B Submit Your Resale Certificates To Printify

1. State-specific resale certificate: You are able to submit a resale certificate to Printify for each state that you collect sales tax so that we do not receive it from you. Your resale certificate will go under review, and, if approved, you will not be charged sales tax on orders shipping to the state that issued the resale certificate. If denied, well let you know why, so you can fix and resubmit it.

2. Uniform sales tax exemption certificate : The MTC is a commission that has developed a uniform resale certificate that is acceptable for use as a blanket resale certificate in 38 states in the USA for sales tax purposes. This means that by using the MTC, you can claim a resale exemption for multiple states. The certificate itself contains instructions on its use. It includes a list of all the states that have indicated to the Commission that an adequately filled form satisfies their requirements for a valid resale certificate. Find out how to apply for the MTC certificate and any specific limitations on its use.

Please submit your resale certificates in your account settings under Indirect Taxes, and our team will review them.

Section 7

Determine Which Products Or Services Are Taxable

Not all products and services are taxable in all states. More states are adding more products and services to the list of taxable items. In addition, states are trying to determine what is a service and what is a product. For example, if a CPA does business taxes, is that a service or a product? Different states answer this question in different ways.

The sales tax collection, reporting, and paying requirements are the same for all business types, including home-based businesses. States differ on what’s taxable and the details of how to get a seller’s certificate. Here’s a list of all state taxing agencies.

Do I Need To Collect Sales Taxes

If you own, or are starting, a small business, its vital that you understand your tax obligation, or it could lead to serious trouble, including fines. The tax collection and payments should be part of your business plan, and part of the homework you do when you set up your business.

If you sell online and have customers from other states, this can get tricky. It can end up costing you money if you dont know and follow the rules.

To get started on the sales tax journey, and what role your business plays, you should be able to answer these questions:

What is your sales tax nexus? Nexus is where your business has a presence, but like all other things sales-tax related, its not that simple. Its always in the state where you reside and conduct business, even if youre doing it from your kitchen table, but it extends from there. If you have more than one physical location, particularly in different communities or states, affiliates, or more, that is part of the nexus. Some states also count employees who work remotely in another state, or contractors. Warehouses and distribution centers count, too. If your business sells online to other states, it may have an economic nexus .

Does your state or local jurisdiction require you to get a license to sell or sales tax permit? Start by registering with your states taxing agency. Find out, too, if you must register in other states you do business in.

You May Like: How Much Is Taxes For Doordash

Filing Requirements For Occasional Or Isolated Sales

A casual sale is an occasional or isolated taxable sale by a person who is not in the business of selling taxable property or services. People who make casual sales from their home and have no intention of making sales on a regular basis as a business do not have to register for sales tax. These occasional sales must be made from your home, and the purchaser must pick up the item at your home.

Even though you may not have to register for sales tax, you must collect sales tax from the buyer and send it to New York State if the item is taxable, unless the sale meets the special rules for a garage sale discussed in Tax Bulletin Sales from Your Home . Use Form ST-131, Sellerâs Report of Sales Tax Due on a Casual Sale, to remit tax due on a casual sale.

Example: You are retiring and moving into a smaller home. You decide to sell your dining room set which includes a table, chairs, and hutch for $800. You list the furniture in your local newspaper for sale. The furniture is taxable, but this sale does not require registration for sales tax purposes because it is an isolated one-time sale. However, it does not meet the special rules for garage sales because the selling price of the items exceeds $600. You are required to collect sales tax on the selling price of the items and send it to New York State with Form ST-131.

How To File A Return For Sales Tax

If you are registered for sales tax purposes and collect sales tax, you are required to file a return that indicates how much sales tax you have collected and remitted. Follow the guidelines on the TaxJar map to file a return for each state. TaxJar connects all marketplaces you sell and then creates return-ready tax reports in the manner in which a state wants to receive it. If you are tax registered, you are required to file a sales tax return whenever you have a filing due, even if you did not collect any sales tax to avoid penalties.

Section 9

Read Also: How To Do Taxes With Doordash

Destination States With No Sales Tax

There are a few states that do not charge sales tax, such as ECOM CPAs home state of Oregon, as well as New Hampshire, Montana, Alaska,and Delaware even if there is no state sales tax, local jurisdictions can choose to charge sales tax, meaning that it is still a destination state, where the local sales tax applies.

For remote sellers , sales tax is usually destination-based.

What Are Some Common Compliance Pitfalls For Small Businesses

Managing your tax obligations isnt easy and non-compliance unintentional or not can result in serious consequences for your business. Knowing some common compliance pitfalls ensures that you wont be surprised by an unexpected sales tax obligation.

