When Will Tax Refunds Start In 2020

Once the IRS has accepted your tax return, you’ll most likely receive your tax refund within 21 days if you e-file. More than 90% of tax refunds in recent years have been issued within that time period. If you are among the 8% of Americans who still file a paper tax return, it could take considerably longer.

So, if you e-file your tax return and the IRS accepts it on the first possible date, you can expect to receive your refund by Feb. 17, although you could certainly get it significantly earlier. In practice, the IRS typically issues tax refunds once a week , so your most likely direct deposit date would be Feb. 14. Of course, if you choose to receive your refund by paper check, you aren’t likely to get it quite so fast.

Finally, if you claim either the Earned Income Tax Credit or the Additional Child Tax Credit on your return, your refund could potentially be delayed. The IRS is required to hold all refunds that claim these credits until at least Feb. 15.

Getting Someone To Help You With Your Tax Return

There are several ways you can ask for help with your tax return. You can appoint a relative, friend or an accredited accountant to complete and send your tax return to HMRC on your behalf.

If you decide this is the best option for you, you will need to notify HMRC.

Find out how to get help with Self Assessment tax returns.

Even if you authorise someone to act on your behalf, it is still your responsibility to make sure your tax return is correctly completed and submitted on time.

Handing over sensitive personal information, even inadvertently, puts you at risk. Someone using your Government Gateway account could steal from both you and HMRC, and leave you having to pay back the full value of any fraudulent repayment claim made on your behalf.

If you appoint a tax agent, they can access the information they need to deal with your tax affairs using HMRCs agent digital services. Your agent should never need to log in as you, or ask you to share your Government Gateway user ID and password with them.

If Youre Worried About Your Tax Bill

If you are worried about how to pay your bill or whether you can afford to pay it, we can help.

We want to work with you to find an affordable way for you to pay the tax you owe, for example paying what you owe in instalments.

