How Do You Pay Quarterly Estimated Taxes

For a fee, you can always make your quarterly estimated tax payments with a debit or credit card, but IRS Direct Pay offers a direct transfer of funds from your bank account to the IRS for free. Payment can also be made by check that is mailed to the IRS with a completed estimated tax payment voucher, Form 1040-ES. Regardless of how you make payment, youll want to maintain records of your payments that show the amount and date paid to help you prepare your tax return.

What Is The Self

If you are wondering what is self-employment tax then you need to have clarity before filing the tax. Self-employment tax and for those business owners who act as independent contractors or self-employed and they have to pay the self-employment tax which includes Social Security and Medicare taxes.

If you are self-employed then you will receive an Internal Revenue Service form 1099. Moreover, if you work for several clients then you will get several 1099 forms. The person or business who is sending you the form cannot withhold the taxes which means that no taxes are withheld on any 1099 income. You have to track your expenses and check if you are eligible for any tax deduction.

Who Should Pay Estimated Taxes

The IRS uses a pay-as-you-go income tax system, meaning you must pay your taxes as you earn income. It enforces this by charging penalties for underpayment if you havent paid enough income taxes through withholding or making quarterly estimated payments. It also charges penalties on late payments even if you get a refund.

The IRS uses a couple of rules to determine if you should make quarterly estimated tax payments:

- You expect to owe more than $1,000 after subtracting withholding and tax credits when filing your return.

- You expect your withholding and tax credits to be less than:

- 90% of your estimated tax liability for the current tax year

- 100% of the previous years tax liability, assuming it covers all 12 months of the calendar year

The tax code calls this last item the safe harbor rule. This requirement increases to 110% of your adjusted gross income exceeds $150,000 .

One exception applies for farmers and fishers who earn at least 66.6% of their income from their trades and so only need to meet an equivalent amount of their tax liability.

Paying your taxes quarterly can also avoid the cash crunch you might face come tax time. Paying in quarterly installments makes paying your bill far easier than one lump sum payment, especially if youve underestimated your taxes due.

Recommended Reading: How Do You Pay Owed Taxes

Facts You Need To Know:

- The EFW transaction authorizes the U.S. Department of the Treasury to transfer the specified payment amount from the specified bank account to the Treasury’s account,

- “IRS USA Tax Payment,” “IRS USA Tax Pymt” or something similar will be shown on your bank statement as proof of payment.

- If the payment date requested is a weekend or bank holiday, the payment will be withdrawn on the next business day. In that case, your bank may put a hold on those funds, and treat it as a pending transaction.

- The payment amount will be debited in a single transaction. No recurring or partial withdrawals will be made.

- Federal Tax Deposits cannot be made via the EFW payment option. For payment options for making Federal Tax Deposits, please refer to the Tax Form Instructions for that form.

How To Pay Federal Estimated Taxes Online To The Irs In 2022

Discover how experts are combatting inflation with Gold with this free report.

Inside Your Report:

- Top Strategies to Hedge Inflation

- Benefits of diversifying with gold and precious metal

- 2022 IRS Loopholes

- Why experts are turning to Gold

The U.S. has a pay-as-you-go taxation system. Employers withhold income tax from employees every pay period and send it to the IRS to help the government maintain a reliable schedule of income. All they have to do is file by the IRS tax deadline to get a tax refund.

But freelancers and small-business owners usually dont have a human resources department pulling tax money out of their paychecks, so they have to pay estimated taxes four times per year.

While its a little extra work, filing your estimated tax payments each quarter helps you stay on top of your taxes. It also protects you from having to cough up all the dough at once if you learn to do it correctly.

Quarterly tax payments are due April 15, June 15 and September 15 of the tax year, and January 15 of the next year. Your income tax liability accrues on income as it is earned, rather than being due on April 15 of the next year.

If you receive income unevenly during the year you may annualize your income. Complete the MI-2210 Annualized Income Worksheet to determine what quarter your payments are due.

Note: Payments that are not received by the due date will be applied to the following estimated tax quarter.

Read Also: How To Pay Nc Taxes Online

How To Avoid The Underpayment Estimated Tax Penalty

- The underpayment tax penalty can be avoided if the taxpayer owes less than $1,000 in tax after withholdings and credits

- The other way to avoid the underpayment penalty is by paying a minimum of 90% of the tax you owe, or 100% of the tax shown on the return for the previous tax year

- For example, if your tax bill for the previous year was $4,000, and this year you withheld $4,500, but your total income tax bill is $6,500, you wont have to pay the underpayment penalty because you withheld more than the last years tax obligation

- Lets assume you made estimated tax payments of only $2,000. This is approximately 31% of your tax obligation and is less than your prior years income tax

- Therefore, youll have to pay the underpayment penalty unless you meet other criteria specified by the Internal Revenue Service. You can use FlyFins tax penalty calculator to figure out your underpayment penalty

Basics Of Estimated Taxes For Individuals

FS-2019-6, April 2019

The U.S. tax system operates on a pay-as-you-go basis. This means that taxpayers need to pay most of their tax during the year, as the income is earned or received. Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated or additional tax payments or a combination of the two. If they dont, they may owe an estimated tax penalty when they file.

