How To Prepare For Tax Season When You Have Crypto

The best thing you can do to simplify your crypto-related 2021 tax filing is start planning ahead now. Dont wait until April 1, 2022, to begin gathering your reports and figuring out what you owe, even if thats how you typically approach tax season.

You do not want to be in the situation in April where youre trying to catch up with one years worth of crypto activity, White says. You really want to treat it more like a business, where on a monthly basis you are making sure that all of your taxes are up to date, making sure you are tracking things correctly, and being more proactive about it.

If youre just dipping your toes into trading Bitcoin or another cryptocurrency, and only have a few transactions , you may be able to easily report your crypto earnings yourself using your typical tax software.

Most people are pretty simple: they have a W-2, they have a couple 1099 interest forms, and they may have some crypto, Chandrasekera says. So those people dont really need a CPA. But if youre somebody dealing with large amounts of money, youre making DeFi transactions, staking or mining operations, those people will want to have a CPA to sit down and do tax planning and tax-saving strategies.

If You Participate In An Airdrop Or Fork

An airdrop is when a new crypto project launches and sends out several free tokens to early adopters and their communities to encourage adoption as part of a broader marketing effort to promote the projects inception. If you frequently interact with crypto platforms and exchanges, you may receive airdrops of new tokens in your account. These new coins count as a taxable event, causing you to pay taxes on these virtual coins.

A hard fork is a wholesale change in a blockchain networks protocol that invalidates previously-verified transaction history blocks or vice versa. Many times, a cryptocurrency will engage in a hard fork as the result of wanting to create a new rule for the blockchain. The new, upgraded blockchain contains the new rule while the old chain doesnt. Many users of the old blockchain quickly realize their old version of the blockchain is outdated or irrelevant now that the new blockchain exists following the hard fork, forcing them to upgrade to the latest version of the blockchain protocol. For a hard fork to work properly, all nodes or blockchain users must upgrade to the latest version of the protocol software.

A hard fork doesnt always result in new cryptocurrency issued to the taxpayer, and doesnt necessarily generate a taxable event as a result. However, in the event a hard fork occurs and is followed by an airdrop where you receive new virtual currency, this generates ordinary income.