Contact us about Self Assessment

- phone: 0300 200 3310

- alternative ways to contact us

Read Also: What If I Already Paid Taxes On Unemployment

Why Do I Owe So Much In Taxes 2021

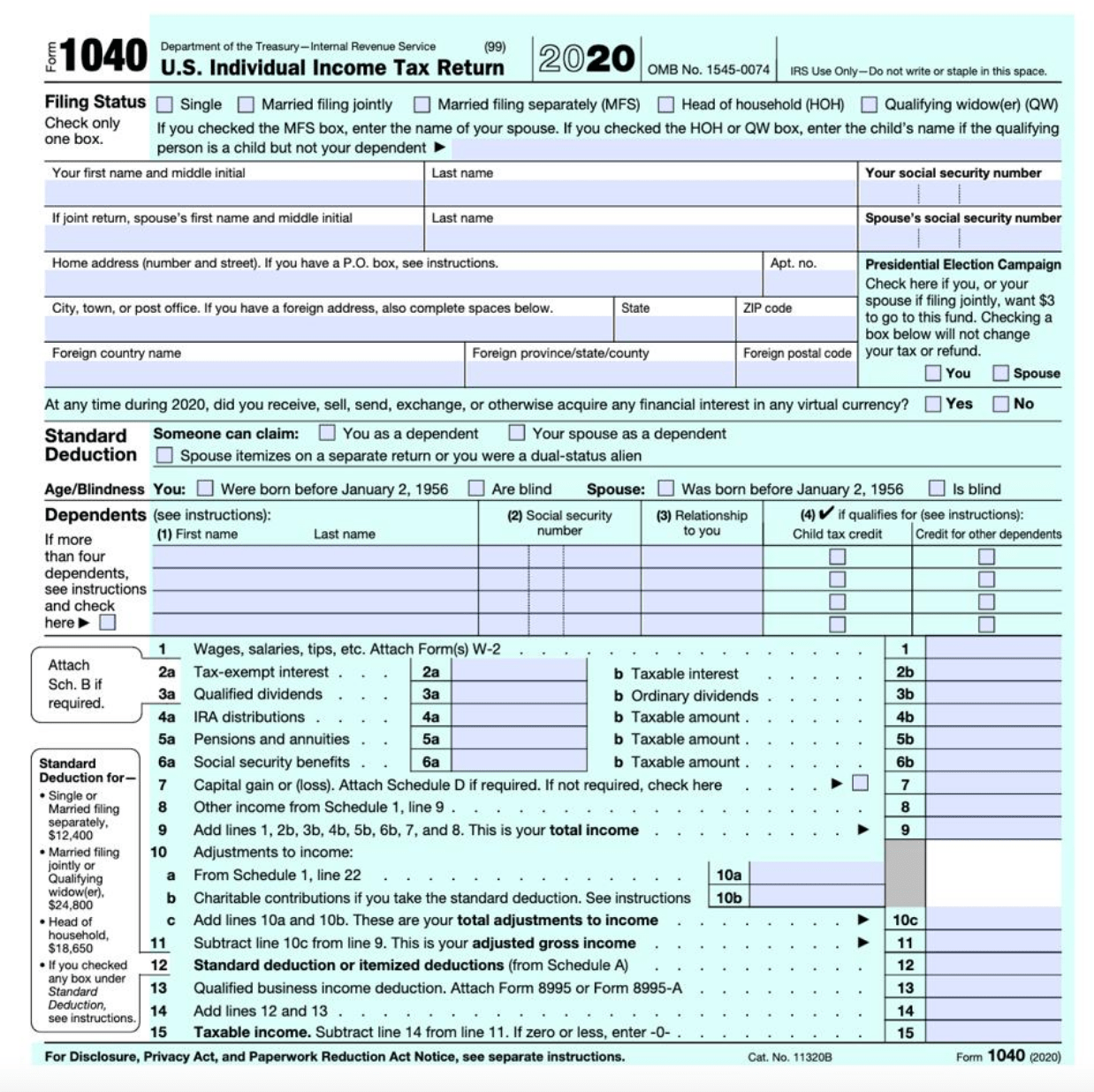

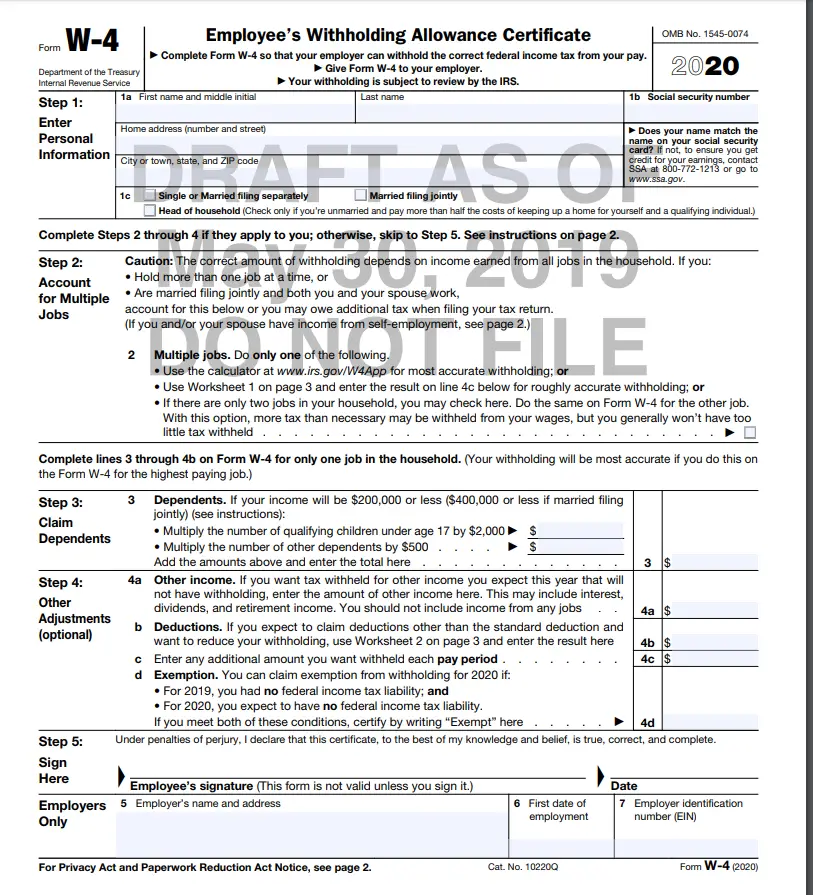

Job Changes If you’ve moved to a new job, what you wrote in your Form W-4 might account for a higher tax bill. This form can change the amount of tax being withheld on each paycheck. If you opt for less tax withholding, you might end up with a bigger bill owed to the government when tax season rolls around again.

How Late Can I File My Taxes

Asked by: Adella Littel

Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. Filing this form gives you until to file a return. If October 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day.

Also Check: How To Pay Back Taxes Online

Additional Tax Filing Facts To Keep In Mind

- Up to 70% of taxpayers are eligible to file their taxes for Free. In addition, commercial partners of the IRS offer free brand name software to 100 million individuals and families who make less than $62,000.

- Online tax forms allow you to have electronic versions of IRS paper forms regardless of your income. They can be prepared and filed by you if you are comfortable preparing your income taxes.