- Falling behind. Falling behind on sales tax legislative updates in various states is a concern for many small business owners. And if youre doing business in multiple states, it can be a monumental task to make sure you know about and understand tax legislation when it gets passed.

- Breaking down rates. Inability to break down rates required by a tax jurisdiction can also be an issue. Sales tax rates include the state rate, plus any local or other taxing jurisdiction at the point of sale. Knowing how to navigate the increasingly dense tax rates, and the ability to track and ensure compliance across your business, is critical to success.

- Understanding nexus. Neglecting to collect tax where you have nexus will quickly become a problem. The first step is understanding and identifying where and when you have a nexus and how that will affect the amount of tax you must remit to the individual state.

- Exemption certificates. Failing to collect exemption certificates on exempt sales is a common problem. In most cases, asking for an exemption certificate immediately is the best course. But it does cause extra work for both you and your customer. However, having the completed forms is necessary and expected during an audit.

Read Also: Did The Tax Deadline Get Extended

What Is South Dakota Vs Wayfair All About

Some states began to realize that they were really missing out on some sales tax just because a company did not have a physical presence in their state. Specifically, South Dakota residents could purchase items from online retail giants like Wayfair, and pay no sales tax, because Wayfair did not have a physical presence in South Dakota. Not many online giants have a physical presence in South Dakota! In contrast, for states like New York, Pennsylvania, or California, many online giants do have a physical presence in these states, so these states were getting sales tax when their residents made purchases from online giants.

Not only did this physical presence sales tax nexus hurt the state, but it also hurt local businesses. Would you rather buy furniture from a local store and pay 4-6% in sales tax, or purchase furniture online and pay 0% sales tax? This created an advantage for online retailers and hurt small brick and mortar stores.

So South Dakota decided to change things. They passed a law in 2016 requiring online sellers who had either $100,000 in gross sales or 200 transactions in their state, regardless of physical presence, to collect and remit sales tax. When the online retailers did not comply with this new law, South Dakota took Wayfair to court.

Determine The Sales Tax Rate To Use

There is not a standard sales tax rate that all states and counties use. Each tax agency sets its own rate, which is a percentage of a taxable product or service.

As the sales tax collector, you need to know how much the sales tax rate is in the state and/or county youre collecting for.

