Can You Claim Simple Ira Contributions On Your Tax Return

When you contribute to a SIMPLE IRA, you contribute pre-tax money to the retirement account. This means the employer does not withhold part of the contribution for federal income tax before the funds are deposited in a SIMPLE IRA. Hence, the employer does not report the contributions as an income on W-2 form, and you wonât be required to report the contributions as income on your tax return.

However, different rules apply to businesses. The IRS allows employers to claim a tax deduction on matching contributions to employees’ SIMPLE IRAs on Schedule C of the business tax return. As a result, the matching contributions are not reported on W-2 form of the employee participants.

If you are a sole proprietor or a business partner, you can deduct the salary reduction contributions and the matching or non-elective contributions made to your SIMPLE IRA on Form 1040 line 28.

When Are Simple Ira Contributions Due

SIMPLE IRAs are funded in two ways i.e. employee contributions and employer contributions. These contributions must be deposited into the employee’s account before the due date to avoid incurring penalties.

Employee contributions deducted from the employee’s paycheck as salary reduction contributions must be deposited in the employee’s account within 30 days of the month in which the payments were due. For example, if the contributions were taken from the employee’s paycheck on April 30, they must be deposited in the employeeâs SIMPLE IRA by May 30 of the same year.

If you are self-employed and there are no other employees in the business, the salary reduction contributions must be deposited by January 30 of the following year.

The employer can make contributions to each employeeâs SIMPLE IRA, either as matched contributions or non-elective contributions. The employer contributions are due by the deadline for tax returns, usually October 15. If there is an extension, the due date for employer contributions can extend to Oct 15.

Account Opening And Funding Questions

- What if I have accounts elsewhere?

-

Consolidating all your accounts at Schwab may help you better manage your finances. We can help you every step of the way in bringing your assets over in a tax-efficient manner. Learn how to transfer.

- What do I need to open a Traditional IRA account?

-

- Social security number

Don’t Miss: Can Roof Repairs Be Claimed On Taxes

Choosing The Best Ira Cd

Shopping for a CD that youre planning to hold in an IRA is just like looking for a standard CD. Youll need to consider both the yield and the length of the CD term. Since top CD rates are still low, IRA expert Ed Slott recommends comparing CDs with terms no longer than one year, to ensure the money is freed up soon so it can be reinvested as rates rise.

Look for a bank that insures deposits up to the limit for each account holder for each qualified account type .

Finally, decide whether youre looking for a bank that only appeals to you because of its high-yield CDs or an institution that meets several of your financial needs, like offering low rates on mortgages and advanced digital features.

What Is An Ira

IRA stands for an individual retirement account. The money that you put in an IRA grows tax-deferred throughout your life. In exchange, you cannot access the funds until the retirement age of 59 1/2, except in select circumstances.

Saving for retirement in an IRA is attractive for most investors because of the following benefits:

- Easy to set up. Setting up an IRA is easy and quick. Many investment companies allow you to set up your account online or through a mobile app in minutes.

- Access to a wide variety of investments. While company retirement plans limit contributions to a handful of choices, IRAs have far more investment options. You can invest in stocks, bonds, mutual funds, ETFs and a variety of alternative assets.

- Unemployed spouses may also contribute. If your spouse has earned income, you do not need to be employed to contribute to an IRA. This benefit ensures that everyone can save towards their retirement needs.

- No taxes on annual gains. As long as the money stays in your IRA, it will continue to grow tax-deferred. Depending on the type of IRA youve selected, withdrawals may be tax-free or taxed as ordinary income.

Due to the valuable tax benefits of an IRA, there are limits to how much you can contribute each year. This limit is now indexed for inflation and the IRS updates the contribution limits every few years. In 2022, you can contribute up to $6,000 in your IRA. For investors ages 50 and over, you can contribute an extra $1,000 as a catch-up provision.

Read Also: Where To Get Income Tax Done Free

Are Simple Ira Contributions Tax Deductible

When you contribute to a SIMPLE IRA, you may want to deduct the contributions on your annual tax return. Find out if SIMPLE IRA contributions are tax-deductible.

A SIMPLE IRA is a retirement savings plan that provides self-employed individuals a simpler way to save for retirement. This retirement plan combines the features of a conventional IRA and 401, allowing both the employer and employee to contribute to the account. However, there are different rules on whether contributions can be deducted from the annual tax return.

