Unemployment Benefits Are Taxable Income

Unemployment benefits are considered income along with wages, salaries, and bank interest. You will need to include them as part of your total income when you file your taxes. State unemployment divisions issue an IRSForm 1099-G for those who have received unemployment insurance during the year, including those received through the federal programs created during the pandemic but administered through the state unemployment agencies.

Individuals must report their unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. The amount will be carried to the mainForm 1040. Remember to keep all of your forms, including any 1099-G form you receive, with your tax records.

Unemployment compensation must be reported on your #IRS tax return. Learn more at

IRSnews

No Matter How You File Block Has Your Back

Who Needs To File An Amended Return To Claim The Tax Break

Most taxpayers dont need to file an amended return to claim the exemption. If the IRS determines you are owed a refund on the unemployment tax break, it will automatically correct your return and send a refund without any additional action from your end.

The only reason to file an amended return is if the calculations now make you eligible for additional federal credits and deductions not already included on your original tax return, like the Additional Child Tax Credit or the Earned Income Tax Credit. If you think youre now eligible for deductions or credits based on an adjustment, the most recent IRS release has a list of people who should file an amended return.

Recommended Reading: How Do I Know If I Got Unemployment

Also Check: How To Take Taxes Out Of Employee’s Paycheck

Will I Owe Taxes Because Of My Unemployment Compensation

- Generally, states dont withhold taxes on unemployment benefits unless asked.

- However, if you qualify for EITC, or the child tax credits, your taxes could be covered.

- You can do a year-end tax checkup to see if you have enough credits and withholding to cover your taxes. You may still have time to make adjustments to lower your shortfall.

- If you are still unemployed come 2021 tax time, you can set up a payment plan with the IRS or work out other delayed payment options.

- The IRS assesses penalties on the balance owed when you file and when you pay late they also compound interest on the full bill daily. The IRS has programs that may forgive your tax penalties. If you qualify, this will also help reduce your interest and lower your overall tax bill.

- Make sure you file your tax return on-time, even if you cant pay. In the short-term, the penalties for filing late are higher than the penalties for paying late.

Dont Miss: Unemployment Pa Ticket Number

Keeping Track Of Your Unemployment Benefits

Itâs a good idea to keep track of all the paperwork associated with your unemployment benefits. Take screenshots of online documentation. Keep receipts for the unemployment you receive. Make sure you know how much you are entitled to receive. If you are receiving more than you are supposed to receive, you will be required to return the overpayment. So, it is smart not to spend that money.

Itâs a good idea to put the overpayment in a separate bank account to keep yourself from spending it. If there is an error, you can contact the unemployment office. You can also ask your state-elected officials for help. It is their job to make sure their constituents receive the government benefits theyâre eligible for. You can also contact a private attorney for help.

Don’t Miss: How To Find Property Tax Amount

Reporting Unemployment Income For Taxes

Your stateâs unemployment agency will report the amount of your benefits on Form 1099-G. The IRS gets a copy, and so do you. The form will also show any taxes you had withheld.

You must report these amounts on line 7 of the 2020 Schedule 1, then total all your sources of additional income in Part I of the schedule and transfer the number to line 8 of the 2020 Form 1040.

The economic impact payment or stimulus checks that you might have received are not considered to be unemployment compensation. You do not have to pay taxes on this money.

Child Care Expenses Deduction And Unemployment

You may write off the cost of childcare expenses on your taxes, and this does not change even if you are unemployed. There is no expectation to withdraw your children from care simply because you are not working. In fact, one of the provisions of receiving EI is that you are seeking work and ready to start, conditions that may be hard to meet if your children are withdrawn from care.

Read Also: Veterans Individual Unemployability Fact Sheet

Read Also: Do Elderly Have To File Taxes

Earned Income Tax Credit

The earned income tax credit, or EITC, is a federal income tax credit for working people with low to moderate income. If you earned money through wages or self-employment work before losing your job, you might qualify for this credit in the tax year in which you had eligible income.

