Before Filing Your Income Tax And Benefit Return

You can easily change your address using My Account or the MyCRA mobile web app.

You can also change your address:

- through certified tax software when filing your return, if you are registered for My Account

If you have moved, you need to inform the CRA as soon as possible to avoid interrupting your benefit and credits payments. If you are a paper filer, you need to update your mailing information in order to receive the 2021 Income Tax Package. We encourage you to change your address online and sign up for email notifications. These notifications act as an early warning about important changes made on your account.

If youre not registered for My Account, your representative can send an authorization request through Represent a Client or, if they are filing tour tax return for you, through EFILE.

For more information on how to authorize a representative, go to Representative authorization.

The CRA offers small-business owners and self employed individuals free help by phone or videoconference virtually through the Liaison Officer Service. This service helps you understand your tax obligations and makes you aware of possible business deductions. The Liaison Officer will answer tax-related questions , discuss business deductions and explain common tax errors.

You can sign up for direct deposit:

- by registering for My Account

- by using the MyCRA mobile web application

- through many financial institutions like banks, credit unions and trust companies

The Legality Of Filing Without Your W

If you file electronically, you will have no problem filling your taxes without having your W-2. However, you still need the information from the W-2 in order to accurately do your taxes. Some of the things you will need are:

- Medicare tips and wages

- Withheld Medicare tax

- Any withheld local income taxes

Although it is not necessary to submit a W-2 copy when you file electronically, you will have to enter the information found on this form. It is still very important to make sure your W-2 stays in a safe place because you may need it at some point. For instance, it may be required for background checks, for an audit, or other similar situations.

Keep in mind that you will have to produce the W-2 and other documents in case of an audit. They will allow you to show evidence of your income, as well as withholding. If you are unable to show that you entered those numbers in good faith, you may end up dealing with legal problems.

The employer is the one who should file the W-2 form with the Social Security Administration. This has to be done before the end of January. Also, the information will be shared by the SSA with the IRS. This is how they will be able to tell whether you and your employer reported different numbers, in which case an audit will take place.

Pay Stub Deduction Codes What Do They Mean

Below, you will find some of the most common deduction codes that appear on your pay stub. Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER, which refers to an employers contribution if the employee receives a company match. However, this is by no means an exhaustive list.

Many companies list codes on their paycheck specific to how they do business or the benefits they offer to employees. For example, some businesses may list health insurance as HS while others may call it HI. Unions, savings funds, pensions, organizations and companies all have their own codes too, any of which could appear on your paycheck, depending on your circumstances.

| Code |

|---|

Also Check: Where Can I File Back Taxes For Free

Introduce Basic Tax Forms

Here are some of the fundamentals of common tax-related documents and forms. Click on the link to see actual examples of the forms.

When your teen begins a new job, he or she will be asked to complete a Form W-4. Filling out a W-4 helps the employer calculate the correct amount of federal income tax to withhold. To determine the appropriate number of allowances, you can use the withholding calculator at IRS.gov.