The IRS has seen an increasing number of taxpayers subject to estimated tax penalties, which apply when someone underpays their taxes. The number of people who paid this penalty jumped from 7.2 million in 2010 to 10 million in 2017, an increase of nearly 40 percent. The penalty amount varies but can be several hundred dollars.

The Tax Cuts and Jobs Act, enacted in December 2017, changed the way tax is calculated for most taxpayers, including those with substantial income not subject to withholding. As a result, many taxpayers may need to adjust the amount of tax they pay each quarter through the estimated tax system.

You May Like: What Is The Sales Tax In Georgia

Most Taxpayers Have The Following Payment Options

Though interest and late-payment penalties continue to accrue on any unpaid taxes after July 15, the failure to pay tax penalty rate is cut in half while an installment agreement is in effect. The usual penalty rate of 0.5% per month is reduced to 0.25%. For the calendar quarter beginning July 1, 2020, the interest rate for underpayment is 3%.

In addition, taxpayers can consider other options for payment, including getting a loan to pay the amount due. In many cases, loan costs may be lower than the combination of interest and penalties the IRS must charge under federal law.

How To Make An Electronic Funds Withdrawal Payment:

- Use commercial software, a paid preparer, or IRS Free File to e-file your federal tax return and at the same time submit an EFW payment request.

- Upon selection of the electronic funds withdrawal option, a payment record will display for entry of payment information. Visit EFW Payment Record Instructions for details.

Don’t Miss: When You File Taxes Is It For The Previous Year

Why The Government Requires Quarterly Estimated Tax Payments

Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed individuals with quarterly tax payments. If you work for yourself as an independent contractor or freelancer, your taxes typically are not automatically taken from your paychecks. Therefore, the IRS collects income taxes with quarterly tax payments.

To determine if a taxpayer must make quarterly tax payments, they follow several guidelines.

- You anticipate owing more than $1,000 when filing your return for 2022

- You anticipate the withholding and tax credits will be less than 90% of your estimated tax liability for 2022 or 100% of your 2021 year tax liability .

If your adjusted gross income exceeds $150,000 $75,000 if youre married and file separately the requirement is 110%. Farmers and fishermen are an exception to this requirement. If youre in either of these professions and earn at least 66.6% of your income from the trades, you only need to pay a corresponding amount of the tax liability.

While paying your quarterly tax estimates seems like a pain, it can help you avoid a big tax bill during tax time. In addition, paying quarterly taxes makes your tax payment more manageable throughout the year.

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

Read Also: Where To Get Your Taxes Done

How To Pay Quarterly Income Tax

This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow’s content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 15,315 times.Learn more…

In addition to regular income tax, Americans who are self-employed are responsible for Medicare and Social Security taxes that normally would be paid by their employer an amount known as the “self-employment tax.” If you are self-employed and expect to owe more than $1,000 in taxes at the end of the year, the IRS requires quarterly estimated income tax payments. You are also responsible for quarterly income tax payments if you were self-employed and had to pay any self-employment tax at all last year. Once you’ve determined your payment amount, you can pay through the mail or by using the IRS’s online payment system.XTrustworthy SourceInternal Revenue ServiceU.S. government agency in charge of managing the Federal Tax CodeGo to source

How Will I Know If I Need To Make An Estimated Payment

If you are required to file a tax return and your Virginia income tax liability, after subtracting income tax withheld and any allowable credits, is expected to be more than $150, then you must make estimated tax payments or have additional income tax withheld throughout the year from your wages or other income.

Read Also: What Is Property Tax In California

The Annualized Income Installment Method For Freelancers With Fluctuating Income

Its not unusual for freelancers and self-employed individuals to earn loads of money in one quarter and very little the next. That can make estimated tax payments stressful.

The annualized income installment method can help make this situation easier. Using this method, youll be able to figure out how much you are paying per quarter using Schedule AI. It can be found on page 3 of form 2210.

You May Like: Paying Taxes For Doordash

Determining Your Payment Amount

Don’t Miss: What Percentage Of Tax Should I Pay On My Wages

Payment Options For Individual Income Tax

To make paying taxes more convenient and hassle-free, the Office of Tax and Revenue allows the use of:

OTR will receive the electronic transaction from the vendor and apply it to the taxpayer’s account. The District’s third-party payment vendor will charge taxpayers a nominal fee for the credit/debit card transaction based on 2.5 percent of the transaction amount.

I Expect My Tax Bill To Be Less This Year Than Last Year What Can I Do

Note: References to income tax include Class 4 NIC.

You can apply to reduce your payments on account. You can do this at any time using form SA303 either online or in paper form up to when the balancing payment is due. You can also make the claim on the previous years tax return giving details of the circumstances in the additional information box at the end of the form.

Please bear in mind that if you reduce your payments on account below what they should in fact have been you will have to pay interest on the shortfall from the date each payment on account was due. In some cases, HMRC may charge a penalty if the reduction is excessive. Any taxable coronavirus support payments such as grants received under the Self-Employment Income Support Scheme are treated as taxable income and should be included when calculating any reduction in payments on account.

