Get A Copy Of A Tax Return

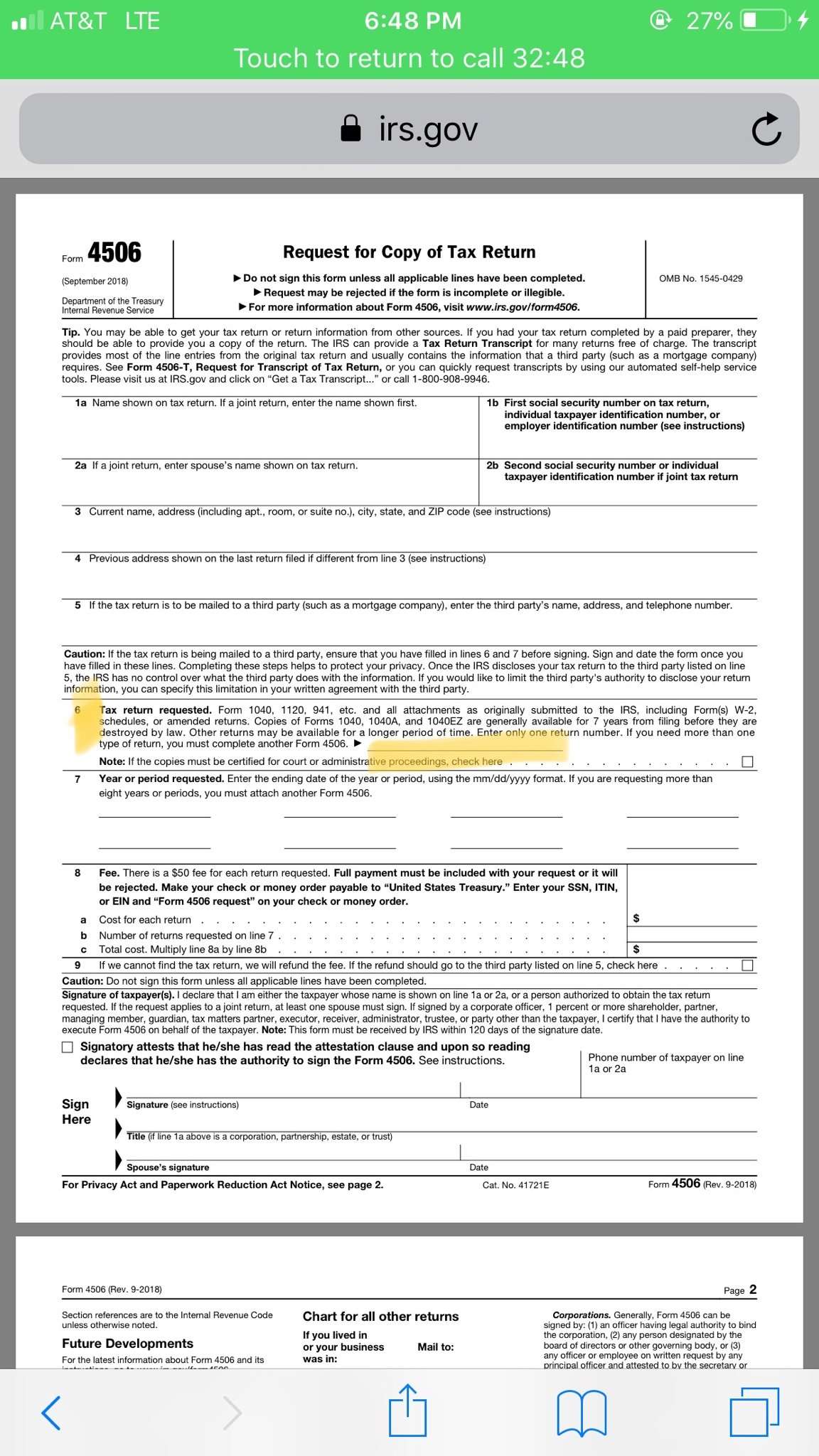

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Paper Returns: Going Traditional

Filing a paper return, it can take six to eight weeks to receive your return, but in some instances you must submit by mail:

- Living in a community property state and you are married, but filing a separate return.

