The Simplified Home Office Deduction

If youre one of the 2.4 million Canadians whove been working from your couch, the kitchen table or the kids bedroom this year because of COVID-19, youll likely be able to claim some home-office costs on your 2020 tax return without having to sift through receipts or ask your employers to fill out forms.

If youre an employee whos been toiling at home more than 50 per cent of the time over at least four consecutive weeks in 2020 due to COVID-19, youll be able to claim a deduction of $2 for every work-from-home day up to a maximum of $400. This is what the CRA is calling a temporary flat-rate method of calculating the home office deduction.

If youre an employee with significant home office expenses, you can use the current detailed method of calculating the home office tax break, the CRA has said.

Now is the perfect time to gather all your home expenses to determine whether you want to use the detailed method, or the new temporary flat rate method introduced this week by the CRA, Golombek told Global News via email.

You can use the CRAs new handy online calculator to do just that.

READ MORE: How much could you save with the Liberals $400 home office deduction?

What Do These Irs Tax Return Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

When Youll Get Your Irs Tax Refund In 2022 And How To Track It Explained

- 8:58 ET, Jul 22 2022

MORE than 96million tax refunds have been delivered this year, but millions of Americans are still waiting on one.

Below we have outlined when to expect it and how to track your refund this year.

We have also highlighted some important dates you should keep circled on your calendar.

Also Check: Do You Have To File Taxes On Social Security Income

File Your Tax Return Electronically

Combining direct deposit and electronic filing can greatly speed up your tax refund. Since filing electronically requires a tax software program, it can flag errors that may cause processing delays by the IRS. These errors can include incorrect Social Security numbers, dependents dates of birth, and misspelling of names.

You can electronically file your tax return for free using the IRS Free File Program if your adjusted gross income is less than $73,000. Most simple tax returns can also generally be filed for free with commercial tax software providers, although you may be charged to file your state taxes.

If your tax situation is more complicatedif you sold property, paid business expenses or earned investment or business income, for exampleyou should consider hiring a tax professional. Having a knowledgeable tax professional, such as an enrolled agent, certified public accountant , or other tax professional, can help review your tax return and identify any mistakes that may slow down the processing of your tax refund.

Featured Partner Offers

On Cash App Taxes’ Website

Gather Your Personal Information

Youll need to know whether youll be claiming any dependents on your tax return, how much you earn per year, and how much will be withheld in taxes.

Most important of all, though, is your filing status. The tax brackets change based on whether youre filing as a single taxpayer, married but filing jointly, or married but filing separately.

Recommended Reading: How To Track Your State Tax Refund

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.

Repaying Emergency Benefits You Dont Qualify For

If you have to repay any COVID-19 benefits you didnt qualify for, it would be best to return the funds by the end of the year, Golombek told Global News.

To the extent that youve got the money and you have the opportunity to repay it before the end of the year, that would be the ideal scenario, he says.

There is no obligation to return the payments by the end of the year. But repaying after Dec. 31 means the amounts will show up on your T4A for 2020 and you may have to pay taxes on them, Golombek says.

If you end up paying taxes on money you return, the CRA will eventually make you whole but you may have to wait until you file your 2021 tax return in the spring of 2022 until that happens.

Any repayments made in 2021 will be recognized on a T4A slip for 2021, which will allow the individual to claim a deduction on the 2021 income tax and benefit return, the CRA told Global News said via email.

The process is based on general tax rules in the Income Tax Act that apply to repayments of taxable income, the CRA said.

Recommended Reading: When Does Inheritance Tax Kick In

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Consider What If Scenarios

Did you go through the calculator and find out that your refund is low or your balance due is too high. If so, try playing around with different scenarios to reach a number that you are satisfied with. For example, you could increase your charitable contributions or add some energy-saving home improvements.

If you foresee your income changing, you may want to try estimating taxes with a lower or higher income so you can see just how much of a difference it makes.

Also Check: When Is Sales Tax Due

The Wait Time Depends On How You File

Most Canadian income tax refunds are issued in anywhere from two weeks to 16 weeks depending on the type of return and when you filed it, according to the Canada Revenue Agency . When you file your tax return on or before your due date, CRA will send a Notice of Assessment and any applicable refund within:

- Two weeks of receiving your electronically filed return

- Eight weeks of receiving your paper-filed return

- 16 weeks of receiving your nonresident paper-filed return

The CRA also says refunds are faster if you choose to use direct deposit.

The deadline to file returns in Canada typically falls on April 30, 2021.

Why You May Owe More Taxes This Year:

The first round of emergency benefits Ottawa rolled out during the pandemic did not have any tax withheld at source. If you received either the CERB or the Canada Emergency Student Benefit , youll have to include 100 per cent of those payments in your 2020 tax return.

How much tax youll actually end up paying depends on your overall income for 2020. For example, if you made $27,000 from work in 2020 and received $8,000 worth of CERB, your taxable income for the year would be $35,000. Both the income you received from CERB and your job would be taxed in the same way.