- VITA and TCE provide free tax help to those who qualify. You can learn more about them by going to the IRS website and entering free tax prep in the search box. Alternatively, you can download the IRS2Go mobile app on your phone and find a free tax prep provider that way.

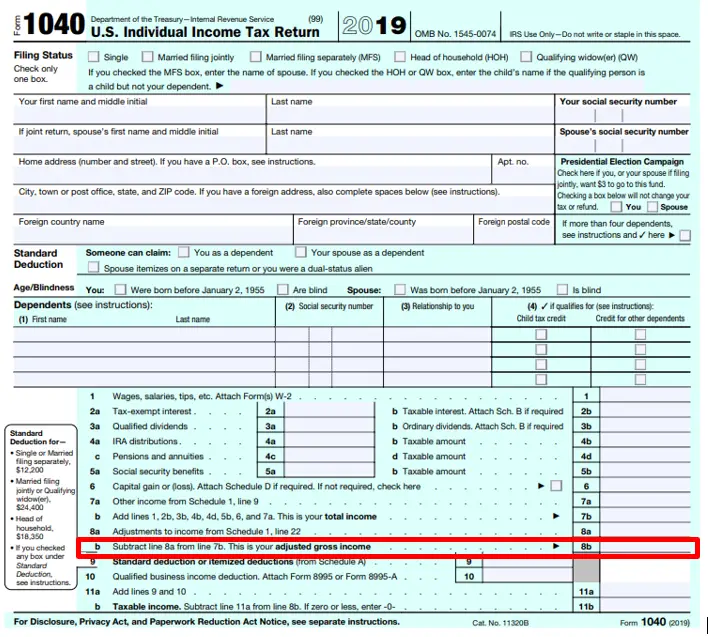

When Did Irs Accept Returns 2020

IRS opens 2020 filing season for individual filers on Jan. IR-2020-02, January 6, 2020 The Internal Revenue Service confirmed that the nation’s tax season will start for individual tax return filers on Monday, January 27, 2020, when the tax agency will begin accepting and processing 2019 tax year returns.

Read Also: Can I File Taxes With My Last Pay Stub

Filing If You Received Covid

The CRA and Service Canada processed more than 27 million Canada Emergency Response Benefit applications, totaling more than $81 billion in payments to Canadians. The CRA also processed more than 2 million Canada Emergency Student Benefit applications that totaled more than $2 billion in payments.

If you received CERB, CESB, Canada Recovery Benefit , Canada Recovery Sickness Benefit , or Canada Recovery Caregiving Benefit payments, you will have to enter on your return the total of the amounts you received. You will receive a T4A and/or a T4E tax slip in the mail with the information you need for your return. You can view tax slips online as of February 8, 2021 in My Account. Residents of Quebec will receive both a T4A and RL-1 slip from the CRA, however, the RL-1 slip will not be available for viewing in My Account.