Gains On Crypto Trading Are Treated Like Regular Capital Gains

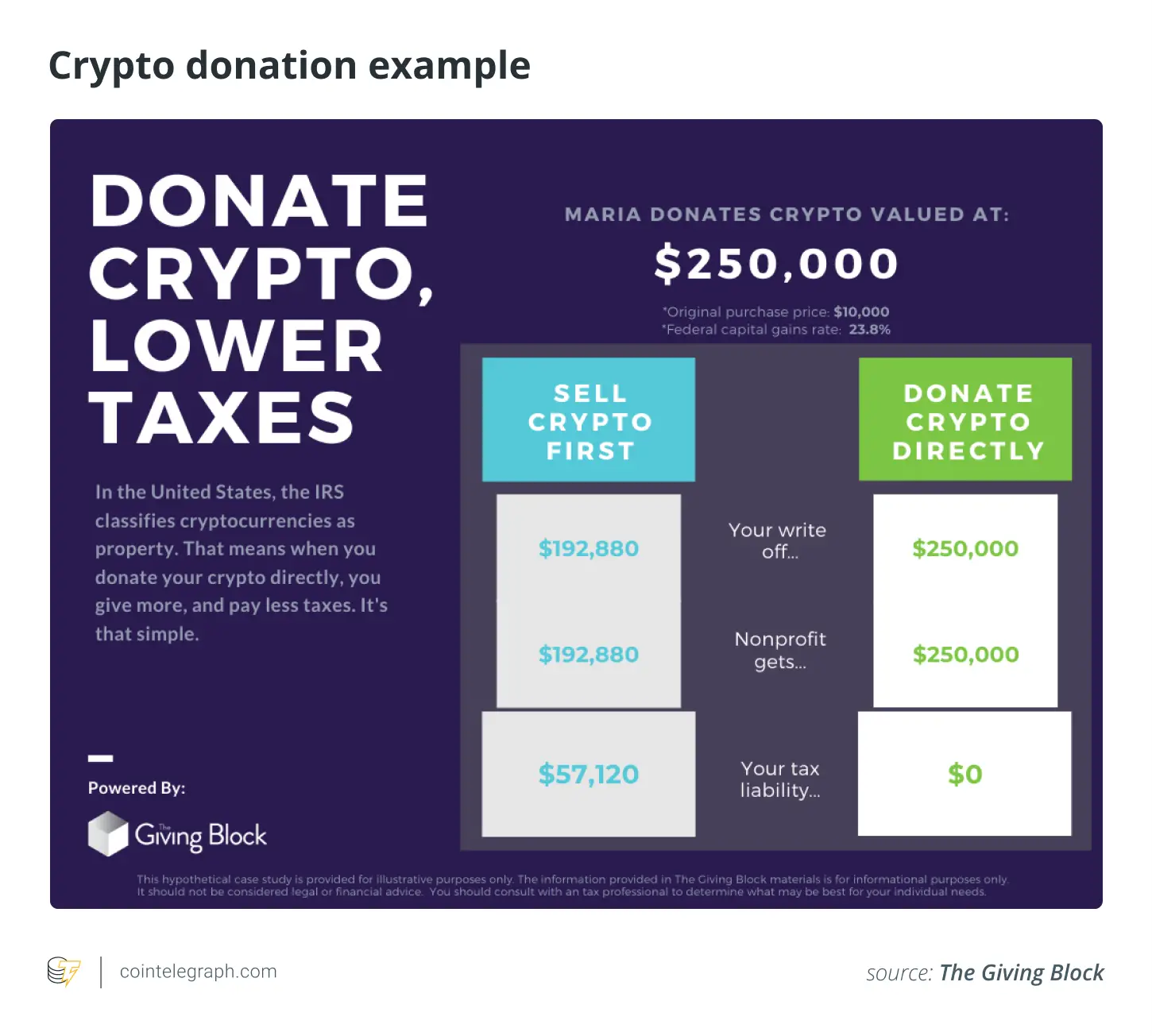

So youve realized a gain on a profitable trade or purchase? The IRS generally treats gains on cryptocurrency the same way it treats any kind of capital gain.

That is, youll pay ordinary tax rates on short-term capital gains for assets held less than a year. But for assets held longer than a year, youll pay long-term capital gains tax, likely at a lower rate .

And the same rules for netting capital gains and losses against each other also applies to cryptocurrencies. So you can deduct capital losses and realize a net loss of up to $3,000 each year. If your net losses exceed this amount, youll have to carry them over to the next year.

Recommended Reading: Will Irs Extend Tax Deadline

Can The Irs Track Crypto Activity

Despite the anonymous nature of cryptocurrencies, the IRS may still have ways of tracking your crypto activity.

For example, if you trade on a crypto exchange that provides reporting through Form 1099-B, Proceeds from Broker and Barter Exchange Transactions, they’ll provide a reporting of these trades to the IRS.

Further, the IRS makes use of blockchain analytics tools for identifying crypto activity of digital wallets and ties them to individuals in instances where they suspect tax evasion and/or money laundering may be occurring.

As a result, youll want to make sure you report all crypto activities during the year on your tax return.

Paying For Goods Or Services

Selling crypto for cash isnât the only reason youâll have to pay taxes on a crypto transaction. If you use crypto like normal cash, that transaction is going to be taxable, too.

For example, letâs say you bought a single Bitcoin for $100 a few years back. Youâre pretty lucky because that Bitcoin could now be worth over $50,000. But you also want to treat yourself, so you decide to use that Bitcoin to purchase a new sports car.

In the eyes of the IRS, this transaction is going to qualify as a taxable event. This is because you have to dispose of your digital asset â which, in this case, is your Bitcoin.

That Bitcoin was originally worth $100, and your new asset is worth $50,000. To the IRS, this transaction counts as a capital gain of $49,900.

This is a pretty big gain, and you need to report it on your taxes in the same way youâd report a crypto-for-cash sale: IRS Form 1040.

In most cases, this capital gain is probably going to generate some type of tax expense youâll need to pay to the IRS.

You May Like: How To File Va State Tax Extension

How Coinledger Can Help

1. Select each of the cryptocurrency exchanges, wallets, and platforms youʼve used throughout the years.

2. Import your historical transactions by connecting your accounts via API or uploading the CSV transaction history report exported by your exchanges.

3. Finally, generate your tax reports based on this imported data with the click of a button.

Once youʼve generated your tax reports, you can send them to your tax professional or import them directly into your preferred tax filing software like TurboTax or TaxAct.

You can test out the software yourself by creating a free account here.

Do You Pay Tax When You Sell Crypto In The Us

Yes – you’ll pay tax when you sell crypto in the US. But the amount you pay will vary depending on how long you’ve held your asset and your regular income. You’ll pay short-term Capital Gains Tax on crypto held for under a year and long-term Capital Gains Tax on crypto you’ve held for more than a year.