But unemployment benefits dont count as earned income for the purpose of the EITC, so if you didnt have any earned income in the tax year, you wont be able to claim this credit. Eligibility also depends on other factors, including your filing status, the number of qualifying children you can claim, and the amount of your earned income.

The credit is refundable, meaning that, in addition to reducing the amount you owe, it could give you a refund over the amount of tax you paid in.

Need Help With Unemployment Compensation Taxes

- Do I Have to Pay Taxes on my Unemployment Benefits can walk you through how to pay federal and if applicable, state taxes on your unemployment benefits.

- Get Free Tax Prep Help can help you locate a VITA site near you so that IRS-certified volunteers that can help you file your taxes for free.

- Code for Americas Get Your Refund website will connect with an IRS-certified volunteer who will help you file your taxes.

The deadline to file your taxes this year is April 18, 2022.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.

Read Also: What Does Tax Credit Mean

Information For People Who Already Filed Their 2020 Tax Return

This law change occurred after some people filed their 2020 taxes. For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation, the IRS will determine the correct taxable amount of unemployment compensation. Any resulting overpayment of tax will be either refunded or applied to other taxes owed.

The agency will do these recalculations in two phases.

- First, taxpayers who are eligible to exclude up to $10,200.

- Second, those married filing jointly who are eligible to exclude up to $20,400, and others with more complex returns.

Taxpayers only need to file an amended return if the recalculations make them newly eligible for additional federal tax credits or deductions not already included on their original tax return.

For example, the IRS can adjust returns for taxpayers who claimed the earned income tax credit and, because the exclusion changed their income level, may now be eligible for an increase in the EITC amount.

However, taxpayers would have to file an amended return if they did not originally claim the EITC or other credits but are now eligible to claim them following the change in the tax law. Taxpayers can use the EITC Assistant to see if they qualify for this credit based upon their new taxable income amount. If they now qualify, they should consider filing an amended return to claim this money.

These taxpayers may want to review their state tax returns as well.

Read Also: Are You Taxed On Cryptocurrency Gains

How To Calculate Futa

Only the first $7,000 of payments to any employee in a calendar year is subject to FUTA tax (after deducting To calculate your FUTA tax liability for each payroll, follow this process:

Begin with the FUTA taxable wages for a pay period , plus:

- Most fringe benefits, including wages and salaries, commissions, fees, bonuses, vacation allowances, sick pay, and the value of goods, lodging, food, and other non-cash benefits, and

- Employer contributions to employee retirement plans, and

- Other specific payments, as noted above.

From this amount, deduct:

- All payments that are exempt from FUTA tax and

- All amounts for each employee over $7,000 for the year.

You will need this total for all employees for the FUTA report on Form 940.

Then, take the total amount up to $7,000 for all employees and multiply it by 0.6% to get the amount of unemployment tax due.

Set aside this amount in a liability account .

Dont Miss: Applying For Indiana Unemployment

Read Also: How Much Is California State Tax

Paying Unemployment Taxes At The State And Local Level

At the local and state level, the options to pay for your state and local taxes may differ depending on where you live. Contact your state, county, or local unemployment office to learn about the different options to pay your taxes. These options may include:

1. Requesting to have state and/or local taxes withheld. The steps to request state and local tax withholding differ.

2. Making quarterly estimated payments. The due dates for estimated payments at the state and local level may differ from federal due dates.

3. Paying your taxes in full. If you need your full amount of your unemployment benefits and cannot make quarterly estimated payments, you can pay your taxes all at once when they are due. However, you may receive an underpayment penalty for not paying enough taxes throughout the year.

Start Saving As Soon As Possible

If the bill isnt too big, you may be able to simply save up enough money between now and the April 15 due date to pay the bill by then. The most efficient way of doing this is to set up a savings plan for yourself where you automatically put aside a small amount each week from your checking to your savings account.

You May Like: How To Do My Own Taxes On Turbotax

Tax Season Is Here Dont Expect A Refund For Unemployment Benefits

- Tax season started Jan. 24 and runs through April 18. A tax break isnt available on 2021 unemployment benefits, unlike aid collected the prior year.

- The federal tax code counts jobless benefits as taxable income.

