State Tax Return Due Dates

Unless you live in a state with no income tax, don’t forget that you probably have to file a state tax return as well. Most states synch their income tax return deadline with the federal tax due date but there are some states that have different deadlines . State rules regarding tax filing extensions may differ from the federal rules, too. Check with the state tax agency where you live to find out when your state tax return is due and/or how to get an extension.

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

Key Information To Help Taxpayers

The IRS encourages people to use online resources before calling. Last filing season, as a result of COVID-era tax changes and broader pandemic challenges, the IRS phone systems received more than 145 million calls from January 1 May 17, more than four times more calls than in an average year. In addition to IRS.gov, the IRS has a variety of other free options available to help taxpayers, ranging from free assistance at Volunteer Income Tax Assistance and Tax Counseling for the Elderly locations across the country to the availability of the IRS Free File program.

“Our phone volumes continue to remain at record-setting levels,” Rettig said. “We urge people to check IRS.gov and establish an online account to help them access information more quickly. We have invested in developing new online capacities to make this a quick and easy way for taxpayers to get the information they need.”

Last year’s average tax refund was more than $2,800. More than 160 million individual tax returns for the 2021 tax year are expected to be filed, with the vast majority of those coming before the traditional April tax deadline.

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return. The IRS urges taxpayers and tax professionals to file electronically. To avoid delays in processing, people should avoid filing paper returns wherever possible.