The CRA recognizes that receiving these slips might generate questions for Canadians. Individuals who believe they received a T4A or a RL-1 by mistake or believe there may be discrepancy with the information provided on these slips should contact the CRA.

If you received the CERB or CESB, no tax was withheld when payments were issued. If you received the CRB, CRSB, or CRCB, 10% tax was withheld at source. For Quebec residents who received the CRB, CRSB, and CRCB, 5% of the tax withheld will be reported on the T4A slip and the other 5% will be reported on the RL-1 slip.

Do Not Risk Having Your Benefits And Credits Interrupted

Doing taxes on time is the best way to ensure your entitlement to benefits and credits, like the Canada child benefit , the Old Age Security pension payments, and the goods and services tax/harmonized sales tax credit, are not interrupted. Even if you owe tax, dont risk having your benefits and credits interrupted by not filing. If you cannot pay your balance owing, the CRA can work with you on a payment arrangement.

You May Like: How Much Is Property Tax

When Can I File My Taxes For 2022

Many people are asking, when can I file my taxes for 2022? The Internal Revenue Service announced that the nations tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

If you file your taxes online, you can start now and your tax return will be automatically transmitted to the IRS as soon as they open the new tax season. This is the fastest way to get your refund.

Online tax software offers advanced tools to help you file your taxes and pay the least amount possible. Online software companies, including IRS Free File partners, start accepting tax returns in early December.

Avoiding A Tax Extension

Filing your tax return early may help eliminate the need to file an extension. Extensions of time are often required as a result of disorganization more than financial need. Some people who wait until the last minute to file their returns simply need time to look for additional deductions or gather receipts.

- Push the process too close to the filing deadline, and you increase the likelihood that you will need the assistance of a tax professional to help you sort your finances and complete your return.

- Even worse, if you file an extension but don’t pay what you owe if you have a balance due, the IRS will charge you interest and penalties on the outstanding tax debt until it is paid in full.

- Preparing your tax return early in the year helps you avoid this situation.

Read Also: Can You Get The Stimulus Check Without Filing Taxes

Amended Returns Must Be Filed By Paper For The Following Reasons:

How Can I File My Taxes

The IRS accepts tax returns filed one of two ways:

A reported 88% of individual tax returns are e-filed per year. Any tax return filed by a tax professional in an H& R Block tax office, using the H& R Block tax software, or through the H& R Block online filing program is usually e-filed. However, you can always choose to have your return printed to mail yourself.

E-file is the quickest filing method and typically helps you receive a tax refund faster.

Recommended Reading: Do You Have To File Taxes If Your On Ssdi

What Happens If I Don’t File My Taxes On Time

Individuals who owe federal taxes will incur interest and penalties if they don’t file and pay on time. The penalty for not filing your taxes on time is 5% of your unpaid taxes for each month that the return is late, maxing out at 25%. For every month you fail to pay, the IRS will charge you 0.5%, up to 25%.

When Can I File My Taxes

Each year, the IRS issues a statement in early January with the first day to file taxes.

Typically, the official date when you can file taxes falls in mid to late January.

The IRS announced it will start processing tax returns Feb. 12. Worried about waiting weeks for your refund? We can do your taxes now and when you file at Block, you could get a Refund Advance up to $3,500 today. No waiting on the IRS. No loan fees and 0% interest.

Read Also: How To Contact Credit Karma Tax By Phone

The Irs Recommends Filing Your Taxes Early

According to the IRS, you should file your taxes early so you can avoid delays when waiting for your tax refund. This means youll get your tax refund the fastest way possible!

With an estimated 153 million tax returns expected to be filed, 80% of which will be submitted through online tax software, its always better to start as soon as possible and avoid any system downtime or painful delays.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Also Check: How Much Tax Is Deducted

How Many Kids Can You Claim On Taxes

You can claim as many children dependents as you have. You will get a dependent exemption for each, you will get child tax credit for children 16 or younger, Child and Dependent care credit has a maximum dollar amount. And for the EIC, you get credit for 3, but there is no increase in EIC for more than 3 dependents.

