Lifetime Learning Credit Education Credits

The Lifetime Learning Credit allows people to take credits for taking classes at a community college, university or other higher education institutions. The maximum amount of expenses you can deduct is up to $10,000 for an unlimited number of years. However, the maximum you can receive as a credit is $2,000 per tax return.

The credit allows for a dollar-for-dollar reduction on the amount of taxes owed. The expenses can include tuition, fee payments and required books or supplies for post-secondary education for yourself, spouse or dependent child. The credit is not refundable, which means the credit can be used to pay any taxes you owe, but you cant receive any of it as a refund.

The 2020 credit amount begins to decrease if your modified adjusted gross income is over a certain threshold . The credit is not available once your income exceeds certain amounts . The IRS has yet to announce the thresholds for the 2021 tax year.

Note: This credit cant be claimed in the same year as the American Opportunity Tax Credit if the expenses are claimed as the Lifetime Learning Credit.

How To Calculate Your 2021 Federal Income Tax

If youre looking at that table and thinking, What in the world does any of this mean?dont worry! The first thing to remember is that the rates on the table only apply to your taxable income. So take out deductions before you start doing the math.

Heres an example: Lets say youre a single filer who made $60,000 this year and are taking the standard deduction of $12,550. Youd first subtract the $12,550 from $60,000, leaving you $47,450 of taxable income. That means only $47,450 is going to be taxed. Yeah, baby!

Now if you give that tax chart another look, youll notice $47,450 falls into the 22% bracket. But the whole amount isnt going to be taxed at 22%just a portion of it. Heres how it breaks down:

2021 Tax Brackets on $47,450 of Taxable Income

|

Tax Bracket |

|

|

Total Taxes Due |

$6,187.50 |

And remember that these are the federal income tax rates. Some states might have either a flat income tax, different tax brackets, or no income tax at all.

Oh, and dont forget to claim any tax credits you might be eligible for after you find out how much you owe in taxes! Tax credits are extremely valuable, because they lower your tax bill dollar for dollar.

For example, the child tax credit allows taxpayers to claim up to $3,600 per qualified child. So in the scenario above, if you had one child under 6 years old, you could claim that credit and knock your tax bill down to $2,587.50 . This is assuming you chose not to receive child tax credit payments in advance in 2021 .3

Explanation Of Claim Codes

Claim code 0

This code represents no claim amount. If the federal claim code is 0 because the employee is a non-resident, the territorial claim code must also be 0. This claim code may also be used if the employee indicated they have more than one employer or payer at the same time and have entered 0 on the front page of Form TD1 for 2022.

Claim codes 1 to 10

The claim code amounts do not appear on either the federal or the territorial TD1 form.

You match the “Total claim amount” reported on your employee’s or pensioner’s TD1 forms with the appropriate claim codes. Then, you look up the tax for the employee’s pay under the claim code in the federal and territorial tax tables for the pay period.

Indexing of claim codes amounts

The credits that apply to each federal and territorial claim code have been automatically changed in the tax tables by the indexing factor for the current year. If your employee did not complete the federal and territorial TD1 forms for 2022, you continue to deduct income tax using the same claim code that you used last year.

Chart 3 2022 Federal claim codes| Total claim amount |

|---|

Chart 4 2022 Yukon claim codes

Note

Since Yukon legislation mirrors the federal legislation, please refer to the Federal claim code table above.

Read Also: Tax Lien Investing California

And 2022 Federal Income Tax Brackets And Tax Rates

6 Minute Read | November 18, 2021

If theres one topic we doubt youre planning to bring up at your next dinner party, itd be federal income tax. Talk about a buzzkill. No one likes to think about taxes. But its important to know how much youll need to shell out during the year to keep Uncle Sam off your back. And how do you figure that out? Thats right, federal income tax brackets and tax rates.

Tax brackets and tax rates rise and fall depending on the year and current tax law, and if youre like most people, you probably dont follow them too closelyunless you need help falling asleep at night. But what are tax brackets and tax rates? Lets take a closer look at what they are and how they change how much you pay in federal income tax.

Avoiding The Early Withdrawal Penalty

There are some hardship exceptions to penalty charges for withdrawing money from a traditional IRA or the investment-earnings portion of a Roth IRA before you reach age 59½. Common exceptions for you or your heirs include:

- Qualified education expenses

- Disability of the IRA owner

- Death of the IRA owner

- An Internal Revenue Service levy on the plan

- Unreimbursed medical expenses

- A call to duty of a military reservist

IRS exceptions are a little different for IRAs and 401 plans they even vary a little for different types of IRAs.

You also escape the tax penalty if you make an IRA deposit and change your mind by the extended due date of that year’s tax return. You can withdraw the money without owing the penalty. Of course, that cash will then be added to the year’s taxable income.