Also Check: What Percentage Of Tax Should I Pay On My Wages

What If I Owe More Than I Can Pay

Don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

When Is Tax Day

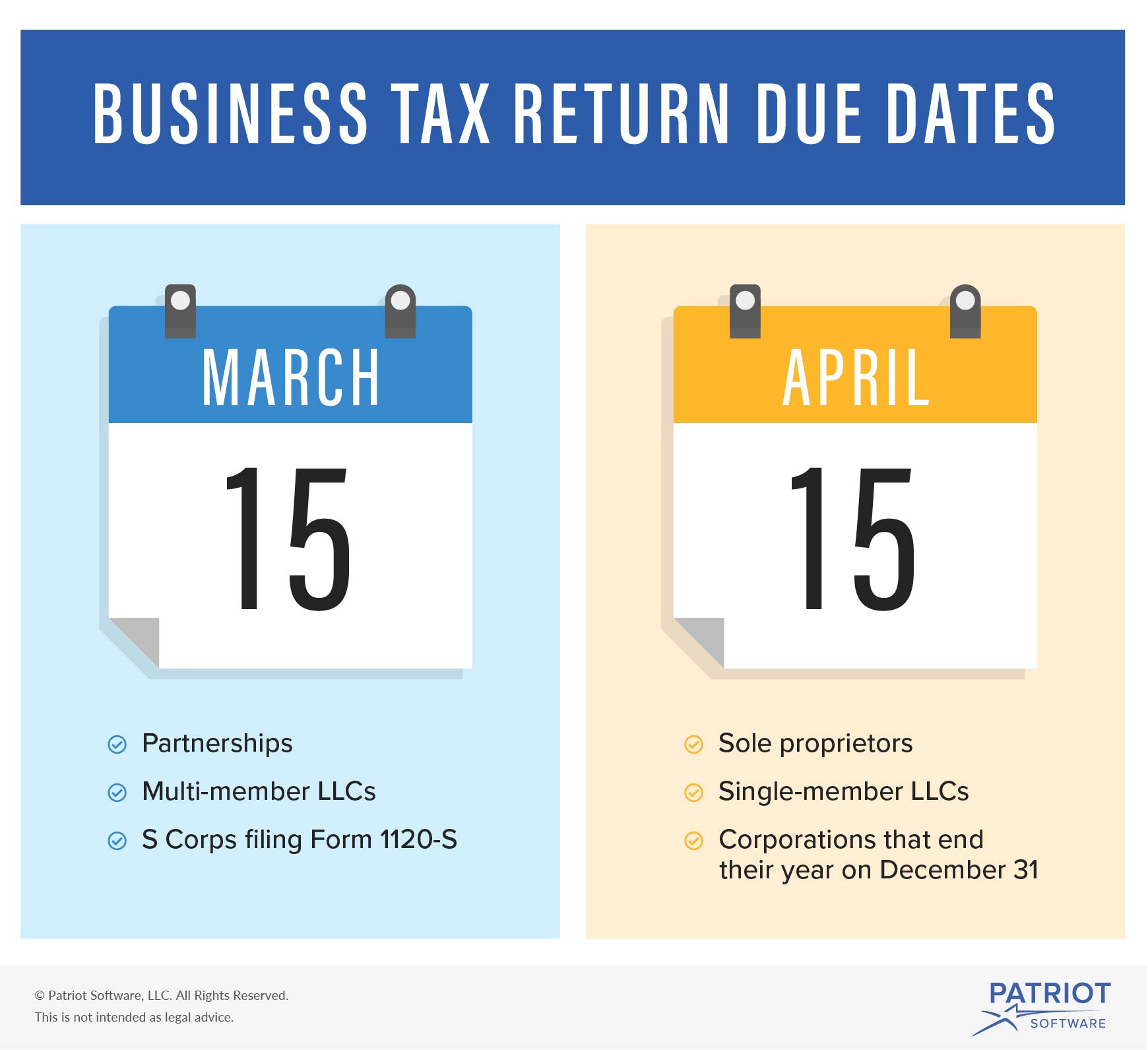

While January to April is called âtax season,â the big âtax dayâ is usually April 15. If that falls on a holiday or weekend, it moves to the next business day.

Because April 15 falls on a Saturday and the 17th is the observation of Emancipation Day, this yearâs tax day is April 18, 2023. This is when individual taxpayers, sole proprietors, and C corporations need to file their taxes.

Note that if you are using a fiscal year that isnât the calendar year, your tax filing deadline is different and depends on your business entity and when your fiscal year ends.

Read Also: How Do You Paper File Your Taxes

What’s The Fastest Way To File My Tax Return

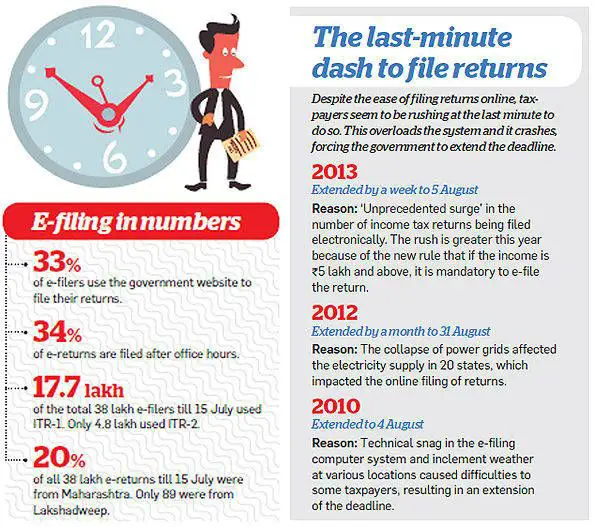

The fastest and most accurate way to file your tax return is to file electronically.

E-filing your tax return with the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don’t have to worry about it getting lost in the mail or arriving late. You’ll also get confirmation right away that the IRS has received your return and has started processing it.

If you’re waiting for a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

Time Is Running Out To Claim Your Stimulus And Child Tax Credit Payments

Last month, the IRS reported that millions of eligible people have yet to properly claim their COVID relief payments. The IRS uses tax returns to determine eligibility for both pandemic stimulus checks and child tax credits, and unfortunately, those who need the relief mostsuch as people with lower incomes, limited internet access, or who are experiencing homelessnessare often the least likely to have filed their taxes. Heres what you can do to take action before this weeks deadline for claiming your stimulus and/or child tax credit payments.

Read Also: How Do You Check On Your Tax Refund

Due Date Of Filing Itr Of Firms Ay 2022

- Income Tax e-filing of return is mandatory in the case of partnership firms irrespective of the quantum of taxable profits. Even in the case of losses, a partnership firm should file its ITR online.

- If the tax audit is required in the case of a partnership firm, the due date of furnishing the tax audit report is 30th September 2022. In such a case, the ITR should be filed on or before 31st October 2022.

- In non-audit cases, the ITR of a partnership firm shall be filed on or before 31st July 2022.

- Where a partnership firm is having total income up to Rs. 50 Lakhs and declaring income u/s 44AD, 44ADA, or 44E, Form ITR-4 has been prescribed by the Income Tax Department. In other cases, the partnership firm should file its ITR in Form ITR-5.

Save Hours Of Admin Time With Wise Business

Navigating business tax deadlines can be stressful, but managing your business account doesnt have to be.

With the Wise Business account, you can easily manage invoices and payments online or even from the app.