Don’t Miss: What Percentage Of Your Paycheck Goes To Taxes

When You Make Money On Crypto Uncle Sam’s Going To Want A Piece

It’s not the most exciting part of crypto investing, but if you do invest in a digital currency, you need to know how taxes on crypto work. Although cryptocurrencies are still new, the IRS is working hard to enforce crypto tax compliance.

There are quite a few ways that you can end up owing taxes on crypto, and even trading one cryptocurrency for another can be a taxable event. You also need to pay taxes if you realize a gain on other digital assets, such as non-fungible tokens . If you don’t keep accurate records, it can be hard to piece together your gains and losses at tax time. And, if you don’t pay your crypto taxes — even if it’s an honest mistake — you could end up paying costly penalties.

This guide will explain everything you need to know about taxes on crypto trading and income. You’ll learn about how to file crypto taxes, crypto tax rates, and other important details about this complex subject.

How Much Us Crypto Tax Do You Pay

Calculating how much cryptocurrency tax you owe in the U.S. is based on how long youve held the assets prior to disposing of them, as well as which income tax bracket you fall under.

This is divided into two parts:

- Short-term capital gains: Profits from a crypto asset held less than a year are taxed at the same rate as whichever income tax bracket youre in. Any losses can be used to offset income tax by a maximum of $3,000. Any further losses can be carried forward.

- Long-term capital gains: For crypto assets held for longer than one year, the capital gains tax is much lower 0%, 15% or 20% tax depending on individual or combined marital income.

You May Like: When Do Non Profits File Taxes

Do I Have To Report Selling Crypto

It is when you sell cryptocurrencies that the IRS will come calling, meaning you will need to report those trades. That is because, like stock sales, you will owe taxes on your capital gains from the sale. You owe capital gains taxes any time you sell a taxable asset for more than you paid for it. Questions about whether you will have to pay a long-term or short-term capital gains rate are best reserved for your accountant or other tax professionals.

How To Pay Tax On Crypto

Crypto investors need to report gains on cryptocurrency on their annual self-assessment tax return or they can use HMRCs real-time capital gains tax reporting service to pay tax on crypto.

Accurate record keeping is really important for anyone who is self-employed, and crypto investors are one such group who also need to keep accurate records for tax purposes too.

HRMC says crypto investors must declare the following:

-

Date you disposed of them

-

Number of tokens youve disposed of

-

Number of tokens you have left

-

Value of the tokens in pound sterling

-

Bank statements and wallet addresses

-

Records of the pooled costs before and after you disposed of them

Getting the right financial advice for your circumstances is key.

If youre still not sure what you need to declare, find your perfect financial adviser with Unbiased now.

Don’t Miss: How Do I Protest My Property Taxes In Harris County

How To Report And Pay

If you need to report and pay Capital Gains Tax, you can either:

- complete a Self Assessment tax return at the end of the tax year

- use the Capital Gains Tax real time service to report it straight away

The amount of tax due might be different if you are not a resident in the UK.

If you complete a tax return, you must complete it in pound sterling.

Staking As Part Of A Pos Consensus Mechanism

Some cryptocurrencies – like Polkadot, Solana, Avalanche and Cardano – use a PoS consensus mechanism. In a PoS consensus mechanism, you stake your crypto to earn a reward. It’s very similar to mining crypto as part of a PoW mechanism – a network participant gets selected to add the latest batch of transactions to the blockchain and earn crypto in exchange.

There is an argument that because you are creating newly generated coins, you should not be taxed on the receipt of the coins – the argument uses the analogy of creation of other property who would not be taxed on the value of the computer following the completion of manufacturing, but only once sold to an eventual customer.

Also Check: How To Do Tax Deductions

Selling Or Trading Coins From An Airdrop

You’ve already paid Income Tax on your airdropped coins and you later decide you want to sell them so you can invest in something else.

Airdropped coins or tokens are viewed exactly the same way as any other cryptocurrency from a tax perspective, so you’ll pay Capital Gains Tax when you later dispose of airdropped crypto by selling it, trading it or spending it.

Your cost base for your airdropped coins will be the fair market value on the day you received them. We’ll use the same example as above to explain.

How Is Cryptocurrency Taxed Here’s What You Need To Know

If you think the lack of government oversight means that cryptocurrency is not taxed, you’re in for a big surprise.

