I Never Got My Second Stimulus Check Even Though It Says It Was Mail Can I Claim It On My Taxes

If you are eligible for a stimulus check and it was lost, stolen or destroyed, you should request a payment trace so the IRS can determine if your payment was cashed.

If a trace is initiated and the IRS determines that the check wasnt cashed, the IRS says it will credit your account for it but the IRS cannot reissue the payment. Instead, you will need to claim the Recovery Rebate Credit on your 2020 tax return if eligible.

If you are filing your 2020 tax return before your trace is complete, do not include the payment amount on line 16 or 19 of the Recovery Rebate Credit Worksheet, the IRS says. You may receive a notice saying your Recovery Rebate Credit was changed, but an adjustment will be made after the trace is complete.If you do not request a trace on your payment, you may receive an error when claiming the Recovery Rebate Credit on your 2020 tax return.

Josh Rivera

Check your State or Federal refund status with our tax refund trackers.

You May Like: How To Pay Virginia State Taxes

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

How Do I Calculate Futa Taxes

For each payroll, you must determine FUTA taxes payable based on the total gross pay paid to employees, up to $7,000 per employee each year. Then multiply this total by the FUTA tax rate .

After you calculate the total tax for all employees for the pay period, you must set aside that total in a payables account in your accounting system. Unemployment tax is a trust fund tax, meaning that it is an amount you owe that must be paid to a government agency.

Also Check: Do Dependents Need To File Taxes

Also Check: How Much Of Paycheck Goes To Taxes

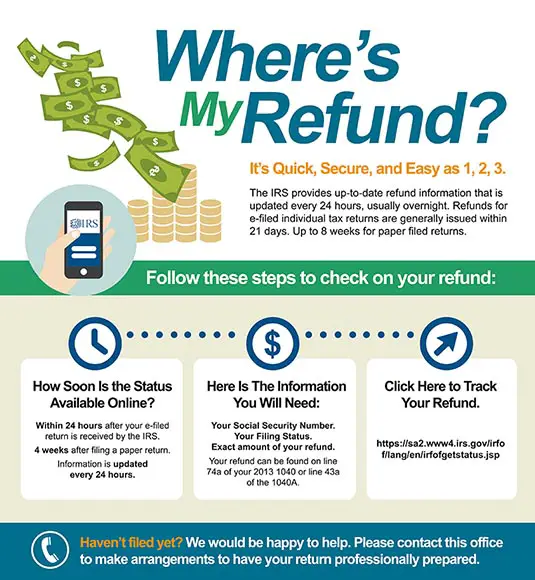

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

I Have Moved To Another Address Since I Filed My Return My Refund Check Could Have Been Returned To The Department As An Undeliverable Check What Do I Need To Do To Get My Check Forwarded To My New Address

In most cases, the US Postal Service does not forward refund checks. To update your address, please complete the Change of Address Form for Individuals, call the Department toll-free at 1-877-252-3052, or write to: North Carolina Department of Revenue, Attn: Customer Service, P.O. Box 1168, Raleigh, NC 27602-1168.

Also Check: What Will My Tax Return Be

How Much Tax Refund Money Will Massachusetts Taxpayers Receive

Eligible Massachusetts taxpayers will generally receive a 2022 tax refund of about 14% of their 2021 Massachusetts income tax liability. However, if you have unpaid taxes or owe child support, the amount of your refund may be reduced by the amount of the outstanding tax liability or unpaid child support.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Is filed on paper

- Needs further review in general

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q& A below.

- Includes a Form 8379, Injured Spouse AllocationPDF, which could take up to 14 weeks to process

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return. If were still processing your return or correcting an error, neither Wheres My Refund? or our phone representatives will be able to provide you with your specific refund date. Please check Wheres My Refund? for updated information on your refund.

Don’t Miss: Where Is My Tax Refund 2020

Don’t Let Things Go Too Long

If you haven’t received your tax refund after at least 21 days of filing online or six months of mailing your paper return, go to a local IRS office or call the federal agency . Taking these steps wont necessarily fast-track your refund, according to the IRS, but you may be able to get more information about what’s holding up your refund or return.

Use The Irswheres My Refund Online Tool

Since 2003, the IRS has provided an online tool that lets you track the status of your refund electronically. You can access the tool, called Wheres My Refund?, as soon as 24 hours after you e-file your tax return . You can also download the IRS2Go app to track your tax refund on your mobile device.

Youll need the following information to check the status of your refund online:

- Social Security number or ITIN .

- Exact amount of the refund listed on your tax return.

Once you input the required data, youll encounter one of three status settings.

The IRS updates refund status once a day, usually overnight.

Recommended Reading: When Do Taxes Have To Be Done By

Claiming Property Taxes On Your Tax Return

OVERVIEW

If you pay taxes on your personal property and owned real estate, they may be deductible from your federal income tax bill. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas, and some agencies also tax personal property. If you pay either type of property tax, claiming the tax deduction is a simple matter of itemizing your personal deductions on Schedule A of Form 1040.

Apple Podcasts | Spotify | iHeartRadio

The Irs2go Mobile App

You can access the Wheres My Refund? tool from your laptop or desktop computer, or you can use IRS2Go if you prefer to use your mobile device. This app is available as a free download on iTunes, Google Play, and Amazon. You can use it to:

- Check your refund status.

