Spouses Who Work In Different States

A big problem for military families in the past was having residency in more than one state. Members of the military are exempt from state residency and taxes in states where they’re stationed, but their spouses weren’t always exempt prior to 2009. This meant that each spouse would have their own state of residency. They would owe taxes to both states.

The Military Spouse Residency Relief Act was passed in 2009. This legislation has largely eliminated the problem of dual taxation for servicemembers and their spouses.

Other spouses who have just married, who are separated, or who commute to other states to work could find that they owe taxes to more than one state. You can still file your state tax returns jointly if you’re married and you find that you need to file in more than one state. But most states require that you include both your and your spouse’s income on their return.

California State Tax Credits

Available California tax credits include the following:

- Child adoption costs: 50% of qualified costs for a qualified adoption in the year an adoption is begun.

- College access tax credit: 50% of contributions to the College Access Tax Credit Fund, Californias Cal Grants financial aid program.

- Earned income tax credit: Similar to the federal earned income tax credit, Californias credit is intended for lower-income working people. If your income qualifies you, the amount of the credit depends on your income and the number of qualifying children you have.

Maine Direct Tax Filing

Maine offers FastFile and 1040 I-File, a tax preparation and e-file program for taxpayers with relatively simple returns. Enter your information, and the program will calculate your return. If you owe, you can pay electronically or request to delay your payment. If you’re entitled to a refund, you’ll receive it by direct deposit.

Not every taxpayer can use FastFIle, though. If you fall into one of the following categories, you can’t file with FastFile:

- You file married-filing-jointly and someone else can claim you or your spouse as a dependent.

- You are a nonresident or part-time resident of Maine, all your income comes from Maine, and you claim either Schedule 1A income, or you claim any of the following credits: earned income tax credit, child care credit, adult dependent care credit.

- You’ll claim credits for taxes paid to other jurisdictions

- Your Maine return requires you to file Schedule NR, Schedule NRH, Form 2210ME, or as an injured or innocent spouse

