New York Faces Revenue Shortfalls Due To Tax Paying Residents Moving Out

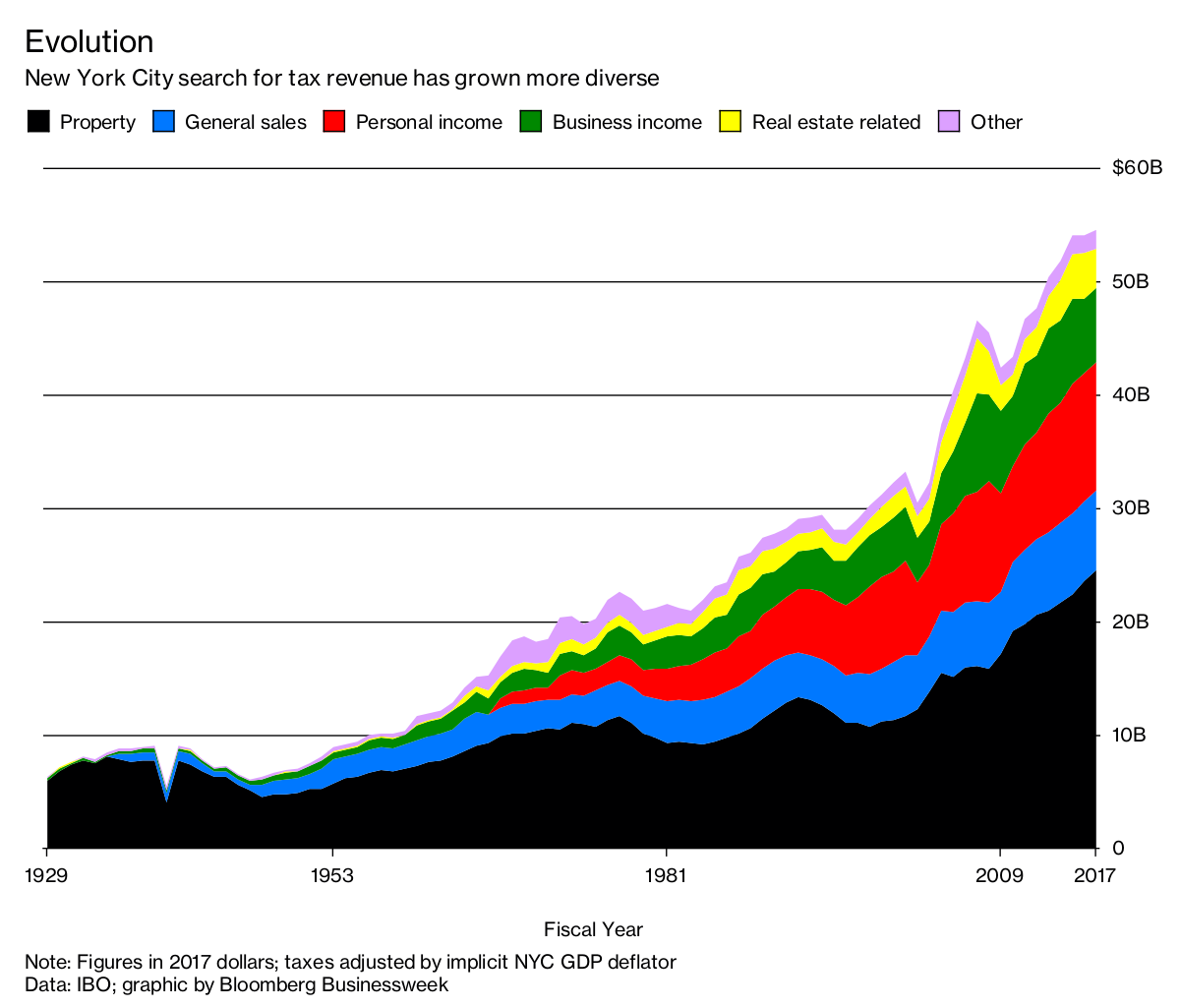

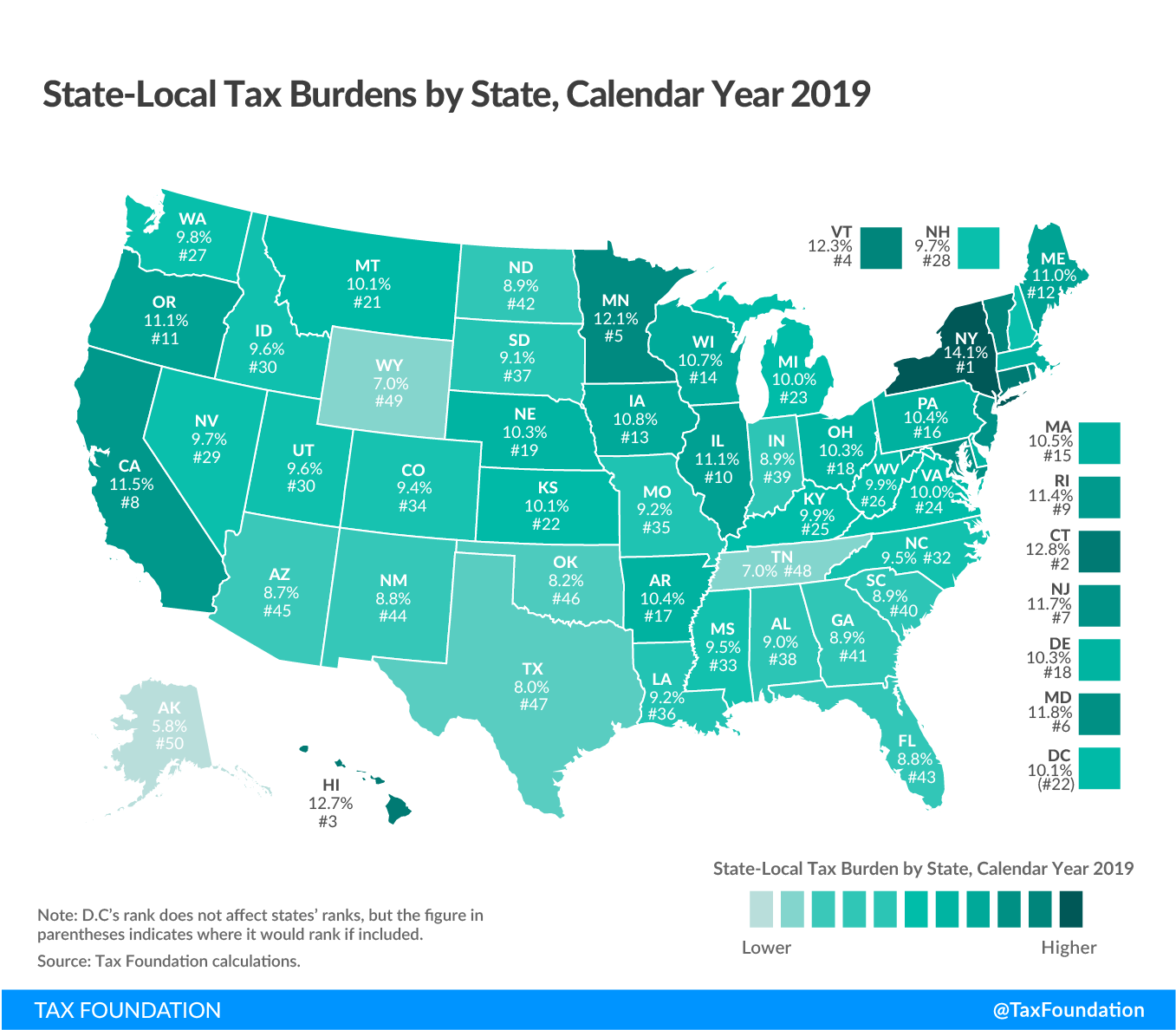

Approximately 115,000 New York State residents left between 2015-2019, taking their tax dollars with them.The rise of remote work due to the COVID-19 pandemic has further increased the volume of residents moving out of state. According to New York State Comptroller Thomas P. DiNapoli, the states largest revenue source is from personal income tax, which accounts for 2/3 of state revenues. The largest number of departures came from married filers who were earning between $100k-$500k, and these individuals typically paid a substantial amount of tax. As a result of these departures, state and local tax authorities are challenged with finding new revenue sources to replace the taxes lost due to residents leaving the state.This will likely take the form of increased audit activity of departing residents. Please note that former New York State residents often continue to have New York Source income particularly if they have deferred compensation and/or stock options.New York is aggressively auditing former residents who fail to report state source income and pay the associated tax. If you are considering changing your tax residence, or have received an audit notice, please contact a member of the Withum SALT team.

