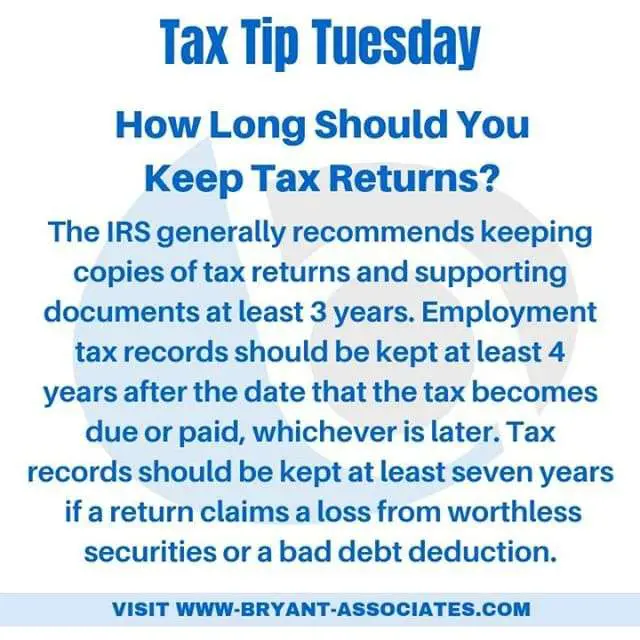

Most Taxpayers: Three Years

The statute of limitations for an IRS audit expires after three years. That means most taxpayers should keep their tax records for three years after the date they filed their return, or two years after they paid tax whichever is later.

Real estate ranking:Buying a house? Here are 10 cities with the biggest increase in homes for sale

There are three exceptions to the IRS audit time limit. The agency can go back six years for an audit if you under-reported your gross income by 25 percent or more.

The IRS can also audit returns that claim a capital loss on worthless securities or take a deduction for bad debt, up to seven years after the return was filed.

If you didnt file a tax return or filed a fraudulent one, there is no statute of limitations for an IRS audit. In these cases, keep all your records indefinitely.

You Need To Keep Your Tax Returns For At Least Three Years

The IRS recommends that everyone keep their tax returns for at least three years, or two years from the date you paid your taxes, whichever is later. This way, if it decides to audit you, you should have all the necessary paperwork available. Throwing these documents away ahead of schedule only hurts you because if you’re audited, the government could disallow legitimate tax deductions if you don’t have the paperwork to prove that you were eligible to claim them.

You should hold onto your tax return for six years if you failed to report a substantial amount of income on your tax return, but hopefully, this doesn’t apply to you because you should never try to hide income from the government. The IRS recommends holding onto your tax returns for seven years if you filed a claim for a loss of worthless securities or a bad debt deduction, and you should hold onto your tax paperwork indefinitely if you did not file a return for a given year or if you filed a fraudulent return, which again, you’re hopefully not doing.

Dispose Of These Documents Carefully

When the time to toss your tax returns finally arrives, its imperative you dispose of the documents properly.

Shred all paperwork so you dont put yourself at risk for identity theft, Zimmelman advises.

Tax documents contain lots of sensitive information, including your Social Security number, bank statements, and brokerage account statements. If this information falls into the wrong hands, you are vulnerable to financial loss.

Recommended Reading: Do They Take Taxes Out Of Doordash

How Long Should I Keep My Tax Records

Heres how long you should keep your records, and exceptions to the three-year rule.

Keep your tax records for three years if:

- No fraud was committed and all income was reported.

- You filed a claim for credit or refund after your return was filed.

Keep your tax record for four years if:

- You maintain employment tax records. Keep these for at least four years after the date that the tax becomes due or is paid, whichever one is later.

Keep your tax records for six years if:

- You could have underreported your income by 25%. If this is the case, the IRS can review your taxes from up to six years ago.

Keep your tax records for seven years if:

- You filed a claim for a loss from worthless securities or bad debt deduction.

Keep your tax records indefinitely if:

- You purchased property, so you can show the amount that you originally paid for it.

- You do not file a return each year.

- You filed a fraudulent return.

How Long Should I Keep Tax Returns

The IRS explicitly mentions keeping your tax returns for three years, but there are special circumstances where youll want to keep these records for longer:

- If your tax return includes omitted income, keep your records for six years.

- If worthless securities or bad debt were deducted, keep your records for seven years.

Businesses keep their tax returns for three years due to the Period of Limitations. Since you can amend your tax returns for up to three years, this is the bare minimum that youll want to keep your tax records.

The IRS is supposed to perform an audit within a three-year period, but discrepancies can lead to issues with the IRS for seven years.

Many accountants recommend keeping your tax returns and all supporting documentation for seven years just in case.

