Finding The Id For Your Business

Getting Irs Help To Look Up Your Ein

You can ask the IRS to search for your EIN by calling the Business and Specialty Tax Line at 800-829-4933. This department is open from 7 a.m. to 7 p.m. local time, Monday through Friday.

Only the authorized person for your business can obtain this information. The IRS will ask for your identification, and you must be able to prove your identity as a sole proprietor, a partner in a partnership, an LLC owner, or a corporate officer.

Tins Required For Requests For Reduced Withholding

- A transferor looking to reduce or eliminate the FIRPTA withholding amount must file a Form 8288-B, Application for Withholding Certificate for Disposition by Foreign Persons of U.S. Real Property Interests. Since Form 8288-B requires a TIN, a transferor and/or transferee who does not qualify for an SSN may apply for an ITIN by attaching Form 8288-B to Form W-7 and mailing the documents to Internal Revenue Service, Austin Service Center, ITIN Operation, P.O. Box 149342, Austin TX 78714-9342.

Recommended Reading: Laurie Kazenoff

Itin Guidance For Foreign Property Buyers/sellers

Effective June 22, 2012, the IRS has made interim changes that affect the Individual Taxpayer Identification Number application process. Some of the information below, including the documentation requirements for individuals seeking an ITIN, has been superseded by these changes. Taxpayers and their representatives should review changes which are further explained in these Frequently Asked Questions, before requesting an ITIN.

What Is An Ein And What Is It Used For

As mentioned, your EIN is a unique numerical identifier that is assigned to you by the IRS. The primary purpose of an EIN is for the IRS to identify taxpayers who are required to file various business tax returns. Not every business is required to have an EIN, but there are several criteria that you must pass in order to be sure you wont need an EIN.

According to the IRS, if you answer yes to any of these questions about your business, then you need an EIN:

- Do you have employees?

- Do you operate your business as a corporation or a partnership?

- Do you file any of these tax returns: Employment, Excise, or Alcohol, Tobacco and Firearms ?

- Do you withhold taxes on income, other than wages, paid to a non-resident alien?

- Do you have a Keogh plan?

Another piece of criteria concerns the types of organizations your business is involved with. If your small business is involved with trusts, estates, real estate mortgage investment conduits, non-profit organizations, farmers cooperatives or plan administrators, then you are required to have an EIN for your company.

See: 2020 Business Tax Deadlines You Need to Know

Read Also: How To Buy Tax Liens In California

If All Else Fails For An Ein Lookup Call The Irs

If none of the above search methods work for you, calling the IRS is another simple and straightforward option.

The IRS Business & Specialty Tax Line is accessible at 1-800-829-4933 from 7:00 A.M. to 7:00 P.M. Monday through Friday.

Simply call the number and tell the representative you need your EIN. For this method to work, you need to have access to certain sensitive identification information, however, if youve got that then its a pretty painless process aside from the typically long wait times.

Keep in mind that to obtain your EIN over the phone you must be able to prove that youre a qualified person including:

- The sole proprietor in a sole proprietorship

- Partner in a partnership

- Corporate officer

Once youve answered their security questions, theyll be able to provide your business EIN.

Discover The Steps Involved In Getting A Federal Tax Id Number For Your New Business And How This Asset Helps Simplify A Range Of Financial Processes From Paying Employees To Filing Taxes Presented By Chase For Business

Getting a federal tax identification number is an important first step when you start your business.

According to the IRS, a federal tax ID number is used to identify a business. There are many reasons why a business may need one, including paying employees, claiming benefits and filing and paying taxes.

Heres how to figure out if you need a federal tax ID number, how to apply for one and when your business should use it.

Read Also: Buying Tax Liens In California

Can I Cancel A Tin

In terms of a business, an EIN cannot be canceled. Once the IRS assigns a business their business tax ID, it is non-transferable. What a business owner can do is close a business. To close a business, you must simply send a letter to the IRS stating your information and your reason for terminating the business. They will then follow up with your request and confirm when the closure has taken place.

A Social Security Number is also a unique number that stays with you forever. In this case, the IRS does not allow cancellation or transfers.

Receive Your Federal Tax Id Number

After you submit your online application with all the required information, you should receive your federal tax ID number. You can view, download, save and print the confirmation notice which includes your number directly from the IRS website. You can start using your EIN as soon as you receive this notice.

Once you have your EIN, meet with a your local business banker to learn how a business bank account can help get you started on the right foot and what financing options may be available for you.

