Understanding The Tax Deductions On Your Pay Stub

- Income tax

- Employee contributions to Employment Insurance

- Employee contributions to the Canada Pension Plan

These deductions mean that the amount on your paycheque will be less than the total you earned. Your employer must withhold and remit these amounts directly to the Canada Revenue Agency . However, you do get credit for having paid these amounts, which are reported on your T4, when you file your annual tax return.

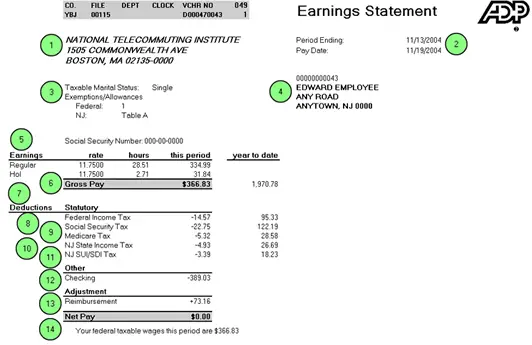

Depending on how you get paid, your pay stub will either be attached to your cheque or to a direct deposit statement. This sample pay stub illustrates the following common terms:

What Else Youll Need

The information listed above will all be on your pay stub. This should be sufficient to file your taxes. However, to make sure you have calculated the right amount and that you arent paying too much , youll need a tax calculator.You should always do this before going to file your taxes with pay stub. There is no shortage of trustworthy and accurate tax calculators out there on the web. Youll be able to calculate it accurately by adding in your year-to-date taxable income alongside any leftover taxable income that is not in the pay stub you are using to file your taxes.You should also provide the calculator with further information. If you have any dependents or other similar outgoings, make sure to include those. Also, try and include any tips or expenses that may be relevant. Its important to make sure the tax calculator you are using is up to date and relevant to the current tax year.Once ran all of this information through a calculator, you should be able to determine if youre owed a big fat refund by the IRS. Make sure to run the information through several times in order to confirm that your result is accurate.If you find that youre owed a particularly large refund, it may be that your employer is withholding too much from your paycheck for deductions. Likewise, if youre unfortunate enough to owe a lot of extra money to the IRS, you should consider arranging more to be withheld from your paycheck for tax purposes.

How To File Taxes With Your Last Pay Stub

Tax season is one of the most stressful times of the year, however, it doesn’t have to be. Your W-2 form will provide you with most of the information you need to file your taxes. However, sometimes your employer may have failed to provide you with one, making things a little trickier.Not to worry. As long as you have a pay stub, you’ll be perfectly able to file your own taxes, with minimum hassle. If you want to know how to file taxes with last pay stub, all you need to do is follow a few simple steps.

The information on your pay stub, which you can generate yourself online, will help you figure out everything you need to know. You’ll be able to calculate how much you owe, as well as determine whether or not you might be due a refund.As long as you’re filing your taxes online, which is known as e-filing, filing taxes with last pay stub is totally legal and relatively simple. Here’s everything you need to know about filing taxes with your last pay stub.

Recommended Reading: Are Moving Costs Tax Deductible

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

Why Do You Need To Understand Wage Deductions

Each pay stub includes year-to-date fields for each withholding category so you can track how much money youve paid for taxes, Social Security and Medicare throughout the year. Many employers include a similar listing for contributions to retirement savings plans and health plans. Youll generally see these fields marked as the acronym YTD on your pay stubs.

Any errors in your deductions are your responsibility to report. The last thing you want is for an error to be repeated through several pay periods. If you have questions about any of the information listed on your pay stub, be sure to contact your payroll provider.

Read Also: Taxes On Plasma Donation

Read Also: How To Find Tax Identification Number

Pay Stub Deduction Codes What Do They Mean

Below, you will find some of the most common deduction codes that appear on your pay stub. Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER, which refers to an employers contribution if the employee receives a company match. However, this is by no means an exhaustive list.