- The American Rescue Plan Act had waived federal tax on up to $10,200 of benefits collected in 2020. The measure applied per person, for households with income less than $150,000.

Tax season is officially here. And those who collected unemployment benefits in 2021 may be in for an unwelcome surprise.

While a federal tax break on jobless benefits was available during last years tax season, the same isnt true this year.

Since unemployment benefits count as taxable income, recipients who didnt have tax withheld from their unemployment payments in 2021 may owe money to the IRS or get a smaller-than-expected tax refund.

The American Rescue Plan Act, a pandemic relief law, waived federal tax on up to $10,200 of unemployment benefits per person collected in 2020, a year in which the unemployment rate spiked to levels unseen since the Great Depression.

Households qualified for the federal waiver if their income was under $150,000.

However, Congress hasnt approved a similar tax break for 2021 benefits which may surprise taxpayers when they file their income tax returns. Tax season starts Jan. 24 and runs through April 18.

You May Like: How Much House Can I Afford After Taxes

Paying Taxes When You Are Unemployed

Unless the federal and/or state governments act to change the law, youll likely have to pay federal income tax on the unemployment compensation you receive while out of work because of COVID-19.

You have multiple options for paying your taxes when youre unemployed.

You can choose to have federal income taxes withheld from your unemployment compensation when you apply for unemployment benefits, or you can choose not to do so and just pay estimated taxes each quarter to avoid a tax bill when you file your return.

Of course, you could also wait until you file your taxes and pay any tax you owe at that time. But you may want to think long and hard before choosing that option, especially if youre worried you may continue to struggle financially even after the COVID-19 crisis subsides. The federal tax system is pay-as-you-go, so youre supposed to pay taxes on income as you receive it throughout the year. If you dont pay enough throughout the year, a big tax bill in April might not be your only worry. You could also face a penalty for underpaying your estimated taxes.

If your total income for the year including wages, unemployment benefits, interest, retirement distributions and all other income you made is less than the standard deduction for your filing status, you normally arent required to file a tax return, says Christina Taylor, senior manager of tax operations for Credit Karma Tax®. In that case, you might not need to have tax withheld from your unemployment.

Recommended Reading: What Is The Deadline For Filing Taxes

Making Estimated Tax Payments

You might be required to make payments directly to the IRS as quarterly estimated tax payments if you elect not to have taxes withheld from your unemployment benefits. This works out to a payment once every three months. You can elect to do this instead of having 10% withheld from every unemployment check, giving yourself a little bit of wiggle room when money is tight.

You might even have to make quarterly payments in addition to withholding from your benefits. Youre obligated to make estimated payments if you expect that youll owe at least $1,000 after accounting for all taxes withheld from all your sources of income, and if you expect that your withheld taxes plus any refundable tax credits youre eligible for will be less than 90% of what youll owe, or 100% of the total taxes you paid last year.

You might want to consult with a tax professional because the whole equation can be complicated. You could accrue additional penalties if you dont pay enough tax, either through withholding or estimated tax payments.