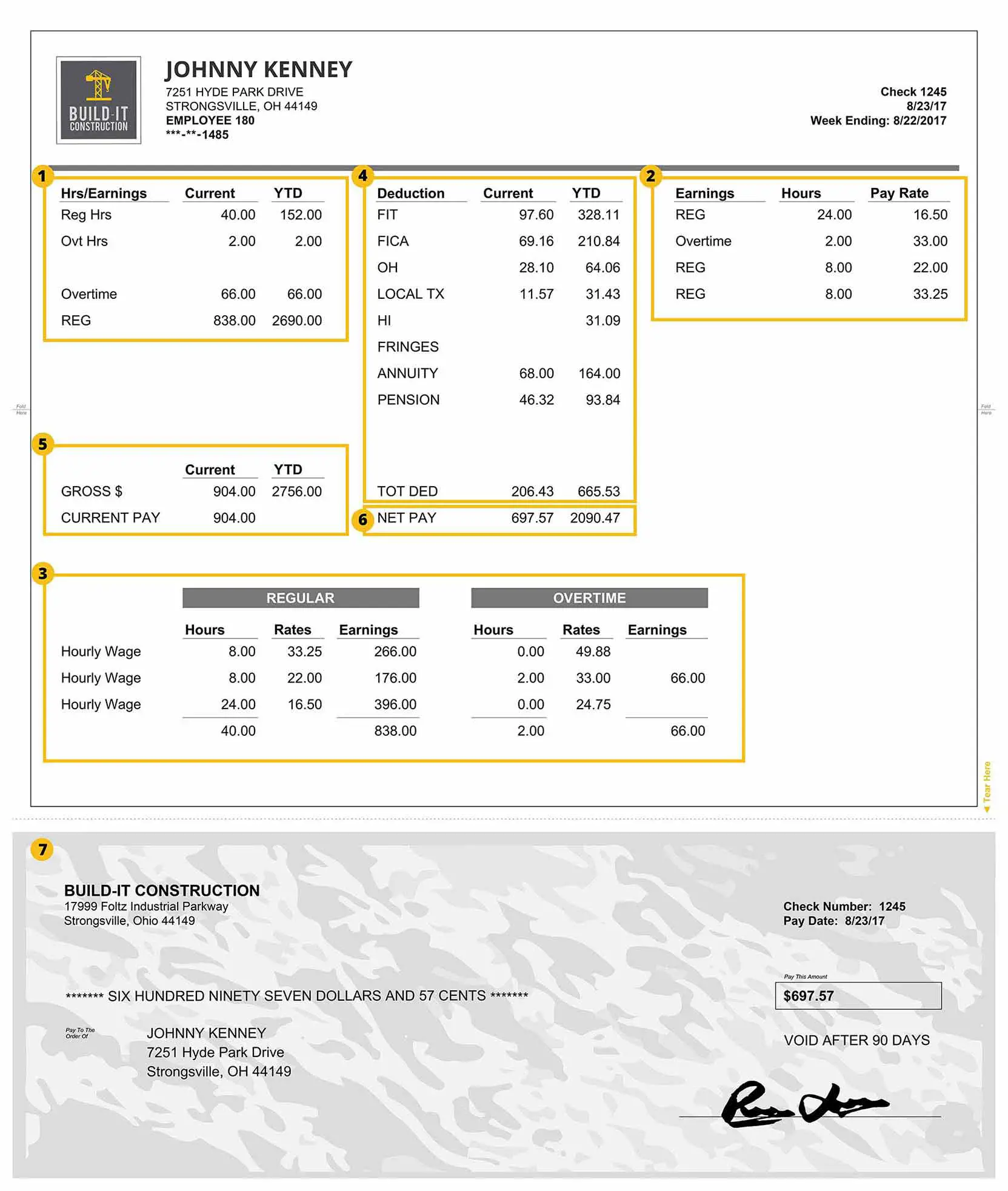

Every paycheck should be accompanied by a pay stub, with information about the employee and the pay period. When your teen receives the first paycheck, be sure to confirm that all of the personal information is correct.

A W-2 reports an entire years earned income . Tip income should be tallied daily, reported to employers monthly and included on an annual income tax return, where its reported as wages. Employees usually receive at least three copies of the W-2: one for filing with the federal tax return, one for filing with the state tax return and one for filing away in their own records.

What If Your Pay Period Is Not In This Guide

This guide contains the most common pay periods: weekly, biweekly , semi-monthly, and monthly. If you have unusual pay periods, such as daily , or 10, 13, or 22 pay periods a year, go to the Guide T4008, Payroll Deductions Supplementary Tables, or the Payroll Deductions Online Calculator to determine tax deductions.

You May Like: How To Calculate Doordash Taxes

You May Like: How Much Do Small Businesses Get Taxed

What Is A Pay Stub

A paycheck stub is a paycheck attachment that goes into the details of an employeeâs current pay as well as their YTD amount. If you give your employees physical checks, the paper pay stub is an actual attachment to their paper check. If you pay your team electronically, their paycheck stub would be digital. Heres a paycheck stub example, automatically generated by the Hourly app:

Pay stubs help your employees get a better sense of their compensation, including their rate of pay, gross earnings , and any deductions that are being taken out of their pay, like income tax and employee benefits. They can also help employees with proof of income when needed, like for a car loan or to lease an apartment. And, if you provide your team with an online pay stub, they wont need to ask you every time they need to show that proof of income.

How Do You Fill Out A W

Figure your federal and state gross income. Locate your year-to-date gross income on your last pay stub. Add any overtime or bonus compensation if the payments are listed separately from gross pay on your pay stub. Subtract pretax deductions.

Can I use my last pay stub for Turbotax?

Yes you can use your final pay stub. However, if you arent familiar with doing taxes I would not attempt to figure out what goes where. A W-2 is more concise and puts everything in its appropriate form. The IRS is accepting some returns/forms.

Also Check: Should I Charge Tax On Shopify

Should You Use Your Last Pay Stub To File Taxes

You should keep in mind that filing taxes with your last pay stub is a last resort. Its not a good idea to file your taxes using your last pay stub if you just want to get your refund early.

Why? Your last pay stub may not be entirely accurate. It could even be missing some key information, which makes it harder to file an accurate tax return.

This could lead to you needing to file an amended tax return. Preparing an amendment takes time and effort, and it could even cost you extra fees. Its not worth using an inaccurate pay stub just get to taxes finished early or receive your refund sooner.

Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

Also Check: What Is The Tax Rate On Social Security

Understanding The Tax Deductions On Your Pay Stub

- Employee contributions to Employment Insurance

- Employee contributions to the Canada Pension Plan

These deductions mean that the amount on your paycheque will be less than the total you earned. Your employer must withhold and remit these amounts directly to the Canada Revenue Agency . However, you do get credit for having paid these amounts, which are reported on your T4, when you file your annual tax return.

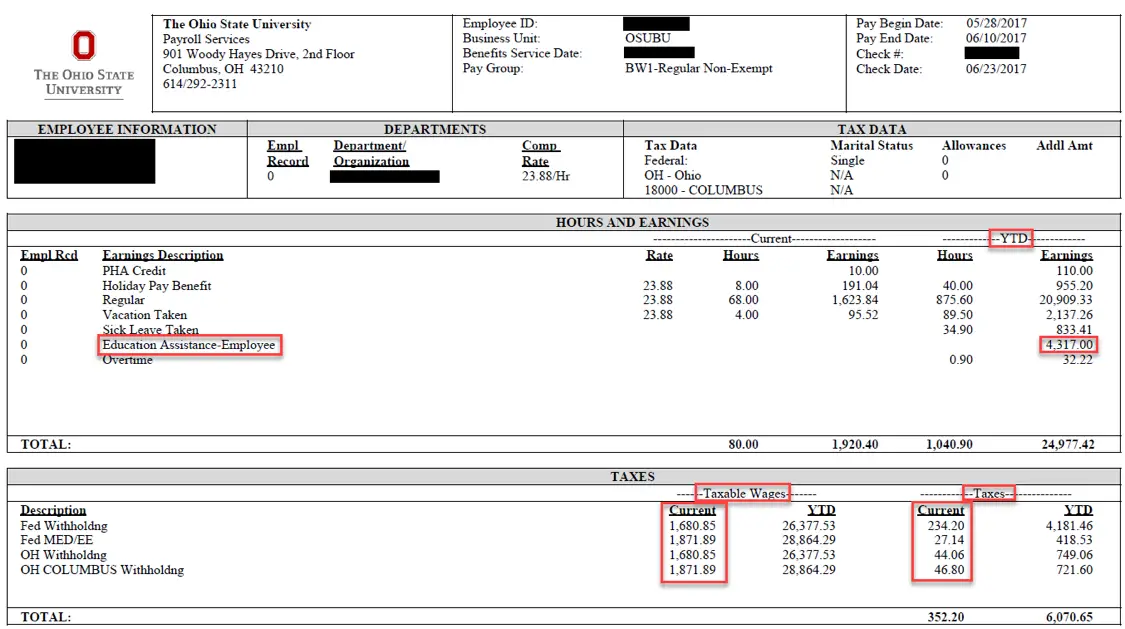

Depending on how you get paid, your pay stub will either be attached to your cheque or to a direct deposit statement. This sample pay stub illustrates the following common terms:

How To Get My Pay Stubs From Walmart If Im Terminated

How can I get it? If you had a decent relationhip with management, go to the store and one of them can print the stub for you on or after payday. If your store has an onsite GR personTheres also a link to a portal you can obtain from the HR link on the corporate site, it let me enter my employee or personal info and view an online paystub.

You May Like: Where’s My Income Tax Return

What Can I Use As Proof Of Self Employment

To prove you are self employed, you can use an app or hire an accountant. However, the best way to prove you are self employed is by having a pay stub. Using Paystubs 365 can help you generate a pay stub to provide proof of employment by creating a professional self employment pay stub with either a traditional pay stub or an advanced pay stub.

What Else You Might Need

As mentioned earlier, the IRS will require an explanation of how you arrived at the listed amounts. Therefore, to ensure that you have calculated correctly so that you do not pay too much or too little, you should consider utilizing a tax calculator. It is important to use a calculator when filing your taxes via your pay stub. There is an abundance of online tax calculators, so theres no reason not to be using one.Also, ensure to provide your tax calculator with any other relevant information. For example, if you have any dependents and similar outgoings, ensure that you feed them to the calculator. Make sure that the calculator is up to date and relevant to the current tax year. After running this information through the calculator, you should be able to determine how much you are owed in refunds by the IRS.Consider running that information through the calculator several times to certify the accuracy of the results.

Also Check: When Did Income Tax Start

How To File Taxes With Last Pay Stub

Tax season can be very daunting and sometimes its stress can take a toll on you.

But staying familiar with and getting a knack for filing your taxes and deductions can eventually become muscle memory.

Your W-2 form usually contains most of the information including your gross and net income and the deductions that go with it.

However, there are times when employers cant produce the W-2.

This is when paystubs come in handy.

This article will get into how to file taxes with your last pay stub.