- Make a payment if you owe taxes.

- Get free tax guidance.

- Retrieve security codes for certain online IRS services.

The IRS issued more than 111 million tax refunds in 2019, with the average being $2,869. Overall, more than 150 million individual tax returns were processed.

You May Like: When Are Irs Taxes Due

Also Check: How To Pay Back Taxes Online

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

How Much Interest Does The Irs Owe Me

If you filed a proper return on time and the IRS does not issue your refund within 45 days after accepting it, the agency is required to start paying interest on your refund amount.

As of July 1, the interest rate rose from 4% to 5% as a result of the Federal Reserve’s recent decision to raise the federal funds rate. If you electronically filed on time, the 45-day period started on April 18. If you filed a paper return, it began the day that the IRS marked your return as “accepted.”

Of course, any IRS interest you receive with your refund is considered taxable income.

Also Check: How To File Llc Taxes On Turbotax

What Should I Do

When can I check on my refund?

- Did you file your tax return electronically? Within 24 hours after the IRS receives your tax return.

- Did you file a paper return? Four weeks after mailing your tax return.

- Did you file an amended return? Refund information wont be available online, whether you filed your tax return electronically or on paper. Call the IRS at 800-829-1040 You can, however, check the status of your amended tax return with Wheres My Amended Return? on IRS.gov. It should generally be available three weeks after you mail the amended tax return to the IRS.

When checking on your refund, have this information available:

- Your Social Security number or Individual Taxpayer Identification Number or your spouses SSN or ITIN, if you filed a joint tax return.

- Your filing status .

- The exact refund amount shown on the tax return.

- If you chose to get your refund by direct deposit or paper check.

- If you selected direct deposit, did you ask the IRS to divide it among multiple accounts?

Was the refund a Refund Anticipation Check or Refund Anticipation Loan? Contact your tax return preparer.

If you didnt receive your refund or didnt get the amount you expected, there are several possible reasons why

- The refund was lost or stolen.

There are steps you can take to determine which of the above reasons is most likely the I dont have my refund common situation will take you through the possibilities.

Thewheres My Refund Online Tool

The IRS indicates that it issues most refunds within three weeks if you choose direct deposit and youve e-filed your tax return. Refunds can take six to eight weeks if you file a paper return.

The IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. This will help speed refunds during the ongoing public health and economic crisis in 2021.

Go to Wheres My Refund? on the IRS website to check the status of your refund. The tool is updated every 24 hours. Youll need some information at your fingertips:

- Your Social Security number or Employer Identification Number as it appears on your tax return

- The filing status you claimed on your return: single, head of household, married filing jointly, married filing separately, or qualifying widow

- The exact refund amount as shown on your tax return

Youll be redirected to a Refund Status Results screen when you plug in this information. This screen should say one of three things:

- Return received

- Refund approved

You should see an estimated date for deposit into your bank account if your refund has been approved. There should also be a separate date for when you should contact your bank if you havent received your refund by then.

You cant use the Wheres My Refund? tool to get information about your 2020-21 stimulus checks, also referred to as economic impact payments. Use the Get My Payment tool instead if youre still expecting one of those checks.

Recommended Reading: Is Credit Karma Safe For Taxes

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include “Surviving Spouse” and “Deceased” next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

Where Is My Federal Tax Refund What To Do If You Dont Receive It

June 5, 2018 By Michael Taggart

Youre here because youve been asking yourself, Where is my federal tax refund? Youve already submitted your tax returns and are now looking forward to extra money. The anxiety is not fun, but the good news is you can know the status. This guide will show you the factors affecting the tax refund and the process on how to check the refund status online.

You May Like: Where To Report Bitcoin On Taxes

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you’re receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

Read Also: Can You File Back Taxes Online

Estimate Your Tax Bill

Once youve gathered your documents, take some time to review them thoroughly, says tax expert Lisa Niser. This will help determine how much you owe the IRS or how much you can expect to receive in a refund.

A large refund from the IRS may seem like an advantage, but it isnt the most effective use of your money, experts say. Youre essentially giving the IRS an interest-free loan, which is money you could have otherwise saved, used to pay down debt, or invested.

Niser recommends working with a tax professional to create an accurate projection for your 2023 taxes, especially if you have a complex tax situation. You can find qualified tax professionals through the IRS portal. If your taxes are simple, there are also several free calculators online that you can use to get an estimate, such as the IRS Tax Withholding Estimator tool or HRBlocks tax calculator. Knowing the amount of taxes youve already paid can help you address potential issues immediately.

The biggest challenge is that people are surprised by their taxes, Niser says.

Help With Unemployment Benefits And How To File Your Taxes

We understand that you may have a lot on your plate right now. Where your taxes are concerned, H& R Block is here to help. Be sure to visit our Unemployment Tax Resource Center for help with unemployment related topics.

Free tax filing with unemployment income: You can include your Form 1099-G for free with H& R Block Online Free.

Worried your taxes are too complex for H& R Block Free Online? Check out Blocks other ways to file.

Related Topics

Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H& R Block.

You May Like: How Old Do You Have To Be To File Taxes

Don’t Miss: How To Pay Your Taxes Owed