Pennsylvania Announces Voluntary Compliance Program For Retailers With Inventory In Pennsylvania

The Pennsylvania Department of Revenue has announced that it is offering a Voluntary Compliance Program for any business that has inventory or stores property in Pennsylvania but is not registered to collect and pay Pennsylvania taxes. The program announcement does not specify which taxes are affected however, the program is listed under the Department of Revenues website section for Tax Obligations for Online Retailers, which specifically refers to sales and use tax, personal income tax, corporate net income tax, and other taxes such as cigarette taxes and fuels taxes. This program runs through June 8, 2021 and offers a limited lookback period and penalty relief when the business becomes compliant. Taxpayers who choose to participate in this program will not be liable for taxes owed prior to January 1, 2019. Taxpayers who participate in the program will also be given penalty relief for any noncompliance for past due tax returns that were not filed and taxes that were not paid. For additional information, please visit the Pennsylvania Department of Revenue website, which provides a Business Activity Questionnaire that must be completed.

May 13, 2021

How Does Pennsylvania Real Estate Tax Work

Pennsylvania code gives several thousand local public districts the power to levy real estate taxes. Most often, the taxes are collected under a single billing from the county. Every municipality then is given the tax it levied. Overall, there are three stages to real estate taxation: establishing tax rates, evaluating market value, and then bringing in the tax.

Counties and cities in addition to thousands of special purpose districts have taxing authority accorded by Pennsylvania law. All are official governing bodies managed by elected or appointed officers. They work in a distinct neighborhood such as within city borders or special purpose units including recreation parks, water treatment plants, and fire districts.

The citys implementation of real estate taxation cannot disregard the states statutory rules. All property not exempted should be taxed equally and uniformly on one current market worth basis. Owners rights to reasonable alerts to tax levy hikes are also mandated.

The city determines tax rates all within Pennsylvania regulatory guidelines. Reserved for the county, however, are appraising property, issuing billings, taking in collections, carrying out compliance, and addressing conflicts.

Pa Inherence Tax Returns Update

Due to the recent closing of commonwealth and county office buildings to help prevent the spread of COVID-19, the Department of Revenue is aware that taxpayers have been unable to meet their Inheritance Tax filing and payment obligations. To address these concerns, the Department is asking County Register of Wills offices to implement the following procedures when their operations resume:

If a taxpayer is filing a return or making a payment and indicates that either was due during the timeframe that offices were closed, please place a date received as of March 12, 2020, on the return and the receipt.

In addition, the Department is making system modifications to not apply penalties for payments received late, that otherwise would have been timely during office closures.

Recommended Reading: Where’s My Income Tax

Business Licenses And Business Taxes

The City of Easton requires all businesses located in or doing business within the corporate limits of the City of Easton to have a Business License. Licenses are for the calendar year and must be obtained before transacting business. Business licenses must be renewed each year. Renewals are due by February 28.

Quarterly Business Privilege Tax filings :

- 1st installment – 4/30/21

- 3rd installment – 10/31/21

- 4th installment – 1/31/22

Businesses must file a tax return on their gross receipts for the previous year by April 15 for calendar year filers or 105 days after the end of their fiscal year for other fiscal years. The City periodically audits businesses to check accuracy and compliance with the business tax laws.

Pennsylvania Releases Bulletin On Taxation Of Medical Marijuana

Under Pennsylvanias Medical Marijuana Act , Pennsylvania imposes a tax on the gross receipts a grower/processor receives from the sale of medical marijuana at the point a grower/processor sells or transfers product to a dispensary. The tax is paid by the grower/processor at the rate of 5%. Grower/processors and clinical registrant grower/processors must submit quarterly medical marijuana gross receipts tax returns, even for periods where no taxable sales occurred. Returns and payments must be submitted electronically through the Pennsylvania Department of Revenues online filing system . For further information, please see Pennsylvanias recently released Medical Marijuana Tax Bulletin 2021-01.

You May Like: What Is Advanced Premium Tax Credit

The City Of Philadelphia Provides Extensions And Installment Plans For Property Tax Relief

The City of Philadelphia has changed the extended due date for real estate taxes from April 30, 2020 to July 15, 2020. The Department has also extended the deadline to July 15th for senior citizens over the age of 65, and eligible low-income homeowners, to apply for an installment payment plan for their real estate taxes.