You can make batch payments and add team members to help with payments. All past payment info is saved for the future, saving you hours of work.

Youll get the real exchange rate when you send invoices in other currencies, saving you on average up to 19x compared to PayPal.

Over 300k businesses use Wise. Interested to learn more? You can read how Alternative Airlines saved over £75K in 9 months with Wise.

Recommended Reading: What If I File My Taxes 1 Day Late

Other Important Dates Of The 2023 Tax Season

In addition to those already mentioned, there are two other important dates to keep in mind for your 2023 tax return:

2023: deadline for employees and independent contractors to receive their W-2 or 1099-NEC/1099-MISC forms .

2023: deadline for 2022 individual tax returns that received a filing extension.

File For An Extension By Tax Day

If you can’t finish your return by the April 18 tax deadline, file IRS Form 4868. This will buy most taxpayers until Oct. 17 to file their tax returns. See more about how extensions work.

Note: A tax extension gets you more time to file your return, not more time to pay your taxes. You still must pay any tax you owe, or a good estimate of that amount, by the tax deadline. Include that payment with your extension request or you could face a late-payment penalty on the taxes due.

» MORE:See how to set up an installment plan with the IRS by yourself

Also Check: How To Figure Tax On An Item

How To File Taxes As A C Corp

C corporations and LLCs that elect to be taxed as C corporations use Form 1120, the U.S. Corporation Income Tax Return, to file their income taxes.

Whether youâre filing Form 1120 yourself or getting a tax professional to do it for you, youâll need the following information on hand to complete and file the form:

- Total assets held by your corporation

- Royalties earned

- Business tax credits you plan to apply for

You have the option to file Form 1120 either online using the IRS e-file service or by mail. Once youâve completed Form 1120, you should have an idea of how much your corporation needs to pay in taxes. If itâs more than $500 for the whole year, youâll be required to pay them in quarterly installments.

Alignment With State And District Of Columbia Holidays And Changes In Date

Tax Day occasionally falls on Patriots’ Day, a civic holiday in the Commonwealth of Massachusetts and state of Maine, or the preceding weekend. When this occurred for some time, the federal tax deadline was extended by a day for the residents of Maine, , Massachusetts, New Hampshire, New York, Vermont, and the District of Columbia, because the IRS processing center for these areas was located in Andover, Massachusetts and the unionized IRS employees got the day off. In 2011 and 2015, Tax Day fell on Patriots’ Day. However, federal filings were directed to Hartford, Connecticut, Charlotte, North Carolina and Kansas City, Missouri, and there was no further extension for Maine, Massachusetts or other surrounding states’ residents. In 2019 and 2021, when Patriots Day was again observed on the tax filing deadline, residents of Maine and Massachusetts were given extra time to file as post offices in those states would be closed on normal deadline.

Emancipation Day is celebrated in Washington, D.C. on the weekday nearest April 16, and under a federal statute enacted decades ago, holidays observed in the District of Columbia have an impact nationwide. If April 15 falls on a Friday, then Emancipation Day is celebrated on the same day and tax returns are instead due the following Monday, April 18. When April 15 falls on a Saturday or Sunday then Emancipation Day is celebrated on the following Monday and tax returns are instead due on Tuesday.

Don’t Miss: How Do Tax Debt Relief Companies Work

Tax Filing Postmark & E

The April 18 tax deadline does not refer to when the IRS receives your tax return. Instead, it refers to the date that the tax return is postmarked. So if you mail out your tax return on April 18 by USPS mail and the IRS receives your tax return after that date, your return wont be considered late. The same rule applies for e-filing your taxes. If you e-file your taxes, you must do so by April 18 as well.

Free File Fillable Forms

Free File Fillable Forms is a sister service of IRS Free File it’s open to all taxpayers, including those who made more than $73,000 in 2021. Like IRS Free File, it’s a completely free online-filing option.

A seasonal program, Free File Fillable Forms is open every year from roughly mid-January to mid-October. It’s an online repository of every and any form you’ll need for a federal return. Once you’re finished with your work, you may electronically sign the return, and submit it via the site.

Free File Fillable Forms definitely has its limitations: It doesn’t give advice it doesn’t do state returns it doesn’t allow you to do federal returns for anything but the current tax year it doesn’t let you do revisions once you’ve filed and, as the IRS cautions, it doesn’t do an “extensive” math check on your numbers.

The site is currently closed but should open again soon for the 2022 tax year.

