Do I Have To File Business Taxes If I Made No Money

The owners of corporations must file Form 1120, United States Internal Revenue Service, with the IRS. Form 1040, Income Tax Return for Corporation. No matter if you had expenses or not, you are required to file a corporation income tax return if you made no money. Therefore, we need to file Form 1120 / 1120-S if we do not have income or expenses.

Pricing Methods Used By Tax Preparers

You can ask up front how the firm determines its prices if you’re comparing tax professionals or accountants. Ask for an estimate of what their services might cost you, although you probably won’t get an answerat least not a firm, definitive oneuntil you’ve met with the professional and they have a firm grasp of your tax issues.

Some accountants offer free consultations, so you might get an answer at the end of this initial meeting.

Otherwise, the firm would have to base its number on your personal summary of your situation, and this might or might not provide an accurate picture of your tax situation. After all, you probably wouldn’t be seeking a professional’s services if you were exceptionally savvy about tax matters.

Some of the methods used by tax professionals to set prices include:

- A set fee for each tax form or schedule

- Fee based on the complexity of the client’s situation

- An hourly rate for time spent preparing the tax return and accompanying forms and schedules

- Additional fees for services such as expediting returns, filing for extension, or responses to IRS audits.

Why Use Donotpay To Fight And Waive Turbotax Fees

At DoNotPay, we have several years of experience helping people waive TurboTax fees and get refunds. We have helped thousands of people file successful appeals.

We make your appeal process faster and easier. You won’t spend too much time filing the appeal, and neither will you have to fill several forms.

Appeal your fees with just a few clicks of a button.

You May Like: 1099 From Doordash

Who Should Use Turbotax

Whether youre an experienced tax preparer or have little knowledge of tax law beyond knowing you need to file, TurboTax makes tax filing easy by walking you through the process with interview-style questions and options for live, on-screen support when needed.

TurboTax, a product of the financial, accounting, and tax-preparation software provider Intuit, is one of the most popular tax-filing options out there. Its popularity partly stems from its name recognition but also from the companys focus on design and offering users plenty of features.