- You claim income or credits on Schedule 1S

Also Check: How To Calculate Taxes For Doordash

How To File Your Federal Tax Return For Free

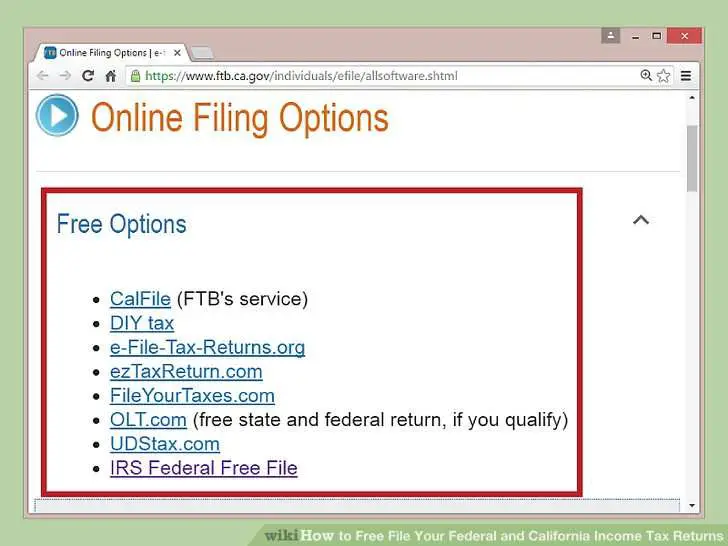

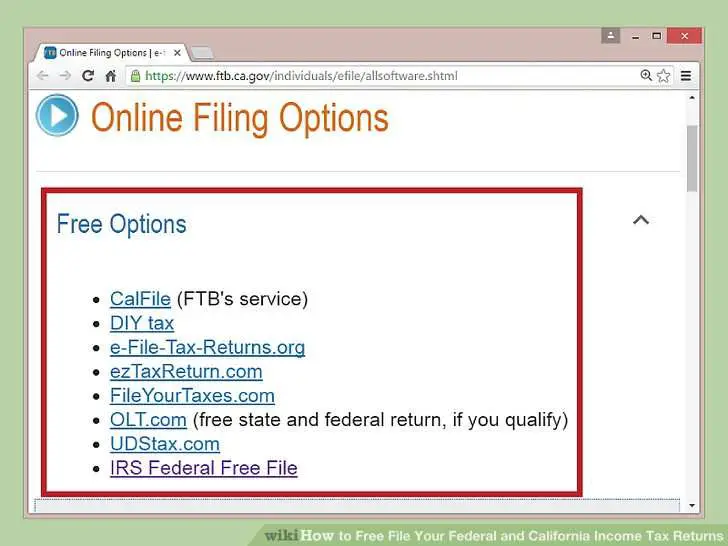

In the past, I have gone to the IRS free file webpage, because they have links to a bunch of tax preparers that offer free tax return filing . Some of them offer a state return to be filed for free as well, but most dont.

If you are interested in this option, you will have to use the links on the IRS page in order to get the free efile deal they are offering. Many of the tax preparation websites listed will not offer you the free efile if you go directly to their website.

Can You File Your Taxes Online For Free In California

Preparing and filing your taxes does not have to be costly if you use a free online tax filing program in California.

- Households earning less than $60,000 in adjusted gross income may be eligible.

- Earnings less than $57,414 may qualify families for the Earned Income Tax Credit as well as free filing.

- Free tax preparation and filing help is available for California residents through the OC Free Tax Prep program.

Preparing your taxes can be a complicated and frustrating process if youre not sure which forms you need, what exemptions or deductions to claim, or what tax credits you may be qualified for. Plus, purchasing the correct software and actually filing your taxes can become costly as well. This can become a financial burden, especially for low-income households.

Recommended Reading: Reverse Tax Id Lookup

How Do You Pay California Taxes

To pay California state taxes, follow these steps:

E-filing your California state return gets you the fastest refund and reduces errors. H& R Block tax software will choose the right state form for you.

Residents should file either:

Part-year residents and non-residents should file Form 540NR.

Commuting To Another State To Work

You would have to file a resident tax return in your home state and a nonresident state tax return in your work state if you commute to another state to go to work. All your income from all sources goes on your resident tax return, even the income you earned in your “work” state. But you would only include the wages you earned in your work state on your nonresident state tax return.

Pursuant to the Wynne decision, many states provide tax credits on resident returns for taxes you pay to other jurisdictions. The taxes you pay to your work state are effectively subtracted from any taxes you owe to your home state, so you won’t take a double tax hit.

Read Also: Tax Write Offs Doordash

Taking Advantage Of Free Filing

Orange County United Ways OC Free Tax Prep has partnered with H& R Block, the IRS, and other local partners to make preparing and filing taxes as easy and affordable as possible in order to promote financial stability. Tax refunds play an integral role in stabilizing low- and moderate-income families and allowing them to better provide for their children. Take advantage of available opportunities to file your taxes for free in California through these services at www.ocfreetaxprep.com.

Irs Free File Program

Many Americans are eligible to file their taxes for free through the IRS Free File program, which is a public-private partnership between the agency and the Free File Alliance, a group of tax preparation companies with online software such as TaxAct, FreeTaxUSA and others.

In 2020, 4.2 million Americans used the Free File program for their 2019 taxes, according to the IRS. While that was a nearly 50% increase from the previous year, more could still use the program.

If your annual gross income in 2021 was less than or equal to $73,000, you can use one of the Free File software programs to submit federal taxes free of cost. In addition, some products will also let you file your state taxes for free. The software generally includes step-by-step instructions and help for filers.

This year it may be especially important for Americans to use the service, as it will help them file electronically. The IRS has recommended that people file online and receive any refunds through direct deposit this year to avoid delays.

To use the program, you must go through the IRS site not directly to a tax preparer. The program opened Jan. 14.

