Deducting Your Home Sweet Home

Owning a home can give you hefty tax write-offs each year, including for points paid when you bought the home and possible deductions for mortgage interest. You can also deduct property taxes paid during the time you live in your home. Here are the caveats: For mortgages taken out on or after Dec. 15, 2017, the new tax law lets you deduct interest on loan amounts up to $750,000 .

Taxpayers are also limited to a $10,000 deduction for state and local taxes , which is a combination of property taxes plus either state and local income taxes or sales taxes. The deduction for private mortgage insurance premiums has been brought back through the 2020 tax year. You also get some tax benefits when you sell your home. For instance:

- You can deduct property taxes and mortgage interest you paid for the portion of the year before you sell.

- If you are active-duty military, you can even deduct your moving expenses.

- You can also deduct the fees you incur to unload your home, any commission you paid to a real estate agent, and any fees you paid at closing, such as legal or escrow fees, as well as the costs of repairs or improvements.

But these aren’t really tax deductionsthey’re deducted from the sale price, which helps lower your gain and reduce your capital gains tax.

Please note, if your home loan is over the $750,000 limit, you can still deduct the mortgage interest related to the portion of your loan up to that amount.

What Auto Depreciation Means For Your Taxes

The general idea behind car depreciation for taxes is to spread the cost of a car out over its âuseful life,â instead of writing off its whole cost the year you buy it.

Useful life describes the amount of time it takes for your vehicle to lose 100% of its original value. For tax purposes, the IRS generally considers five years to be standard for most vehicles. . There are two basic methods to depreciate your vehicle for taxes: mileage and actual expenses.

Standard mileage deduction

Most people are familiar with the term âbusiness mileage.â If youâre not, itâs exactly what it sounds like: the number of miles you drove for work in a given year. This is a great option for people who drive a lot for work, such as truckers or Uber and Lyft drivers.

Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle: gas, repairs, oil, insurance, registration, and of course, depreciation. For 2021, that rate is $0.56 per mile.

You can use this rate to calculate your tax deduction at the end of the year. For instance, letâs say you drive 12,000 miles in a year, 5,000 of which were for work. Your mileage write-off would be $2,800 . The only rule is that âbusiness mileageâ does not include commuting mileage. Commuting miles are the distance you drive from home to work.

This expense method allows you to claim your actual vehicle costs, such as gas, oil changes, repairs, insurance, and depreciation.