Many companies list codes on their paycheck specific to how they do business or the benefits they offer to employees. For example, some businesses may list health insurance as HS while others may call it HI. Unions, savings funds, pensions, organizations and companies all have their own codes too, any of which could appear on your paycheck, depending on your circumstances.

| Code |

|---|

When To Contact The Irs

The safest solution is to wait for your W-2. You could ask your employer to send your W-2 before the Jan. 31 deadline, but employers are not obligated to honor such a request. If you don’t receive a W-2 by Feb. 14, contact the IRS. It will attempt to urge your employer to send the W-2, and will provide you with a form to send with your tax return, explaining that your W-2 is missing and describing how you arrived at the wage and tax information on your return. In this case, you can use your final pay stub with a clear conscience.

References

Recommended Reading: How To Pay Federal And State Taxes

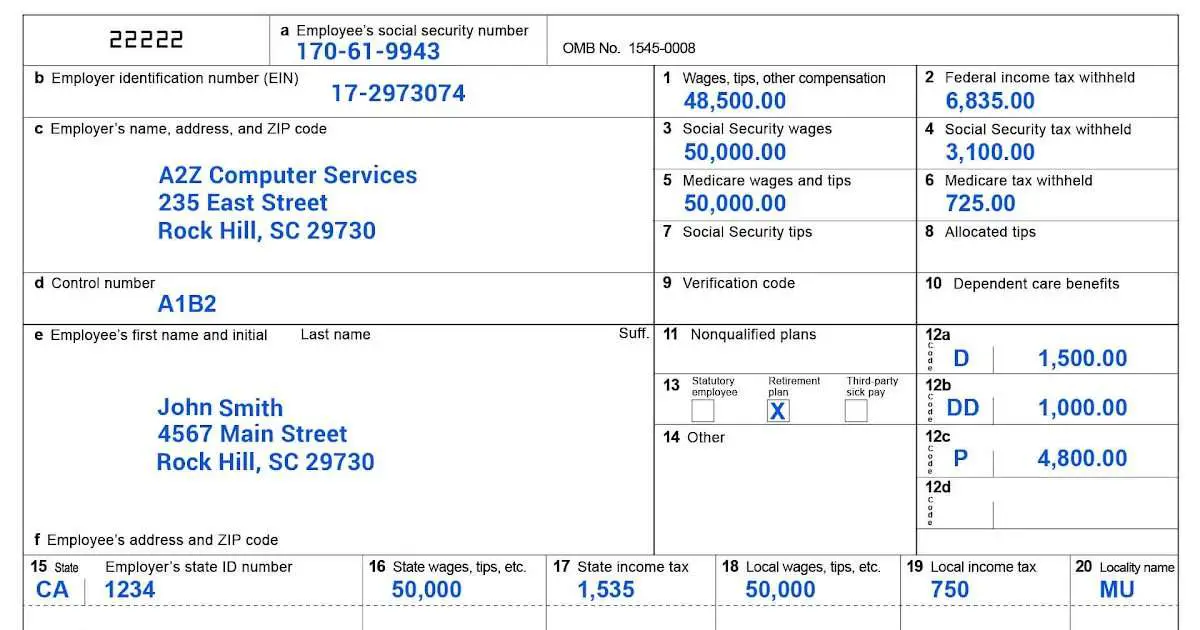

How Is A Paycheck Or Pay Stub Related To A W

A W-2, Wage and Tax Statement, is issued at the end of the year as a legal tax document. It summarizes the entire years worth of paycheck information in one document. Employers send one copy to the IRS and employees use their copies to file their personal income taxes.

- W-2s are due to are due to the Social Security Administration and employees by January 31 each year.

- The amounts in a W-2 should match the employees final pay stub of the year.

Each time an employee receives a paycheck, he or she should review the pay stub and ask questions if something doesnt make sense or is possibly incorrect.

The longer any error is unfixed, the greater the potential tax and financial implications. For example, if the income tax withholding isnt high enough, the employee will face a larger personal income tax bill. Or, if the employer isnt contributing the right payroll tax amounts, itll cost more to fix the longer it goes on undetected.