May 20, 2022

What Are The Tax Benefits Of An Llc

One of the most popular ways to organize a business is as a limited liability company, otherwise known as an LLC. LLCs require less paperwork than C corporations and S corporations, while giving owners some of the same protections against being held personally liable for any actions of the business. But the true advantage of this title comes in the form of tax benefits. LLCs give business owners significantly greater federal income tax flexibility than a sole proprietorship, partnership and other popular forms of business organization.

Make sure you have a financial plan in place for your small business. Talk to a financial advisor today.

Other Taxes In New York State

The Empire State also has several other taxes that you may run into. Here are some of the main ones.

- Alcoholic beverages tax Varies by type of alcohol. For example, beer and wine are taxed at 14 cents and 30 cents per gallon, respectively. New York City also has a separate tax on wine and certain spirits containing more than 24% alcohol by volume. The distributor pays the tax.

- Cigarette and tobacco tax The state assesses an excise tax of $4.35 per package of 20 cigarettes, and New York City levies an additional tax of $1.50 per 20-cigarette package. The distributor pays the tax.

- Motor fuel tax The tax rate is 17.7 cents per gallon for motor fuel, but the rate can vary with other types of fuel. The tax is paid by the distributor.

- New York City taxicab ride tax Theres a 50-cent tax on each taxi trip that starts and ends in New York City or starts in New York City and ends in Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk or Westchester county. The tax is paid by the medallion owner, agent or hail base.

While most residents likely wont pay any of these taxes directly, the distributors and others paying the taxes may pass it on to you via an increase in the price of the product or service youre buying.

Read Also: Do I Have To Pay Taxes For Babysitting

What Is The Nyc Sales Tax

NYC sales tax varies depending on the item that’s being purchased. Clothing and footwear under $110 are exempt from NYC sales tax. Sales tax on most other items and services is 4.5%. The city charges a 10.375% tax and an additional 8% surtax on parking, garaging, and storing vehicles for a total tax of 18.375%. There’s a Manhattan Resident Parking Tax exemption from the 8% surtax.

Why Do I Owe Ny State Taxes This Year 2021

A Few Other Reasons You Owe NYS tax You may have lost a property tax deduction or perhaps there is a change in your filing status. Lastly, you may not have had enough withholdings or deductions. This leaves more income to be taxed resulting in either a lower refund or the need to pay additional taxes.

You May Like: How Does Stimulus Check Affect Taxes

New York Tax Deductions

Income tax deductions are expenses that can be deducted from your gross pre-tax income. Using deductions is an excellent way to reduce your New York income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your Federal and New York tax returns. For details on specific deductions available in New York, see the list of New York income tax deductions.

Judge Reverses Decision On Non

An administrative law judge recently issued a decision that reversed the Division of Taxations determination of a taxpayers software product sales . The taxpayers service allows agents to access detailed financial reports of personal commissions and performance, and a projection for what is needed to reach their next goal. The administrative law judge determined that since these reports are specific to an individual with minimal overlap of a previous report that it will not be subject to tax. In this case, the judge made a clear distinction between the personal information services offered by the taxpayer and SaaS. Had the judge determined that the taxpayer was selling SaaS and not a personal information service, then the taxpayer would have been required to collect and remit sales tax.

Recommended Reading: When Are Taxes Being Sent Out

How Do I Pay My Estimated Taxes

When filing your estimated taxes, use the 1040-ES IRS tax form or the 1120-W form if you’re filing as a corporation. You can fill out the form manually with the help of the included worksheets, or you can rely on your favorite tax software or tax adviser to walk you through the process and get the job done. From there, you can pay your federal taxes by mail or online through the IRS website. You’ll also find a complete list of accepted payment methods and options, including installment plans.

Nyc May Abate Ubt Late Filing/late Payment Penalties But Interest Still Accrues

The New York City Department of Finance, upon request, will waive late filing and late payment penalties for individual unincorporated business tax taxpayers, if such taxpayers complete filing payment on or before May 17, 2021. However, interest will accrue at the underpayment rate for the late payments. UBT taxpayers can request a penalty abatement by using the Departments portal, sending an email, filing a paper return and writing 21 at the top of the page, or request an abatement in writing.

You May Like: Can You Do Previous Years Taxes On Turbotax

New York State Sales Tax

In the state of New York, the sales tax that you pay can range from 7% to 8.875% with most counties and cities charging a sales tax of 8%.

