Where Are Your Customers Located Do You Have A Nexus There

Sales tax generally depends on the ship-to location of the item and whether you have a strong connection to the state . Youll always have sales tax nexus in your home state, however the following business activities may subject you to that states sale tax regulations:

-

Having an office, warehouse, store, or other physical presence of business

-

Having an employee, contractor, salesperson, or other person doing work for your business

-

Storing inventory

-

Working with affiliates or someone who advertises your product in exchange for a portion of sales

-

Having a dropshipping relationship

Some states also impose sales thresholds for sales tax nexus. For example, if you have more than $100,000 in sales, you may be required to pay sales tax in that state. To understand your business tax responsibility, start by researching nexus laws in states where your business has a physical presence or meets economic nexus thresholds. Once youve listed these states, its a good idea to confirm your list with a certified accountant.

Why Is Sales Tax Collected

Businesses collect sales tax when their customers purchase taxable goods or services because their state and local governments require them to do so. These governments then use the money they receive from the sales tax to fund public schools, emergency services, healthcare, road construction and maintenance and public transportation.

Being informed about state and local sales tax rules helps businesses ensure they charge customers the right amount and makes it easier for employees to explain why their company collects sales tax to customers who may not understand it.

Simplifying Sales Tax For Your Online Store

Calculating sales tax on your own can quickly become a manual, burdensome process. Not only do you have to keep track of all your sales tax nexus locations and ensure youre charging the right amount, you also have to stay on top of ever-evolving tax regulations.

An easier way to manage sales tax is to use an automated sales tax solution. With an automated system, tax calculation for your business is hassle-freeall you need to do is select the states where you do business and the software takes care of the rest.

Wix Merchants can take advantage of an automated sales tax integration with Avalara, which automatically calculates sales tax for each location you sell to, so your customers always get real-time rates as they shop and check out. Theres no longer a need to rely on ZIP codes or rate tables because your sales tax rates are updated and calculated based on the most current rules worldwide. This automated system can reduce the time you spend on tax-related activities by 50% or more.

Log in to your Wix account.

From your Wix site dashboard, click Settings.

Select Store Tax.

Here are some guides to setting up your sales tax automations if you sell in home rule states or Canada.

Dont have your online store up and running yet? Create your eCommerce site and start selling today.

Daniel Clinton

Managing Editor, Wix eCommerce

Recommended Reading: Does Turbotax Do Local Taxes

How To Calculate Sales Tax: Step

Are you a small business owner that wants to better understand how to calculate sales tax? Maybe you are a consumer who wants to know how to calculate sales tax and know how much the product will end up actually costing you. Today, we will give a simple explanation of how sales tax is calculated and reflected in the financial records.

How Do You Calculate Net Income In Canada

Every deduction you can make is subtracted from your total income each year to arrive at your net income. determines your provincial and local non refundable credits as well as other social credits you receive, such as the GST/HST equivalable credits, or any social benefits you receive like the GST/HST credit or the Canada child benefit.

Don’t Miss: Is 529 Federal Tax Deductible

How Do You Find Out The Percentage

1. How to calculate percentage of a number. Use the percentage formula: P% * X = Y

How Much Is Gst And Hst In Ontario

The current rates are as follows: five percent in Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon four percent in Nunavut and three percent in Quebec.13 % is the tax rate in Ontario.Taxes on goods and services are levied at a rate of 15 percent in the provinces of New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island.

Read Also: How To Pay City Taxes

Sales Tax In The United States

As mentioned before, most of the states in the U.S. apply a single-stage retail sales tax with different rates and scopes: there are 46 different sales taxes with distinct exclusions. As Schenk and Oldman pointed out, the relatively high diversity in the enacted tax law in various states have several economic implications:

- Business conducted on a nation-wide scale need to devote substantial resources to comply with many states and local sales taxes. It increases the complexity and administrative costs related to businesses.

- As most of the services are not subject of sales taxes, the total tax base is shrinking due to the expanding trend of electronic services and the increase in the sharing economy .

- Tax evasion is expanding as the current sales tax system inefficiently tax most cross-border and mail order shopping by consumers.