Source:

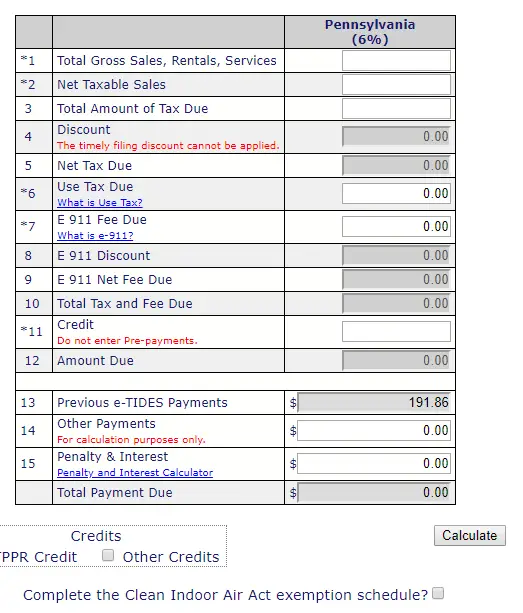

Pa Waiver Of Penalties On Accelerated Sales Tax Payment

The Department of Revenue is waiving penalties for businesses that are required to make Accelerated Sales Tax prepayments by the deadline of Friday, March 20, 2020. For April sales tax payments, the Department is waiving the AST prepayment requirement and asking businesses to remit the sales tax that they have collected in March.

May 2, 2020

Don’t Miss: How Do You Pay Taxes When You Are Self Employed

When Are The Pennsylvania State Quarterly Taxes Due

When you earn income that does not have taxes withheld by an employer, you still have to pay taxes on it — in Pennsylvania, you may have to make as many as four payments per year. These are called estimated payments, and you only have to make them if you estimate that your untaxed income will be above a certain amount. If you don’t pay these estimated taxes, you could face a penalty.

Philadelphia Revises Its Income Tax Faq Pertaining To Covid

The Philadelphia Department of Revenue has revised its answers to a list of frequently asked questions regarding the Departments wage tax policies throughout the coronavirus pandemic. The FAQs address different circumstances for determining the extent to which a nonresident employees compensation is treated as compensation for services performed in Philadelphia and, thus, subject to the Philadelphia wage tax. For example, for employers who have a policy consistent with Philadelphias current guidance that all employees who are able to work from home are required to do so, but allow access only if employees prearrange to come to the Philadelphia workplace and pass a health assessment, the wages of the nonresident employees are subject to the wage tax only with respect to the days that they passed the health assessment and spent the day working at the Philadelphia workplace. For answers to additional questions, and other specific examples, please see Philadelphia Wage Tax Q& A applicable to COVID-19 policies, Philadelphia Dept. of Rev., 05/01/2021.

May 5, 2021

You May Like: How Much Taxes Will Be Taken Out

Newport Township Hazleton Wilkes

The Luzerne County Treasurers Office will collect the County taxes for Hazleton, Nanticoke, Wilkes-Barre and Pittston cities for 2022. The office will also be collecting the County/Municipal taxes for Newport Township.

Office hours are 9 a.m. to 4:30 p.m., Monday through Friday. Questions regarding the collection of taxes can be directed to our office at 570-830-5129.

Pennsylvania Property Tax Rates

Property taxes are collected on a county level, and each county in Pennsylvania has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in Pennsylvania.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across Pennsylvania. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in Pennsylvania.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the Pennsylvania property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free Pennsylvania Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Pennsylvania.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

Keep in mind that assessments are done on a property-by-property basis, and our calculators cannot take into account any specific features of your property that could result in property taxes that deviate from the average in your area.

You May Like: When Will I Get My Tax Refund For Unemployment

Irs Announces Tax Relief For Pennsylvania Victims Of Hurricane Ida

This news release has been updated to extend disaster relief until February 15, 2022.

to add Dauphin County

to add Fulton, Huntingdon, Luzerne and Schuylkill counties

to add Bedford and Northampton counties

PA-2021-05, September 14, 2021

Pennsylvania Victims of remnants of Hurricane Ida that began August 31, 2021 now have until February 15, 2022, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following the recent disaster declaration issued by the Federal Emergency Management Agency, the IRS announced today that affected taxpayers in certain areas will receive tax relief.