You May Like: Do I Have To Claim Plasma Donation On Taxes

But Some Experts Say You Might Want To Keep Documents Longer

While the IRS suggests most taxpayers only need to keep basic records for three years, theres an argument for holding onto these documents for at least seven years a year longer than the six-year statute of limitations in cases where income was substantially underreported.

If your tax return looks like the great American novel, the running of the three-year audit period may not save you, Dr. White says.

She explains that because the IRS has six years to go after you if you substantially under-reported income, you may need your records to prove you didnt underreport your income by more than 25% .

If you think youre potentially at risk of an audit, you should keep your documents longer than usual, Zimmelman advises. Being at risk for an audit doesnt mean youre doing anything wrong. It just means that your tax situation might raise a few red flags that require the IRS to take a closer look.

You should also keep copies of your tax returns forever so you can prove you filed your taxes if the IRS says you didnt, as theres no time limit on the IRS bringing a case for failure to file.

The IRS has been known to lose or misplace tax returns, Dr. White warns. The IRS receives millions of returns over a three-month period and lost returns are inevitable. So how do you protect yourself? You keep copies of every single tax return.

Whats Included In Tax Records

Records include both tax returns and any paperwork you used to file taxes any documents proving the income, credits, or deductions you claimed. For most people this means, at a minimum:

- Tax return forms .

- Wage statement forms, usually W-2s or 1099s.

- Receipts for any deductible expenses.

- Health care coverage documentation for you and any dependents .

- Records of retirement fund contributions.

- And any other documents relevant to tax filings, like acknowledgments of charitable donations or investment appreciation.

Read Also: Plasma Donation Taxable Income

Ownership Records And Other Key Business Documents

There are certain documents that need to be kept indefinitely. These include your company formation documents, such as articles of incorporation and articles of organization .

If youre a corporation, youll also need to keep any director or shareholder meeting minutes and a stock ledger. Other key ownership and business documents should be kept permanently including deeds, titles, property records and any contracts.

Other Key Business Records To Keep

While youre keeping things for the IRS, dont forget about keeping other records that are required for your business.

If you have employees, youll want to get a clear understanding of what documentation related to hiring you need to keep. In many cases, you may need to keep a hiring file with details of the job listing and applicant information. Where your company is located and its size will determine exactly what youll need to keep and for how long. For example, if your company is subject to the Age Discrimination in Employment Act , youll need to keep information on applicants for one year.

There are also key business documents that youll want to keep indefinitely. Hang onto your company formation documents like articles of incorporation or articles of organization. Youll also want to keep titles, shareholder meeting minutes, permits and licenses, insurance documents and any contracts.

Keeping organized records in both your business and personal life is important. When it comes to keeping records: If youre ever in doubt, dont throw it out.

Don’t Miss: Doordash How Much To Save For Taxes

Period Of Limitations That Apply To Income Tax Returns

The following questions should be applied to each record as you decide whether to keep a document or throw it away.

Are Scans Or Copies Of Tax Records Acceptable Do I Need The Original File

The CRA is very reasonable and they recognize the world is shifting to digital records. So they are willing to accept:

- Books, records, and supporting tax documents produced and retained in paper format

- Books, records, and supporting tax documents produced on paper, and subsequently converted to and stored in an electronically accessible and readable format and

- Electronic records and supporting tax documents produced and retained in an electronically accessible and readable format

Records and supporting documents originally produced in paper format have to be kept in paper format, unless they are saved in acceptable microfiche, microfilm, or electronic image formats. If you do scan documents, it is required that the image follows proper imaging practices.

If you have any questions about record keeping or any other tax accounting services, please contact a member of our staff.

Don’t Miss: Doordash Payable Account

What Tax Records Should I Keep

You need records to properly prepare your tax return and get the credits and deductions to which you are entitled. You should keep your prior tax returns, including your W-2s, receipts, canceled checks, mileage logs, expenses tracking, employer reimbursement statements, bank statements, photos, and any other document that relates to a potential credit or deduction on your taxes. A good rule of thumb is to include at least two verifiable forms of proof from separate sources for each type of deduction or credit youre looking to claim .

Keeping important information secure and protected can prevent identity theft and cyberattacks.

Too Many Charitable Donations

Making significant charitable donations will make you eligible for some substantial deductions during tax season. However, if you dont have the documentation to support the validity of your contribution, dont claim. For example, the IRS is going to notice a tax return that claims $10,000 in charitable deductions when that tax payers annual salary was only $40,000.