Employee salary deferrals to a SIMPLE IRA are not tax-deductible from their income on Form 1040. If you have enrolled in your employerâs SIMPLE IRA plan, the retirement contributions are excluded from your gross income for federal withholding. Claiming a tax deduction on your tax return could amount to claiming the deduction twice.

Income Limits For Other Types Of Iras

A Roth IRA is the only IRA that has a strict income limit for eligibility to make any contributions. While there are ways to backdoor money into a Roth IRA, such as by contributing to a traditional IRA and doing a Roth conversion, you can’t put money directly into a Roth if your income exceeds the annual cap.

Traditional IRAs don’t have this rule — nor do other types of IRAs, such as and SIMPLE IRAs, which are commonly used by self-employed individuals and small business owners. You can contribute to a SIMPLE or SEP IRA no matter how high your income is, provided you meet the eligibility requirements for these account types.

Also Check: How To Pay Sales Tax For Small Business

Receiving A Tax Deduction

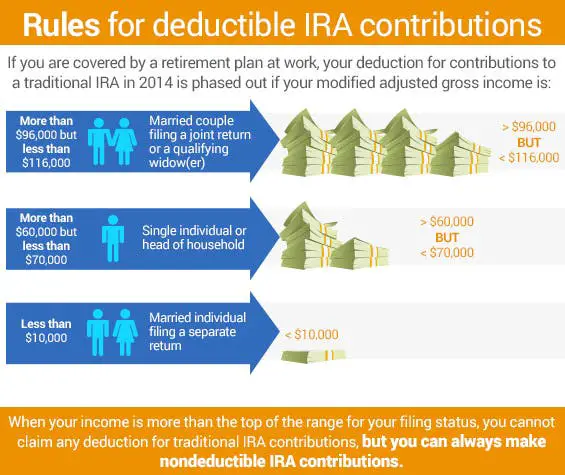

If you do not participate in an employer-sponsored plan, such as a 401, a SEP IRA, a SIMPLE IRA, or another qualified plan, contributions to your traditional IRA may be tax-deductible.

If you participate in any of these plans, you may be considered an active participant, and the deductibility of your contributions would be determined by your modified adjusted gross income and your tax-filing statusthat is, whether you and your spouse file separately, you’re married and file jointly, or you’re a single filer.

If your traditional IRA contribution is not deductible, you may still make a nondeductibleIRA contribution to it. Alternatively, you may contribute to a Roth IRA, provided your MAGI satisfies the Roth IRA eligibility limits for the 2022 and 2023 tax years, which are as follows:

| MAGI and Contribution Limits for Roth IRAs for 2022 and 2023 | |

|---|---|

| Filing Status | |

| $153,000 or more | No contribution allowed |

For the table above, the full contribution limit is $6,000 for 2022 and $6,500 for 2023. In addition, individuals 50 years old and older qualify for an additional $1,000 catch-up contribution. If your income falls between the ranges that allow only a partial contribution, you may use a special formula to determine that partial contribution. This IRA calculator will further help you determine if youre eligible for an IRA.

If you are married but lived apart from your spouse for the entire year, you must file in the single category.

Special Considerations For Roth And Traditional Iras

A key consideration when deciding between a traditional and Roth IRA is how you think your future income will compare to your current situation. In effect, you have to determine if the tax rate you pay on your Roth IRA contributions today will be higher or lower than the rate youâll pay on distributions from your traditional IRA later.

Although conventional wisdom suggests that gross income declines in retirement, taxable income sometimes does not. Think about it. Youâll be collecting Social Security benefits, and you may have income from investments. You might opt to do some consulting or freelance work, on which youâll have to pay self-employment tax.

And when the kids are grown and you stop adding to the retirement nest egg, you lose some valuable tax deductions and tax credits. All this could leave you with higher taxable income, even after you stop working full time.

In general, if you think youâll be in a higher tax bracket when you retire, a Roth IRA may be the better choice. Youâll pay taxes now, at a lower rate, and withdraw funds tax-free in retirement when youâre in a higher tax bracket. If you expect to be in a lower tax bracket during retirement, a traditional IRA might make the most financial sense. Youâll reap tax benefits today while youâre in the higher bracket and pay taxes later on at a lower rate.