In terms of record keeping, employees should keep pay stubs for about a year and W-2s should be kept a minimum of three years. The standards for employers are more difficult to define due to the many labor and tax laws involved. The IRS recommends that employers keep payroll tax records for a minimum of four years. However, as payroll records touch so many areas of compliance, employers should be sure to check all the applicable guidelines.

Also Check: Www.myillinoistax

Can You File Your Taxes Online Using Your Last Pay Stub From December

Even though the IRS allows you to file your taxes online, youre still required to retain specific income-related documents. The main document is your W-2 form, which is mailed to you by your employer. The W-2 form contains information regarding your yearly earnings and the figure that was withheld for tax purposes. Youll need these figures to fill out your tax return online.

Receiving Your W-2 Form

Federal law mandates that your employer mail you your W-2 form by January 31st of the year after your employment. However, they are given a grace period of 15 days. if you havent received your W-2 by February 15th, you can file an official complaint with the Internal Revenue Service.

W-2 Alternative

In reality, you really dont need to wait for your W-2 form to arrive if it is missing. You can check with the home office of your employer to see if they have mailed it to you. If they havent, and you live close to their location, you can make a personal inquiry at their office. In these cases, they may be able to provide you with a your W-2 form.

Using Your Last Pay Stub

Filing Your Tax Return Online

Once you have all of the information that you need, you are armed with the ability to fill out your taxes online and file them. Youll want to make sure that you use exact figures when entering items such as FICA or Medicare withholding tax. In addition, if you do use a pay stub to identify your earnings and the amount withheld, you are required to include IRS Form 4852.

Also Check: Can You File For Previous Years Taxes

What Do I Need To File My Return Without A W

When you realize that you simply cant wait any longer for your employer to send a duplicate of your IRS Form W-2, Wage and Tax Statement, dont let this stop you from filing on time. Although your employer has until January 31 to send out your W-2, if you havent received it by February 27th, you need contact the IRS so a follow-up can be conducted with your employer. Unfortunately, you wont be able to e-file your return if you do not have your W-2. Because you also have to attach IRS Form 4852, Substitute for Form W-2, Wage and Tax Statement_,_ which allows you to file your return in the absence of a W-2, you must file a paper return.

You will receive Form 4852 from the IRS along with a copy of the notice that was sent to your employer requesting your replacement W-2. At this point you can continue to wait for your employer to supply the missing W-2, or you can go ahead and use your last pay stub to determine what you need to report on your IRS Form 1040, U.S. Individual Income Tax Return.

Can I File My Taxes With Just My Last Pay Stub I Got This Year

According to the Internal Revenue Service, you should wait to get your W-2 tax form from your employer before filing your income tax return. But if the form doesn’t come and you’ve reached out to your employer and the IRS, you’re still required to file your taxes with your best estimate of what you were paid and what was withheld from your paychecks. One way to do this is by using the information on your last pay stub of the tax year.

Tips

-

In the event that you did not receive a W-2 form from your employer, you can use your last pay stub of the year to provide the IRS with evidence of your income when you are filing your taxes.

You May Like: Can You Use Pay Stubs To File Taxes

Can I File My Taxes Without My W2

ikkie_2005_rox

Hello- You might beable to file your return using information from your last pay stub orpaycheck of the year but that doesnt mean you should.

We knowthat you count on getting your refund as quickly as possible.However, many tax experts advise against filing without your W-2.

Why? Becausein your hurry, you could cause your refund to be delayed for weeks.

Important: Filing your return using only your last paystub or paycheck could create headaches for you later:

- The IRS or your state might send you notices, if whats on your pay stub doesnt match whats on your W-2. The W-2 contains specific data that isnt always on your paycheck.

- If the numbers you enter on your return dont match your W-2, the IRS could hold up your refund for weeks until the differences are resolved.

- You might have to amend your return, If you do file with your pay stub only and some figures differ from your W-2. That can be time-consuming.

As soonas you receive your W-2 ,you can use our TurboTaxImport feature.

Hope this helps and thank you for using TurboTax!

If youremployer participates, import your data automatically tosave time and ensure your return is accurate.

