Estimating Your Taxes In More Complex Situations

If your tax scenario is more complex, you will have to provide information on dependents, your spouses earnings, income from other jobs, and any tax credits and deductions you plan to claim.

The IRS recommends using its online Tax Withholding Estimator to make sure the right amount is being withheld from your pay. IRS Publication 15-T, meanwhile, is used by employers to figure out how much federal income tax to withhold from employees paychecks.

You can also use Form W-4 to request additional money be withheld from each paycheck, which you should do if you expect to owe more in taxes than your employer would normally withhold.

You might ask your employer to withhold an additional sum if you earn self-employment income on the side and want to avoid making separate estimated tax payments for that income. You can also use Form W-4 to prevent your employer from withholding any money at all from your paycheck, but only if you are legally exempt from withholding because you had no tax liability for the previous year and you also expect to have no tax liability for the current year.

Recommended Reading: How Much Tax Do You Pay On Doordash

How To Change Your Take

If you’re wondering what percentage of your paycheck is withheld for federal income tax and how you can adjust it it all comes down to Form W-4. To calculate how much you should take out of each paycheck, use aW-4 Withholding Calculator and try a few different tax scenarios to find what works best for you.

Thenew format for the W-4 form introduced in 2020 allows you to indicate how much money you earn from additional jobs or how much your spouse makes to set accurate withholding levels.

- Additionally, you can adjust forchild tax credits, credits for other dependents, and any other relevant tax deductions you plan to take in excess of the standard deduction.

You may be able to simply ask for an additional specific dollar amount to be withheld. The W-4 comes with a worksheet to help you calculate the amount you want to have taken out.

- If you enjoy the thrill ofa large refund, don’t claim any extra deductions or make adjustments for other credits.

- Conversely, the more credits and deductions that you specify, the larger your regular paycheck will be and the lower your refund will be.

Most tax experts advise you not to go for a large refund because that, in effect, means you’re giving the government an interest-free loan. Financial advisors typically recommend that you should maximize your paychecks andinvest the extra money throughout the year.

Your Tax Withholdings And Savings Questions Answered

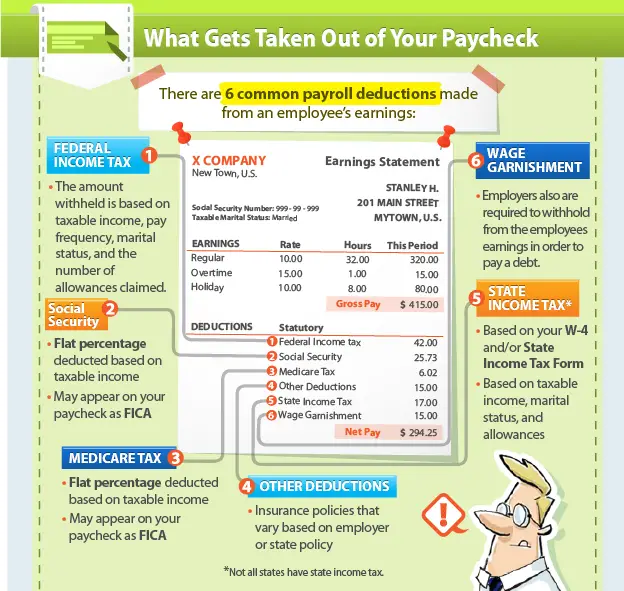

Seeing how much money is being withheld from your paycheck can be confusing and frustrating. Heres how tax withholdings work, where your money goes, and answers to your other withholding questions.

The amount of your money being withheld from your paycheck for taxes can be confusing and frustrating. So what are tax withholdings and how do they work? And where is part of your earned income going? These and other tax withholding questions are answered here.

Dont Miss: How To Do Taxes On Doordash

Recommended Reading: How Much Will I Make After Taxes In Texas

Whats The Importance Of The W

One big part of the income tax formula comes from the information you give to your employer when you start your job. On the first day at most jobs, you must fill out a Form W-4, known as an Employees Withholding Certificate.

It tells your employer how many people are dependent upon your income, which determines how much tax you pay. These are called allowances.

You can claim one allowance for yourself, as long as no one else claims you as a dependent. You can claim one allowance for every dependent other than yourself or your spouse . You can claim either zero or one allowance for your spouse. You can also claim one more allowance if you file your taxes as the head of household, meaning youre unmarried and paid more than half the cost of maintaining your home this year.

The more allowances you claim on your W-4, the less money will be taken out of your pay for federal and state income taxes.