Can You Write Off Car Registration On Taxes

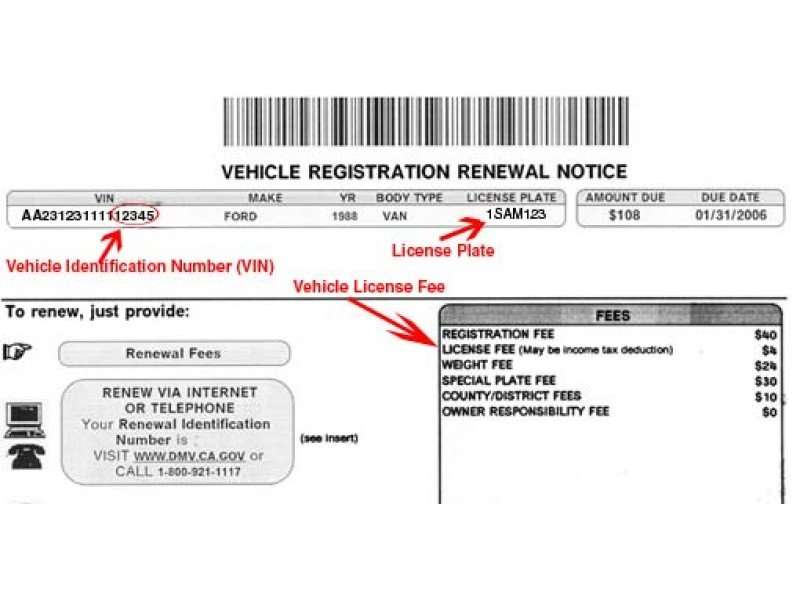

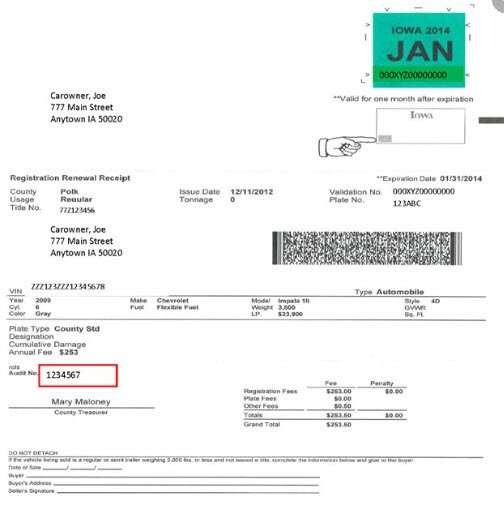

Annual car registration fees may be deductible on your federal income taxes , but only under certain circumstances. The portion of the registration fee that is charged based on the vehicles value as opposed to its size, age or other characteristics can generally be claimed as a deduction .

Read Also: Doordash Deductions

Is My Car Registration Fee Deductible

Yes, if its a yearly fee based on the value of your vehicle and you itemize your deductions.

You cant deduct the total amount you paid, only the portion of the fee thats based on your vehicles value.

And, not all states have value-based registration fees. The states that do are listed below along with the deductible portion of your registration fee.

The Ato States That You Can Claim Car Expenses If You:

- do work-related journeys during the day/night.

- drive to work-related conferences or meetings that arent held at your usual place of work.

- travel between two places of employment if neither of them is your home.

- drive from a normal workplace to a different workplace, then back to where you would usually work.

- drive from home to a workplace that isnt your usual place of work and then drive to your usual workplace or directly home.

- regularly work at more than one site each day so you drive between them before driving home.

- You have to carry bulky or heavy tools or equipment to and from work and you are not able to store them at work.

You May Like: How To Get Tax Information From Doordash

Driving Home A Tax Break

You pay a sales tax on your car when you buy it. Some states continue to tax you each year for, as Kentucky puts it, the privilege of using a motor vehicle upon the public highways. Most states also send out a notice to demand their tax payment to register your car each year. After you slap your new decal on your car, you may be able to file the receipt and add that payment to your deductions for personal property taxes in April.

If your state calculates a percentage of the vehicle registration based on the value of your car, you can deduct that percentage as part of your personal property taxes. The percentage of the vehicle registration based on the weight of your car is not tax-deductible. For example, in New Hampshire, a portion of car registration is deductible and a portion is not deductible .

The same goes for an RV or boatcheck the registration paperwork to see if you are paying property taxes on those, too, and keep in mind the $10,000 cap on total SALT taxes.

How Is The Arizona Vehicle License Tax Calculated

The state of Arizona charges a vehicle license tax at every registration and renewal. This tax is assessed for each $100 of your vehicles value. Note that the value of your vehicle is calculated as 60% of the original manufacturers retail price, and that total will be lowered by 16.25% at every registration renewal.

For each $100 of the vehicles value, you will be assessed:

- New vehicles: $2.80.

- Alternative Fuel Vehicle: $4.

Recommended Reading: Doordash Filing Taxes

When Am I Entitled To Any Excise Tax Credits Or Refunds

-

If you have sold or destroyed a vehicle, you may apply to receive a credit/refund of a portion of the Indiana vehicle excise taxes by submitting Application for Vehicle Excise Tax Credit / Refund State Form 55296.

Only vehicles charged Vehicle Excise Tax, Recreational Vehicle Excise Tax , County Vehicle Excise Tax, and Municipal Vehicle Excise Tax are eligible to receive a Vehicle Excise tax credit or refund. Proof that the Vehicle was sold, destroyed, or otherwise disposed of is required in order to apply for a credit or refund. The documents that may be used as proof include, but are not limited to:

- Bill of Sale Must contain the name of purchaser, date of sale, hull identification number , selling price, and signature of the seller.

- Certificate of Gross Retail or Use Tax State Form 48842 Must be completed by dealer and show the watercraft was traded in.

- Copy of assigned title, front and back.

- A statement from the insurance company that states the vehicle was a total loss. The statement must include the vehicle’s VIN.

Can I Deduct Vehicle Registration Fees On Federal Tax Return

Your vehicle registration fees might be tax deductible.