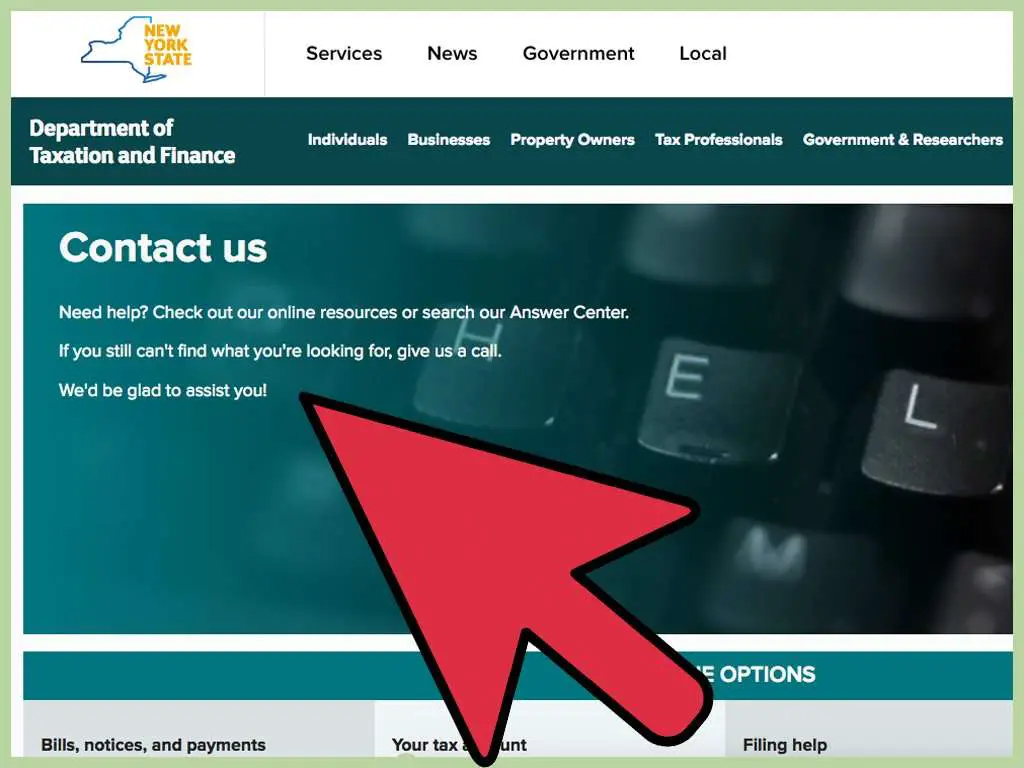

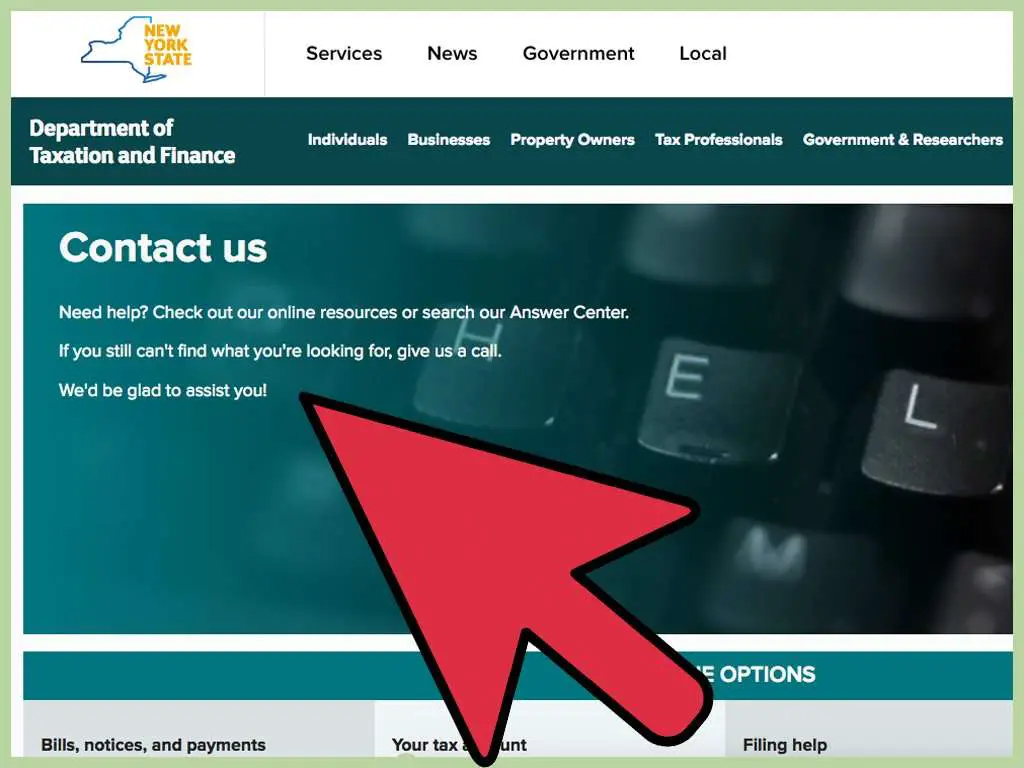

To do this, head over to your state website and look into:

- State sales tax rates

- County sales tax rates

Again, pay attention to the goods and/or services that are exempt from sales tax while youre on your states sales tax web pages.

Read Also: Do I Have To Claim Plasma Donation On Taxes

Do You Charge Sales Tax When Selling To Canada

Nevertheless, you cannot simply turn over your obligations if you sell into Canada. Goods and Services Taxes in Canada are charged in the form of an integrated Harmonized Sales Tax , which appears in some provinces in combination with Provincial Sales Tax . In Alberta, Northwest Territories, Nunavut, and Yukon the GST only applies.

Sales Tax Exemptions And How To Handle Them

Besides products like food and prescription drugs that might be exempt from sales tax, certain types of buyers might not be required to pay sales tax. Resellers, those that buy products to sell to someone else, and some non-profits in some states are two examples.

If your state allows exemptions for these types of buyers, you will need to get a copy of their valid reseller’s permit or exemption certificate. You should keep these permits or certificates on file in case you are asked to present them by sales tax agents.

Read Also: How To Take Taxes Out Of Doordash

A Apply For A Resale Certificate

As a Printify seller, we recommend that you request a resale certificate from state authorities. A resale certificate is different from a sales tax permit as it allows you to buy products without paying sales tax on our end if you plan to resell them and collect the sales tax through your business. This means that Printify will not collect sales tax from you.

Key Actions For Filing & Paying Sales/use Tax

The following categories of sales or types of transactions are generally exempted from the sales/use tax:

Food & clothing

Sales of food for human consumption and clothing costing $175 or less. For items that cost more than $175, sales tax is only due on the amount over $175 per item.

Periodicals

Sales of periodicals such as newspapers and magazines. Newsletters, however, are generally not treated as newspapers and may be taxable.

Admission tickets

Sales of tickets to activities such as sporting and amusement events.