Youre allowed to say whatever you want on your W-4 form. All it changes is how much is withheld for taxes from your paycheck. If you put an allowance number lower than your actual allowances, theyll withhold more from each paycheck and youll have a big refund. If you put an allowance number too high, theyll withhold less from your check, but youre likely to owe money when you file your taxes.

In general, the best move is to be as honest as possible on your W-4 form.

Overview Of Alabama Taxes

Alabama has income taxes that range from 2% up to 5%, slightly below the national average. The Heart of Dixie has a progressive income tax rate, in which the amount of tax withheld depends on which of its three tax brackets you fall under. This generally means that youll be at a higher rate if you earn more. Depending on which county you live in, local income taxes may also be withheld.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You May Like: How To Find Tax Id

What Is A State Income Tax Withholding

This is how all 50 U.S. states stack up when it comes to paying taxes. via @CNBCMakeIt

CNBC

You may get confused between a federal and state income taxes which is crucial especially when you are filing your own taxes. They are separate from each other and unlike federal income tax, state taxes are generally dependent on laws imposed by the State Department of Revenue. This means each state has a different tax system and seven out of the fifty states currently impose no state taxes. These states include Wyoming, Washington, Texas, South Dakota, Nevada, Florida, and Alaska.

How To Figure Out The Percentage Of Taxes Taken Out Of Paychecks

Related

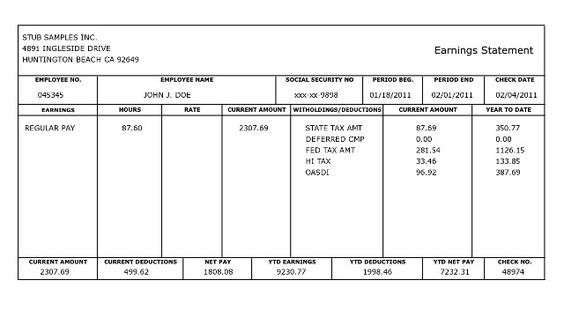

The percentage of taxes withheld from a worker’s paycheck varies based on the withholding allowances the worker reported on IRS Form W-4. To determine the exact tally requires access to state and federal tax brackets and gross wage information. You must also incorporate Social Security and Medicare withholdings into the calculations.

You May Like: How Does Refinancing Affect Taxes

Why Is My Employer Not Withholding Enough Federal Taxes

Your employer bases your federal tax withholding on your tax filing status and the number of personal allowances claimed on your W-4. The more allowances you claim, the lower your withholding. Accordingly, if you’ve claimed too many allowances, your employer would take out enough for your federal income taxes.

Overview Of Tax Returns And Deposits

Employers have the responsibility to file employment-related tax returns and deposit employment taxes according to set deadlines. If they fail to do so, they may be subject to failure to file and failure to pay penalties. What’s more, “responsible persons” in the company who fail to deposit trust fund taxesamounts withheld from employees’ paychecksmay be subject to a 100% personal liability. This trust fund recovery penalty is triggered when a person with the authority to make payment decisions willfully fails to deposit the taxes. The possibility of these penalties means employers must get things right.

Don’t Miss: Who Can Claim Education Tax Credit

Taxes Taken Out Of Paycheck: Everything You Need To Know

Receiving your first ever payslip is exciting, but seeing taxes taken out of paycheck can ruin this for you. Generally, these tax deductions cause dissatisfaction among employees. Our mission is to protect the rights of individuals and businesses to get the best possible tax resolution with the IRS.

Why Do I Always End Up Owing Taxes

Well the more allowances you claimed on that form the less tax they will withhold from your paychecks. The less tax that is withheld during the year, the more likely you are to end up paying at tax time. … In a nutshell, over-withholding means you’ll get a refund at tax time. Under-withholding means you’ll owe.

Don’t Miss: When Do We Get Our Taxes Back 2021

How To Calculate Employer Payroll Taxes

Payroll taxes are figured according to an employee’s Form W-4. This form tells the employer the employee’s marital status and whether additional withholding should be made to cover certain personal taxes to which an employee may be entitled that reduce his or her income taxes. If no W-4 is provided, then an employer withholds as if the employee were single with no other adjustments.

Employers relying on outside payroll service providers, such as Paychex, can leave the calculations to them. Some employers who do payroll in-house use software or rely on tables provided by the IRS in Circular E to calculate payroll taxes.

How You Can Affect Your Tennessee Paycheck

While you can’t control all factors in your Tennessee paycheck, there are some choices that affect the size of the checks you receive throughout the tax year.

