Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

You can opt to have federal income tax withheld when you first apply for benefits. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development, Unemployment Insurance, PO Box 908, Trenton, NJ 08625-0908. for the “Request for Change in Withholding Status” form.

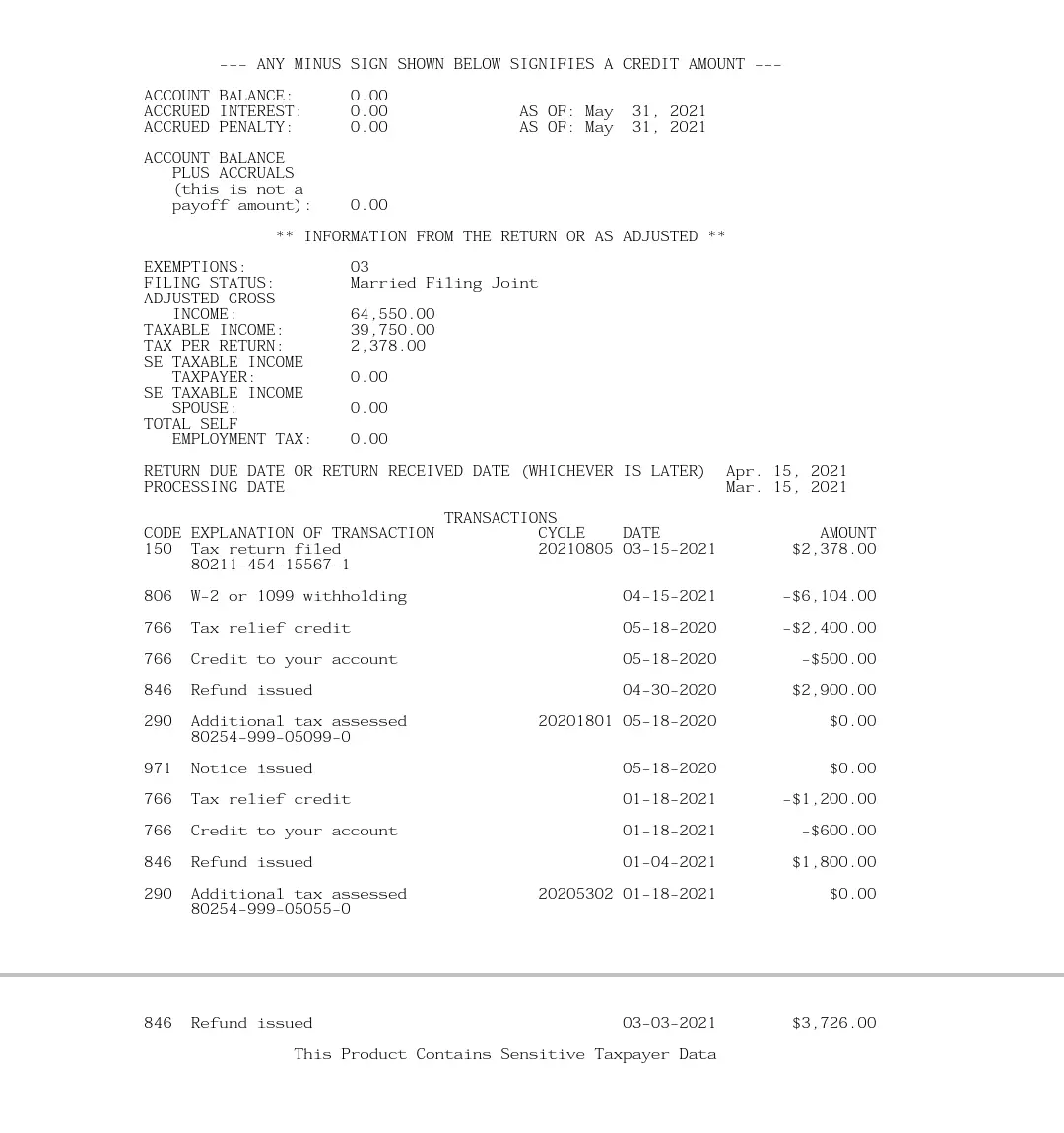

After each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. This information is also sent to the IRS.

Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2021, you may be the victim of identity theft. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304.

IMPORTANT INFORMATION FOR TAX YEAR 2021:

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Canada Revenue Agency: How Much Tax Will You Owe On Cerb Next Year

Canada Revenue Agencys support payments have tax implications. However, if you set some money aside and invest in robust stocks like Dollarama you could cover your tax liability relatively quickly.

More on: DOLget instant access to our top analyst recommendations, in-depth research, investing resources

Canada Revenue Agencys disaster relief programs have put a much-needed floor beneath millions of households. The Canada Emergency Response Benefit program has been the most popular and controversial of these initiatives.

Designed to offset the loss of income from the economic lockdown, over 8 million Canadians have claimed CERB payments so far this year. The program has recently been extended to October, so millions more could join the program in the weeks ahead.

While the program has been praised for its user-friendliness and speed, applicants may have overlooked the fact that claiming these payments could have tax consequences next year.

Heres a rundown of the tax implications of the CERB program and how much you might owe during next years tax filing.

Also Check: How Can I Get Money Back On Taxes

Unemployment Benefits Are Subject To Federal Income Tax

Unemployment benefits are subject to federal tax and, depending on where you live, you may owe state taxes as well.

On the federal level, your benefits are taxed as ordinary income, so the amount you owe is based on your tax rate. However, there’s one important difference — you won’t owe Social Security or Medicare taxes on your benefits. Typically, employers and employees each pay 6.2% in Social Security tax and 1.45% in Medicare tax, but you won’t owe this on your unemployment income.

As for state taxes on unemployment benefits, the rules vary depending on where you live. In the seven U.S. states with no income taxes you won’t have to worry about owing. And in some other states where income is ordinarily taxed, including Pennsylvania, New Jersey, California, and Montana, unemployment benefits are excluded. But in most states, you are subject to tax just as if your benefits were income from a job.

What Are My Obligations For Paying Suta

To determine if you are required to pay SUTA tax and submit any attendant reports, take these steps:

- Follow your states guidelines. Each state has its own qualifications for employers who must pay SUTA tax. Check with your states unemployment tax office to learn these requirements.

- Fill out the appropriate forms. In addition to filing your SUTA tax return, youll need to fill out a wage report that details the total amount you paid your employees each quarter. To file your payroll taxes and fill out your report, visit your states website and download the SUTA quarterly tax and wage reports.

- Calculate your payment. Determine your businesss SUTA contribution based on your states wage base and tax rate. Consider using top payroll software, such as those in our Paychex review and our review of ADP, to keep track of your employees quarterly wages and accurately calculate your SUTA payment. Doing so automates your SUTA calculation process and saves valuable time.

- Submit taxes and reports on time. In most states, youre required to file your reports and payments each quarter of the calendar year. These documents are due by April 30, July 31, Oct. 31 and Jan. 31. Submit on time to avoid late fees.

Recommended Reading: Where To File Connecticut State Taxes

Getting Taxed On A Bonus

Bonuses are not taxed differently than ordinary income. However, your bonus may appear to be taxed at a higher rate when you first receive it. Thats because bonuses are considered supplemental wages, which include everything from commissions to overtime to prizes from your employer. Supplemental wages are subject to a different set of withholding rules than those that apply to your regular wages.

For the most part, supplemental wages are taxed at a flat 22%, down from 25% in years prior to 2018. But when you file your tax return, the bonus is counted along with the sum total of all your income that year. If the 22% tax rate resulted in you paying too much tax, part of it could be refunded to you after you file.

Extra income from a bonus can go a long way. We recommend putting as much as you can in a high-yield savings account to save for a rainy-day fund or emergency .

Ready to shop for life insurance?