Also Check: What Is The Sales Tax In Kansas

Claiming Tax Deductible Donations

Tax deduction is given for donations made in the preceding year. For example, if an individual makes a donation in 2021, tax deduction will be allowed in his tax assessment for the Year of Assessment 2022.

You do not need to declare the donation amount in your income tax return. Tax deductions for qualifying donations will be automatically reflected in your tax assessments based on the information from the IPC . IRAS will no longer accept claims for tax deduction based on donation receipts.

Set A Course For Retirement Thats Right For You

Your contribution limits for a Roth IRA tax deduction are the same as those for a traditional IRA. But the amount you can contribute will begin to phase out once you reach a certain income. Here are the phaseout limits:

- For single filers, IRA contributions for tax year 2022 begin phasing out at $129,000 and are ineligible at $144,000.

- For joint filers, IRA contributions for 2022 begin phasing out at $204,000 and are ineligible at $214,000.

If youve made the transition from being employed to self-employed, or if youve experienced a significant drop in income and hence a drop in tax rates, you might want to look into how converting to a Roth IRA could benefit you because youd possibly pay lower taxes up front.

Keep in mind that under these tax laws, you may no longer reverse a rollover into a Roth IRA. So if you made a conversion or rollover into a Roth IRA after January 1, 2018, youre stuck with it.

Note there are a few more rules that apply to the phasing out of both your IRA contribution and deductibility. To learn more about tax year 2022, visit the IRS.gov page for 2022. You can also visit the TD Ameritrade page on IRA and Roth IRA rules, or contact a tax consultant.

Want more detailed information about IRAs? The TD Ameritrade IRA Guide offers plenty of useful information to help you decide whats best for your retirement goals.

Past performance of a security or strategy does not guarantee future results or success.

Read Also: How Much Tax Do You Pay On Social Security

General Comments About Roth Iras

1.1 A Roth Individual Retirement Arrangement is an individual retirement plan established pursuant to section 408A of the United States Internal Revenue Code of 1986 . For U.S. income tax purposes, contributions to a Roth IRA are not deductible from income, earnings and gains are exempt from tax, and distributions are generally not included in income. For an overview of Roth IRAs see Internal Revenue Service Publications 590-A, Contributions to Individual Retirement Arrangements and 590-B, Distributions from Individual Retirement Arrangements .

1.2 For Canadian income tax purposes, the income accrued in a Roth IRA is generally taxable on a current, annual basis. An individual resident in Canada who owns a Roth IRA must determine:

- the legal characterization of the Roth IRA and resulting taxation of income accrued in and distributions from the Roth IRA pursuant to the Act and

- whether the relief provided in the Canada-U.S. Treaty for Roth IRAs is available .

If You Are Married Filing Separately

For taxpayers who are married and filing separately, the tax deduction limits are drastically lower, regardless of whether they or their spouses participate in an employer-sponsored retirement plan. If your income is less than $10,000, you can take a partial deduction. Once your income hits $10,000, you do not get any deduction.

Don’t Miss: How To Block Someone From Claiming Your Child On Taxes

You Can Still Make Ira Contributions For The 2019 Tax Year

The deadline for making contributions to IRAs for tax year 2019 was extended to July 15, 2020 as part of the IRS tax deadline extension due to the global pandemic. This means you still have time to potentially lower your 2019 tax bill by making a tax-deductible IRA contribution if you qualify. You can even open a new IRA between now and July 15 and make contributions for tax year 2019 if you dont currently have one established.

You dont have to wait until tax season either. You can allocate any contributions you make between now and the deadline of April 15th of next year for tax year 2020. This will enable you to get a jump start on retirement saving this year and potentially maximize tax savings on your 2020 return.

Check That You Didn’t Underpay Taxes

It’s good to end each year knowing that you haven’t substantially underpaid your tax obligations, so as not to trigger interest and possible penalties when you file a return later.

Thus, it’s smart to run some numbers before year-end to make sure you haven’t been withholding too little on job income, from retirement-account withdrawals and so on. In some cases, you might want to make an estimated tax payment before year-end.

The basic rule is that you can avoid a penalty if you pay at least 90% of your current-year tax obligation, though that number can be difficult to estimate, Clair noted. Another option is to pay at least 100% of your prior-year tax bill, for 2021, though that rises to 110% if your adjusted gross income tops $150,000. A penalty also wouldn’t apply if you owe less than $1,000.