- Claiming a dependent who has already been claimed by someone else.

- Submitting a tax form that cannot be e-filed .

- Filing before or after the e-file window.

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback – Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Read Also: How Much Does Illinois Take Out For Taxes

% Free Fed & State Plus A Free Expert Review With Turbotax Live Basic

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Important Information About This Website

finder.com.au is one of Australia’s leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don’t cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn’t a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you’re unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Where our site links to particular products or displays ‘Go to site’ buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Also Check: What Percentage Of Taxes Do The Top 1 Pay

What Tax Documents Do I Need If I Bought A House

If you bought a house, keep documents like your closing costs paperwork, mortgage statements, home improvement invoices and receipts , property tax statements, and more. For example, if you were issued a qualified Mortgage Credit Certificate by a state or local government unit or agency, you may be able to a mortgage interest credit.

Tax Preparers: Going Pro

With a complex federal tax code more than 74,000 pages long, its no wonder over half of U.S. taxpayers hire a professional to help them. If you go this route, check to ensure your preparer has an IRS Preparer Tax Identification Number and find out their service fees up front.3 Also, keep in mind that if your tax preparer files 10 or more returns in a year, the IRS requires that your tax return be filed electronically.3

You May Like: Are Roth Ira Contributions Tax Deductible

What Kind Of Documents Do You Need To Buy A House

This document is required to prove whether the sale or purchase of a particular property is being done by an authorised person on behalf of the owner of the property. This has to be produced in original for getting a home loan.

Do you need a tax return to buy a house?

The Tax Return Documents Required for a Purchased House. by Lauren Treadwell. When you buy a house, you can receive a myriad of tax deductions. These include mortgage interest and points you paid to receive a lower interest rate.

Keep Your Cra Information Up

File your taxes online or by paper, or find other options such as having someone else complete them for you:

File your tax return online or mail us your completed tax return to your tax centre

Read Also: Do I Need To File Federal Taxes

Previous Years Tax Return

Your accountant will use this as a reference tool to help compile the current return. It gives easy access to crucial information like the deductions your company has or has not been taking.

The previous years return also makes it easier for your tax accountant to identify any discrepancies and track changes to your finances or business structure.

Can One Spouse File Married Filing Separately And The Other Head Of Household

As a general rule, if you are legally married, you must file as either married filing jointly with your spouse or married filing separately. However, in some cases when you are living apart from your spouse and with a dependent, you can file as head of household instead.

What happens if I accidentally filed single instead of married?

I accidentally filed as single, when actually I am married If so, and you dont want to file jointly with your spouse, then you can just change to Married Filing Separately on your amended return.

Why would a married couple file separately?

Though most married couples file joint tax returns, filing separately may be better in certain situations. Reasons to file separately can also include separation and pending divorce, and to shield one spouse from tax liability issues for questionable transactions.

Why would you file separately when married?

Does a married couple get 2 stimulus checks?

Some married couples could also get two payments. If a joint tax return is filed, a married couple could get two separate third stimulus payments. Half may come as a direct deposit and the other half will be mailed to the address the IRS has on file.

Do you have to file a joint tax return if you are not married?

Do you need marriage certificate to file jointly?

Read Also: How Long To Keep Personal Tax Returns

Documentation Needed To Claim Mortgage Interest As A Tax Deduction For An Owner

Related Articles

The IRS allows you to deduct up to 100 percent of the interest you paid on your mortgage each year, even if you bought your home using owner financing. Know the rules and secure the appropriate documentation to file with your tax return to claim mortgage interest as a tax deduction on your owner-financed home.

Tip

Owner financing differs from traditional financing offered by institutional lenders because you make your mortgage payments to the previous owner of the home, not a mortgage company. An owner who provides financing must file certain documentation with the IRS as a traditional lender would.