Individuals and households affected by remnants of Hurricane Ida that reside or have a business in Bedford, Bucks, Chester, Dauphin, Delaware, Fulton, Huntingdon, Luzerne, Montgomery, Northampton, Philadelphia, Schuylkill and York counties qualify for tax relief. The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. For instance, certain deadlines falling on or after August 31, 2021, and before February 15, 2022, are postponed through February 15, 2022.

Businesses with extensions also have the additional time including, among others, calendar-year partnerships and S corporations whose 2020 extensions run out on September 15, 2021 and calendar-year corporations whose 2020 extensions run out on October 15, 2021.

Pennsylvania Issues Sales Tax Guidance On Energy Drinks And Energy Shots

Effective June 15, 2019, energy drinks or shots that are four ounces or greater will be subject to sales tax in Pennsylvania, but energy drinks or shots less than four ounces will be exempt. For purposes of determining the 4-ounce threshold, taxpayers should not aggregate the ounces in a given package when the drinks are sold in a multi-pack. For instance, if each bottle in a 6-pack of energy drinks or energy shots contains 1.98 ounces, but the total fluid ounces for the 6-pack amounts to 11.88 ounces, the 6-pack is not subject to tax because the individual products making up the 6-pack are all below the 4-ounce threshold. For specific information, please see Pennsylvania Sales Tax Bulletin No. 2021-02, 05/04/2021.

You May Like: Where Is Home Office Deduction On Tax Return

Business Return General Information

Due Dates for Pennsylvania Business Returns

Corporations – PA Corporate Net Income Tax Report, RCT-101 is due 30 days after the federal due date for both calendar and fiscal year filers.

S-Corporations – March 15, or same as the federal return.

Partnerships – March 15, or same as the federal return.

Fiduciary & Estate – April 15, or same as the federal return.

Business Extensions

Corporation – Corporations that have obtained a federal extension by filing Form 7004 with the Internal Revenue Service will be granted an automatic extension to file PA Corporate Net Income Tax Report, RCT-101. Corporate taxpayers granted a federal extension must indicate this on the tax return by selecting from the main menu of the Pennsylvania return select Heading Information > Federal Extension Granted.

A Corporation that is only seeking to extend the filing of the Pennsylvania tax return can request a 60-day extension to file the PA Corporate Net Income Tax Report, RCT-101 by filing the Annual Extension Request, REV-853 electronically by the due date of the original return. To access REV-853 from the main menu of the Pennsylvania return select Supplemental Forms > Extension Request. This form can be e-filed.

Amended Business Returns

Pennsylvania Department Of Revenue Grants Hurricane Ida Relief Return Filing Extensions

The Pennsylvania Department of Revenue has extended the due dates to file individual and business tax returns for Taxpayers affected by Hurricane Ida. This extension is applicable to Taxpayers in Bucks, Chester, Delaware, Montgomery, Philadelphia, and York counties, as well as other areas in Pennsylvania designated by the Federal Emergency Management Agency as qualifying for public assistance. The tax relief applies to various return filings with deadlines starting August 31, 2021, however, does not apply to tax payments. Various return filings for Individuals, Partnerships, S-Corporations, and Trust & Estates have Ida Relief extension until January 3rd, 2022. However, return filings for Corporations have Ida Relief extension until February 2nd, 2022.

Also Check: Are Raffle Tickets Tax Deductible

Philadelphia Wage Tax Refund Requests

For tax year 2021, the City of Philadelphia Department of Revenue has announced that they will be accepting tax refund requests from businesses on behalf of their employees who were mandated to work outside of the city due to the pandemic. Before submitting, employers should submit qualified employees W-2 form to the Philadelphia Tax Center and understand that employees with severance, bonus pay, or stock options do not qualify for wage tax relief.

Philadelphia Payroll Tax Guidance For Non

The City of Philadelphia issued payroll tax guidance on March 26, 2020, pertaining to the Covid-19 pandemic. The City uses a requirement of employment standard for payroll taxes. Philadelphia asserts for nonresidents who work from their home for their own convenience, then the nonresident employee would be still be subject to tax. This is similar to the New York convenience of employer rules. However, in respect to the pandemic, the City states even if the employers base of operation is in Philadelphia, the employer is not required to withhold on wages on nonresident employees if they are required/ordered to work from outside of the City.