With insurance, maintenance and registration fees, owning a car can feel almost as expensive as buying one. However, you might be able to claim your registration fees as a tax deduction on your federal return, depending on how you use your car and how the vehicle registration fees are calculated.

Also Check: Doordash Tax Withholding

Repayments And Imputed Interest

When you lease a passenger vehicle, you may have a repayment owing to you, or you may have imputed interest. If so, you will not be able to use the chart.

Imputed interest is interest that would be owing to you if interest were paid on the money you deposited to lease a passenger vehicle. Calculate imputed interest for leasing costs on a passenger vehicle only if all of the following apply:

- one or more deposits were made for the leased passenger vehicle

- one or more deposits are refundable

- the total of the deposits is more than $1,000

New Vehicle Calculator Faqs

Usually within 30-45 days of purchasing your vehicle.

The permit the dealer provides for display on the passenger side of the front window is valid until the plates and stickers are received by the customer, or for six months from the sale date, whichever comes first.

You must have liability insurance covering damage to the person or property of others. Comprehensive or collision coverage is for damage to your vehicle only, and does not meet the financial responsibility requirement. Check your policy or talk to your agent or broker to be sure that you have the correct liability insurance coverage. The minimum liability insurance coverage required for private passenger vehicles per accident is $35,000 and is defined by the following levels of coverage:

- $15,000 for injury/death to one person.

- $30,000 for injury/death to more than one person.

- $5,000 for damage to property.

Dealers may charge buyers a document preparation service fee not to exceed $65 program participant). This fee is not required or collected by DMV.

Don’t Miss: Do I Have To Pay Taxes On Doordash

What If I Use A Motorbike Or A Van For Work

There are different rules for vehicles such as:

- motorbikes

- Utes, trucks or vans with a carrying capacity of a tonne or above

- or a minivan capable of carrying nine or more passengers

You need to keep a record and claim for actual work related travel expenses, such as petrol or diesel costs. Rather than claiming these expenses as car expenses, include them in the travel expenses section of your tax return.

Its recommended that you keep a logbook and to record each expense so you can verify your claims at tax time.

If youre not sure which method is best for you, please dont hesitate to get in touch via live chat call us on: 1300 693 829 or send us an email to: .

Is Tax Deducted From Auto Insurance Claims

Auto insurance works on the principle of indemnity. This means your insurer bears the loss on your behalf. You are not making a profit out of the claim amount. On the contrary, you are suffering a loss. Thus, the claim amount is non-taxable irrespective of whether the claim is a major or a minor one.

Lets understand this better with the help of an example.

Suppose Mr. Sanjiv owns a 3-year-old Maruti Swift car. The current market price of the car is about Rs. 5 lakhs. Unfortunately, the car was stolen. Since the police were unable to find the car, they issued a non-traceable report. Finally, Mr. Sanjiv raised a theft claim. He was given a claim amount of Rs. 5 lakhs. Tax deductions were not applicable on this amount since this was the compensation of loss for the car owner and not a means to make a profit.

Note: The example is for informational purposes only, details will vary as per terms and conditions of the policy.

Also Check: Do You Get Taxed On Doordash

Can I Claim Car Rego On Tax

There are 2 basic ways to claim Motor Vehicle Expenses in your Income Tax Return. To be able to claim Motor Vehicle Expenses you need to be able to prove you have to drive your car for work. You are the number 1 sales person in your organisation. You can certainly say you use your Motor Vehicle for work.

Business Use Of A Motor Vehicle

You can deduct expenses you incur to run a motor vehicle you use to earn business income.

To calculate the amount of motor vehicle expenses you can deduct, fill in “Chart A Motor Vehicle Expenses” of Form T2125, Statement of Business or Professional Activities, Form T2042, Statement of Farming Activities, or Form T2121, Statement of Fishing Activities.

If you are a partner in a business partnership and you incur motor vehicle expenses for the business through the use of your personal vehicle, you can claim those expenses related to the business on “Line 9943 Other amounts deductible from your share of net partnership income ” by filling in Part 5 of form T2125, T2042 or T2121.