Don’t Miss: How To Send Tax Return By Mail

Irs Tax Stimulus Checks For 2022 Perhaps With Recovery Rebate Credit

Some people might want to file returns even though theyre not required to do so to claim a Recovery Rebate Credit or the 2021 stimulus payments.

According to the IRS, individuals who didnt qualify for a third Economic Impact Payment or got less than the full amount may be eligible to claim the Recovery Rebate Credit. For those who got some money, the IRS says youll need to know the total received to calculate the correct rebate credit to avoid processing delays.

The IRS will send Letter 6475 starting in late January with the total amount of the third Economic Impact Payment received. Economic impact payment amounts also can be viewed on IRS online accounts.

Read Also: How Much Should I Put Aside For Taxes 1099

Do I Have To Pay Taxes On Unemployment Income

Yes, unemployment benefits received in 2022 are taxable. The exemptions that applied to income tax on unemployment benefits granted under the American Rescue Plan only applied to benefits collected in 2020.

If you’re currently or have been recently unemployed and can’t afford to pay your taxes, make sure to file a return anyway. There is a penalty for filing late or neglecting to file at all. You can request an installment agreement to help you pay taxes over time. You can do this online through the IRS website, by filling out Form 9465, or by for help.

You May Like: What Is The Best Tax Preparation Company

What Happens To My Tax Deadlines If I Live In An Area Impacted By A Natural Disaster

If you need more time because you live in an area hit by a natural disaster, you might qualify for tax relief from the IRS. The IRS often postpones the tax filing deadline for taxpayers who live in or have a business within a federally declared disaster area.

For example, the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires.

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- Electronically filing and choosing direct deposit is the fastest way to get your refund. When using direct deposit, the IRS normally issues refunds within 21 days. Issuance of paper check refunds may take much longer.

- If you already have an account with a bank or credit union, make sure you have your information ready â including the account and routing number â when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

- You can learn more about choosing the right prepaid card here.

Also Check: Can You File Taxes Online

What You Need To Know For The 2022 Tax

Ottawa, Ontario

Canada Revenue Agency

Last year, Canadians filed almost 31 million income tax and benefit returns. Having the information you need on hand to file your return makes the filing process that much easier. We want to help you get ready, so you are in good shape when it comes time to file your return this year.

Here you will find information on filing options, COVID-19 benefits, and whats new for this tax-filing season.

Also Check: How Much Medicare Tax Is Withheld

File Electronically And Choose Direct Deposit

To speed refunds, the IRS urges taxpayers to file electronically with direct deposit information as soon as they have everything they need to file an accurate return. If the return includes errors or is incomplete, it may require further review that may slow the tax refund. Having all information available when preparing the 2021 tax return can reduce errors and avoid delays in processing.

Most individual taxpayers file IRS Form 1040 or Form 1040-SR once they receive Forms W-2 and other earnings information from their employers, issuers like state agencies and payers. The IRS has incorporated recent changes to the tax laws into the forms and instructions and shared the updates with its partners who develop the software used by individuals and tax professionals to prepare and file their returns. Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov. For the latest IRS forms and instructions, visit the IRS website at IRS.gov/forms .

You May Like: When’s The Last Day To Do Your Taxes

Tax Extension: The October Deadline For Filing Your Return Is Almost Here

If you are among the roughly 19 million people who asked the IRS for another six months to file their taxes in 2022, time is almost up.

Almost 1 in 8 taxpayers asked for an extension to file their taxes this year, according to data from the IRS, which expects a total of about 160 million tax returns to be filed in 2022. While most Americans file their returns before the traditional April 15 deadline, people who needed more time were able to automatically receive another six months from the tax agency in order to get their files in order.

This year, the tax extension deadline for filing your 2021 return is October 17, rather than the typical date of October 15, because the 15th falls on a Saturday. Yet while that gives taxpayers a little more breathing room, experts have recommended filing as soon as possible in order to avoid last-minute pitfalls. They also recommend sending your return electronically, since the IRS has struggled mightily with processing paper returns during the pandemic.

“Using the electronic filing options can make people’s lives easier than mailing in paper tax returns,” said Eric Bronnenkant, head of tax at Betterment, told CBS MoneyWatch.

Typically, about 1 in 10 taxpayers asks for an extension, but this year may have seen a jump in requests for extra time because of the ongoing pandemic and the complexity of a tax year that included the enhanced Child Tax Credit and other tax changes.