Closing Costs On A Rental Property

You cannot deduct settlement fees and other closing costs on a primary or secondary home. However, different rules apply for rental properties. The IRS sees the money you earn from renting out a home or condo as taxable income.

You have a lot more leeway when deducting closing costs and other upkeep expenses for a refinance on a rental property. Some expenses you can claim as deductions on a rental property include:

Recommended Reading: Chase Recast

Recommended Reading: Who Is Exempt From Filing Taxes

Tax Preparation Checklist For 202: What To Gather Before Filing In California

There are a lot of forms involved in filing taxes, so make sure you have everything you need before preparing your tax returns in California:

- Gather any documents related to income earned throughout 2021.

- Gather forms supporting available deductions or tax credits related to healthcare, childcare, education, and job expenses.

It is never too early to start gathering your tax documents! You can our handy checklist to make sure youre fully prepared to file. The documents can be used for both your federal and California state return.

What Documents Do I Need For My Taxes

Tax season is upon us once again. Maybe its your first time filing your taxes, or you want to make your tax preparers life easier but dont quite know how to. Youve been pushing off doing your taxes because you feel like its a huge chore, and you dont even know where to start.

Its well into March, and the April 15th deadline is right around the corner. Now you have two options: file for an extension and delay the inevitable, or you can get yourself together and push through for a just in time filing. Either way, youll need your information and tax forms to make the task possible. This article will go through everything youll need to file a tax return successfully. Read to the end and make sure you have everything that applies to your situation to file the most accurate return possible.

Personal Information

This one should be the most self-explanatory. Youre filing your tax return, so it only makes sense that youd be using your personal information. This will allow the IRS to know whos return, how to contact you, and most importantly where to deposit your tax refund.

- Your full name how it is spelled on your social security card

- Bank account number and routing number

- Copy of last years tax return

Dependent Information

If you have any kids or someone whom you can claim as a dependent, youll need to include the following information on your tax return.

- W-2: Employment wages

- State and local income taxes/sales taxes

- Vehicle registration taxes

Don’t Miss: How To Calculate Tax In Texas

Joint Tax Return For Married Couples Open Accordion

The Confederation and the cantons have introduced tax relief with the aim of ensuring that married couples and persons in a registered partnership do not face a greater tax burden than cohabiting couples.

The Federal Tax Administration provides comprehensive information on the taxation of families in its publications.

What Are The 1095

If you or a member of your family enrolled in health insurance coverage through a government-run marketplace in 2020, the marketplace should send you a 1095-A form. The form shows the months of coverage purchased through the marketplace and any Premium Tax Credit the insurance company received from the government to help cover your premiums. If you are eligible for the Premium Tax Credit, received your insurance through a qualified marketplace and did not have the credit paid out throughout the year directly to your health insurance provider, you should file an 8962 form to receive reimbursements.

Best for:People who bought private health insurance on government-run marketplaces.

Don’t Miss: How To File Quarterly Taxes

How Do Ubereats Drivers Pay Taxes

If you are an Ubereats driver, you should first get yourself registered with the HMRC. They will then issue a Unique Taxpayers Reference to you via post.

This is a ten-digit set of numbers issued by the HMRC to individuals and businesses who qualify for paying tax returns in the UK. You will find this number on the front page of the tax return .

You can use this UTR number to file your taxes by 31st January using your Government Gateway ID.

If you are filing a tax return for the first time, you need to register with the HMRC Government Gateway user ID. You will write differently depending on which of the following classifications:

- you are a self-employed or a sole trader

- you are not self-employed

- you are registering a partner or partnership

Once you have registered, you can choose to file your tax returns by making an online payment.

If you want to check the amount of tax you should be paying during your self-assessment you can use this Uber Tax Calculator. However, it would be best to seek the advice of a legal or financial adviser so that the details filed during your self-assessment are accurate and you are neither faced with underpaid taxes nor with overpaid ones.

View Irs Account Information Online

Individuals can use their IRS Online Account to securely access information about their federal tax account, including payments, tax records and more.