Cryptocurrency has headlined many news articles, served as the subject of social media posts, and gained significant traction in mainstream culture. Bitcoin, the first digital currency, has grown exponentially in recent years, with a total market capitalization growing from a modest $10 billion in July 2016 to over $1.1 trillion earlier this year.

If you’ve held on to your Bitcoin since then, you’ve obviously learned how to increase your net worth and now have a sizable unrealized capital gain in your portfolio. But what happens if you choose to convert this erstwhile investment into an actual currency used to buy goods and services?

You’re going to feel a tax pinch. But do you know how much you’ll owe Uncle Sam? To answer that question, you need to understand what cryptocurrency is and how your tax liability is determined every time you buy it, sell it, or mine it.

You May Like: Can You File 2 Years Of Taxes At Once

Can The Irs Track Your Cryptocurrency

Itâs often assumed that because cryptocurrency is anonymous, evading taxes is fairly easy. This is not true.

Major exchanges like Coinbase send 1099 forms to the IRS which contain your information and records of your crypto income.

The IRS can use the information that it receives from major exchanges to match âanonymousâ wallets to known individuals. In the past, the agency has worked with contractors like Chainalysis to analyze the blockchain and crack down on tax fraud.

In the future, the IRS will have even more information at its disposal to identify tax cheats. The 2021 infrastructure bill requires strict reporting requirements for American exchanges.

Crypto Taxes In 202: Tax Rules For Bitcoin And Others

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Cryptocurrency is taxable when you sell it, or if you earn it as income. You report your transactions in U.S. dollars, which generally means converting the value of your cryptocurrency to dollars when you buy, sell, mine, earn or use it.

Heres how crypto taxes work:

You May Like: Can You File Taxes Without Your W2

How Is Cryptocurrency Taxed

First off, you dont owe taxes on crypto if youre merely hodling, as aficionados would say. But if youve gained any income from crypto this yeareither from staking, lending or sellingyou may owe taxes on the proceeds.

The IRS treats all cryptocurrencies as capital assets, and that means you owe capital gains taxes when theyre sold at a profit. This is exactly what happens when you sell more traditional securities, like stocks or funds, for a gain.

Lets say you bought $1,000 in Ethereum and then sold the coins later for $1,600. Youll need to report that $600 capital gain on your taxes. The taxes you owe depend on the length of time you held your coins.

If you held your ETH for one year or less, the $600 profit would be taxed as a short-term capital gain. Short-term capital gains are taxed the same as regular incomeand that means your adjusted gross income determines the tax rate you pay.

Federal income tax brackets top out at a rate of 37%. To be in the top bracket for 2023, you would need to make $578,126 or more as a single filer.

Two Factors Determine Your Tax Rate

If youre paying taxes on the profit you made buying and selling crypto, your rate depends on:

How long you owned it before selling. If you owned crypto for one year or less before selling it, youll face higher rates between 10% and 37%. If you owned the crypto for more than a year, your rates will be between 0% and 20%.

Your total income for the year. The highest tax rates apply to those with the largest incomes.

» Find out moreabout tax rates and crypto

Don’t Miss: How Much Is H& r Block For Taxes

How Is Crypto Income Taxed

Remember, you donât pay one flat tax rate on all of your taxable income. Instead, youâll pay progressively higher tax rates on each portion of your income.

Letʼs say you made $25,000 in short-term capital gains from your crypto trading, and this was the only income you had for the year. Would you simply pay 12% of tax on that $25,000?

No. Instead of paying a flat tax on your entire income, youʼll pay different tax rates as you ascend through the income tax brackets. In this case, you only pay 10% on the first $10,275 and 12% on the next $14,725.

Do You Have To Report Crypto To The Irs

If you have a profit/loss from crypto trading or receive any form of income in crypto, youll need to report it to the IRS.

Lets see the crypto operations you need to report and which taxes are due in each case:

-

Selling crypto for USD: Capital gains taxes

-

Trading crypto for another cryptocurrency: Capital gains taxes

-

Trading a cryptocurrency like ETH for a stablecoin: Capital gains taxes

-

Earning interest in crypto: Ordinary income taxes

-

Receiving a crypto airdrop: Ordinary income taxes

-

Receiving crypto staking rewards: Ordinary income taxes

-

Earning a salary in crypto: Ordinary income taxes

-

Receiving new coins from a hard fork: Ordinary income taxes

-

Receiving crypto as a bonus reward, referral fees, tips: Ordinary income taxes

You May Like: How Much Tax Do I Need To Pay