What If I Am Unable To Get A W

If you cannot get a W-2, either because your employer doesnt want to give you one or because the document doesnt arrive, you should reach out to the IRS. By doing this, you will get them to contact your employer for a solution.

But if this doesnt solve anything, you can still file your income taxes by filling out form 4852.

You May Like: What’s The Property Tax In Texas

Can You File Tax With A Pay Stub

The answer to this question is yes. You can file your tax even if you dont have the W-2. All you need is your last pay stub. This document contains all the information you need, and you can generate it by using an online tool such as paystubsnow.com. It will enable you to understand how much you own, and as long as you are using the e-filing system, that is, as long as you are completing this task online, it is relatively simple.

Need Help With A Tax Issue

Get connected with a tax law attorney in 60 seconds or less.

45,632 have been matched with an attorney. 100% free consultation.

Although you won’t have to present them to a tax preparation specialist in person, you’re still required to retain certain essential income-related documents when you file your taxes online. Chief among these is the W-2 form that your employer must mail to you at the end of each tax year. This form contains important information about your total annual earnings and the amount of tax that your employer has already withheld for the year. Without these figures, you won’t be able to complete your tax return properly.

Your employer is required by law to mail out your W-2 form for the previous year by January 31st. To allow for postal hang-ups, the IRS observes a “grace period” of 15 days during which an employer can’t be held accountable for missing W-2 forms. This means that you’re eligible to file a complaint with the IRS and take corrective action against your employer on or after February 15th.

In practice, you may not need to wait until the second month of the year to seek out your missing W-2 form. You’re entitled to check with your employer’s home office to determine the status of your W-2 form. If you live nearby, you can simply travel to the office to make an inquiry in person. By making your impatience apparent, you may be able to secure a copy of your W-2 early.

You May Like: What Is The Deadline For Filing Taxes

Is It Possible To File Taxes Without A W2 Or 1099 Misc

As the tax season calls for refunds, W2 Forms & 1099 Form click your mind first. One of the biggest myths of the tax filing process is that tax returns cannot be filed without the said documents. Though it is not so.

Having enough details to file tax returns with W2-Form or 1099 MISC 2019 Tax Forms Online is strategic. But, what if these tax forms are not available? Some employers may not provide the information on time. In may happen that they have been misplaced by employees. What to do then?

You can request a copy of W2-Form 2019 or 1099 MISC from the employer and even if they dont give a copy, tax returns can still be filed. Form 4852 is used as a substitute for the two forms respectively. This form requests the wages and withheld taxes information.

New User Offer: Get $4.99 OFF on your 1st Paystub Order

Having an earnings statement or paycheck stubs online can be very helpful. You can file taxes with your last paystub. It is thus recommended to keep a track of your earnings and save the recent paychecks for precise data available whenever required.

Do you know? If you dont have an accurate figure of your Earnings, youll have to estimate it to complete the tax form.

This may put you at risk if you fill a random amount and your actual earnings are more. You should create pay stubs instead or request it from your employer for precise tax filing.

What Else You’ll Need

The information listed above will all be on your pay stub. This should be sufficient to file your taxes. However, to make sure you have calculated the right amount and that you aren’t paying too much , you’ll need a tax calculator.You should always do this before going to file your taxes with pay stub. There is no shortage of trustworthy and accurate tax calculators out there on the web. You’ll be able to calculate it accurately by adding in your year-to-date taxable income alongside any leftover taxable income that is not in the pay stub you are using to file your taxes.

You should also provide the calculator with further information. If you have any dependents or other similar outgoings, make sure to include those. Also, try and include any tips or expenses that may be relevant. It’s important to make sure the tax calculator you are using is up to date and relevant to the current tax year.

Once ran all of this information through a calculator, you should be able to determine if you’re owed a big fat refund by the IRS. Make sure to run the information through several times in order to confirm that your result is accurate.If you find that you’re owed a particularly large refund, it may be that your employer is withholding too much from your paycheck for deductions. Likewise, if you’re unfortunate enough to owe a lot of extra money to the IRS, you should consider arranging more to be withheld from your paycheck for tax purposes.

Also Check: Is It Easy To File Your Own Taxes