How The Appraiser Arrives At Value

The values of recently sold homes in your area can be taken into account when calculating value. The appraiser will compare your home to others similar to yours and value it based on those sales prices, using a method known as the market approach.

The cost approach is based on how much it would cost to replace your home, although this method is used less frequently with residential properties.

How Property Taxes Are Calculated

When it comes to calculating property taxes for a certain area, this process starts with an assessor evaluating all the properties within the municipality. Next, the local government establishes the amount of money that is to be raised by the property taxes. Then, the property tax rate is calculated and finally, each property owner receives a bill.

How property taxes are calculated can vary depending on state or local government. Some governments choose to tax property by imposing a rate or millage on the fair market value of the property. Others impose property tax by a percentage of the market value of a home.

Per Capita Property Tax

D.C. leads the way in the property tax per capita by state category with $3,500. New Hampshire and New Jersey, naturally, follow with per capita property taxes of $3,310 and $3,277. Connecticut is the only other state whose per capita property tax by state is over $3,000 . Alabama, Oklahoma, and Arkansas have the lowest property tax per capita. In Alabama, the per capita amount paid is only $582, while in Oklahoma and Arkansas, its $731 and $741, respectively.

Recommended Reading: How To Pay Estimated Taxes

Who Sets Home Values

You can’t simply tell the state, county, or municipality how much you think your home is worth and let them take it from there. Your home’s value for tax purposes is based on its appraised value, and the appraiser isn’t an independent third party. Tax assessors typically work for the government.

Most states have an appeal process in place so you have some recourse if you receive what you consider to be an astronomical and unreasonable assessment.

You can expect your tax bill to go up if you add a second floor to your home or put an in-ground swimming pool in your backyard because improvements such as these will most likely increase your home’s value. You could find yourself paying more in property taxes even if your state’s tax rate remains unchanged because that percentage rate is applied to a larger value.

States That Charge No State Individual Income Tax

What is individual income tax? Most of the states in the United States impose a personal/individual income tax on residents. These taxes are deducted from the salary, wages and other source of income of residents.

For household that earn high income, residing in a state that doesnt charge personal income tax can be a huge plus. Just know that states that charge low income taxes often make up for it by increases taxes in another way, like, for instance, by having high sales or property taxes.

Below are the seven states in the U.S. that doesnt charge state personal income tax:

Together with these seven states, Tennessee and New Hampshire have no tax on earned income. However, the states charge tax on income from interest and dividends, so, not everyone is free from this.

Recommended Reading: What Is Adjusted Gross Income On Tax Return

Even With The Federal Exemption From Death Taxes Raised Retirees Should Pay More Attention To Estate Taxes And Inheritance Taxes Levied By States

The 2017 tax reform law raised the federal estate tax exemption considerably. Before that law was enacted, the exemption was $5.49 million per person for decedents who died in 2017. It’s up to $12.06 million for people who die in 2022 . So, now, even fewer taxpayers have to worry about federal estate taxes when they pass away. However, if your goal is to leave as much as you can to your heirs, then you should also pay attention to the state you choose for retirement.

Twelve states and the District of Columbia levy their own estate taxes, sometimes called “death taxes,” and some have much lower thresholds than the federal government. In addition, six states have inheritance taxes. Maryland, whose nickname is the Free State, has both.

The good news for retirees focused on estate planning: There are 33 states that have neither estate taxes nor inheritance taxes. Take a look to see if your state is on the list .

Overall Rating for Taxes on Retirees: Tax-friendly.

Sales Tax: 4% state levy. Localities can add as much as 7.5% to that, and the average combined rate is 9.24%, according to the Tax Foundation.

- Groceries: Taxable

- Motor Vehicles: Taxable

- Prescription Drug: Exempt

Income Tax Range:Low: 2% . High: 5% .

Some Alabama municipalities also impose occupational taxes on salaries and wages.

Taxes on Social Security: Benefits are not taxed.

Property Taxes: In Alabama, the median property tax rate is $406 per $100,000 of assessed home value.