The sales tax rate in New York actually includes two separate taxes: sales tax and use tax. The state groups these together when talking about sales tax and both taxes are the same rate so it doesnt matter where you purchase things. New York sales tax is currently 4%. Each county then charges an additional sales tax between 3% and 4.5%.

Counties in the metropolitan commuter transportation district also collect a sales tax of 0.375%. This applies to all taxable sales within the counties of Bronx, Kings , New York , Queens, Richmond , Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, Westchester.

| Sales Tax in New York Counties |

| County |

| 8% |

Filing Your Nyc Return

The New York City personal income tax is filed with New York State with your state return. Forms can be found on the New York Department of Taxation and Finance website. You can file your return by mail or e-file it.

New York City government employees must file an additional tax form: Form NYC-1127.

New York City’s taxes are due by April 15 in most years. They should be paid along with your New York State income tax.

Read Also: Where Can I Do My Taxes For Free

New York Income Tax Estimator

You can use the income tax estimator to the left to calculate your approximate New York and Federal income tax based on the most recent tax brackets.

Keep in mind that this estimator assumes all income is from wages, assumes the standard deduction, and does not account for tax credits.

For a more detailed estimate that takes these factors into account, click “View Detailed Estimate” .

New York City Musical And Theatrical Production Tax Credit For Corporate And Personal Income Tax

On July 23, 2021, Governor Andrew Cuomo announced the New York City Musical and Theatrical production tax credit which is designed to revitalize the theater district after its closure due to the Covid-19 pandemic by offering up to $100 million in tax credits. The two-year program for approved companies will allow tax credits for up to 25% of qualified production expenditures such as sets, costumes, sound, lighting, salaries, fees, advertising costs, etc. First-year program applicants can receive up to $3 million per production and second-year applicants up to $1.5 million. Companies can receive credits for tax years beginning on or after January 1, 2021, but before January 1, 2024. Applications must be submitted by December 31, 2022, and final applications no later than 90 days after the production closes or 90 days following the program end date of March 31, 2023, whichever comes first.

Also Check: How To File Previous Years Tax Returns

New Electing Resident S Corporation

Effective for tax years beginning on or after January 1, 2021, New York enacted the PTET allowing partnerships ) and S corporations to make an annual election to pay an entity-level tax at rates ranging from 6.85% to 10.9% on the entitys taxable income. An offsetting personal income tax credit is allowed for the electing partnerships direct partners or members or the S corporations direct shareholders.

Under the new legislation, effective for tax years beginning on or after January 1, 2022, the definition of an electing S corporation is amended to include either an electing resident S corporation or an electing standard S corporation. An electing resident S corporation is an electing S corporation that certifies at the time of its election that all of its shareholders are residents of New York. If such a certification is not made, the corporation will be treated as an electing standard S corporation.

If an electing entity is an electing resident S corporation, then its taxable income includes the sum of all items of income, gain, loss, or deduction to the extent included in the taxable income of the resident shareholders. If an electing entity is an electing standard S corporation, then its taxable income includes the sum of all items of income, gain, loss, or deduction derived from or connected with New York sources.

New York Estate Tax Exemption

The New York estate tax threshold is $5.92 million in 2021 and $6.11 million in 2022. That number will keep going up annually with inflation

This means that if a persons estate is worth less than $6.11 million and they die in 2022, the estate owes nothing to the state of New York. New York has a cliff that impacts very wealthy estates. If the estate exceeds the $6.11 million exemption by less than 5%, it only pays taxes on the amount that goes over the threshold. If the total value is more than 105% of exemptable amount, taxes are paid on the entire estate.

Heres an example of how that works: 105% of $6.11 million is $6,415,500 million. If your estate is worth between $6.11 million and $6,415,500 million, you only pay tax on the amount that exceeds $6.11 million. So if your estate is worth $6.26 million, your taxable estate is only $150,000. If your estate surpasses $6,415,500 million, all of your estate is taxable. If your total estate is $6.5 million, for example, you will pay estate taxes on all of that.

You May Like: What Does Tax Topic 152 Mean

New York Holds Purchase And Lease Of Picasso Painting Was Not A Sale For Resale

An LLC taxpayer-owned by two family trustspurchased a one-half interest in a Picasso painting. The other 50-percent purchaser was the father of the two sons in whose name the trusts were established. Sales tax was paid on the transaction by both purchasers. A few years latersubsequent to a lease of the painting structured between the LLC and the fatherthe LLC sought a refund for the sales tax it paid on its original purchase of the painting on the grounds the purchase was a sale for resale. Retroactively going back and using the lease as a basis for sale for resale argument was not successful. New York reasoned that in order to be a sale for resale, the taxpayer would have needed to show its sole purpose for purchasing the painting was to lease it. Here, however, the additional purpose for purchasing the painting was because it was an investment and added to the taxpayers art collection.