Its possible you wont have to pay any tax at all.

If youre under $12,000 in total income for the year, you dont have to worry about any income taxes next year, Frank Fazzari, a chartered professional accountant at Vaughan, Ont.-based Fazzari + Partners, previously told Global News.

READ MORE: It didnt seem right Class-action lawsuit proposed over CERB repayments

With the second round of COVID-19 benefits that became available in September the CRB, the Canada Recovery Sickness Benefit , and the Canada Recovery Caregiving Benefit the government has been withholding 10 per cent in tax at source. This, however, may be insufficient to cover your tax liability, Jamie Golombek, managing director of tax and estate planning with CIBC Private Wealth Management, has warned.

Also Check: Can You File Missouri State Taxes Online

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Changes In Income Or Exemptions

If your expected Virginia adjusted gross income changes during the year, re-compute your estimated tax to determine how much your remaining payments should increase or decrease.

A change in income, deductions or exemptions may require you to file an estimated payment later in the year. If you file your state income tax return and pay the balance of tax due in full by March 1, you are not required to make the estimated tax payment that would normally be due on Jan. 15.

If you file your return after March 1 without making the January payment, or if you have not paid the proper amount of estimated tax on any earlier due date, you may be liable for an additional charge for underpayment of estimated tax.

Read Also: Can You Do Your Taxes Late

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

What’s Your Actual Tax Liability

The following information from the Form 1040, which you use to file your taxes each year, will help you determine your tax liabilityand whether you’ll get a refund or end up owing more:

- Line 24: The total tax due is what you owe in taxes for the year

- Line 25d: Income tax withheld is the total amount withheld from your income

Is the number on Line 25d larger than the number on Line 24? If so, that means you withheld too much. Go to:

- Line 34: This is your refund

Or is Line 24 larger? If so, you didn’t withhold enough. Go to:

- Line 37: This is the amount you owe

Also Check: How Do I Find What My Property Taxes Are

Estimated Irs Refund Tax Schedule For 2021 Tax Returns

In prior years, the IRS issued its refund tax schedule to provide a timeline of when you can expect to receive your tax refund. While the IRS no longer publishes a refund tax schedule, we put together an estimate of when you might expect to receive your tax refund based on previous years.

|

Date the IRS received your return |

Estimated direct deposit refund date |

Estimated check refund date |

|

May 13 |

People In Ontario Will Get Money Sent To Them Today Here’s How Much To Expect

A cheque from the government is on tap for some Ontarians this week.

Thats because the first instalment of the climate action incentive payment is set to be issued on July 15 along with a retroactive payment for April.

The CAIP is a tax-free payment created to help offset the cost of the federal pollution pricing. This follows the federal governments 2019 move to establish a national price on carbon pollution.

In the past, CAIP was handed out as a refundable credit claimed on an annual basis, but as of this month, the government has pivoted to quarterly installments.

The payment is only available to people living in Ontario, Alberta, Saskatchewan and Manitoba.

The amount residents receive depends on their family situation and the province they live in.

In Ontario, the program provides an annual credit of:

- $373 for an individual

- $186 for a spouse or common-law partner

- $93 per child under 19

- $186 for the first child in a single-parent family

There is also a rural supplement of 10 per cent of the base amount for residents of small and rural communities.

Residents do not need to apply for CAIP. Instead, the Canada Revenue Agency will determine who is eligible based on income taxes and benefit returns.

In order to receive CAIP payments, income taxes and benefit returns must be filed every year.

Read Also: What’s The Capital Gains Tax

Tax Refund Calculator: How Much Will Margaret Get Back In Taxes

How much does she stand to get back?

Subtract the red circle from the blue for the refund.

Uncle Sam might owe Margaret $14,465 when all is said and done. And if her situation doesnt change in 2021, her refund will actually grow to $20,584.

NOTE: Everyones tax situation is unique and any online tax refund calculator will, at best, provide you with a rough estimate of how much youll get back. The two examples above are incredibly simple and dont fully capture the nuances of someones actual financial situation.

Play around with them and be as specific as you can. The more details you can provide the better of an idea youll have of what youll receive for your refund.

So now you know roughly how much youll be getting back and youre ready to collect the money Uncle Sam owes you.

Before you hoist your Dont tread on me flag and march down to the IRS building to get your money, you should know about all the ways you can get your tax refund.