States With The Lowest Property Taxes

The 10 states with the lowest property taxes are an interesting mix geographically-speaking. Five out of the 10 states are located in the U.S. South region, as designated by the Census Bureau. Four out of the 10 states with the lowest property taxes are located in the U.S. Mountain division. And one state is located in the Pacific division. Below is a breakdown of the 10 states with the lowest property taxes:

Median real estate taxes paid: $1,788

Owner-occupied median home value: $636,400

Effective property tax rate: 0.281%

Also Check: How To Buy Tax Lien Properties In Nc

States With The Lowest Average Effective Property Tax Rates In 2022

Property taxes are determined at a local level, not the state level, so different communities in a state can have different property tax costs. To get the bigger, statewide picture of each states property tax costs, we looked at its average effective property tax rate which is based on the average cost of owner-occupied residential property taxes paid across all communities.

Credit Karma found this data in the U.S. Census Bureaus 2020 American Community Survey.

Note that theres a tie for third and fifth place for states with the lowest average effective property tax rates.

| Rank | |

|---|---|

| South Carolina | 0.566% |

Hawaii is the real surprise on this list because it typically ranks as a pretty expensive state, especially in terms of the cost of property. In our study on the cheapest states to live in, Hawaii came in as the most expensive state for average Zillow home value, average rent and cost of living.

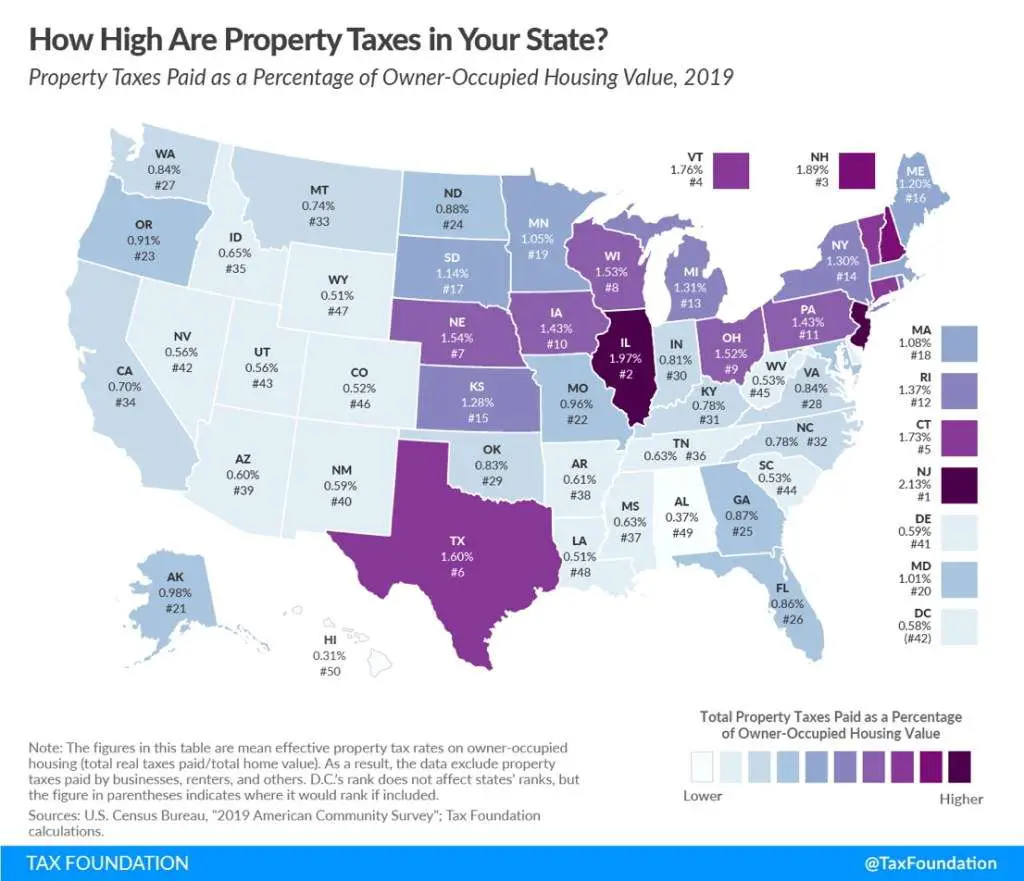

The state with the highest average effective property rate is New Jersey at 2.47%, followed by Illinois at 2.24% and Connecticut at 2.13%.

