Facilities Provided By The Ird

To facilitate taxpayers to make instalment applications, the Inland Revenue Department provides:

- Enquiry Hotline 187 8033

- Designated Fax line for applications by fax 2519 6757 and

- Designated Postal box for applications by mail

The IRD pledges to reply to the applicants within 21 working days after receipt of the application.

For further information on instalment applications, please call our Enquiry Hotline 187 8033.

Do Us Citizens Have To Pay Taxes On Foreign Income

Yes, U.S. citizens have to pay taxes on foreign income if they meet the filing thresholds, which are generally equivalent to the standard deduction for your filing status. You may wonder why U.S. citizens pay taxes on income earned abroad. U.S. taxes are based on citizenship, not country of residence. That means it doesnt matter where you call home, if youre considered a U.S. citizen, you have a tax obligation.

Your expat tax filing requirement doesnt change even if youre paid by a foreign employer overseas. In addition to federal income taxes, some U.S. citizens living abroad also need to file state taxes as well, depending on their last state of residence.

Taxable foreign-earned income includes:

If youre a U.S. citizen abroad and have never filed a tax return, you can relax. The IRS built in a safeguard for honest expats who truly didnt know they had to file. You can get caught up penalty-free with Streamlined Filing Compliance Procedures. To qualify, you must:

- Have lived in a foreign country for at least 330 days during one of the last three years

- Confirm it was a genuine mistake you failed to file your U.S. tax return and FBAR

What Is An Irs Payment Plan

An IRS payment plan is an agreement you make directly with the agency to pay your federal tax bill over a certain amount of time. There are two kinds of IRS payment plans: short-term and long-term.

Typically you’ll make monthly payments to settle what you owe. So long as you’re keeping up with that, the IRS usually won’t garnish your wages or seize any bank accounts or property. But getting on an IRS payment plan doesnt get you out of interest and penalties for late payment those accrue until your balance is zero.

» Learn more:10 more ways to make an IRS payment.

Read Also: Where Do I Mail My Tax Return

Paying Your Taxes Over Time

In 2022, the deadline to file your 2021 taxes is Apr. 18. And even if you’re afraid you won’t be able to afford paying your taxes, it’s better to file and set up a payment plan than to avoid filing entirely. This could lead to interest and penalties.

So if you get the dreaded news of owing Uncle Sam, here are your options of extended payment plans:

Do You Owe More Tax Or Will You Receive A Refund

If your refund exceeds your total balance due on all outstanding tax liabilities including accruals, youll receive a refund of the excess unless you owe certain other past-due amounts, such as state income tax, child support, a student loan, or other federal nontax obligations which are offset against any refund.

Will I get refund if I owe back taxes 2020?

2. You owe back taxes. If you owe back taxes, the IRS will take all your refunds to pay your tax bill, until its paid off. The IRS will take your refund even if youre in a payment plan .

Will I get a stimulus check if I owe the IRS?

Because stimulus money is designed to boost the economy and give a lifeline to those in need, you will receive a stimulus check even if you have outstanding debts. The IRS is not going to use your stimulus check to offset what you owe the government.

When you owe taxes How long do you have to pay?

The IRS will provide up to 120 days to taxpayers to pay their full tax balance. Fees or cost: Theres no fee to request the extension. There is a penalty of 0.5% per month on the unpaid balance.

Recommended Reading: Do You Have To Pay Taxes On Insurance Settlements

How Does It Work

- For each type of tax you can indicate whether you would like to pay the outstanding amount automatically or not.

- You authorise the municipality to deduct the assessment amount from your bank account.

- The authorisation continues for each assessment of the same sort of tax which you receive thereafter until you stop it yourself or the debit payment fails 2 times.

- The number of instalments depends upon the moment you request the direct debit. Are you doing this immediately after receiving your tax assessment? The amount will be withdrawn from your bank account in 12 monthly instalments. Are you requesting a direct debit later? Then you will have fewer months to make the payments. The amount that you will have to pay each month will then be higher.

- A separate amount will be deducted each month for each assessment which you pay in instalments.

How Can I Pay My Federal Taxes With Installments Or Monthly Payments

How Can I Pay My Federal Taxes With Installments or Monthly Payments?