Example: Robert continued

Roberts income for 2022/23 is likely to be much lower than that for 2021/22, so he can claim to reduce his payments on account. Robert works out that he will have an income tax bill for 2022/23 of around £2,200. The reduction will be £600. He therefore claims to reduce each of his 2022/23 payments on account by £300 each.

On 8 February 2023, Robert realises that he has reduced his payments on account by too much. He thinks he will have an income tax bill for the year 2022/23 of nearer £2,500 and not £2,200.

Recommended Reading: Can I Still File Taxes

You May Like: Can I Pay My Estimated Taxes Online

What Are Quarterly Taxes And When Are They Due

Everyone has to pay taxes. If you work a traditional full-time job , your employer takes taxes from your paycheck without any action on your part.

If youre self-employed , youre typically responsible for paying taxes on your own. Thatsbecause taxes are not automatically withheld from your pay.

Quarterly taxes are estimated tax payments you make to the IRS throughout the year . In other words, you to pay your 1099 taxes in chunks four times a year, rather than as one big payment.

These payments are based on your estimated income for the current year. Most people use their previous years taxes as a guide.

But not every 1099 worker has to pay the self-employed quarterly tax payment .

How Do I Pay These Quarterly Taxes Online

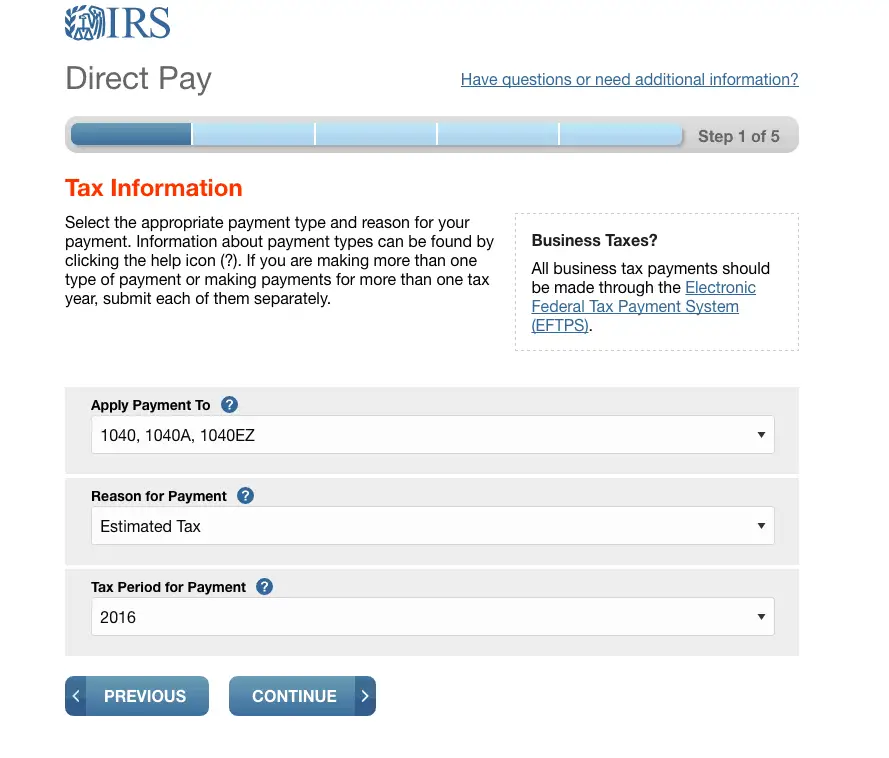

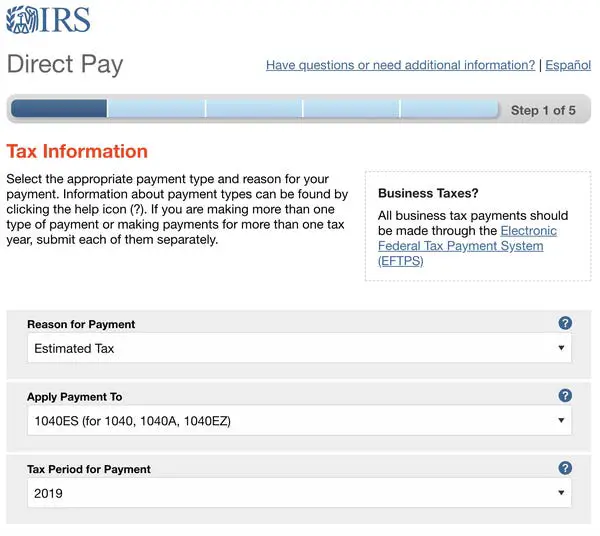

You can pay your estimated taxes each quarter through the IRS website by going to IRS.gov/payments. You can pay through IRS Direct Pay by entering your bank account information, or you can pay via credit card for a fee.

Alternatively, you can pay the IRS through the Electronic Federal Tax Payment System , provided free by the U.S. Department of the Treasury through which you can pay any tax due to the Internal Revenue Service using this system, according to its website. For estimated taxes to your state, check your states revenue department website.

Read Also: Can I File My Taxes Twice