For Informational/Educational Purposes Only: The views expressed in this article may differ from other employees and departments of JPMorgan Chase & Co. Views and strategies described may not be appropriate for everyone, and are not intended as specific advice/recommendation for any individual. You should carefully consider your needs and objectives before making any decisions, and consult the appropriate professional. Outlooks and past performance are not guarantees of future results. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors.

Don’t Miss: Doordash Independent Contractor Taxes

Relevant Internal Revenue Code Sections

Section 6109 of the Internal Revenue Code provides that “When required by regulations prescribed by the Secretary Any person required under the authority of this title to make a return, statement, or other document shall include in such return, statement or other document such identifying number as may be prescribed for securing proper identification of such person.”

Internal Revenue Code section 6109 provides: “The social security account number issued to an individual for purposes of section 205 of the Social Security Act shall, except as shall otherwise be specified under regulations of the Secretary , be used as the identifying number for such individual for purposes of this title .”

|

Types Of Tax Identification Numbers

Both individuals and businesses in the U.S. have to file tax returns every year to report their annual income and pay any unpaid taxes on that income. Names can be duplicated, so the IRS established a system of using completely unique numbers to identify each taxpayer. Officially known as a Tax Identification Number , TINs come in several forms. The Social Security Administration assigns numbers to American citizens and permanent residents in the form of social security numbers . Most citizens receive their social security numbers as children for use throughout their lives, and its common for them to memorize their SSNs by the time they are young adults.

In some cases, people are authorized to work in the U.S. but dont qualify for an SSN. Examples include nonresident aliens and spouses and dependents of U.S. citizens or resident aliens who are not citizens themselves. The IRS issues Individual Tax Identification Numbers to these individuals to allow them to file income tax returns.

Also Check: Can I Write Off Mileage For Doordash

Individual Taxpayer Identification Number

The IRS issues the Individual Taxpayer Identification Number to certain nonresident and resident aliens, their spouses, and their dependents when ineligible for SSNs. Arranged in the same format as an SSN , the ITIN begins with a 9. To get an individual tax id number, the applicant must complete Form W-7 and submit documents supporting his or her resident status. Certain agenciesincluding colleges, banks, and accounting firmsoften help applicants obtain their ITIN.

How To Find The Ein For Your Business

More often than not, there will be an instance when you’re working through a business document or application, and you come upon a question asking for your EIN. What if you cant remember it? The three best places to find your business EIN are:

- Your business tax return from a previous year

- The original document of your receipt or the document you received from the IRS when you applied for your EIN

- Your states business division website, if you registered your partnership, LLC, or corporation with your state

You could also look for your EIN on other business documents or applications, including:

- A business bank account application

- An application for a business loan

- The application for a business credit card

- A copy of a state or local license or tax permit

- On a 1099-NEC form you received for your work as an independent contractor or freelancer

- On the 1099-MISC form or 1099-NEC form that you used to report payments by your business

Don’t Miss: Wheres My Refund Ga State

How To Apply For An Ein

Applying for an EIN is very straightforward and easy, and you should do it as early as possible when starting your business. Many early steps when starting a company, like opening business bank accounts or hiring an employee, will require that you have or get an EIN. Here are the ways you can apply for an EIN:

- Apply for EIN Online: Naturally, this is the preferred and most common way to apply for a federal tax ID these days. You can apply for an EIN right at the IRS website on their EIN online application.

- Apply for EIN by Fax: Businesses can fax in their application to the appropriate IRS fax number. Youll use a physical application, Form SS-4, which can be found on the IRS website.

- Apply for EIN by Mail: This is the old-fashion method and takes four weeks to process as a result. You will fill out a physical application, Form SS-4, and mail it to the appropriate address.

There are a few key stipulations about your eligibility to apply for an EIN. Applicants must either have a Social Security number, an Individual Tax Identification or an existing EIN to be eligible for one. Also, the applicant must be an individual, not a business entity, and the true principal officer, owner, general partner, grantor or trustor of the business.

Get your EIN when you form your company with MyCompanyWorks.

Sales Tax Id Verification Tool

All sales are subject to sales tax until the contrary is established. The burden of proof that a sale is not subject to tax is upon the person who makes the sale, unless the seller, in good faith, takes from the purchaser a valid certificate of exemption.