Read Also: Can You Get An Extension On Your Taxes

Can I Take An Ira Tax Deduction

Whether you can reduce your taxes today by deducting your IRA contributions is a bit more complicated. This depends on several different factors, starting with your access to a retirement plan where you work.

If youre single and you are not covered by a retirement plan , you can deduct the entire amount of your annual IRA contribution on your federal income tax return, which may reduce the amount of taxes you pay today.

Even if your spouse doesnt work outside the home and you file a joint tax return, he or she can still contribute to a separate IRA and deduct the contribution, up to the contribution limits. This is referred to as a Spousal IRA Contribution.

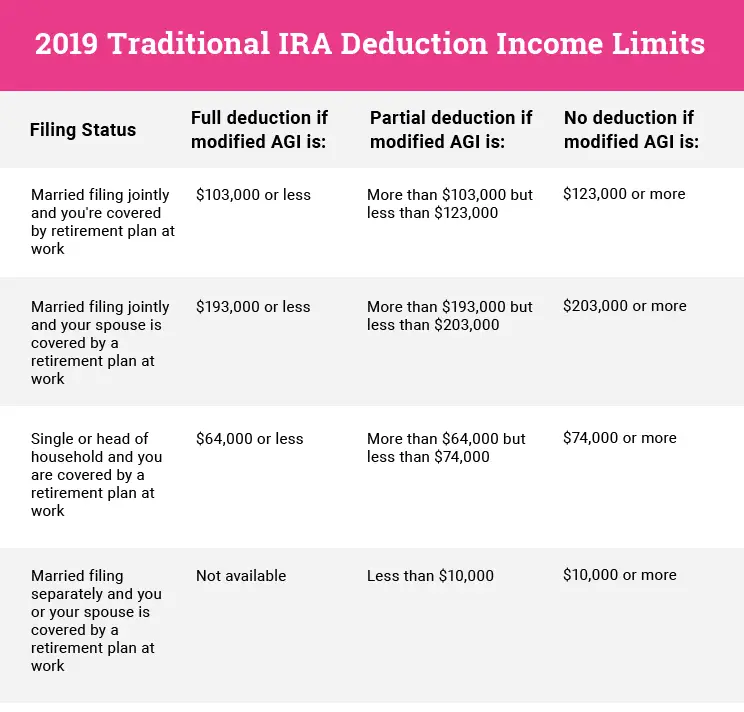

However, if you are considered covered by a retirement plan, your ability to deduct your IRA contributions will depend on your tax filing status and modified adjusted gross income.

For 2019 taxes, IRA tax deductions start to phase out once your modified adjusted gross income reaches $64,000 if youre single or $103,000 if youre married and file a joint tax return for the year. The deduction phases out completely once your MAGI reaches $74,000 if youre single or $123,000 if youre married filing jointly. .

For 2020 tax returns, IRA tax deductions start to phase out once MAGI levels reach $65,000 for singles and $104,000 for married and filed jointly returns. Deductions phase out entirely once MAGI reaches $75,000 for single filers, and $124,000 if you are married filing jointly.

Taxes On Traditional Iras And Roth Iras: An Example

Say that you invest $6,000 a year starting when you are 35 years old into a traditional IRA. First, you take $6,000 off of your annual income when you file your taxes. Then assume that your account averages six percent of interest each year.

According to this IRA calculator, when you retire at 65, your account would be valued at $524,000 â and you saved $122,771 total in taxes.

If you then take $100,000 out of the traditional IRA, you add $100,000 to your income. According to the 2020 tax brackets, thatâs a 24 percent tax bracket for a single person. If your only other income was Social Security, you will have to pay taxes on the distribution and some on your Social Security.

That same $100,000 coming out of a Roth IRA would not increase your taxable income one penny.

Thatâs the real draw of a Roth IRA.

You May Like: Can You Pay Irs Taxes Online

If You Have Other Retirement Accounts

That $6,000 or $7,000 in 2022 is the total you can deduct for all contributions to qualified retirement plans. For 2023, this is $6,500 or $7,500. Having a 401 account at work doesn’t affect your eligibility to make IRA contributions, and you can deduct up to the maximum annual contribution of $20,500 in 2022 and $22,500 in 2023.

If you need to prioritize, it often makes sense to contribute enough to your 401 account to get the maximum matching contribution from your employer. But after that, adding an IRA to your retirement mix can provide you with more investment options and possibly lower fees than your 401 charges.