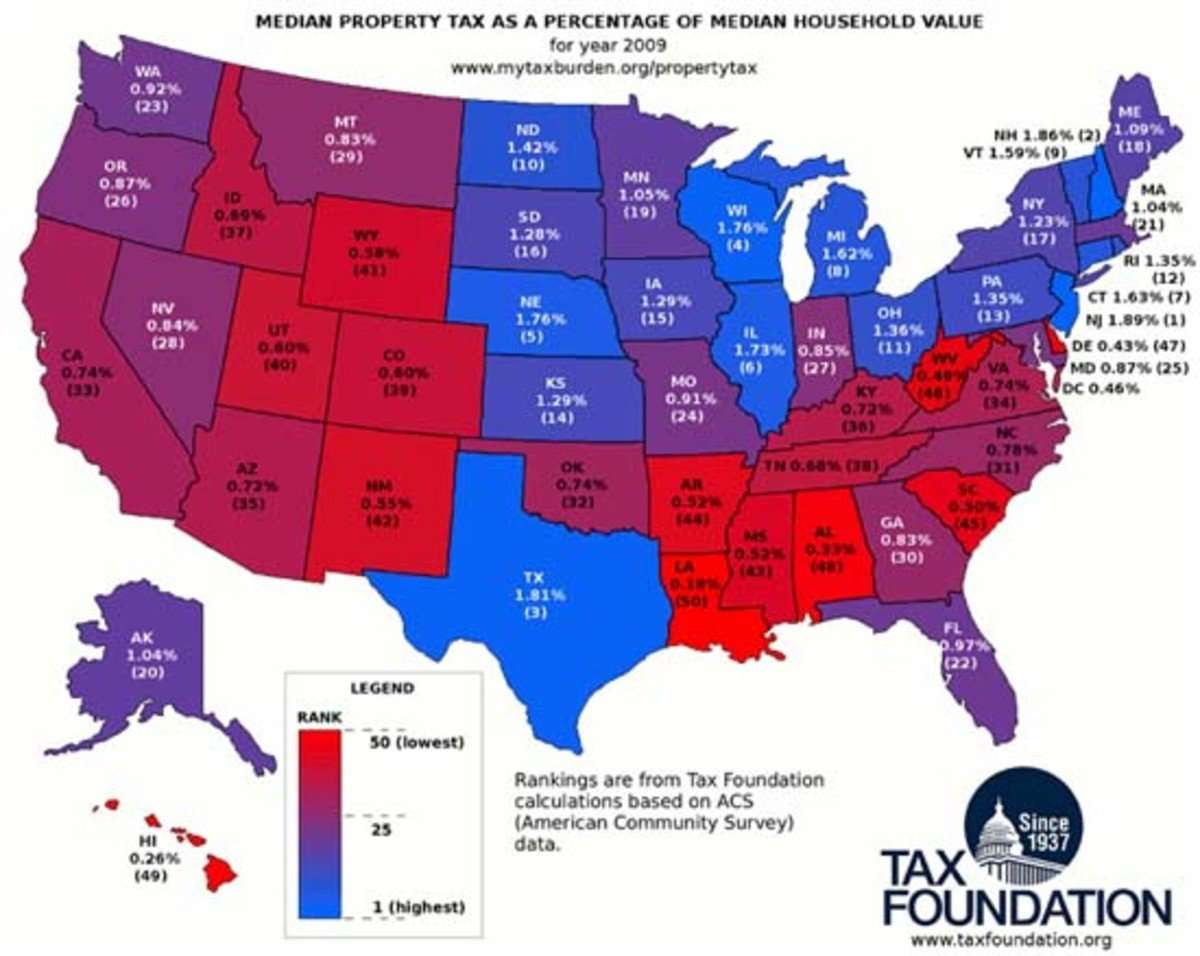

The map that follows shows the average effective property tax rate for each state, along with its rank. Theres a little cluster of higher average effective property tax rates in New England. Texas and Nebraska also make the list of top 10 most expensive states in terms of average property tax rates.