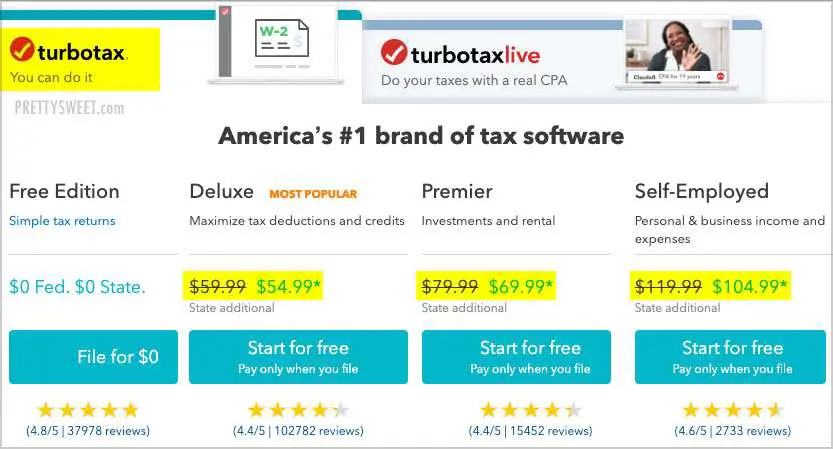

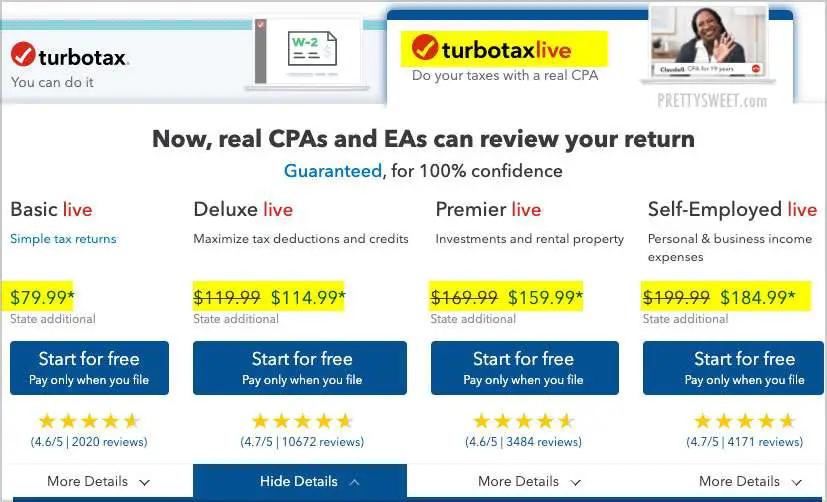

How Much Does Turbotax Online Cost

For federal filing, TurboTax offers three premium plans ranging from $59 to $89. With the paid plans, state filing is extra. One free state return is included in the free option.

With TurboTax Online, you are provided with a no-cost option of trying it out before you purchase. You will not be asked to pay until you actually file your return electronically or print it.

Here is the cost to file your taxes with TurboTax:

- TurboTax Online Free Edition This version allows you to file form 1040 for free.

- TurboTax Online Deluxe Edition $59 This version searches 350+ tax deductions and credits, plus maximizes mortgage and property tax deductions

- Premier Online Edition $69 This version gives everything in Deluxe, plus covers stocks, bonds, ESPPs, and other investments.

- Self-Employed Online Edition $89 This version gives everything in premier, plus guidance for contractors, freelancers, and small business owners

- TurboTax Online Military Edition E-1 through E-5 can file free. However, you have to pay extra to file state returns, but the cost of e-filing your state return is combined with the state preparation fee. You also gain access to file one federal return and up to five state returns with your user account.

You May Like: 1040paytax.com Official Site

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

They Charge An Hourly Rate

If your tax advisor charges by the hour, make sure you find out how much they charge and how much time they expect to spend on your taxes. Usually, a tax pro will charge an hourly fee between $100200 per hour, depending on what kind of tax forms you need to file.6 If they can get your taxes done in less time, you wont get stuck with a high bill at the end.

Don’t Miss: How To Protest Property Tax Harris County

The 10% Temporary Wage Subsidy For Employers

In response to Covid-19, certain income tax measures have been enacted to provide relief to employers. The 10% Temporary Wage Subsidy is one of these measures that will allow eligible employers to reduce the amount of the payroll deductions required to be remitted to the Canada Revenue Agency. The subsidy is equal to 10% of the remuneration you paid from March 18 to June 19, 2020, up to $1,375 for each eligible employee. The maximum total is $25,000 for each eligible employer. For more information on the TWS, go to 10% Temporary Wage Subsidy for Employers.

You May Like: What Happens If I Forgot To File Taxes

How Complicated Are Your Taxes

Lets be honest for a second: If you want a plain vanilla tax filing, you could probably get away with paying a fee close to the minimum range. But the more complicated your tax situation is, the more time itll take to prepare your return. And we all know time is money.

For example, lets say you have a side business. Youll want to itemize deductions and file a Schedule C IRS form in addition to your basic 1040. In that case, the average cost is around $515.4

Read Also: Efstatus.taxact.com Login

How Much Does Turbotax Cost For A Student

TurboTax is a tax preparation software that is designed to help you file your taxes. It is available for both Windows and Mac, and there is a free version and a paid version. The paid version costs $59.99 for a single return or $119.99 for a return with state filing.

Understanding The Value Of The Service

You need to know that the value of tax preparation is more than the fee. Not every single organization is the same. Here are some of the things you should be looking for.

Flexibility in Filing Whether you want to file online or through an office, you should be able to do it. You should be able to get as much help or as little help as you require to file your taxes and claim your deductions.