Know That Your Nanny Should Be Classified As A Household Employee

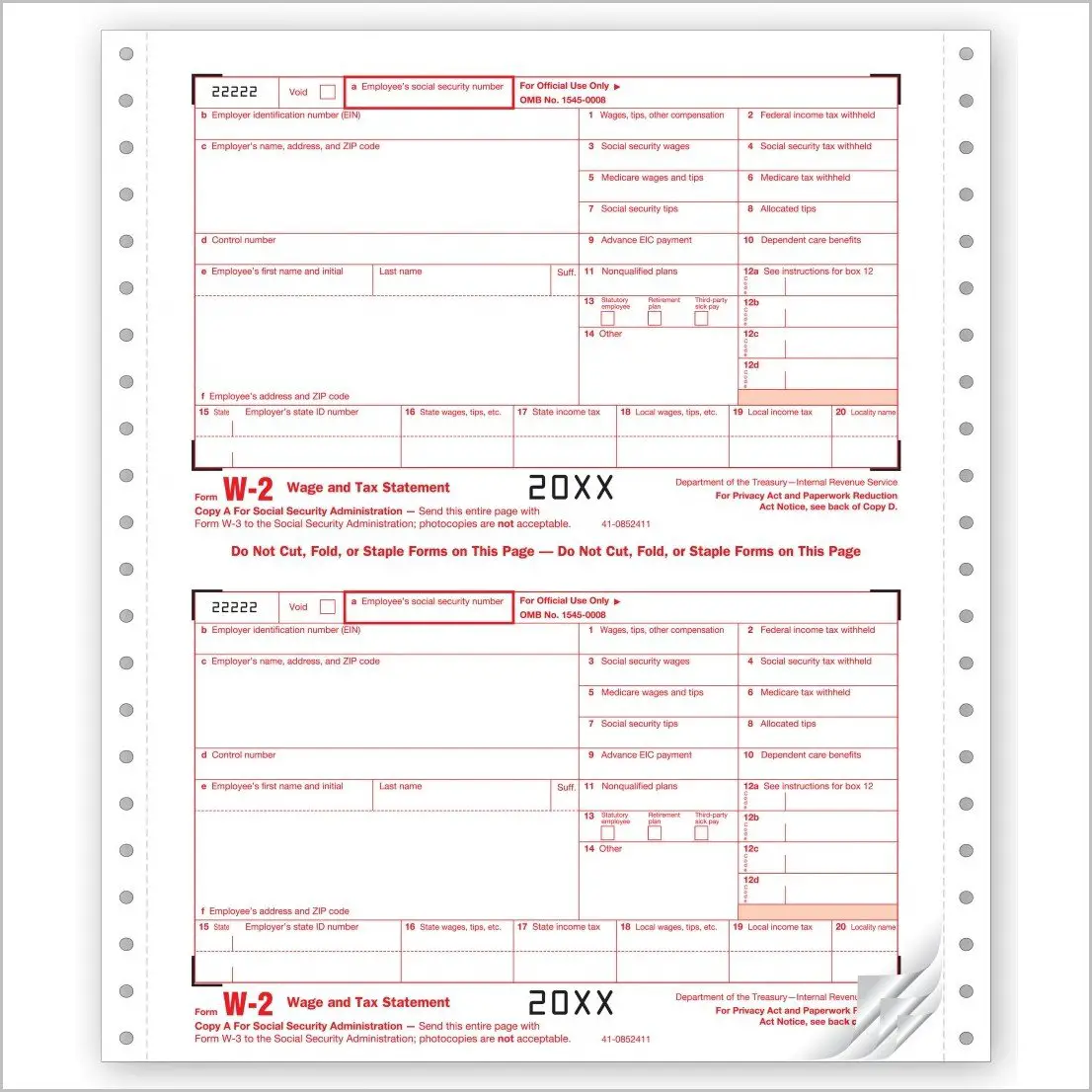

The IRS has ruled that, with very few exceptions, nannies are employees of the families for whom they work not independent contractors. This is regardless of the amount of hours worked, wages paid or whats written in an employment contract. This means your nanny should be given a W-2 form, rather than a 1099 form, to file their taxes. Worker misclassification is considered a form of tax evasion and is a risk you should not be willing to take.

Recommended Reading: How Much Do Tax Accountants Make

How Does The $10200 Tax Waiver Work

As part of the American Rescue Plan, many taxpayers wouldnt be required to pay taxes on up to $10,200 in unemployment benefits received last year. The exclusion is up to $10,200 of jobless benefits for each spouse for married couples.

So its possible that if both lost work in 2020, a married couple filing a joint return might not have to pay federal income taxes on up to $20,400 in jobless benefits.

It can be a little confusing. So, for example, if one spouse received $15,000 in jobless benefits but the other received just $1,000 in unemployment compensation in 2020, then the exclusion for tax purposes that the couple would receive would be $11,200 not $16,000.

Read Also: Www.njuifile.net Espanol

State Income Taxes On Unemployment Benefits

Many states tax unemployment benefits, too. There are several that do not, and some waived income tax on benefits received in 2021. For example, Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Seven states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

Recommended Reading: Does Llc Pay Self Employment Tax