To help with filing a return, individuals can view:

- The total amounts of Economic Impact Payments issued for tax year 2021

- The total amount of advance Child Tax Credit payments

- Their adjusted gross income from their last tax return

- The total of any estimated tax payments they made, and refunds applied as a credit

They can also now make and track payments and manage communication preferences, including the option to go paperless and request email notifications for certain notices available online. Taxpayers are encouraged to register for an online account, if they havent already, or sign in to access this information and explore these new features.

Also Check: How Do You Avoid Capital Gains Tax

How Do You Know That You Should File Your Tax Returns For Being Self

If the nature of your work falls into any of the below criteria, you will be considered self-employed and will have to file your tax returns under self-assessment:

- manage a business and its decisions on your own

- take risks and responsibility for the success or failure of the business

- have various customers at the same time

- have the authority to decide how, where and when you do your work

- hire other people to work for your

- organise equipment to manage work related tasks

- take responsibility for completing unfinished or unsatisfactory work on your own time

- charge a certain price from customers for the work you do

- trade goods or provide series to make a profit

What To Bring To Your Local Vita Or Tce Site

-

Proof of identification

-

Social Security cards for you, your spouse and dependents

-

An Individual Taxpayer Identification Number assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

-

Proof of foreign status, if applying for an ITIN

-

Birth dates for you, your spouse and dependents on the tax return

-

Wage and earning statements from all employers

-

Interest and dividend statements from banks

-

Health Insurance Exemption Certificate, if received

-

A copy of last years federal and state returns, if available

-

Proof of bank account routing and account numbers for direct deposit such as a blank check

-

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

-

Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

-

Forms 1095-A, B and C, Health Coverage Statements

-

Copies of income transcripts from IRS and state, if applicable

Also Check: How To Determine Taxes On Paycheck

Check Your Standard Deduction

You can only deduct mortgage interest, property taxes and home equity interest if you itemize your deductions. The home office deduction applies almost exclusively to self-employed taxpayers, as you can no longer deduct unreimbursed business expenses.

When should you itemize your tax deductions? Only when your total itemized deductions exceed the standard deduction. Itemized deductions include mortgage interest and property taxes, but also state income tax or sales tax, charitable contributions, and qualifying medical expenses.

Note that many who itemized before the 2017 Tax Cut and Jobs Act no longer do. That is because the standard deduction was increased substantially. Here are the thresholds for 2020:

- $25,100 for married couples filing jointly

- $18,800 for heads of household

- $12,550 for single filers or married filers filing jointly.

The standard deduction for each of these filing classes is increased for homeowners aged 65 or older.

Note that if you are married and filing jointly, one of you cant take the standard deduction while the other itemizes. You have to both use the same method. In addition, some deductions that you might have taken in the past are no longer allowed. These include: tuition and fees, unreimbursed employee expenses, tax preparation costs and casualty and theft losses.

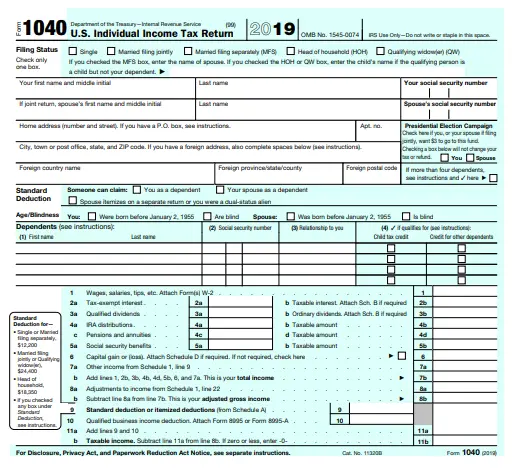

The Appropriate Tax Forms

The correct form depends entirely on your business type and whether you are employed, self-employed, a sole proprietor, in a partnership, or a corporate entity.

You can check the IRS service page for forms and instructions to determine what is relevant to your situation.

The business type may impact the filing date, so check this out carefully, and if there are any questions, discuss this with your accountant.

Recommended Reading: Can You Refile Your Taxes