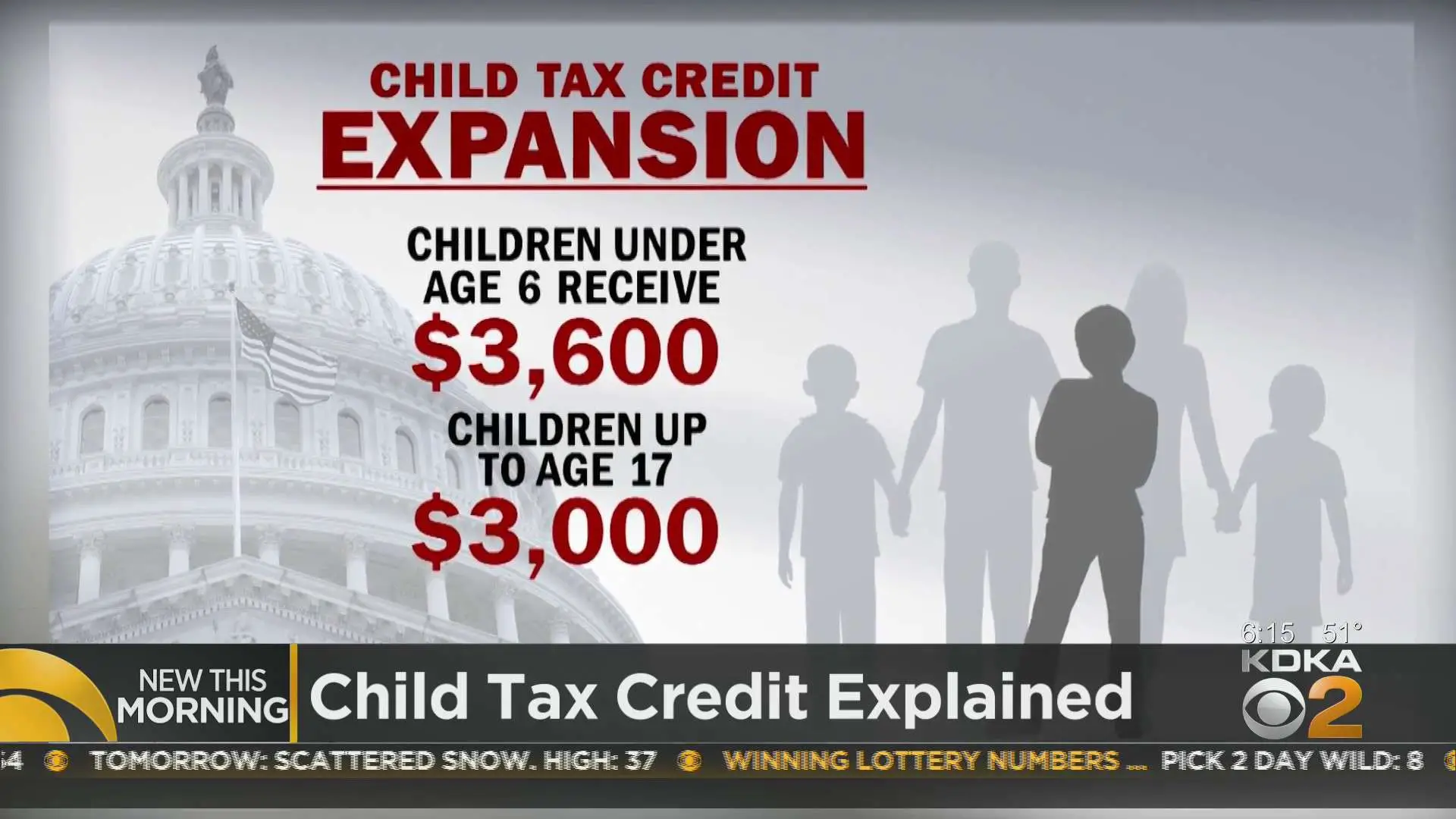

Some Tax Refunds May Be Delayed In 2022

If you claimed the Earned Income Tax Credit and the Additional Child Tax Credit , your tax refund may be delayed. The IRS will issue tax refunds for returns that claim these credits starting in mid-February.

Your financial institution may also play a role in when you receive your refund. Since some banks dont process financial transactions during the weekends or holidays, you may experience a delay in processing. If you opt to receive your tax refund by paper check, use our tax refund schedule to determine when you can expect to receive your refund.

Finally, you can expect your tax refund to be delayed if you filed an amended tax return. The IRS warns that it is taking more than 20 weeks to process amended tax returns.

Read Also: How To Live Without Paying Property Taxes

How To Prepare For Next Year

If you want a larger refund next year , you can update your Form W-4 to change how much is withheld from your paychecks. We recommend checking how much is being withheld from your paycheck once or twice a year to make sure youre on target. For help determining the amount that should be withheld, use the IRS’s calculator or meet with a tax professional.

Estimate Your Payment Amount

You are eligible if you:

- Filed your 2020 tax return by October 15, 2021

- Meet the California adjusted gross income limits described in the What you may receive section

- Were not eliglible to be claimed as a dependent in the 2020 tax year

- Were a California resident for six months or more of the 2020 tax year

- Are a California resident on the date the payment is issued

To receive your payment, you must have filed a complete 2020 tax return by . However, if you applied for an Individual Taxpayer Identification Number and had not received it by October 15, 2021, you must have filed your complete 2020 tax return on or before February 15, 2022. ââ µReturn to place in article

Read Also: What Is My Federal Tax Rate

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.