Which States Have The Lowest Property Taxes

In 2019, taxpayers in Hawaii had the lowest property tax rates of anywhere in the country at just 0.31%. The next lowest states were Alabama at 0.37% and Louisiana and Wyoming, both at 0.51%.

Generally, the states with lower property tax rates tend to be those in the southern and western parts of the country. The biggest exception to this rule is Hawaii, which has the lowest property tax rate in the country. However, Hawaii also has the highest median home value in the country, so homeowners property tax bills in the Aloha State are likely higher than those in the other states listed.

Living in a state with lower property taxes has the clear benefit of reducing the burden of homeownership on taxpayers. This can be especially crucial for young or lower-income home buyers looking to break into the housing market for the first time.

Highest and Lowest Property Taxes by State

| Highest Property Tax Rate States: | Lowest Property Tax Rate States: |

|---|---|

| #1 New Jersey 2.13% |

Read Also: How To Do Taxes For Shipt

States That Doesnt Tax State Sales

Do you know what sales tax is? It is defined by the U.S. Department of the Treasury as a tax charged on the sale of goods and services. Sales tax is in three form, which include vendor tax, the consumer tax, as well as vendor-consumer tax. Only five states in the country dont have a sales tax.

These states are:

Even though Alaska dont charge state sales tax, the state, however, allows local counties to tax local sales on residents. While majority of states indeed charge state sales tax, most of these tax rates are low.

The data from The Tax Foundation shows that states that charge low state sales tax are:

- Colorado

- Oklahoma

- North Carolina

Certainly, when looking into sales tax, you importantly need to remember local sales tax rates too. Together with the state sales tax, these rates can amount to huge sum really quick. Data from The Tax Foundation shows that only five states charge highest median combined state and local sales taxes.

They are:

States that charge the lowest average combined rates include:

- Alaska

- Maine .

States With No Income Tax

The table below illustrates the differences among states with no income tax. The first two columns show the states total tax burden as a percentage of personal income followed by the rank that the state holds among all 50 states.

The third column shows the states affordability ranking, which combines both the cost of housing and cost of living, and the last column includes the states rank on the U.S. News& World Report Best States to Live In list.

These figures are as of the most recent reports: 2021 for overall tax burden, 2020 and 2019 for affordability, and 2021 for Best States to Live In.

| Comparison of States With No Income Tax | |

|---|---|

| No-Tax State | |

| 44 | 1 |

Read Also: What Is The Property Tax Rate In California

States With The Lowest Personal Income Tax Rates In 2022

Eight states had no income tax at all in 2022:

- Alaska

| 20% | $50,001+ |

You pay 10% on the first $10,000 you make. Then 15% on any earnings you make between $10,001 and $50,000, and 20% on anything beyond that.

So how much do you actually pay in taxes in a marginal tax system? Heres how you estimate it:

First, break out how much money you make in each category and then multiply the amount by the tax rate in decimal form. So in our above example, the taxes owed on a marginal basis would look like this:

+ + = $9,000

If your entire income were to be solely taxed at the highest rate, then someone making $60,000 in Imagination would owe $12,000 in taxes $3,000 more than they would using the marginal system.

Because of the marginal tax rates, its important to know the tax brackets along with the income tax rates. Although California has the highest possible income tax rate, Oregons top tax rate kicks in at a much lower income level compared to Californias. That means a person could potentially end up paying less state income tax in California.

For example, single filers in California making between $61,214 and $312,686 cap out at an income tax rate of 9.3%. Meanwhile in Oregon, single filers making above $9,200 have an income tax rate of 9.9%.

One thing to note: Income can be taxed at both the federal and state level. Even if a state doesnt have a personal income tax, an individual may still owe money on their income to the federal government.

How Do I Find Out How Much My Property Taxes Are

You will receive an annual property tax bill from your local tax agencyor an annual statement from your lender if you pay through escrowwith your total tax amount. If you want to estimate your taxes before then, you can look up your property’s assessed value and your local tax rate. Your annual bill will be your assessed value times your tax rate.