Recommended Reading: Can I Still File My 2017 Taxes Electronically In 2021

How Much Do You Have To Make To Owe Taxes

4.5/5

| Filing Status | |

|---|---|

| If both spouses are under age 65: $24,400 | If one spouse is 65+: $25,700 If both spouses are 65+: $27,000 |

Single, under the age of 65 and not older or blind, you must file your taxes if: Unearned income was more than $1,050. Earned income was more than $12,000. Gross income was more than the larger of $1,050 or on earned income up to $11,650 plus $350.

Beside above, how much do I have to make to file taxes 2020? Single: If you are single and under the age of 65, the minimum amount of annual gross income you can make that requires filing a tax return is $12,200. If you’re 65 or older and plan on filing single, that minimum goes up to $13,850.

Similarly one may ask, do you have to pay taxes if you make less than 10000?

Whether to File Taxes Under $10,000Generally speaking, if your earnings are less than the IRS standard deduction plus personal exemption amounts for a certain year, you don’t owe tax, since effectively all of your income is automatically deductible. You‘re also not required to file a return.

Why do I always owe taxes?

Well the more allowances you claimed on that form the less tax they will withhold from your paychecks. The less tax that is withheld during the year, the more likely you are to end up paying at tax time. In a nutshell, over-withholding means you’ll get a refund at tax time. Under-withholding means you’ll owe.

Also Check: What Time Do Taxes Need To Be Filed

Other Factors Youll Need To Consider:

I am collecting unemployment will that impact my income tax?

- Unemployment benefits are taxable.

- Unemployment compensation is not considered earned income for the Earned Income Tax Credit , childcare credit, and the Additional Child Tax Credit calculations and can reduce the amount of credits you may have traditionally received.

Did You Receive Unemployment In 2021 You May Owe The Irs Money

There’s no tax break for unemployment benefits received last year, which means you may owe more than you expected.

Courtney Johnston

Editor

Courtney Johnston is an editor for CNET Money, where she manages the team’s editorial calendar, and focuses on taxes, student debt and loans. Passionate about financial literacy and inclusion, she has prior experience as a freelance journalist covering investing, policy and real estate. A New Jersey native, she currently resides in Indianapolis, but continues to pine for East Coast pizza and bagels.

Dori Zinn

Contributing Writer

Dori Zinn loves helping people learn and understand money. She’s been covering personal finance for a decade and her writing has appeared in Wirecutter, Credit Karma, Huffington Post and more.

Unemployment numbers surged at the start of the COVID-19 pandemic, topping out at 14.7% in April 2020. Even though numbers , they’re still above prepandemic levels. Expanded unemployment benefits, which ended on Labor Day in 2021, provided a lifeline for millions throughout the pandemic. However, if you received any jobless benefits at all last year, you might be in for a shock when you file your taxes.

Here’s everything you need to know about unemployment benefits for this tax season.

You May Like: What Form Is The State Tax Return

Expanded Unemployment Assistance In 2020

In addition to tremendous increases in the number of workers claiming state UI benefits, millions of workers became newly eligible for unemployment benefits, were eligible for additional weeks of benefits, and received higher benefit payments than they would under longstanding UI programs as a result of the CARES Act. The CARES Act, enacted in March 2020, established three programs targeted at jobless workers:

- Pandemic Extended Unemployment Compensation grants thirteen additional weeks of UI to workers eligible for state unemployment benefits who are still jobless when they exhaust their state benefits . The Continued Assistance for Unemployed Workers Act , passed in December 2020, increased this to twenty-four weeks, but the additional eleven weeks can only be paid out in 2021.

- Pandemic Unemployment Assistance allows traditionally ineligible workers to access up to thirty-nine weeks of unemployment benefits . This includes self-employed workers, part-time workers, and low-wage earners, as well as workers unable to work for COVID-19-related reasons .