There are also free basic tax preparation services offered through the IRS Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs, called VITA and TCE, respectively.

Recommended Reading: Can You Write Off Miles For Doordash

Filing And Payment Deadline

For 2019 state taxes, the state has extended the filing and payment deadline. California residents now have until July 15, 2020 to file their state returns and pay any state tax they owe. As with the federal deadline extension, California wont charge interest on unpaid balances between April 15 and July 15, 2020.

You dont need to do anything to get this extension. Its automatic for all California taxpayers. But keep in mind that if youre expecting a refund, you might want to go ahead and file as soon as possible. During the coronavirus crisis, the state is continuing to process tax returns and issue refunds.

While this year is a little different, generally, Californias Tax Day is the same as the deadline for filing your federal income tax return April 15. However, if the 15th falls on a Sunday or holiday, the deadline may be extended.

Who Pays California Taxes

Just like the federal government, states impose additional income taxes on your income if you have a sufficient connection to the state.

Generally, you must file an income tax return in California if youre a resident, part-year resident, or nonresident and you receive income from a source in California over the threshold for filing. California residents are also taxed on worldwide income

You may also want to file a return with California to get a refund if you qualify for the California Earned Income Tax Credit or you had money withheld from your paycheck for state taxes.

You May Like: Door Dash 1099

Pennsylvania Direct Tax Filing

Pennsylvania’s myPATH portal welcomes a wide range of taxpayers. The myPATH filing partial can handle a wide variety of income types, including:

- W-2 and 1099 income

- Income and dividends reported on up to two Pennsylvania Schedule A and Schedule B forms

- Rents and royalty reported on Schedule E

- Schedule SP tax forgiveness credits

- Gambling and lottery winnings on Schedule T

If my PATH doesn’t accept the income you try to provide, you’ll need to file a paper return or use a different website to file your state taxes.

Although they’re not run by individual states, two websites also offer free state returns if you meet certain income requirements. United Way offers MyFreeTaxes.com for state returns, as does Credit Karma.

Out Of State Employment

Residents living in northern California and working in may also be responsible for filing California taxes with that state. The same is true for residents of SoCal working . However, this does not apply to residents working in Nevada, as this state does not currently collect income tax.

Note: States & U.S. territories may make changes to their tax laws with little notice. We do our best to keep this information up-to-date, but it is provided on an “AS IS” basis. For more see our terms.

You May Like: How Does Doordash Do Taxes

Is There A Minimum Income To File Taxes In California

For many California residents, filing taxes is a requirement, but there can be some exceptions based on income and other factors. Individuals or families who do not earn a significant gross income may not have to file a federal income tax return, but there can still be advantages to doing so. OC Free Tax Prep can help offset the costs of filing for low-income households and ensure families are maximizing their return potential.

California residents are gearing up for tax season. Though the deadline to file is May 17, 2021, it is not too early to start gathering necessary documents. A big question on some peoples minds, however, is whether they even need to file taxes if they did not have significant income.

If You Owe And Cant Pay

If you cant pay your tax bill and its less than $25,000, you may be able to set up an installment agreement. You can apply online, by phone or mail. Theres a $34 set-up fee, and 60 months is the maximum payment term.

Keep in mind that even with a payment plan, interest and penalties will continue to accrue until you pay your bill in full.

Also Check: Sales Tax In Philadelphia

Free Virtual Tax Filing Service

Code for America, in partnership with VITA, has created a fully virtual intake process for free tax assistance. In light of COVID-19, Code for Americas Get Your Refund service is a free and safe alternative to prepare your tax return without the risk of in-person interaction.

Visit Get Your Refund to connect with an IRS-certified volunteer who will help you file your taxes. First, you will upload your tax documents online. Then, an IRS-certified volunteer will call you to discuss, prepare, and review your tax return for filing.

Code for Americas Get Your Refund service is free for those who earn less than about $66,000. This is a good option if you are comfortable using technology, including sending pictures or documents electronically.