Don’t Miss: How To Qualify For Farm Tax Exemption

Highest Property Tax #: Vermont

Can maple syrup and Ben & Jerrys ice cream sweeten the sting of Vermonts high property tax rate? Vermonters pay 1.90 percent in property taxes, and the average home costs $227,700 which comes out to annual property taxes of $4,329. Still, the state ranks fairly high in quality of life, somewhere between eleventh and fifth in the nation, depending on which survey you consult. Low crime and unemployment rates, a healthy, educated population and inclusive laws are among the factors that offset its relatively high cost of living.

Effective Property Tax Rates By State

In the US, the median owner-occupied home value is $222,041, with an effective tax rate of 1.09%. Hence, the median property taxes paid for such homes are about $2,412.In the table below, we will go over each state and see how it compares to the American median figures. We will also analyze the states with the highest property taxes alongside the jurisdictions with the lowest property taxes in the US. Please note that in the next table, the focus is on personal property taxes by state.

You May Like: What Happens If Taxes Are Late

Are There Any States With No Property Taxes

All 50 states and the District of Columbia levy property taxes. However, some people may qualify for a property tax exemption. Some states offer homestead exemptions, while other types of exemptions exist for older homeowners, people with disabilities, military veterans, and homeowners who make certain renovations or install renewable energy systems .

Highest Property Taxes #: Connecticut

The average cost of a home in Connecticut is $275,400, placing it above pre-pandemic housing cost averages across the U.S. Factor in the states hefty tax rate of 2.14 percent, and Connecticut homeowners pay an average of nearly $6,000 a year in property taxes. In exchange, they get high-quality health care and education the state ranks third nationwide in these indexes. But its high cost of living and a lack of affordable housing pull it down to the middle of the pack in terms of overall quality of life.

Recommended Reading: How Much Is Sales Tax In Ohio

States That Have Lowest Property Tax Rates

Do you know what property tax is? The United States Department of the Treasury mentioned that each of the states in the country have different definitions of property that is taxable. Some states let towns or local counties to tax real estate, which includes buildings like land, homes, buildings, and so on. Some states also let municipalities to tax individual property .

Property taxes are a percentage of the value of your home that you pay every tax season. This percentage often funds public schools, public transportation, road construction, pensions and other local services.

Even though property tax rates vary from one county to another, you can find out the state with the cheapest total property taxes by checking the average property tax rate of each state.

Here, weve mentioned the 10 states in the country with the cheapest average property tax rates, with the ranking starting from the lowest to highest as reported on tax-rates.org.

Property taxes in the Northeast as well as Midwest can be higher. The ten states in the country with the highest average property tax rates include Vermont, Illinois, Michigan, Texas, New Jersey, Connecticut, Wisconsin, North Dakota, New Hampshire, and Nebraska.

Common Methods Look At Cost And Sales Comparison

Assessors that use the cost method, will look at how much the expense would be to the owner to replace a property in the event it were rebuilt from scratch. The structures depreciation in value and value of the land it is on are taken into account.

In a sales comparison, the assessor will judge your propertys value by comparing it to similar properties that have recently sold in the same area. Variables that could affect the value making the house more of less valuable than another will be used to adjust the assessment.

For commercial and business properties the tax assessor may use the income method. This estimate is based on how much income the property would bring the owner were it rented. Current market rental rates and operating expenses among other things are factored in.

The states most in need of property tax reform, according to our 2022 State Business Tax Climate Index: 50. Connecticut

Tax Foundation

Tax Rates.org provides an online property tax calculator that can give a ballpark idea of the tax bill that you can expect to hit with.

Don’t Miss: How Much Time To File Taxes

File For A Homestead Exemption

The homestead exemption can be used on primary residences as a way to lower property taxes. The exemption essentially protects homeowners up to a certain amount or percentage of their annual property taxes. The exact exemption amount depends on your state. For example, in Colorado homeowners may be eligible to exempt up to $75,000 of their home.

States With The Highest And Lowest Property Taxes

Property taxes can range from a fraction of a percent to over two percent. Depending on the value of your property this can mean a tax bill of a few hundred dollars to thousands of dollars. The average American homeowner in pays about $2,400 in property taxes, according to Business Insider.

Heres a look at the ten states with the lowest property taxes:

Read Also: How Much Is Tax In Florida