- Federal Pandemic Unemployment Compensation added $600 per week to unemployment benefit payments for seventeen weeks between April and July 2020. The last FPUC benefits were paid out the week ending July 26, and Congress did not extend the program in 2020. The CAUW Act reinstated the FPUC program for the 11 weeks between January and mid-March 2021, but at only $300 per week.

Sign up for updates.

What You Should Know

Other Notable Taxes In Texas

Texas has an oyster sales fee. Shellfish dealers in Texas are required to pay a tax of $1 per 300 pounds of oysters taken from Texas waters.

- Cameron County, Texas is located at 26.15° North, and contains the most southern point along the US-Mexico border.

- Three of the ten most populous cities in the country are in Texas.

- In 2014, Texas produced more oil than any country in the world except Saudi Arabia.

Recommended Reading: Is It Hard To Do Your Own Taxes

Earned Income Tax Credit

The earned income tax credit, or EITC, is a federal income tax credit for working people with low to moderate income. If you earned money through wages or self-employment work before losing your job, you might qualify for this credit in the tax year in which you had eligible income.

But unemployment benefits dont count as earned income for the purpose of the EITC, so if you didnt have any earned income in the tax year, you wont be able to claim this credit. Eligibility also depends on other factors, including your filing status, the number of qualifying children you can claim, and the amount of your earned income.

The credit is refundable, meaning that, in addition to reducing the amount you owe, it could give you a refund over the amount of tax you paid in.

Dont Miss: How To Draw Unemployment In Tn

Federal Unemployment Tax Act

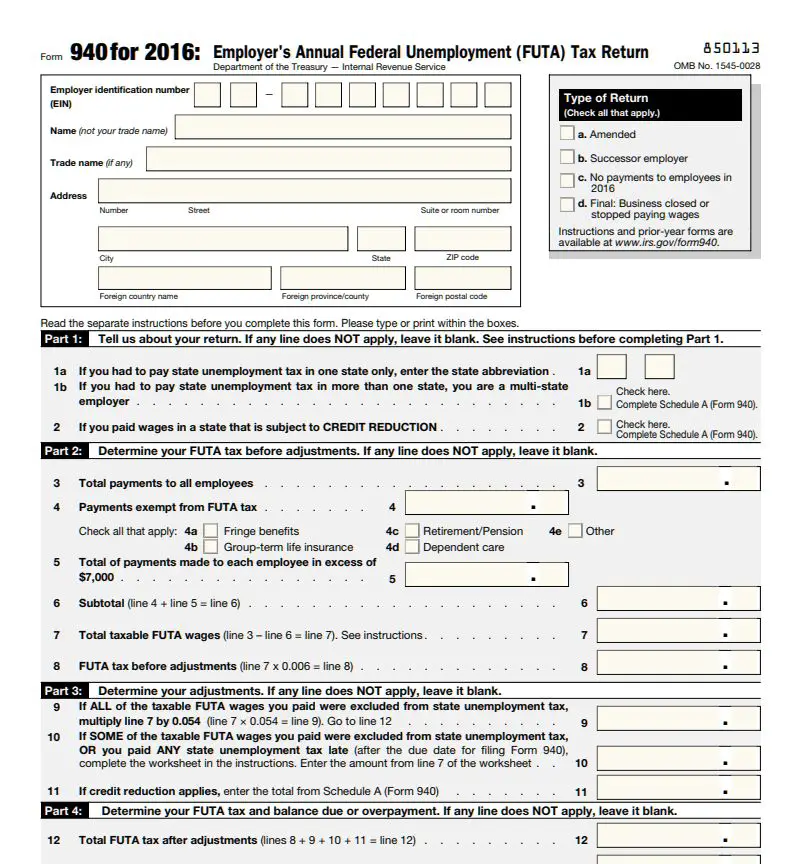

The Federal Unemployment Tax Act , authorizes the Internal Revenue Service to collect a Federal employer tax used to fund state workforce agencies. Employers pay this tax annually by filing IRS Form 940. FUTA covers the costs of administering the UI and Job Service programs in all states. In addition, FUTA pays one-half of the cost of extended unemployment benefits and provides for a fund from which states may borrow, if necessary, to pay benefits. Click here for IRS forms 940 and 940 Schedule A for FUTA year 2012 Federal Unemployment Taxes. The new forms have been updated to include the latest information for states with credit reductions for FUTA year 2012.