Every year, there are millions of taxpayers who find themselves unable to pay their taxes in full to the IRS. The IRS knows there will be some taxpayers coming up short. The good news is the federal government is happy to work with you. The bad news is, theyre relentless in their collection of back taxes and if left unattended, they can levy your bank account, garnish your paycheck, or put a lien on your property to settle your tax bill.

However, their cooperation comes at a price, called penalties and interest. Here are the steps you need to take if you wish to pay your federal income tax with installment payments.

Before you proceed to navigating the complicated maze that is the IRS on your own, we highly encourage all our readers to speak to a qualified Tax Relief Expert at our office. You can schedule a confidential, no obligation consultation to explore your options for tax relief www.SmithsTaxSolutions.com/Contact

Here are some steps you can take to get on an IRS payment plan if you cant pay your taxes in full.

File Correctly and On Time

Waiting until after April 15 to file is also a poor plan, because you will only accrue more penalties. Also, filing an extension does not mean you have more time to pay. It simply means youll end up paying more with penalties and interest, sinking you deeper into a hole.

So make sure you file on time!

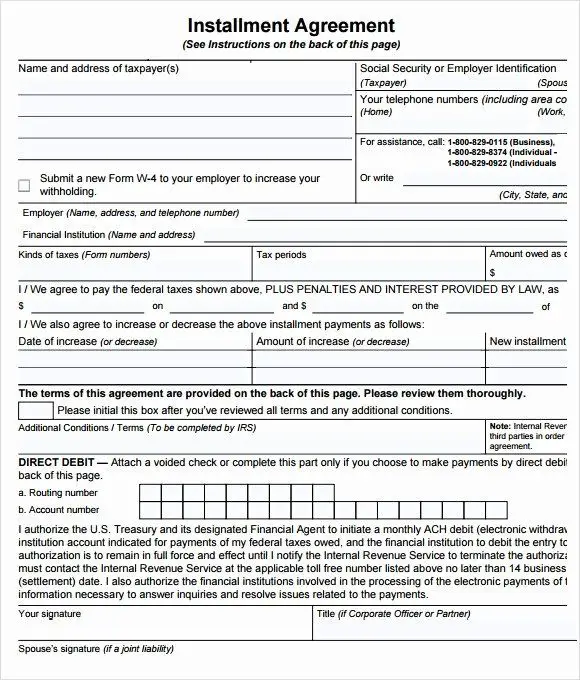

Ok, back to Form 9465

You May Like: Efstatus.taxact 2014

Read Also: Can I File Taxes With Unemployment Income

How Far Back Will Irs Pay Refunds

three yearsThe law gives procrastinators three years to submit a return and claim a refund. The three-year countdown starts on the original due date of the return or the extension due date, if an extension was filed.

What happens if you owe taxes and get a refund?

If you owe back income taxes, your refund can be taken to pay or offset the amount due. If anything is left, it will be refunded to you in the way you requested on your tax return, either by direct deposit or check. You should also get a notice from the IRS explaining why the money was withheld.

How To Apply For An Installment Payment Plan

Applying for an installment plan will be quicker and easier if you do it before the end of the tax year. This will also mean that you can start your repayments earlier and pay less in interest overall.

If you realize you need to apply for an interest payment plan then you can apply in person, via mail, over the phone, or online.

The easiest and cheapest way to apply for an installment plan is to apply online. You can also make your payments online instantly at no extra charge.

You May Like: When Is Oklahoma State Taxes Due

Read Also: Are You Taxed When You Sell Your Home

Working With A Tax Debt Relief Company

If youre already busy juggling all of your other personal and financial responsibilities. The last thing you want is making time to interpret complex IRS tax code and processes to resolve your tax debt. And if your situation is uniquely complicated, you could be up against a brutal battle with the IRS. However, not taking action can result in much graver consequences, such as aggressive interest, collections measures, and even criminal charges.

With more than 65,000 clients and over $600 million in tax debt resolved, the experts at Community Tax are here to help:

- Our team quickly identifies the best tax relief option for you, eliminating the need for hours of self-directed research and considering the pros and cons.

- We resolve your tax issues in a timely manner without making you stay on hold with federal and state tax bureaus.