Utilities and heating fuel

Sales of utilities and heating fuel to:

- Residential users – Residential use includes use in any dwelling where people customarily reside on a long-term basis, whether or not they purchase the fuel, including: Residential users don’t have to present exemption certificates.

- Apartment buildings

- Nursing homes

- Single family or multifamily homes

Telephone services to residential users

- Haircuts

- Car repairs

Also Check: How To Pay Quarterly Taxes Doordash

Sales Tax Nexus Is Just A Fancy Legalese Way To Say Significant Connection To A State

If you, as an online retailer, have nexus in a state, then that state considers you on the hook for charging sales tax to buyers in the state.

Youll always have sales tax nexus in your home state. However, certain business activities create sales tax nexus in other states, too.

Ways to Have Sales Tax Nexus in Different States

- A location: an office, warehouse, store, or other physical presence of business.

- Personnel: an employee, contractor, salesperson, installer or other person doing work for your business.

- Inventory: Most states consider storing inventory in the state to cause nexus even if you have no other place of business or personnel.

- Affiliates: Someone who advertises your products in exchange for a cut of the profits creates nexus in many states.

- A drop shipping relationship: If you have a 3rd party ship to your buyers, this may create nexus.

- Selling products at a trade show or other event: Some states consider you to have nexus even if you only sell there temporarily.

- Economic nexus: You exceed a state-mandated dollar amount of sales in a state, or you make over a certain state-mandated number of transactions in a state.

How To Get Sales Tax Compliant

Once youve determined that you have nexus in a state and are selling taxable items in a state, your next step is to register with that state to collect sales tax.

You can find guides on how to register for a sales tax permit with each state here.

Its important to register before you begin collecting sales tax. States consider it illegal to collect sale tax without a permit, no matter if your intentions are pure.

Once you receive your permit, you will also be assigned a sales tax filing frequency and sales tax due dates.

Your filing frequency is generally monthly, quarterly or annually and depends on your sales volume.

The more you sell in a state, the more often that state wants you to file a sales tax return.

If your sales dramatically increase or decrease as time goes by, your state may assign you a new filing frequency.

Always be on the lookout for letters or other communications from your state once youre registered for a sales tax permit.

Also Check: How To Write Off Miles For Doordash

Selling Across Many States

If you send products or inventory to a large, online company that distributes them to buyers for you, you may have created “connections” in many states in addition to your own.

For example, if you sell online from your own home in California and don’t have any business presence in other states, you have “nexus “or a physical presenceonly with California.

But if you sell your products through Amazons FBA program , you send inventory to Amazon first. That relationship could require you to collect sales tax from customers in other areas where Amazon does business.

TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Perfect for independent contractors and small businesses. Well search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions.

Sales Taxes For Online Sellers

Many online sellers have to pay sales tax in the wake of a 2018 Supreme Court decision, South Dakota vs. Wayfair. In this case, the Supreme Court decided that states can require online sellers to charge and collect sales taxâeven if the seller doesnt have a store or other physical presence in the state.

After Wayfair, 24 states require ecommerce sellers to collect and pay sales tax. Fortunately, most of these states exempt online sellers that process fewer than 200 internet transactions or $100,000 in sales each year.

Recommended Reading: How Do You File Taxes For Doordash

When Does An Amazon Fba Seller Need To Collect Sales Tax

For the purposes of sales tax, ecommerce sellers are treated just like all other online retailers.

As an FBA seller, you are required to collect sales tax in states where your selling meets two criteria:

- Sales tax nexus

- Product taxability

Understanding both will help you determine when and if you are required to collect taxes from your Amazon FBA customers.

What Is A Sales Tax

A sales tax is a point-of-purchase levy that is paid by consumers who buy the taxed goods and services within the borders of the taxing authority. In the U.S., the authority is a state and sometimes a county or city. The tax is added to the price of the item or service, and is included in the total cost for the buyer.

Generally, sales tax is triggered when someone makes a retail purchase of a tangible product , but types of sales tax vary widely from state to state, and may also cover services.

While the buyer bears the legal burden of paying a sales tax, it is the responsibility of the seller to collect the tax and hand over collected taxes to the state and, if applicable, the county or municipality. Sales taxes, where theyre in effect, are required on all cash transactions, as well as on credit sales, installment sales, lay-away sales and sales involving trade-ins or exchanges of property, unless specifically exempted.

One important thing to keep in mind the federal Internal Revenue Service has little to do with sales taxes, though its guidance for nonprofits is used to determine some exemptions. Sales taxes are governed by states, and, to a lesser degree county and municipal bodies that also have sales taxes. This means a hodge-podge of rules and rates to navigate for businesses.

Read Also: Does Doordash Send 1099