Say, for example, you decide to pay for health or life insurance through an employer-sponsored plan. Any premiums you pay for this will be subtracted from your wages. These premiums usually come out pre-tax, which means they come out of your pay before income tax is applied. Pre-tax contributions lower your taxable income and save you money on taxes.

You don’t have to worry about state or local income taxes in Tennessee, but you can reduce how much you owe in federal taxes. If you’re looking to do this, one tactic that you may want to explore is putting money in tax-advantaged accounts like a 401 or 403 retirement plan. Not only will you be saving for the future, but since these accounts take pre-tax money, you will save some money now, too. Those savings could make it worth the fact that your paychecks will be smaller.

If you have certain fixed medical expenses like copays or prescriptions, you may also want to take advantage of a health savings account or flexible spending account . This helps to lower your taxable income in the same way that a 401 does. One important factor to keep in mind, though, is that the money you put into an FSA wont all roll over from one year to the next. You will lose any money you put in over $500 if you dont use it by the end of the year.

Don’t Miss: When Is The Deadline To File Your Taxes

Should I Claim 1 Or 0 On My W 4 Tax Form

The total number of exemptions you are claiming should be based on your filing status . However, knowing if you should claim 1 or 0 on your W4 tax form also depends on how much money you want in your hands each new paydayas well as the tax burden youre willing to face when its time to file.

In the event you claim 0 federal withholding allowances instead of 1 on your W 4 tax form, youll receive less money every paycheck, though your tax bill will likely be reduced at the end of the year. When you claim 1, youll benefit from higher take-home pay but will probably face a higher bill when tax time comes around.

Dont Miss: Grieved Taxes

How Your Florida Paycheck Works

Living in Florida or one of the other states without an income tax means your employer will withhold less money from each of your paychecks to pass on to tax authorities. But theres no escaping federal tax withholding, as that includes both FICA and federal income taxes. FICA taxes combine to go toward Social Security and Medicare. The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that youll benefit from in your retirement years.

Every pay period, your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer will match that by contributing the same amount. Note that if youre self-employed, youll need to pay the self-employment tax, which is the equivalent of twice the FICA taxes – 12.4% and 2.9% of your earnings. Half of those are tax-deductible, though. Earnings over $200,000 will be subject to an additional Medicare tax of 0.9%, not matched by your employer.

Your employer will also withhold money from every paycheck for your federal income taxes. This lets you pay your taxes gradually throughout the year rather than owing one giant tax payment in April. The rate at which your employer will apply federal income taxes will depend on your earnings on your filing status and on taxable income and/or tax credits you indicate W-4 form.

Don’t Miss: Can You File An Amended Tax Return Online

How You Can Affect Your New York Paycheck

If you find yourself always paying a big tax bill in April, take a look at your W-4. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. For example, you can have an extra $25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. This paycheck calculator will help you determine how much your additional withholding should be.

Another way to manipulate the size of your paycheck – and save on taxes in the process – is to increase your contributions to employer-sponsored retirement accounts like a 401 or 403. The money you put into these accounts is taken out of your paycheck prior to its taxation. By putting money away for retirement, you are actually lowering your current taxable income, which can help you save in taxes right now. Another option is to put money in a spending account like a health savings account or a flexible spending account if your employer offers them. The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Just keep in mind that only $500 in an FSA will roll over from year to year. If you contribute more than that and then dont use it, you’re out of luck.

How Your California Paycheck Works

Your job probably pays you either an hourly wage or an annual salary. But unless youre getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck.

When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, youll also pay a 0.9% Medicare surtax. Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, youll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

Also Check: How Much Of Your Taxes Are Returned

When You Need To Update Your W

To avoid surprises at tax time, it’s a good idea to periodically check your withholding. Otherwise, there are some key life changes that definitely warrant an update. Those include:

- When you’re married and either of you starts or stops working

- When you or your spouse are working more than one job

- When you have significant nonwage income, such as interest, dividends, unemployment compensation, or self-employment income, or the amount of your nonwage income changes

- When you’ll owe other taxes on your return, such as self-employment tax or household employment tax

- When you have a life change that affects the tax deductions or credits you may claim

- When any qualified dependent turns age 17, as the deduction for dependents decreases

- When there are tax law changes that affect the individual tax rules

If you find that you need to make changes to your withholding, you can do so at any time simply by submitting a new Form W-4 to your employer. To check on your withholding amount and to see whether you need to make changes to your W-4, the IRS has a comprehensive Withholding Calculator on their website. You’ll need your most recent paystub as well as last year’s tax return. You won’t need to enter any personally identifiable information that ties the numbers you enter to you, but the more accurate the numbers you use, the more effective the calculator will be. Check it out here.