You May Like: Are Doordash Tips Taxed

How Much Does It Cost

The one-off registration tax is calculated based on the vehicle’s tax group, kerb weight, CO2 emissions, NOx emissions and cylinder capacity. For some vehicles, engine power is also included in the calculation.

You can calculate the one-off registration tax yourself:

Doing Well By Doing Good

You donated your skinny jeans and wagon-wheel coffee table to Goodwill which, in turn, reduced your taxes by increasing your charitable deductions. The Internal Revenue Service requires that you provide a qualified appraisal of the item or group of items when you make a physical donation worth more than $5,000. For items such as electronics, appliances, and furniture, you may need to pay a professional to assess the value of your donation.

Individuals can elect to deduct donations of up to 100% of their 2020 AGI . Corporations may deduct up to 25% of taxable income, up from the previous limit of 10%. Additionally, section 2204 of the CARES Act permits eligible individuals who do not itemize deductions to deduct $300 of qualified charitable contributions as an “above-the-line” deduction, i.e., as an adjustment in determining AGI, for the 2020 tax year.

Capital gains property donations, such as appreciated stock, are limited to 30% of AGI, and you may no longer claim a deduction for contributions that entitle you to college athletic seating rights.

Taxpayers who do not itemize their deductions are also allowed up to a $300 deduction for charitable contributions, thanks to the CARES Act. The 60% AGI limitation is suspended for itemizing taxpayers who donate to charity in 2021.

Recommended Reading: Laurie Kazenoff

What Self Education Expenses Can I Claim

You may be able to claim a deduction for self education expenses if your self education relates to your current work activities as an employee or if you receive a taxable bonded scholarship. Recording self education expenses course fees. textbooks. stationery. decline in value of and repairs to depreciating assets.

How Can I Know The Deductible Amount Of My Vehicle Registration Fees

Your deduction is based on the kind of vehicle you registered and how old it is. Use the following information to find your deduction:The annual registration fees on the following vehicles are not deductible: pickups , motor trucks, work vans, ambulances, hearses, non-passenger-carrying vans, campers, motorcycles, trailers, or motor bikes. Newer Vehicles:Newer vehicles include qualifying , as well as qualifying automobiles and . If you registered a newer vehicle, take the weight of your vehicle and divide it by 250 . Subtract this number from the annual registration fee that was paid in 2021. This is your Vehicle Registration Fee Deduction.Example: In 2021, Whitney pays $160 to register her car that weights 4,000 pounds. Her deduction would be calculated by first dividing the weight of her car by 250 . She would then subtract the result, 16, from the $160 registration fee she paid to obtain a deduction amount of $144 .Older Vehicles:Older vehicles include qualifying automobiles and .If you registered an older vehicle, simply multiply your annual registration fee paid in 2021 by 60%. This is your Vehicle Registration Fee Deduction.

Read Also: Doing Taxes For Doordash

Calculating Motor Vehicle Expenses

If you use a motor vehicle or a passenger vehicle for both business and personal use, you can deduct only the portion of the expenses that relates to earning business income. However, you can deduct the full amount of parking fees related to your business activities and supplementary business insurance for your motor vehicle or passenger vehicle.

To support the amount you deduct, keep a record of both the total kilometres you drive, and the kilometres you drive to earn income.

Farming business use includes trips to pick up parts or farm supplies, and to deliver grain. If you did not live on your farm, the travel between the farm and your home is not considered business travel.

Fishing business use includes trips to pick up parts or boat supplies, and to deliver fish to markets. It also includes driving to and from the fishing boat if your home is your main place of business.

Below is an example of how to calculate motor vehicle expenses incurred to earn business income.

When Are Vehicle Registration Fees Deductible

The IRS classifies vehicle registration fees as personal property tax. Namely, a state or local tax charged on personal property, based on the value of the personal property. This fee is deductible in certain circumstances but you can’t just deduct the total amount of the fee.

Instead, the vehicle registration fee should be calculated as a percentage of the car’s value. Higher value cars with higher registration fees can thus garner a higher value deduction. Driver’s license fees and penalty fees imposed for late registration are not eligible for deduction.

Different states assess vehicle registration fees based on different factors. You can only deduct the car registration fee if it’s based on value, not car weight. If your fee takes both into account, you can deduct the part related to value.

You May Like: Federal Tax Return Irs