May 2, 2020

What Is Supplemental Property Tax

A tax on the transfer of residential real property, or interest in the case of $2 million or more in consideration. The rate of tax for is an incremental increase over a previous rate of tax. The purchase price is 25%, and the buyer%27s interest rate is 2.9%. Instructions for Form TP-584- NYC, as well as Form TP-584- NYC, are published.

Read Also: When Is The Due Date For Taxes

Tax Cuts Dont Starve The Beast

Liberals generally believe that conservatives support tax cuts mainly out of selfish personal interest. In truth they have a more noble motivationthough liberals dont like it any better. Most conservatives believe that the best way to downsize government is to take away its allowance, as Ronald Reagan once put it. In other words, tax cuts will lead to spending cuts.

This is a theory I once subscribed to. Back in the days when people cared about federal budget deficits, there was a case to be made that intentionally increasing the deficit by reducing revenues would put downward pressure on spending. Today, unfortunately, the evidence seems to point in exactly the opposite direction.

At the time that I drafted the Kemp-Roth tax bill, in 1977, the Republican Party still believed that budget deficits were evil. Republicans would often even support tax increases, such as in 1969, to balance the budget. But they came to believe that higher taxes only encouraged higher spendinguntil a politically intolerable deficit emerged, at which point they would again be pressured to support tax increases. Eventually, Republicans like Newt Gingrich would charge that their party had become the tax collector for the welfare state.

As a consequence, the old starve-the-beast theory has been turned on its head. Economist Bill Niskanen of the Cato Institute has found that tax cuts now actually lead to spending increases. This suggests that higher taxes would reduce spending.

Limited Liability Companies And Taxes

A single member LLC has a default classification as a disregarded entity. Because of this, the owner of the LLC is not considered an employee. Therefore, any income received from the company is not a salary.

Instead, the Internal Revenue Service considers the single member to be self-employed. Any income received is considered earnings from self-employment.

An advantage of an LLC by someone who has a day job and starts a side business is that the losses from the LLC can offset the salaried income.

In general terms, profit and loss are calculated by deducting the business expenses of the LLC from its revenue. A business expense is one that is considered to be ordinary and necessary and one that a reasonable business would use. For example, a home-based courier business would not be allowed to deduct the payments for a leased Ferrari because its not ordinary nor is it reasonable that you would drive a Ferrari to deliver items.

A necessary item is something the business needs to operate. It does not mean the item must be indispensable, but it does need to be helpful and appropriate for the enterprise.

The federal government taxes 92.35 percent of the net earnings from self-employment. Up to a specified threshold, self-employment income is taxed at a rate of 15.3 percent. This breaks down to 12.4 percent for Social Security and 2.9 percent for Medicare. For self-employment earnings above the annual ceiling amount, only the 2.9 percent Medicare tax is used.

Also Check: Who Can I Talk To About My Taxes

What Is A Supplemental Tax Bill In California

A California Supplemental Tax Bill is a tax bill that is imposed after the sale or purchase of a property. You must pay the supplemental bill if your homes previous assessed value taxes are different from its newly valued appraised value. If youre looking for a quick fix, consider it a catch-up bill.

New York City Denies Corporate Tax Refund For Service

A New York City-based business provided a subscription service, which gave customers access to expert consultants in a variety of fields. As part of its service package to customers, the taxpayer employed salespeople, IT staff, and consulting managers but the expert consultants were compensated as independent contractors. The taxpayer sought a refund for a large portion of corporate income taxes it had paid during tax years 2003-2010. Alternative rationales were offered for differing methodologies, but ultimately the taxpayer settled on an allocation whereby only the locations and amounts paid to consultants and research managers who provided services directly to clients should be counted IT staff was excluded. The City contended that all of these persons contributed to the performance of the services provided to clients. The New York City Tax Appeals Tribunal found the taxpayer hadnt allocated income correctly because receipts had to include work done by both employees and consultants in New York City, not all of whom the company had included. The Appellate Court agreed , determining all these individuals were all part of the delivery of services for which clients paid an upfront flat subscription fee.

Also Check: How To File Taxes Without W2 Or Paystub