Recommended Reading: How Can You Find Out If You Owe State Taxes

What Counts As Unemployment Benefits

In most cases, you will apply for and receive unemployment insurance payments from your state. However, there are many different types of benefits funded by the federal government but paid through your state that also fall under the category of unemployment.

For instance, programs such as Pandemic Unemployment Assistance temporarily expanded unemployment benefits to self-employed workers, independent contractors, freelancers, and part-time workers impacted by the pandemic. Another program, Pandemic Emergency Unemployment Compensation, expanded unemployment benefits under the CARES Act after regular unemployment was exhausted.

Other programs provide unemployment insurance to specific industries, such as railroad unemployment compensation benefits and unemployment assistance under the Airline Deregulation Act of 1978. There are also programs for federal employees and ex-military service members.

Quick tip: All unemployment assistance you receive should be added to gross income. If you’re unsure whether to include a payment, use the interactive tool on the IRS website.

How To Avoid A Hefty Tax Bill On Unemployment Benefits

To avoid being socked with a large bill come tax time, you can voluntarily choose to withhold a portion from your unemployment benefits so you dont get stuck with a tax bill or lose out on a refund you were expecting.

Unless you absolutely cant manage to pay throughout the year, its highly recommended you opt in to withholding a certain amount. The agency that pays your unemployment benefits will withhold a flat 10% to cover all or a portion of your tax bill.

Once youve returned to work, its worth making sure you have the correct amount withheld to avoid a surprise bill. Use the IRS tax withholding calculator to see how much you should withhold.

Also Check: How Much Can Teachers Claim On Taxes

This Calculator Helps Those Who Work For Themselves Calculate Their Self

Self-employed workers can take advantage of numerous tax breaks available to business owners, but that flexibility comes at the cost of owing self-employment tax. Whereas employees only pay the employee share of payroll taxes for Social Security and Medicare, self-employed workers have to pay the employer half as well, boosting the maximum tax rate to 15.3%.

Although a wage limit of $137,700 applies to the Social Security portion of self-employment taxes in 2020, the 2.9% Medicare portion is unlimited. In addition, an additional 0.9% Medicare tax can also apply for high-income taxpayers. That can make it tough to figure out how much youll owe, but this self-employment tax calculator can do the heavy lifting for you. Lets look more closely at self-employment taxes and how this calculator can help you.

* Calculator is for estimation purposes only, and is not financial planning or advice. As with any tool, it is only as accurate as the assumptions it makes and the data it has, and should not be relied on as a substitute for a financial advisor or a tax professional.

Recommended Reading: File For Unemployment In Pennsylvania

Tips For Lowering Your Suta Rate

While your states standards largely determine your SUTA tax payment, you can exert some influence on your rate as well. Below are some tips to keep your SUTA rates as low as possible:

- Limit layoffs. The more unemployment claims your business processes, the more your SUTA tax rate will increase. To avoid rate increases, consider alternatives to laying off an employee, like revisiting your budget and reducing extra expenses.

- Reduce employee turnover. Businesses with high turnover rates often have high tax rates. Before you start the hiring process, plan to keep employee turnover low by making sure you need the help youre paying for and that you can offer a healthy work environment.

- Make a voluntary payment. Some states allow you to buy down your tax rate. If eligible, you can make a payment to the state that lowers your businesss experience rating and thus your tax rate. New employers do not have this option, since they are given a standard rate.

Key takeaway: You can calculate how much you need to pay for SUTA tax based on your states wage base and tax rate.

Don’t Miss: How Much Tax On Gambling Winnings