In general, a seller should only accept a certificate of exemption when the certificate is:

- Fully completed, including, but not limited to, the name, address, a valid sales tax number, and signature of the taxpayer when required

- In a form appropriate for the type of exemption claimed

- Claiming an exemption that was statutorily available on the date of the transaction in the jurisdiction where the transaction is sourced

- Claiming an exemption that could be applicable to the item being purchased and

- Claiming an exemption that is reasonable for the purchaser’s type of business.

On a sale for resale, a certificate relieves the seller from the burden of proof if the seller takes, in good faith, a properly completed certificate from a purchaser who:

- Is engaged in the business of selling tangible personal property

- Has a valid sales tax number at the time of purchase and has listed the number on the certificate and

- At the time of the purchase, the seller has no reason to believe that the purchaser does not intend to resell the tangible personal property in the purchasers regular course of business.

Sales tax numbers may be verified using the Sales Tax ID Verification Tool available through the Georgia Tax Center.

Also Check: Buying Tax Liens California

How To Get A Tax Id

You must register your address for the first time. Around 2 weeks later, you will get a tax ID by post1, 2. It will be a letter from the Bundeszentralamt für Steuern. It looks like this.

If you want your tax ID faster, go to the Finanzamt, and ask for it1, 2. You can do this a few days after you register your address. You don’t need an appointment.

If you are homeless, you can get a tax ID at your local Finanzamt.

If you registered your address before, you already have a tax ID. You just need to find it.

Will The Use Of A Bsn Increase The Risk Of Identity Fraud

The citizen service number will make identity fraud more difficult. Identity fraud is where someone pretends to be another person, e.g. by using someone elses citizen service number, usually with gain as the motive. The citizen service number system has safeguards against this kind of abuse. The number issuing system is improved, preventing the issue of more than one number to the same person. Citizen service number users will have to match the person to the citizen service number before processing data. The citizen service number system provides facilities to assist users with matching .

Also Check: Doordash Deductions

How Do I Perform A Tax Id Lookup

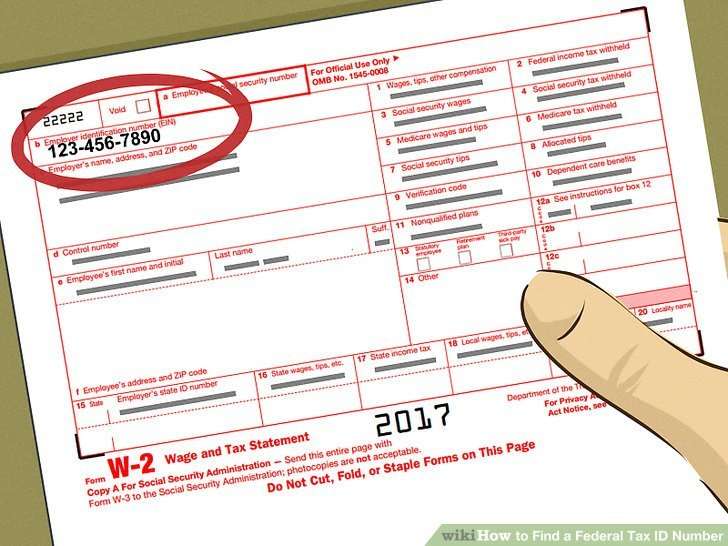

If youre not sure what your TIN is, dont worry. The IRS requires you to include this on all tax documents. So, if you have a 1099 or W2 on hand, you should have the information you need. However, if you cant find these documents, the IRS has resources you can access in case you lose your paperwork. Otherwise, consider these options to secure any of your TINs for a tax ID lookup.

Ssn Where Can I Get It

In order to get an SSN, youll need to fill out an application form. This form is known as SS-5, and can be found at the SSAs forms page online. As well as this form, you should prepare to submit proof of identity, age, and U.S. citizenship or lawful alien status. If you need further information, you can read this article on applying for a personal taxpayer identification number.

Don’t Miss: Doordash Taces

Types Of Tax Id Numbers

- Social Security Number : In addition to its use for government services and identification, this nine-digit number keeps track of your earnings over the course of your lifetime as well as how many years you have worked. This number is issued to US residents, permanent residents, and temporary residents.

- Employer Identification Number : Also known as a Federal Tax Identification Number, or a Business Tax ID. The IRS assigns this nine-digit number to businesses operating in the US. Additionally, EINs go to estates and trusts with income to report.

- Individual Taxpayer Number : This number allows foreign nationals and those who may be ineligible for a social security number to pay taxes. The applicants information does not affect their immigration status or involve immigration enforcement. The nine-digit number is for tax purposes only.