Free Online Tax Filing For California Returns

United Way has joined forces with H& R Block as well as the Internal Revenue Service to offer Orange County California residents two opportunities to have their taxes prepared and filed for free. One way is through MyFreeTaxes.com if you have a simple return. It is a safe, secure way of filing and supports California taxpayers in increasing their refunds while saving money on tax preparation services.

Another option is to utilize OC Free Tax Preps Virtual Service where an IRS-Certified volunteer will prepare your federal and state tax return for free if you qualify.

Free tax filing services can benefit not just those who may have trouble affording the filing process, but also people who are unsure whether they need to file at all or who are looking to receive the EITC or CalEITC tax credits. You can feel confident that your taxes are being prepared accurately, and you are receiving all of the credits and refunds you qualify for.

Also Check: Tax Preparer License Requirements

Service Name: State Of California Franchise Tax Board

Organization Name: STATE OF CALIFORNIA FRANCHISE TAX BOARD

If You Lived In Two States

You’ll have to file two part-year state tax returns if you moved across state lines during the tax year. One return will go to your former state. One will go to your new state. You’d divide your income and deductions between the two returns in this case. But some states require that you report your entire income on their returns, even if you resided there for less than the full year.

You might want to ask your employer’s human resources department for guidance, or touch base with a local tax professional if you lived in two separate states during the tax year.

This process can vary a great deal by state. Check each state’s tax return for an apportionment schedule to find out how you should go about it. The schedule should explain how to divide up your income depending on that state’s rules, if you can divide it at all.

Recommended Reading: Do Doordash Take Out Taxes

Did 2021 Have Stimulus Checks

The government has deployed most of the third round of stimulus checks in amounts of up to $1,400 per person. The 2021 tax season offers an opportunity to claim those payments if you never received a check for which you were eligible or if your circumstances have changed and you now qualify for the money.

You May Know About Ways To File Your Federal Income Tax Return For Free But What About Filing State Taxes For Free

In 43 states and the District of Columbia, Americans have to pay some sort of state-level income tax as well as federal income tax. If you live in a state with a state-level income tax, you may dread the idea of paying someone to complete yet another tax return for you.

If so, youll be happy to know that its possible to file state taxes without paying for it. Heres what you should know about filing your state taxes for free.

Also Check: Do You Have To Claim Plasma Donation On Taxes

States With Tax Reciprocity

Sixteen states and the District of Columbia have reciprocity agreements with other jurisdictions as of 2022. They include:

New Jersey Governor Chris Christie repealed his state’s reciprocity agreement with Pennsylvania in 2017, but it was later reinstated. These two states still have reciprocity as of 2022.

Pick A Free Service Or Program To Use

IRS Free File

If you qualify for guided tax preparation, head to the IRS website to view the eight options available from the Free File Alliance this year:

- Free 1040 Tax Return

- TaxSlayer

- 1040NOW.net

Each of these services has its own restrictions, so read the fine print. Some offers are only valid for people who live in certain states, are a certain age or make below a certain amount of money.

IRS Free File is focused on federal tax returns, not state returns, so you’ll need to pay extra attention if you live in a state with income taxes. A few of the IRS Free File offers, like OLT.com and FreeTaxUSA, give a free state filing to anyone who qualifies for a free federal return. Others, like TaxSlayer and FileYourTaxes.com, only give free state filing to people in certain states. A few don’t offer free state returns, period.

Need help navigating it all? Enter your personal information into the lookup tool at IRS.gov, and it’ll narrow down the choices for you.

If you don’t qualify for guided prep, check out Free File Fillable Forms. This isn’t for beginners you have to select the right form, type in your data, make sure you’re not introducing errors and file the federal return on your own. Though it’s free, this method does require a bit of tax knowledge.

FYI: IRS Free File is available in English and Spanish.

Free versions of online tax software

Despite no longer being affiliated with IRS Free File, both TurboTax and H& R Block still offer ways you can file for free.

VITA

Recommended Reading: Does Doordash Pay Taxes