These issues become more relevant if we take into consideration the significant contribution of sales taxes to state revenues and the current transformation of the economy. It is not surprising then that recent studies have begun to address these problems and examine the possibility of a nation-wide introduced federal VAT or another consumption-based tax which may coexist with the state-level sales tax.

Other Sales Taxes And Fees

Certain businesses may be required to collect one or more of the additional sales and use taxes and fees described below. These taxes and fees must be collected and remitted in the same manner as the state and local sales taxes. The sales tax returns and schedules have designated lines and reporting codes for you to report the additional sales taxes and fees separately.

Also Check: Can I File My Taxes Online

How To Calculate Your Net Tax For Most Businesses

For most businesses, this calculation is straightforward. Generally, with the regular method, the GST/HST is calculated on every supply of a taxable property or service . However, to help reduce paperwork and bookkeeping costs, most small businesses can use the quick method of accounting to calculate their GST/HST net tax remittance . Under the quick method, the GST/HST paid or payable is calculated based on a percentage.

Regular method

You have to calculate your net tax for each GST/HST reporting period and report this amount on your GST/HST return. To do so, calculate:

- the GST/HST collected or that became collectible by you on your taxable supplies made during the reporting period

- the GST/HST paid and payable on your business purchases and expenses for which you can claim an input tax credit

The difference between these two amounts, including any adjustments, is your net tax. For help calculating the net tax and filling out your GST/HST return using the regular method, see:

During your last reporting period, you collected $1,000 of GST/HST from your clients. You are also eligible to claim ITCs of $800 for the GST/HST you paid on business expenses. If you have no adjustments to include on your return for the reporting period, your net tax would be $200.

For more information on claiming ITCs, see Input tax credits.

Quick method

Certain supplies are not eligible for the quick method calculation.

Input tax credits

What State Is Your Customer In And Do You Have Nexus There

Five states have no sales tax: New Hampshire, Oregon, Montana, Alaska, and Delaware. So youâre not required to collect sales tax when making a sale to a buyer in that state.

That means every other state has a sales tax. The good news is that you are only required to collect sales tax in a state where you have âsales tax nexus.â Nexus just means that you are subject to a stateâs sales tax laws. Youâll always have sales tax nexus in the state where you operate your business. But other business activities may give you nexus, too. Employees, a physical store, a warehouse presence and other business activities create sales tax nexus. If you have nexus in a state, then that state generally requires you to collect sales tax from buyers in the state.

Sales tax laws are also changing fast. A recent Supreme Court ruling stated that you may have sales tax nexus in a state if you make a large amount of sales in that state. We recommend using an online sales tax nexus tool or speaking with a sales tax expert if you need help collecting sales tax.

You May Like: How Do I Know What Form I Filed For Taxes

How To Calculate Reverse Sales Tax

Lets be honest sometimes the best reverse sales tax calculator is the one that is easy to use and doesnt require us to even know what the reverse sales tax formula is in the first place! But if you want to know the exact formula for calculating reverse sales tax then please check out the Formula box above.

Read Also: How Does Doordash Do Taxes

How Do I Work Out My Tax

You can work out your tax by following these four stages:

1. Work out whether your income is taxable or notSome income is taxable and some is tax free. You start by adding up all amounts of income on which you are charged to income tax for the tax year.You can then take certain deductions from this figure, such as trade losses.

2. Work out the allowances you can deduct from your taxable income There are several different tax allowances to which you might be entitled. However, at this stage of the tax calculation there are only two which are relevant: the personal allowance and the blind persons allowance.Every man, woman and child resident in the UK has a personal allowance. For most people, the personal allowance for the tax year starting on 6 April 2021 and finishing on 5 April 2022 is £12,570.Despite its name, you do not have to be completely without sight to claim the blind persons allowance. So if you have very poor eyesight, check if you are entitled.You can find out more information on these allowances on What tax allowances am I entitled to?. Note, however, that some so-called allowances are in fact nil rates of tax that are applied at step 3 below, and some are given as a tax credit or tax reduction at step 4 below.

Similarly, if you live in Wales and are a Welsh taxpayer, there are Welsh rates of income tax set by the Welsh Assembly that apply to your non-savings and non-dividend income. The UK rates apply to your savings and dividend income.