The other time you risk a tax penalty for early withdrawal is when you roll over the money from one IRA into another qualified IRA. The safest way to accomplish this is to work with your IRA trustee to arrange a trustee-to-trustee transfer, also called a direct transfer. If you make a mistake trying to roll over the money without the help of a trustee, you could end up owing taxes.

You should not mix Roth IRA funds with the other types of IRAs. If you do, the Roth IRA funds will become taxable.

Some states also levy early withdrawal penalties.

Also Check: What Home Improvement Expenses Are Tax Deductible

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

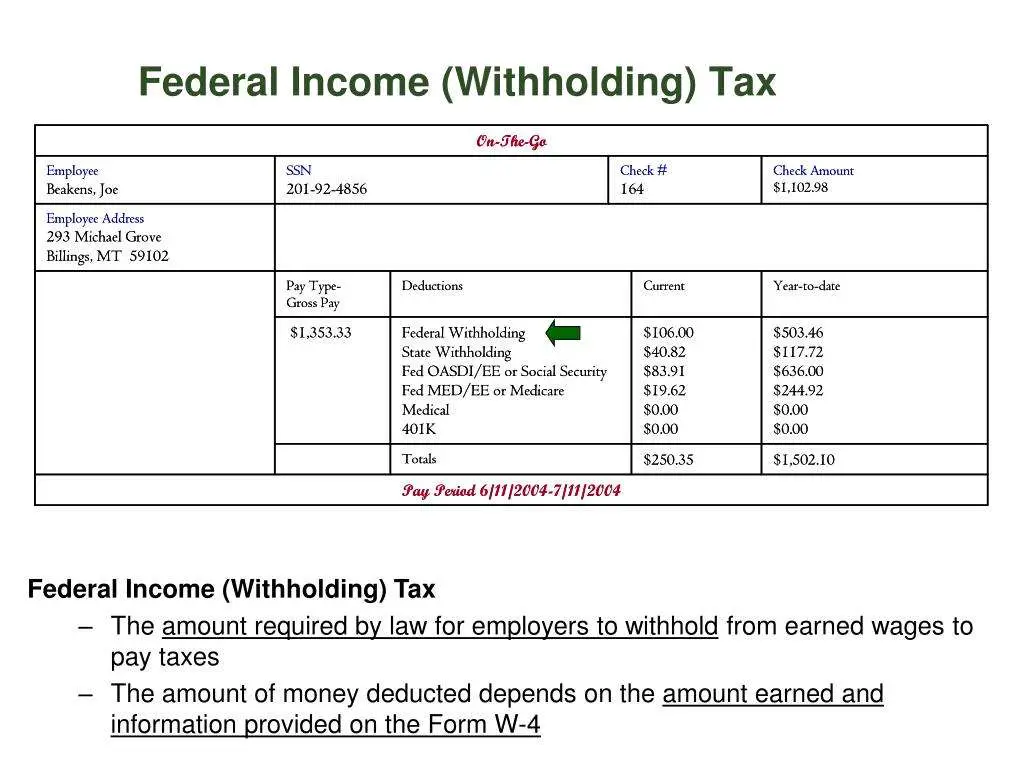

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

What Percentage Is Taken Out Of Paycheck

- Social security tax. It is distributed in such a way that both the employer and the employee pay. There is a base salary cap for this tax.

- Tax on health insurance. Also distributed in such a way that both the employer and the employee pay

- FUTA only applies to the first $7,000 of an employee’s income .

Recommended Reading: Do I Have To File Taxes For Doordash If I Made Less Than $600

How Is Tax Calculated In Canada

Average tax rate = Total taxes paid / Total taxable income.Example: If your taxable income was $50,000 in 2020, you would calculate your federal tax as follows:

How Much Of My Paycheck Can I Keep If I File Taxes

You can keep a certain amount of your salary. The IRS determines the amount of your benefits based on your enrollment status, timing of payment, and number of dependents. For example, if you are single with no dependents and earn $1,000 every two weeks, the IRS can collect up to $538 per check per billing period.

Also Check: Ccao Certified Final 2020 Assessed Value

Do I Have To File Taxes If I Made Less Than $10000

If your gross income was less than $10,000, you may not have to file a federal income tax return. But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck. Filing a tax return even if youre not required to do so is the only way to get any tax youre owed refunded to you.

What Percentage Of Your Paycheck Goes To Taxes

What percentage of taxes are taken out of your paycheck? No percentage tax is withheld from your salary. This is due to the fact that there are several taxes, each of which is calculated differently. In addition, many states’ federal and tax rates differ based on your income, your filing status, and the amount of withholding tax you claim.

Read Also: Taxes On Plasma Donation

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

What Percent Of Taxes Is Deducted From My Paycheck

Social Security Tax and Medicare Tax are two federal taxes that are deducted from your paycheck. The Social Security tax is a percentage of your gross pay until you reach your annual income limit.