Recommended Reading: What Home Improvements Are Tax Deductible When Selling

Income Tax Returns Deadline Extended

Pennsylvanias Department of Revenue announced the deadline for taxpayers to file their 2019 Pennsylvania personal income tax returns is extended to July 15, 2020. Giving taxpayers an additional 90 days to file from the original deadline of April 15, no extension is necessary. This extension applies to both final 2019 tax returns and payments, and estimated payments for the first and second quarters of 2020.

Source:

Mercantile/business Privilege Tax Return

The completed form is due by April 15, 2022 with payment and a copy of your Federal Tax Return. If you are filing an extension with the IRS it is necessary to also file an extension with the Tax Office and submit an estimate tax payment . All extension requests must be submitted by April 15, 2022.

- Tax payments can be made in person at the Tax Office, Monday – Thursday 8 AM – 5 PM, Friday 8 AM – 4 PM.

- Dropped off after hours: 24-Hour Mail Drop Box located outside the township building entrance or in the hallway outside of the Tax Office, under the sign “tax office payments”.

- Checks payable to Abington Township Tax Collector.

Business Privilege Tax and Mercantile License Tax Regulations are issued by the Abington Township Board of Commissioners pursuant to Chapter 152, Article I and II of the Township Code of Abington.

Don’t Miss: Can I Pay Property Tax Online

Homestead / Farmstead Exclusion

If you are an eligible property owner, you have received tax relief through a Homestead/Farmstead exclusion which has been provided under the Pennsylvania Taxpayer Relief Act, a law passed by the Pennsylvania General Assembly designed to reduce your school property taxes. The tax reduction has been funded from slot money revenue from the state.

For The Latest News And Updates On Pennsylvania State And Local Tax

Katerine Velasquezand Justin Howe, JD

The Philadelphia Department of Revenue urged the Pennsylvania Supreme Court to deny a Philadelphia Wage Tax refund to a Philadelphia resident working in Wilmington, DE. In Zilka v. Tax Review Bd. City of Phila., the taxpayer claimed a credit for Wilmington City Tax and the excess Delaware State Tax against her Philadelphia Wage Tax pursuant to the US Supreme Courts Holding in Comptroller of Maryland v. Wynne. The Philadelphia Department of Revenue denied this credit. Subsequently, the Commonwealth Court affirmed the Departments decision and denied the taxpayers claim of impermissible double taxation. The taxpayer then appealed to the Commonwealths Supreme Court, which agreed to hear the case.

If you have questions about your ability to claim a credit for taxes paid to other states, please contact a member of the Withum SALT Team.

Katerine Velasquez, Jensel Feliciano, and Courtney Easterday, MSA

Brandon Vance and Bonnie Susmano, JD, MBA

The Pennsylvania Department of Revenue extended the due dates for filing numerous personal and business tax returns for those impacted by Hurricane Ian. The Federal Emergency Management Agency must designate those impacted. The tax relief is for various tax return filing deadlines that begin on September 23, 2022.

The following returns have until February 15, 2023, to file extended returns:

Breea Boylan, MSA and Kevan Koopaei, CPA

Authored by: Katerine Velasquez and Zhoudi Tang, MST, CPA

Also Check: When Are Taxes Being Sent Out

What Are Pennsylvania Real Estate Taxes Used For

Money from property tax payments is the mainstay of local community budgets. Theyre a funding mainstay for public services funding cities, schools, and special districts, including water treatment plants, fire safety services, recreation and more.

Pennsylvania localities depend on the real property tax to finance governmental services. It usually accounts for the biggest piece of general revenues in these jurisdictions. All other service categories, including police/fire, hospitals, parks, buses/rail, and water/sanitation facilities, benefit from similar fiscal support.

Particularly school districts for the most part operate thanks to property taxes. Also big-ticket items are local government worker salaries/benefits and public safety. Funding police and fire protection is another material need. Other burdensome commitments are public transportation and street work, followed by upkeep and rebuilding. Another expense is water and sanitation works, and trash removal. One more category is public leisure offerings, including athletic courts and other entertainment areas. With this and more, its no surprise why tax assessments are seen as so high.