Don’t Miss: How Much Taxes Deducted From Paycheck Mn

State Record Retention Requirements

Don’t forget to check your state’s tax record retention recommendations, too. The tax agency in your state might have more time to audit your state tax return than the IRS has to audit your federal return. For instance, the California Franchise Tax Board has up to four years to audit state income tax returns, so California residents should save related documents for at least that long.

Failing To Report Part Of Your Income

Form 1099 reports nonwage income you get from things like freelance, stock dividends and interest.

If you have a day job and pick up freelance work on the side, you might be tempted to only submit your W-2 form from your day job and keep your freelance writing income on your Form 1099 a secret.

Well, that is not a great idea because the IRS most likely already knows about that freelance income listed on your Form 1099 because the company you worked for probably sent in a copy of that Form 1099 to claim the work you did for them.

You May Like: Federal Irs Tax Return

What Is Adequate Evidence

In general, receipts, canceled checks and bills will be enough to document your expenses. These documents should help you establish the date, place, amount and reason for the expense.

For example, evidence for your hotel stay should include the name and location of the hotel, the dates you stayed and the cost of the stay, with separate charges for things like meals and telephone calls.

If you are keeping evidence for a meal, youll want to have a receipt that shows the name and location of the restaurant, the number of people served, the date of the meal and the cost.

Along with all documentation, you should also make note of the written explanation of the business purpose. Yes, the IRS wants to be sure that the lunch you had with clients had a business purpose and wasnt just for fun so make note of why it was important to have that meal.

Organizing Preserving And Tossing Records

Keep your records organizedI recommend arranging them by yearand store them in a safe place. If the IRS comes calling, you must be able to promptly produce legible records.

Consider scanning your records and storing them electronically. The IRS has accepted scanned receipts since 1997, a policy that was memorialized by Rev. Proc. 9722. You have to be sure that your scanned or electronic receipts are as accurate as your paper records, and you must be able to index, store, preserve, retrieve, and reproduce the records. As with paper records, you need to be able to timely produce them in a hard copy form if needed.

Finally, when it comes time to get rid of those old papers, dont simply throw old tax returns and banking information in the trash. Its best to shred records with sensitive data. If you dont have a shredder at home, try a shredding service, usually available at shipping or office supply stores for a nominal fee. And that goes for more than just paperyou can generally shred or destroy plastics and electronic media, like DVDs and hard drives, safely, too.

**This is the third column in a series on taxpayers and tax professionals. You can find the rest of the series here:

You May Like: Www Aztaxes Net

How Long Should I Keep Records

The length of time you should keep a document depends on the action, expense, or event which the document records. Generally, you must keep your records that support an item of income, deduction or credit shown on your tax return until the period of limitations for that tax return runs out.

The period of limitations is the period of time in which you can amend your tax return to claim a credit or refund, or the IRS can assess additional tax. The information below reflects the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.

Note: Keep copies of your filed tax returns. They help in preparing future tax returns and making computations if you file an amended return.

The Easiest Way To Keep Records

The IRS says you can use any recordkeeping system as long as it âclearly shows your income and expensesâ. But unless youâre auditioning to appear on an episode of Hoarders, you should probably go paperless and store everything electronically.

The IRS accepts digital copies of documents as long as theyâre identical to the original copies.

Digitizing your records is also a great way to avoid accidentally tossing them in a move or an overzealous fit of spring cleaning. Plus, letâs not forget that paper records can fade, and are susceptible to damage. Telling the IRS that âthe dog ate my tax recordsâ simply wonât fly.

We recommend scanning every record and receipt in your business, tagging it with a descriptive name, and archiving it forever.

Here are some tools that can make digital recordkeeping easier:

- Benchâyou can upload all your receipts and store them in the Bench app, with no storage limits.

- Secure cloud storage services like Dropbox, Evernote, or . Any of these websites will support scanning and storing.

- A dedicated business document scanner, like the Kodak Alaris .

Read Also: Doordash And Taxes

How Long To Keep Tax Records: Can You Ever Throw Them Away

Once youve submitted your tax return to the Internal Revenue Service each year, the last thing you probably want to think about is how to store your tax records. But making these arrangements is essential to protect yourself in the event of a future IRS audit.

The general rule is to keep your tax records for three years, but there are several important exceptions for when you might need to keep your tax records for a longer period as a taxpayer. Read on to learn how long to keep your tax records and when you can safely dispose of them.

Why Should I Focus On Record Keeping

It is not enough to just claim certain credits and deductions, you need to provide documentation as proof. Without valid proof, the IRS may revoke certain deductions or credits, causing you to end up owing on your tax return. If the IRS also finds negligence or improper record keeping, they may impose fines and penalties for failing to maintain proper records. In addition, improper record keeping can result in denied deductions and credits.

Also Check: How To File Taxes From Doordash