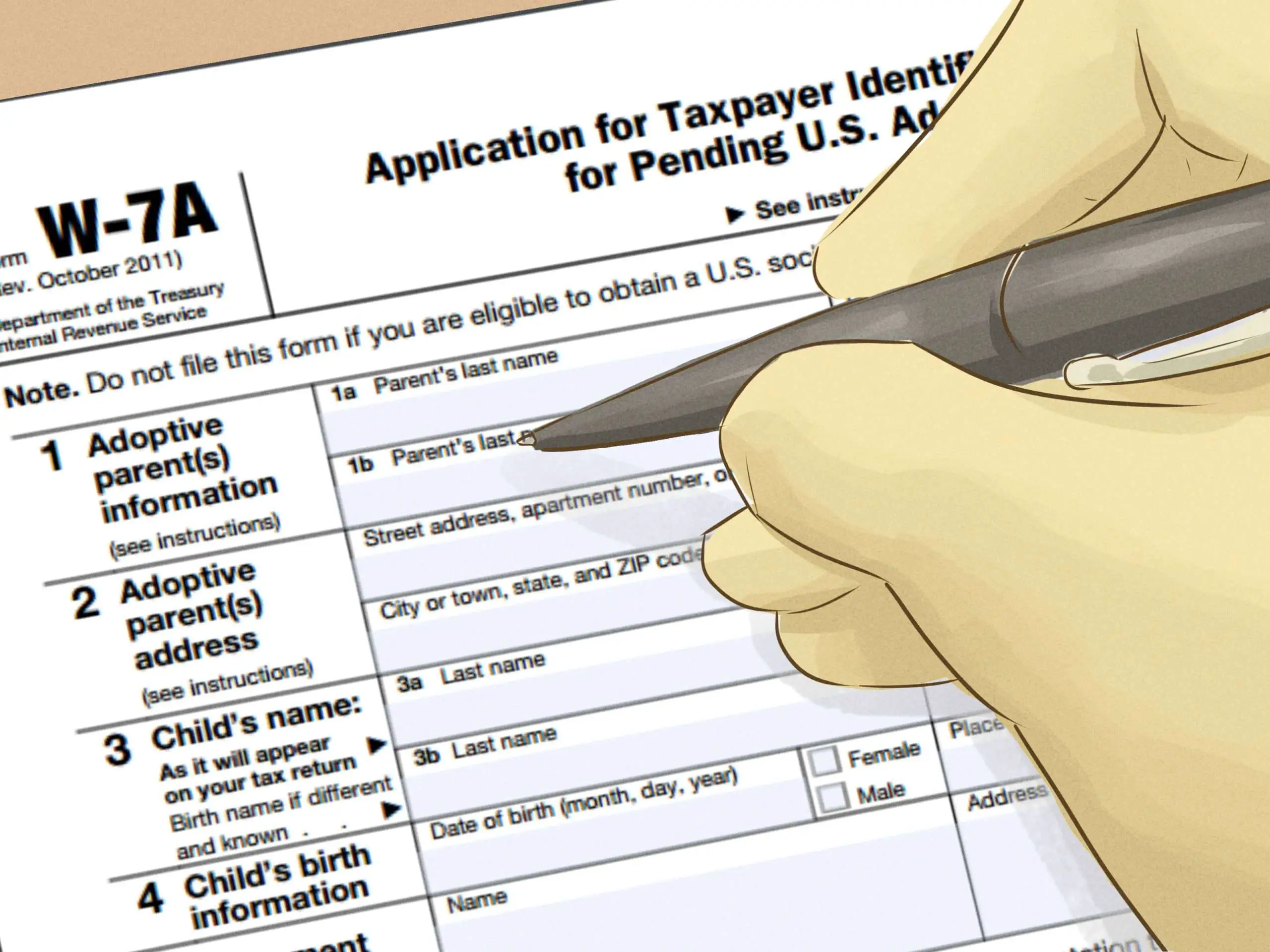

- Adoption Taxpayer Identification Number for Pending U.S. Adoptions : This number is for children involved in domestic adoptions. Its a temporary number given to the adopting parents/taxpayers when they dont have the childs social security number.

- Preparer Taxpayer Identification Number : This number corresponds to those who prepare taxes such as your accountant. All paid tax preparers must obtain a PTIN. This number goes on all prepared tax forms and is an essential component of starting a tax preparation business if you work in this field.