When To Contact The Irs

The safest solution is to wait for your W-2. You could ask your employer to send your W-2 before the Jan. 31 deadline, but employers are not obligated to honor such a request. If you dont receive a W-2 by Feb. 14, contact the IRS. It will attempt to urge your employer to send the W-2, and will provide you with a form to send with your tax return, explaining that your W-2 is missing and describing how you arrived at the wage and tax information on your return. In this case, you can use your final pay stub with a clear conscience.

References

Recommended Reading: How To Pay Federal And State Taxes

Recommended Reading: How To File Income Tax Return Online

How To Request Pay Stubs For Your Small Business

Pay stubs are extremely important for similar web-site a small business. If you beloved this report and you would like to obtain more data about make pay stubs kindly visit our own webpage. The accounting team and human resource department are critical to a small businesss success. Pay stubs are essential for keeping track of employee income. This will allow you to keep your business safe from identity theft and employee turnover. Pay stubs are not only important for requesting raise adjustments, but they can also be used to prove your identity or income in the case of an accident.

While the process for requesting a pay stub may differ from one state to another, it is generally possible to contact your employer to request them. Your request can be directed to the accounting and payroll departments by the human resources department. You can also send your request via email, regular mail or fax. First, you need to locate the payroll service website. Once you have found it, log in to view your pay stubs.

Pay stubs can be important for many reasons. One reason is for tax returns. The stubs are necessary documents to file taxes, so its important to have them handy when filing. Using a paystub generator will allow you to create the documents in minutes, so you wont have to worry about making mistakes. The IRS may sue you if your company fails to provide pay stubs on time.

Dont Miss: Efstatus/taxact

What If You Currently Dont Have A Job

Even though we have focused on people who are employed, we will also give you some advice on how to prove regular income if you are not. Just because you dont have a traditional job, it doesnt mean that you cannot obtain this document. Thats right. Maybe you are retired or receive disability benefits due to a previous injury.

If this is the case, all you need is a Benefit Verification Letter. When it comes to this one, you can get it from the Social Security Administration. It will demonstrate the reasons why you dont have a job , and it will act as confirmation that you are receiving monthly benefits. Clearly, it will include all the details and the exact sum of money you get every month.

Read Also: When Will My Taxes Be Processed

Why Is My W

The compensation may be different on a W-2 vs a final pay stub, but heres why. Your salary is a gross dollar amount earned before taxes and deductions. Meanwhile, your Form W-2 shows your taxable wages reported after pre-tax deductions. Pre-tax deductions include employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and 401 contributions. Thats why your W-2 doesnt match your last pay stub.

| Pay Stub | |

|---|---|

| Gross Dollar Amount of Salary | Taxable Wages Reported |

| After Pre-Tax Deductions Are Taken Out- Health Insurance- 401 | |

| Disability Insurance, etc. |

Unless you opt out of pre-tax deductions, your salary amount will almost always be higher than wages reported on your W-2. To clarify which pre-tax deductions you are opted in to, check Box 1 of your W-2. If you are confused about your Box 1 deductions, our blog Pre-Tax and Post-Tax Deductions: Whats The Difference can help clarify details related to these withholdings.

Reasons Why The Gross Amount On Your End

APS receives many questions during tax season, and the one that comes up most often is, Why doesnt my W-2 match my pay stub? or Why doesnt my W-2 match my salary? It is typical for gross taxable wages on an employees final pay stub of the year to differ from the amount shown on their Form W-2. This difference is a result of the following reasons:

1. Year-End Pay Stubs Include Non-Taxable Income Items

Examples of non-taxable income items include reimbursements for mileage or other types of non-taxable expenses. These non-taxable items are paid back during payroll runs. As a result, the gross wages on an employees pay stub often differ from the Boxes 1, 3, 5, and 16 wages on the W-2 because these non-taxable items will lower gross taxable wages.

Example

2. Company-Sponsored Retirement Plan Participation

Company-sponsored retirement plans like 401s reduce taxable federal and state wages only. They are reported in Boxes 1 and 16, respectively. If you contribute to a retirement plan, the compensation on your end-of-year pay stub vs. your W-2 will be different.

Example

Sallys gross wages are $30,000 but over the course of the year, she contributed $3,000 towards her 401 retirement. Sallys federal and state W-2 wages will be $27,000. .

3. Company Health Insurance is a Pre-Tax Deduction

Example

Johns gross wages are $30,000 but over the course of the year, he contributed $2,000 to a pre-tax health insurance deduction. Johns taxable W-2 wages will be $28,000 .

Recommended Reading: How To Calculate Uber Miles For Taxes

What Is The 4852 Form

As already mentioned, this document enables you to file your taxes using a pay stub if you dont have the W-2 form at your disposal or you received one with incorrect information. No, it wont help you get your refunds faster, but it is instead simply an alternative option. Due to this reason, you will have to clarify why you are using it instead of the W-2. You have to explain that you werent able to obtain the W-2 for your employer or the financial institution, and finally, you have to state that you have informed the IRS about your problem.