is important enough to justify the effort.

Reporting Your Child’s Income On Your Tax Return

Your child might be allowed to skip filing a separate tax return and include their income on your return, but only if:

- Your child’s only income consists of interest, dividends, and capital gains .

- Your child was under age 19 at the end of the year.

- Your child’s gross income was less than $11,000.

- Your child would be required to file a return unless you make this election.

- Your child doesnt file a joint return for the year.

- No estimated tax payments were made for the year, and no overpayments from the previous year were applied to this year under your child’s name and Social Security number.

- No federal income tax was withheld from your child’s income under the backup withholding rules.

- You are the parent whose return must be used when applying the special tax rules for children.

Explain to your child the basics of Social Security and Medicare and the benefits of earning credits in these programs.

Include your child’s unearned income on your tax return by using IRS Form 8814. It’s important to note that doing so could result in a higher tax rate than if the child filed their own tax return. It all depends on the amount of unearned income your child reports.

Also Check: Does Doordash Send You A 1099

Whats The Difference Between Form 1040 1040a And 1040ez

All three forms are basically the same, with one difference. Form 1040EZ is for simple returns.

Still wondering which IRS tax form should I use?

Form 1040A covers a little more information. And the regular Form 1040 lets you report all types of tax information.

All of the forms use the same tables to calculate your income tax liability.

Why Is It Important To Understand Tax Forms

Nowadays, most people file their taxes using websites or other products that do the work of figuring out which forms you need to file and filling them out. But its not always cheap. Many of those services and software like TuroTax or H& R Block charge users depending on which forms they need to use.

For 2020 tax filings , anyone who made less than $72,000 a year is able to file for free as part of the IRS Free File program. Companies including Intuit, which makes TurboTax, H& R Block and others spent millions lobbying to bar the IRS from making its own free filing option while promising to create their own free products. But then, as ProPublica reported, they systematically undermined the truly free options by hiding search results and even though for many, theyre anything but.

If you havent filed yet, we recommend checking out our guide to filing your state and federal taxes completely for free, looking to see if you qualify for the Earned Income Tax Credit or learning how to track your refund. Though the IRS offers the option of paper filing, with the current COVID-19 state of affairs and a massive backlog of paper returns and documents the agency is encouraging taxpayers to file electronically to ensure prompt payment of refunds and avoid filing errors. Most paid and free tax prep services will tell you which forms you need to file, but if youre still confused, see below for a list of the most commonly used tax forms.

Also Check: Do I Have To Pay Taxes For Doordash