DIY Choices Look for a tax preparation assistant that provides you with access to cutting edge software and tax experts. It shouldnt take a long time for you to make sense of your taxes.

The Right Professionals Ensure that youre speaking to tax experts who have years worth of experience in their field. They should also offer a friendly and professional service, as well as being easy to work with. You should have confidence in their ability to do the job right.

Guarantee of a Great Experience Doing your own tax preparation shouldnt fill you with nervousness. Many of the leading companies, including H& R Block, offer a guarantee. If your tax return isnt accepted by the IRS, you dont have to pay a thing.

Get the Maximum Refund The value of a great tax preparation company is getting the biggest refund you can. Its now common for tax companies to provide a guarantee that you will get the maximum refund, and nothing will be forgotten. This is where the real value of a tax preparation service comes from.

Read Also: How To Calculate Taxes For Doordash

What Is The Turbotax Free Edition

TurboTax Free Edition is the name for a free version of TurboTax. It is not the same as the TurboTax Free File edition, which is part of the IRS program.

TurboTax Free Edition is free for people who are filing very simple returns only.

Warning: TurboTax Free Edition is not always free. It puts many people on track to pay.

Read about how TurboTax tries to hide its Free File edition.

Does Your State Require State Income Tax

Some states, including Florida, Nevada, Tennessee and Texas, impose no state income tax and therefore require no annual tax return. Others, such as California, Illinois and New York, charge an income tax to residents, which means filing a separate return. State tax returns are far less complicated than federal returns, but they add one more layer of complexity to the process. TurboTax charges an additional fee for state tax-prep software.

Don’t Miss: Doing Taxes For Doordash

Is Taxact Really Free

Yes, TaxAct is really free but only for federal filing for some users. State filing for the basic free version is an additional $35.

The free version includes W-2 income, unemployment, and retirement. You can add credits such as the earned income credit, and child tax credit. Allowable expenses in this version include dependents and current students.

What Is The Turbotax Free File Program

The TurboTax Free File program is required as part of the IRS Free File program.

To qualify for the TurboTax Free File, you must make under $34,000 per year.

You are eligible if you make less than $34,000 and:

- Work full time

Click here to access the TurboTax Free File program.

Important: If you make under $66,000 per year, you are eligible to file your taxes for free under the IRS Free File program.

If you make under $66,000 per year, .

Don’t Miss: Do You Get Taxed For Doordash

How To Negotiate A Fair Price

Call various tax preparation firms and get a feel for their price ranges if you’re searching for the lowest price. The business might not be able to give you an exact price quote, but they should be able to quote you either an average price or a price range for your tax situation.

Some firms might charge additional fees during their busiest days, like the weeks right after W-2 forms are mailed out or just before the April tax filing deadline. You might be able to obtain a lower price quote during a less hectic time of the tax season.

File A Superseding Return If The Filing Deadline Hasnt Passed

What if you just filed a tax return and then discovered a mistake the very next day. If the filing deadline, including extensions, hasnt passed, then you dont want to file an amended return. Instead, you can file whats called a superseding return. Basically, if you file a second return before the filing deadline, the second return supersedes the first return and is treated as the original return.

A superseding return must be filed on a paper Form 1040 e-filing is not allowed. We also recommend writing Superseding Return at the top of the form.

Since 2019 tax returns arent due until July 15, 2020 , theres still time to file a superseding return this year. Say, for example, you filed a 2019 return back in February and, instead of getting a refund, elected to apply your overpayment against your 2020 tax liability. But then you lost your job in April because of the coronavirus pandemic and now wish you were getting a refund. If you file a superseding return before July 15, you can get the refund this year. It might take a while before the IRS is able to process your superseding return, since theyre behind on tackling paper returns, but at least you wont have to wait until next year to benefit from the overpayment.

You May Like: Sales Tax In Philadelphia

How To Fight And Waive Fees On Donotpay

DoNotPay makes fighting and waiving TurboTax easy. You will complete the process in just a few minutes.