- Together, we can expedite the process by helping you gather the documents you need to apply for the appropriate tax relief solution for your needs.

- Thanks to our experience negotiating with the IRS, were confident in our ability to secure the best possible outcome for your situation.

Whether you need tax relief advice while preparing your taxes or need support finding the best tax debt relief solution for your needs, our team is well-equipped to apply the best strategy for your situation. Get your free consultation today.

What If I Am Not Eligible Or Unable To Apply Or Revise A Payment Plan Online

If you are ineligible for a payment plan through the Online Payment Agreement tool, you may still be able to pay in installments.

If you prefer to apply by phone, call or , or the phone number on your bill or notice

If you are unable to revise an existing installment agreement online, call us at or . If you have received a notice of default and cannot make changes online, or you received an urgent notice about a balance due, follow instructions listed on the letter and contact us right away.

Recommended Reading: What Address Do I Send My Tax Return To

How Long Your Time To Pay Arrangement Lasts

There is no time limit on how long a Time to Pay arrangement can last. How long yours will last depends on how much you owe and what you can afford to pay each month.

Contact HMRC if anything changes that you think affects your Time to Pay arrangement. The arrangement can be made longer or shorter.

If HMRC finds out that something has changed in your circumstances, they may contact you to discuss changing your repayments.

Change Bank Account Number

Tax payments can be deducted from only 1 IBAN . If you change the bank account number, this change will apply to all of your payment authorisations for the Municipal Tax Department. It is not possible, for example, to have the dog tax deducted from a different bank account from the one used to pay the municipal tax bill.

You can also change the bank account in writing by sending a letter to the Municipal Tax Department. The letter should contain the following information:

- the old account number

You May Like: How To Estimate Income Tax

Tips For Paying Your Taxes In Installments

Like most Canadians, your employer probably withholds income tax from your earnings so that you wont have a big tax bill to pay at the end of the tax year. In many cases, you may be eligible for a refund based on expenses and tax credits claimed against tax youve paid. However, if you have business or rental income from which no tax is withheld, you might just have a big tax payment. Tax instalments prevent this through quarterly tax payments for the current tax year .

Self-employed farmers and fishermen may pay tax in a single instalment payment.

Paying Your Debt Earlier

It is possible to pay off your debt earlier. For example using your holiday pay. The Municipal Tax Department will adjust the monthly amount according to the remaining outstanding amount. You can pay off your debt by transferring an amount using online banking. Always note the payment reference number on your tax assessment.

You May Like: What Information Do You Need To File Taxes

Defaulting On Your Payment Plan

You will default on your plan if you fail to pay the minimum due or fail to pay current taxes each year on or before April 10th, and you will again be charged the penalties on your full defaulted taxes beginning with the original default date.

An installment plan CANNOT be restarted in the same fiscal year in which it defaulted. An installment plan also CANNOT be restarted if the property has become subject to our offices annual tax sale.

If eligible, you can start a new installment plan after July 1st following the fiscal year the plan defaulted. The default credit cannot be used to start a new payment plan. That amount will be deducted from the balance after the initial 20% has been applied.

A new installment plan MAY be initiated:

- Only after July 1 following the default of the plan.

- All conditions of the installment plan must be met.

An installment plan MAY NOT be initiated:

- After the fifth year following the declaration of tax default.

- After the property has become subject to Power to Sell.

|

$56.43 per month |

How often do I make payments?

At least once a year. Your annual 20% payment of prior year taxes plus accrued interest and a $81 maintenance fee are due no later than April 10th of each year, plus current year taxes must be paid no later than April 10th of each year while on the five-year plan.

How much are the payments?

Can I pay more often than once a year?

Will the taxes still show as delinquent while Im on the five-year plan?

Registered Charities And Similar Organizations

Charities and Non-Profit Organizations are eligible for reduced property taxes.

Requirements:

- Must be a registered charity as defined in s.248 of the Income Tax Act and have a registration number issued by the Canada Revenue Agency.

- Property must be in one of the commercial or industrial property classes.

Current legislation requires Council to rebate a minimum of 40% of total property taxes payable by a charity and permits rebates of between 0% and 100% to organizations deemed to be similar to a charity.