Filing Electronically And Choosing Direct Deposit Is The Fastest Way To Get Your Refund And Stimulus Payments

If I could give you one important piece of advice for filing your taxes, it would be to file electronically and choose direct deposit for your refund. The best way to file a complete and accurate return is to file electronically. The tax software asks questions about your income, credits and deductions and will help figure your Recovery Rebate Credit. If you want your refund as soon as possible, filing electronically and having your refund sent via direct deposit is the fastest and safest way to receive your money.

If you dont have a bank account, visit the FDIC website or the National Credit Union Association using their for information on where to find a bank or credit union that can open an account online and how to choose the right account for you. If you are a veteran, see the Veterans Benefits Banking Program for access to financial services at participating banks.

So, if you havent filed taxes recently because you thought you didnt have to, I hope Ive given you a closer look into why it might be a great idea to file in 2020. Its something that can be done electronically using a smartphone. Plus, with our helpful online resources and free filing assistance for certain taxpayers, its easier than ever to file electronically and see if youre due a refund. If youve already filed, thank you. Tell your friends and family so they dont lose the money theyre entitled to visit the filing information section of IRS.gov today!

Also Check: Can I Pay Property Tax Online

Do I Have To Pay Taxes On My Unemployment Benefits

As unemployment rates soared during the early days of the pandemic, millions of people received unemployment benefits to help them get by. You might have to pay taxes on that money, but the recently passed American Rescue Plan makes it a lot more unlikely.

The bill, signed into law by President Joe Biden on March 11, made the first $10,200 of unemployment income tax-free for people with adjusted gross income of less than $150,000 in 2020.

If you had already filed your taxes before that date and paid taxes on unemployment, the IRS is working on a fix that will save people the effort of filing an amended tax return and still refund them what they paid for unemployment benefits.

Irs Free File Available Until October 17 Midnight Eastern Time

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Also Check: Do I Need To File An Extension For 2020 Taxes

When Can I File My Return

An important point to note is that while you can file your taxes anytime after the beginning of the year, the IRS will not process any returns until IRS e-File goes live. This includes returns filed via the main tax software providers or directly via the IRS website for lower income filers.

The IRS also reiterated that filing your taxes electronically is the most accurate way to file a tax return and the fastest way to get a refund. It is expected that more than over 80% of tax returns will be e-filed in the latest tax year.

Once your return is accepted the IRS processes your refund based on the IRS E-file Refund Cycle Chart. Exact refund dates are based on IRS processing times and can be found in IRS Publication 2043 and IRS Topic 152 for both e-filed and mailed returns.

After filing and assuming your tax return is on order you should receive your federal refund between 8 and 21 days. If you did not select the electronic deposit option, getting a paper check mailed to you adds about a week. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date.

How Early Can You File Your Taxes To Get Your Tax Refund

We all know that 2020 has been a year of unprecedented loss and financial strain for millions of Americans, but right now we can only hope that some relief is on the way. Maybe Congress will finally decide on another coronavirus stimulus bill, or perhaps a COVID-19 vaccine will quickly help us turn the corner and get back to normal. And maybe just maybe 2021 will start off on a much brighter note.

In the meantime, I know a lot of Americans are eager to file their tax returns as quickly as possible to get their tax refunds. With record unemployment and many assistance programs ending, any extra income is a huge benefit.

After all, the average tax refund for the 2019 fiscal year worked out to $2,711. If youre like many Americans, this amount represents the single largest dollar figure youll receive at once within a calendar year.

Even in a normal economic environment, early tax filers usually try to file their taxes once they get their final pay stub of the year. However, Americans cannot legally file their tax returns for the prior year until January 1st, meaning you cannot file your taxes for 2020 until January 1, 2021.

Even tax software that offers the option to file early really just holds your returns, and transmits it to the IRS when they are able to .

Getty

Don’t Miss: How Do I Check The Status Of My Tax Return