Also Check: How To File Back Taxes Without W2

Add Up All The Sales Taxes

To use this formula, you first need to add up all applicable sales taxes. Start by determining what the sales tax rate is in your state. Then look to see if your county or city applies any additional sales taxes. If so, you want to add all of these numbers together. For example, New York State has a sales tax rate of 4% and New York City has a sales tax rate of 4.5%. If you are buying or selling a product within New York City, the sales tax rate is 8.5% combined.

Is 7 Cents A Dollar Tax

Base retail sales tax is set at a certain number of cents per every dollar spent in a retail transaction, and the rates vary widely. Some states have no base retail sales tax at all. These states are Alaska, Delaware, Montana, Hew Hampshire and Oregon. Only California as a base sales tax above 8 cents per dollar.

You May Like: Is 529 Plan Contribution Tax Deductible

Calculating The Sales Tax Percentage From Total

What if you want to figure out how to calculate the sales tax percentage from total? This could be helpful if you have receipts for the total transaction amount, but arent sure what percentage of that amount should be allocated for sales tax. The formula to calculate the sales tax percentage from total is:

Total Sales Tax / Cost of the Item * 100 = Sales Tax Percentage from Total

If you knew you sold a $50 item, with $5.05 in sales tax, you would use this formula to figure out the sales tax percentage:

5.05/ 50* 100 = 10.1

Recommended Reading: Do I Have To Pay Taxes On Plasma Donation

Us History Of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

Recommended Reading: How Do I Get My Property Tax Statement

Add Tax To Item Pricing

To implement the tax included workaround, manually add tax to all item prices and separate items into departments that represent each tax rate. After this initial setup, youll be able to manually back out the estimated amount of tax collected from reporting.

Example: Put alcoholic drinks taxed at 9.75% into an Alcohol department and food items taxed at 7.75% into a Food department.

How Businesses Calculate Sales Tax

The cost a customer pays when purchasing goods or services from a business includes both the companys sales price and the cost of applicable sales taxes. Businesses and their employees need to know what sales tax is, why they must collect it and how to calculate the correct sales tax amount on each purchase.

Thoroughly understanding this information helps ensure they comply with their state and local sales tax rules and regulations. In this article, we discuss how sales tax is calculated, what it is and answer other frequently asked questions employees have about sales tax.

Recommended Reading: How To Grow Your Tax Business

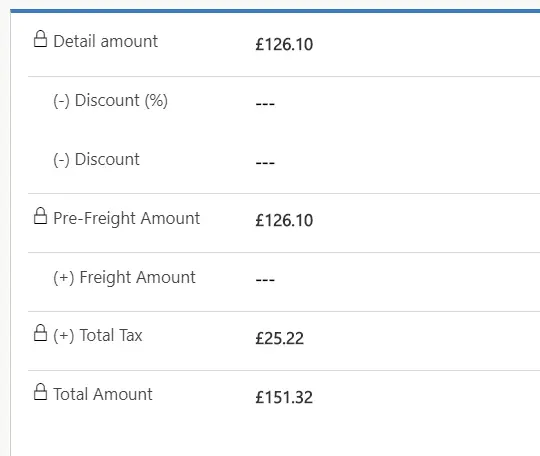

Identifying The Sale Price

An item’s sale price is what a customer is charged for its purchase. This means that it includes any discounts or other reductions. For example, an item costing $100.00 having no applicable reductions has a sale price of $100.00, but an item costing $100.00 on sale for fifty percent off is $50.00. You calculate this by multiplying the converted reduction percentage and then subtract the result from the price total. For example:

The result is the item’s sale price: $50.00. Another example: a $100.00 item is on sale for 15 percent off:

- Convert the percentage reduction: 15 = .15

- Multiply the price by the converted value: 100 x .15 = 15

- Subtract the result from the total price: 100 – 15 = 85

- The result is the item’s sale price including the discount: $85.00

This calculation is essential because it is the sale price including the discount that you use to calculate sales taxes.

New York City Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined NYC rate.

Also Check: Where’s My Unemployment Tax Refund