Review the Charity Rebate Application or contact the tax office at 519-376-4440 ext. 1249 to determine your eligibility for a charitable rebate.

Applications will be accepted between January 1 and February 28 of the following year.

- There is a processing fee of 2.5% for credit card transactions.

- The maximum payment is $5,000.00 per transaction. Multiple payments can be made as separate transactions towards your account.

- Please allow up to two business days for processing.

- You will receive an e-mail confirmation of payment for online payments or a confirmation number by phone.

- You will need your 11 digit roll number to make a payment.

Payment must be received at City Hall by the due date to avoid penalty. A late payment charge of 1.25% is calculated on the amount outstanding and will be added to the property tax account on the first of each month.

For more information, questions, or comments please contact our Property Tax Collector at 519-376-4440 ext. 1249 or .

Don’t Miss: How Do I Find My Old Tax Returns On Turbotax

I Am Applying As An Individual:

- Name exactly as it appears on your most recently filed tax return

- Valid e-mail address

- Address from most recently filed tax return

- Your Social Security Number or Individual Tax ID Number

- Based on the type of agreement requested, you may also need the balance due amount

- To confirm your identity, you will need:

- financial account number or

What Are Your Options If You Are Not Able To Revise Your Existing Plan

If you cant revise or make changes to your existing installment plan online to pay your delinquent tax balance, you can give the IRS a phone call. For individual taxpayers, they can reach out to the IRS via the phone number 800-829-4933. But for those business owners can get in touch with the agency using the phone number 800-829-4933.

Besides that, if you arent able to make updates or changes on your installment plan online and you received a notice of default or an urgent notice about your delinquent tax balance, all you need to do is follow all of the instructions stated on the letter and give the IRS a phone call immediately. They will be able to assist you with your concern further and give you more details.

Don’t Miss: How Is K1 Income Taxed

How Do I Determine If I Qualify For Low Income Taxpayer Status

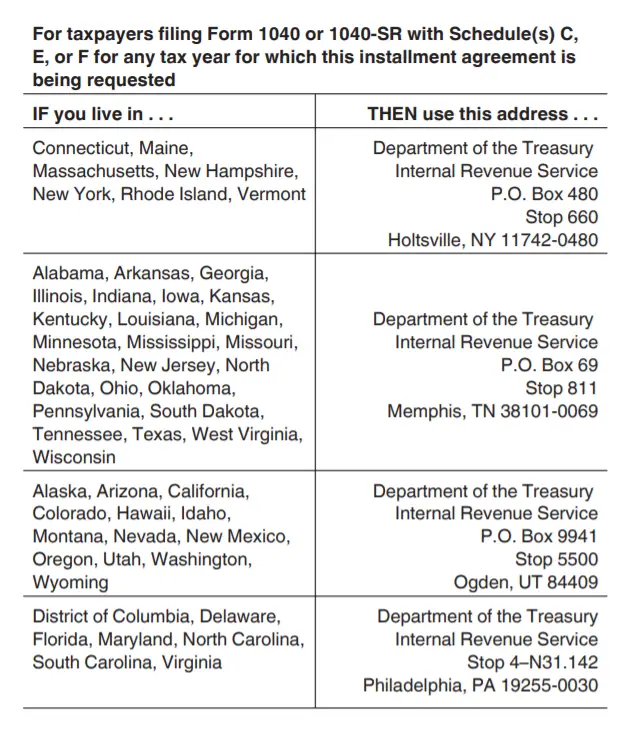

If you believe that you meet the requirements for low income taxpayer status, but the IRS did not identify you as a low-income taxpayer, please review Form 13844: Application for Reduced User Fee for Installment AgreementsPDF for guidance. Applicants should submit the form to the IRS within 30 days from the date of their installment agreement acceptance letter to request the IRS to reconsider their status.Internal Revenue ServicePO Box 219236, Stop 5050Kansas City, MO 64121-9236

Reduce Your Instalment Interest And Penalty Charges

You can reduce or eliminate interest and penalties if you do one of the following:

- overpay your next instalment payment

- pay your next instalment early

This will allow you to earn instalment credit interest. This credit interest is not refundable and can only be used against any interest charges on late payments for the same tax year.

Recommended Reading: How To Do Taxes Online For Free