Here’s how you can use DoNotPay to appeal TurboTax fees:

And that’s it. DoNotPay will file the appeal on your behalf with your details.

Free Tax Filing Programs

-

The basics: You receive free assistance with filing your taxes

-

Price: $0

-

Time youll spend: 1-3 hours

-

Quality: Good

-

Good option for: Those with income under $58,000 per year, those with disabilities, and those who speak limited English

There are a number of free tax preparation nonprofits that will help you at no charge, depending on your income.

For example, the IRSs VITA program can help you find free tax preparation in your area. Search for a tax prep location in your zip code.

If youre in need of assistance with paying your tax bill or resolving any tax disputes with the IRS, you can also get free or low-cost assistance via the Taxpayer Advocate Service.

Read Also: How To Do Taxes With Doordash

Can I Amend My Tax Return

You forgot to declare the money you earned from your side gig on your annual tax return. This could be an honest mistake, of course. But what will happen next? Will the IRS come after you?

Fortunately, the government knows that to err is only human, especially when filing your taxes. Thats why the IRS allows taxpayers to make any changes to their tax returns by submitting an amendment.

This article will discuss amending your tax returns as well as when and how you should do it.

Also Check: Www.myillinoistax

Turbotax Pricing + State Cost For 202:

| NA |

TurboTax Online State costs $49 per state return w/ no additional fee to e-file

*Software includes up to 5 federal e-files and 1 state download. Additional states cost $45 each, and e-file is an additional $25 per state return

**Active-duty Military can file free online here, but there is no military discount for software Download or LIVE editions

Tip: Click to get the best possible price online and view pricing directly from TurboTax here!

Don’t Miss: Do You Get A 1099 From Doordash

Form Td1x Statement Of Commission Income And Expenses For Payroll Tax Deductions

Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out this form in addition to Form TD1. They can estimate their income and expenses by using one of the following two figures:

- their previous years figures, if they were paid by commission in that year

- the current years estimated figures

Employees who choose to fill out Form TD1X have to give you the form by one of the following dates:

- on or before January 31 if they worked for you last year

- within one month of the date their employment starts

- within one month of the date their personal tax credits have changed

- within one month of the date any change occurs that will substantially change the estimated remuneration or expenses previously reported

Note

There is only one Form TD1X for federal, provincial, and territorial tax purposes. For an employee in Quebec, see Employment in Quebec.

Tax deductions from commission remuneration

If an employee is paid on commission or receives a salary plus commission, you can deduct tax in one of the following ways:

Employees who earn commissions without expenses

Employees who earn commissions with expenses

To calculate the amount of tax to deduct, you can use the Payroll Deductions Online Calculator , the Payroll Deductions Formulas , or the manual calculation method found in Section A of the Payroll Deductions Tables .

Note

Also Check: How To Get The Most Out Of Tax Return

Is It Better To Buy Turbotax Or Use It Online

TurboTax Online comes with many benefits. Currently, it appears to be the main product promoted by TurboTax, and as such many users have noted that the online version is more frequently updated. Whats more, using the online version will mean that you will be able to file your taxes from any computer or mobile device that has an internet connection. This is why according to TurboTax 75% of their customers tend to choose the e-filing version provided by the online platform rather than the actual software.

Desktop TurboTax CD/Download is different from the online version as it will be tied to the personal computer that you installed the software on. This means that all of your information will also be stored on the hard drive of your device. On the one hand, this could be seen as more secure as your tax information is not widely available online, but on the other hand, you are only going to be able to access it when you are using your computer that has TurboTax installed on it. The TurboTax download includes the tax preparation fee for one state, the state tax prep comes at an additional cost for those users that choose TurboTax Basic and Business. You are also able to create an unlimited number of federal tax returns, and e-file up to five at no charge. You can print your tax returns as many times as you want.

Also Check: How Much Does Doordash Take In Taxes