Among vs amongstDoes “among” and “between” mean the same thing? Between is generally used to mean, for example, two things. B. between stone and anvil, while between is used for a greater number. However, these rules should be revised if the judgment seems inconvenient or overly arrogant.What is the difference amongst?Low and low are the most common prepositions in English. There is no difference in meaning between these two words, and very often

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

How Do I File My Taxes For Free

When it comes to free tax filing options, all products are not created equally.

During our analysis, we reviewed the free advertised versions of each of the six platforms and awarded H& R Block as our best free pick. But while these tax online products do provide limited free filing options, many of the same providers partnered with the IRS Free File Program to offer a different free product for those who may qualify.

The IRS Free File Program allows you to file your tax return for free if you have an adjusted gross income of less than $72,000. Your AGI is your total income minus certain deductions. Before using this service, you should browse each product offering to see which free product works best for you.

While this program has been in existence since 2001, you may not have heard of it. The IRS estimates that 70% of all taxpayers qualify for the program, only a small percentage of taxpayers have used it.

Since online tax software providers donate these services, they advertise them very little. The free versions from tax software online providers that youll typically see advertised on the top of the page if you Google file taxes for free are different. The main difference? The product youll find through IRS Free File may allow you to file more forms for free than the advertised version.

Economic And Policy Aspects

| This section needs expansion. You can help by adding to it. |

Multiple conflicting theories have been proposed regarding the economic impact of income taxes. Income taxes are widely viewed as a progressive tax .

Some studies have suggested that an income tax doesn’t have much effect on the numbers of hours worked.

You May Like: Roth Ira Reduce Taxable Income

What Small Business Owners Need To Know For Payroll

All of the information above can apply to both business owners and employees. For example, as a small business owner, if youre asked how much federal tax is taken out of my paycheck by employees, youll have a better understanding to explain the process. Additionally, if youre asking this question for your personal paychecks youll also know. If youre one of the small business owners following a DIY approach to payroll, you really need to know the above information.

To handle payroll on your own, make sure that youre getting Form W-4 from employees during onboarding. Additionally, youll want employees to verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season. From there, payroll calculators will be your friend. Payroll calculators can help you calculate what payroll will be for salaried employees and contractors.

The Us Has One System For All Taxpayers But State Rules Vary Widely

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

You May Like: Doordash Income Tax

What Is The Kansas State Tax Rate For 2019

After Kansas maintained a maximum income tax rate for years, Kansas increased its income tax rates for fiscal year 2017, a change that continues to this day. In assessment year 2019, the maximum tax rate is divided into three tax tiers. The disadvantage of this low income tax is the fairly high VAT rate.

State Income Tax Vs Federal Income Tax Example

Consider a single taxpayer who lives in New Hampshire and reports taxable earned income of $75,000 a year plus interest income of $3,000 on their federal tax return. New Hampshire has a $2,400 tax exemption for the interest and dividends tax, so tax is only due on the remaining $600 of interest and dividends income.

This means that the taxpayer would pay just $30 in state taxes because New Hampshire taxes investment income rather than earned income over the exemption amount at the rate of 5%. This individual’s effective state tax rate on their total income of $78,000 would be 0.038%.

If this same person lived in Utah, all of their taxable incomeboth earned and unearnedwould be subject to that state’s 4.95% flat tax rate. In that case, their tax bill would be $3,861 .

In terms of federal taxes, in 2021, under the progressive system, this taxpayer would pay $995 on the first $9,950 of their income which falls into the 10% tax bracket. They would pay 12% on their income from $9,950 to $40,526 , and 22% on the amount greater than $40,526 for a total federal tax bill of $12,248.40. Their effective federal tax rate would be 16.3%.

Recommended Reading: Payable Doordash 1099

Is Unemployment Taxable

Generally, unemployment income is taxable as income at the federal level and may be at the state level, too, depending on where you live. But if you receive unemployment benefits from a private fund that you voluntarily contribute to, its only federally taxable if the benefits you receive exceed the amount you paid into the fund.

How Much You Owe

After you figure out your taxable income, you can determine how much you owe by using the tax tables included in the Form 1040 Instructions. Though these tables look complicated at first glance, theyre actually quite straightforward. You simply look up your income, find the column with your filing status , and the intersection of those two figures is your tax.

For simplicitys sake, the tax tables list income in $50 chunks. The tables only go up to $99,999, so if your income is $100,000 or higher, you must use a separate worksheet to calculate your tax.

To illustrate, lets say your taxable income is $41,049. Using the tables, youd go to the 41,000 section and find the row applicable to incomes between $41,000 and $41,050. Then, you can easily find the tax you owe:

- $4,816 for single filers

- $4,528 for married couples filing jointly

- $4,816 for married couples filing separately

- $4,641 for heads of household

Also Check: Claiming Home Improvement On Taxes